- Bitcoin has a bullish market construction on the every day timeframe.

- The numerous capital influx and robust momentum favored an upward transfer on the every day chart.

Bitcoin [BTC] noticed elevated demand from ETFs a month after the halving occasion. An AMBCrypto report famous that the altcoin efficiency has eclipsed Bitcoin lately.

One other AMBCrypto evaluation drew parallels between the 2020 post-halving and present tendencies. The Rainbow Chart confirmed that BTC was nonetheless within the purchase zone – does the Bitcoin value prediction agree?

Bitcoin bulls should not prepared to pressure the difficulty but

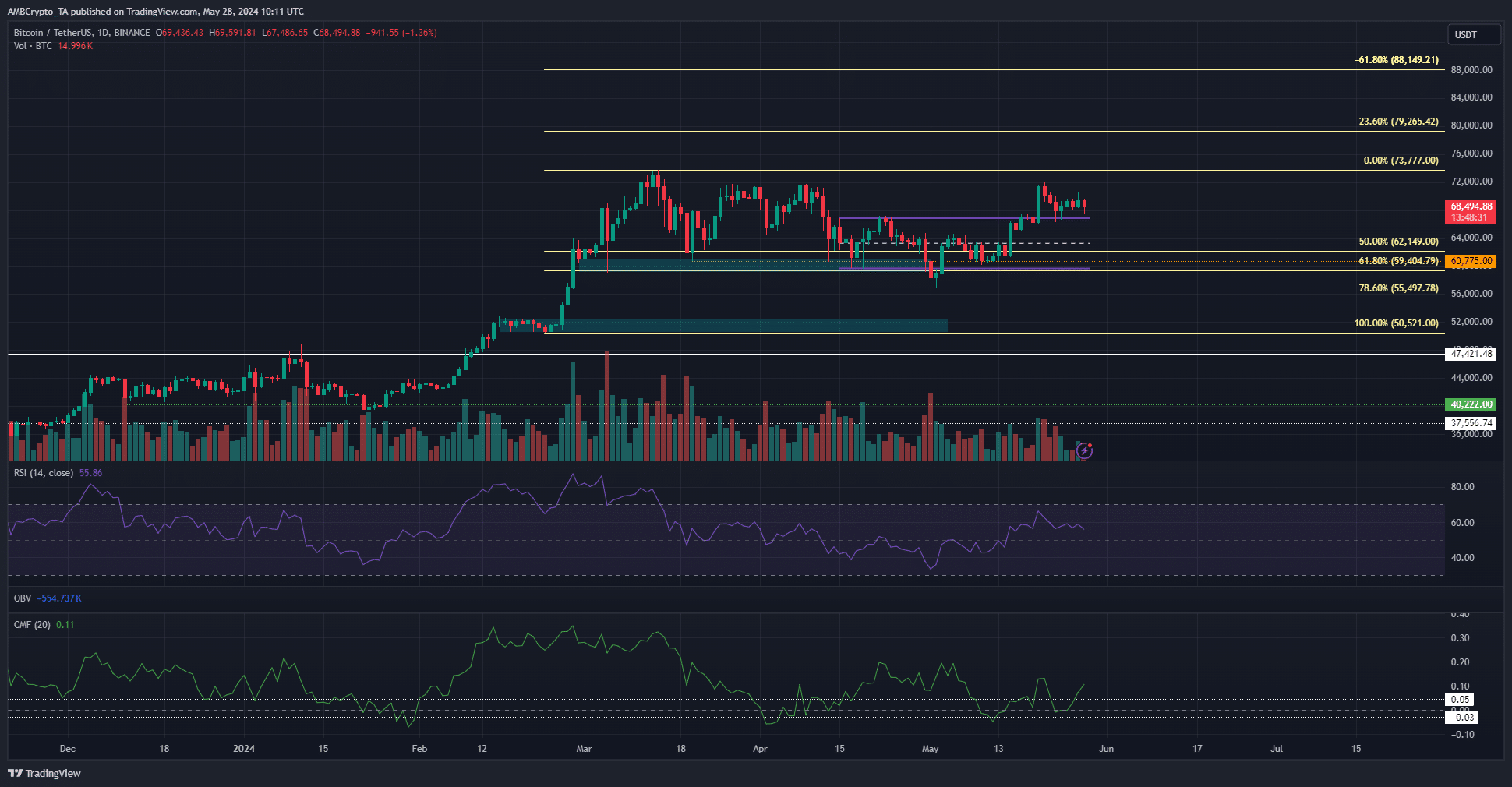

The worth motion on the 1-day chart was bullish. Bitcoin dropped beneath the 61.8% Fibonacci retracement degree (pale yellow) at $59.4k in early Might however was fast to get well.

It has flipped the short-term vary (purple) excessive at $67k to help. Furthermore, the CMF confirmed a studying of +0.12 to replicate vital capital influx to the market.

