- BTC may hike to $67,269 within the first part of the projected upswing

- The liquidation ranges confirmed a bearish bias which will quickly be invalidated

Issues may need modified for Bitcoin [BTC] after the completion of its 4th halving. Nonetheless, when it comes to its value, the extra issues change, extra they continue to be the identical. AMBCrypto got here to this conclusion after monitoring its coin transfers to spinoff exchanges. In keeping with knowledge from CryptoQuant, the variety of BTC despatched to spinoff exchanges has elevated considerably.

Particularly, we noticed that this has been the handwork of whales. Traditionally, when this occurs at a quick charge, it implies that whales are making ready to open lengthy Bitcoin positions.

Massive weapons have gotten aggressive

Pseudonymous on-chain analyst datascope additionally commented on the exercise. In keeping with datascope who shares his ideas on CryptoQuant,

“The increase in transfer rates of Bitcoin from exchanges to derivative exchanges is considered an important indicator. Recent data indicates that these types of transfers have been a significant factor in the rise of Bitcoin prices.”

Bitcoin’s value, at press time, was $63,572, Right here, it’s value noting that earlier than the halving, AMBCrypto had argued that the primary cryptocurrency might already be priced in.

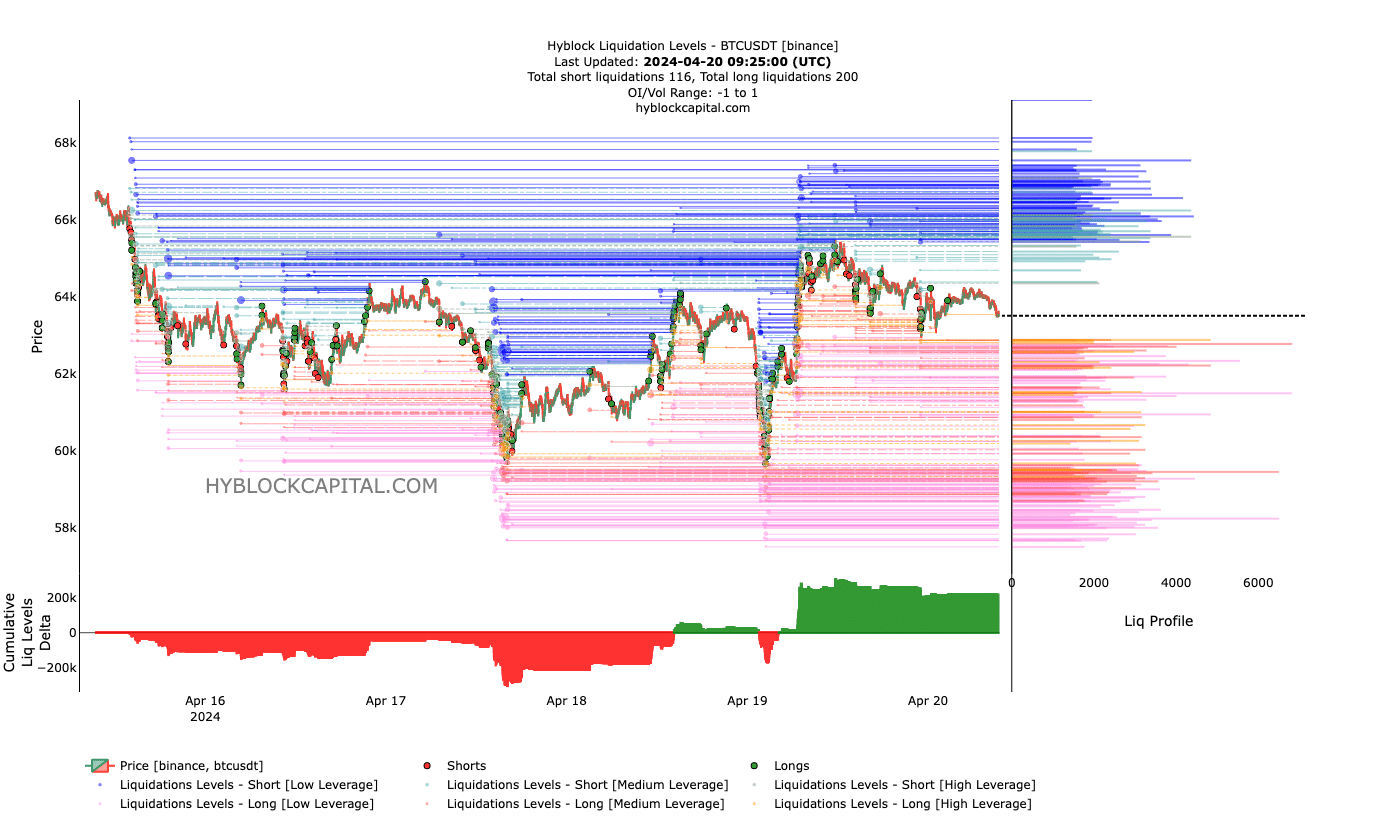

Nonetheless, the stalemate may swap to the upside based mostly on our newest evaluation. The liquidation ranges are one indicator fueling this prediction.

Liquidation ranges revealed estimated value ranges the place a liquidation occasion may happen. For context, liquidation occurs when an trade forcefully closes a dealer’s place. That is both because of an inadequate margin steadiness or a high-leveraged guess that went in the wrong way.

At press time, a cluster of liquidity appeared from $65,434 to $67,269, suggesting that Bitcoin’s value may goal these ranges within the quick time period.

One other factor we observed was that there was aggressive shopping for because the drop under $64,000. If the shopping for stress will increase, longs with low leverage could be rewarded quickly.

Bears gained’t survive what’s coming

Lastly, we thought of the Cumulative Liquidation Ranges Delta (CLLD). On the time of writing, the CLLD was optimistic. Destructive values of the CLLD point out extra quick liquidations.

Quite the opposite, a optimistic studying implies that there have been extra lengthy liquidations. Nonetheless, this indicator additionally has some impact on the worth.

From the indications above, it may be seen that the CLLD revealed a bearish bias. Nonetheless, whales’ coming into their orders with the present liquidity may reverse the sign.

On this state of affairs, the worth may fall and set off some cease losses. And but, as soon as part of the liquidity has been flushed out, the worth may start to make its manner again up.

Learn Bitcoin’s [BTC] Value Prediction 2024-2025

Ought to this be the case shifting on, Bitcoin may rally, and hitting $75,000 could possibly be an possibility within the mid-term. Within the quick time period, nevertheless, BTC might drop decrease than $63,000 earlier than the pump begins a lot later.