The RSI on the every day chart was additionally above impartial 50 to sign bullish momentum. Collectively, the technical indicators pointed towards a bullish Bitcoin value prediction.

This indicated a decrease timeframe liquidity hunt and outlined a consolidation part. The upper timeframe uptrend will seemingly proceed quickly. The Fibonacci extension ranges at $79.2k and $88.1k could be the goal for patrons within the coming weeks.

Does the liquidation cluster to the south warrant Bitcoin’s consideration?

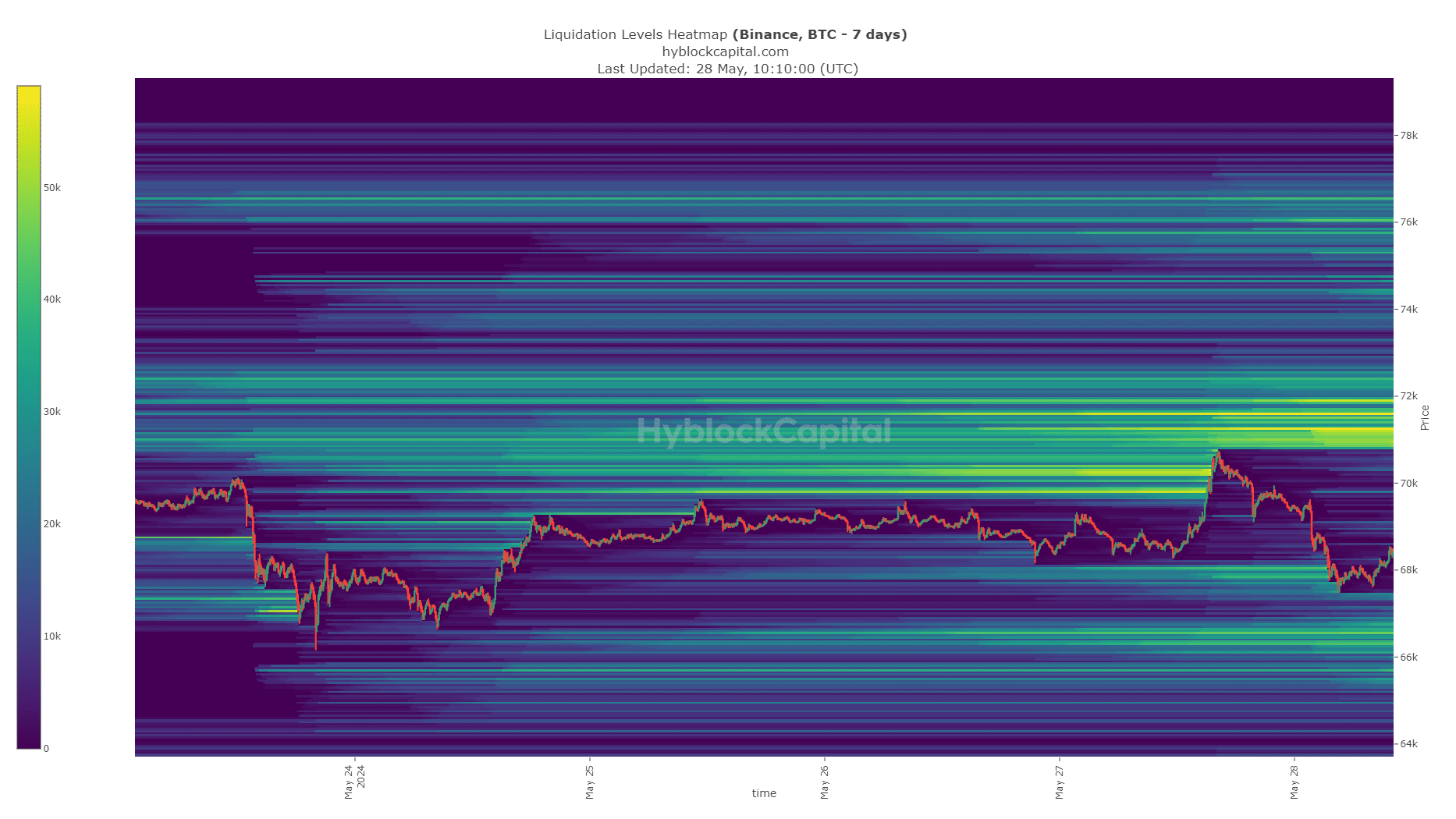

Supply: Hyblock

The info from Hyblock confirmed that the $66.2k-$66.7k area was house to a cluster of liquidation ranges, and BTC may dip to this area.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Alternatively, the liquidity at $67.8k, which has already been swept, is likely to be sufficient to propel Bitcoin again to the $71.2k resistance zone.

Merchants must be ready for each outcomes and handle their threat accordingly. Quick-term volatility was doable and a revisit of the $66.5k degree would supply a shopping for alternative.

Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion.