- Bitcoin value prediction witnessed a pointy value drop following bearish expectations within the U.S. equities market.

- The drop under the mid-range assist may spur a deeper BTC correction to $92k.

Bitcoin [BTC] has shed 5.88% over the previous 24 hours. It had pushed as excessive as $109,588 on the twentieth of January in response to Binance buying and selling knowledge, however has been in a stoop since.

The swift losses in current hours had been seemingly not an indication of inherent BTC weak spot.

The emergence of China’s DeepSeek LLM mannequin has begun to influence the U.S. inventory market. The Nasdaq 100 futures had been down 2.9% at press time, and would reportedly see $1 trillion wiped from the U.S. fairness market at open.

In flip, this panicked sentiment affected crypto and Bitcoin. The market is also de-risking forward FOMC assembly later this week.

Bitcoin value prediction — Vary formation can have a play position

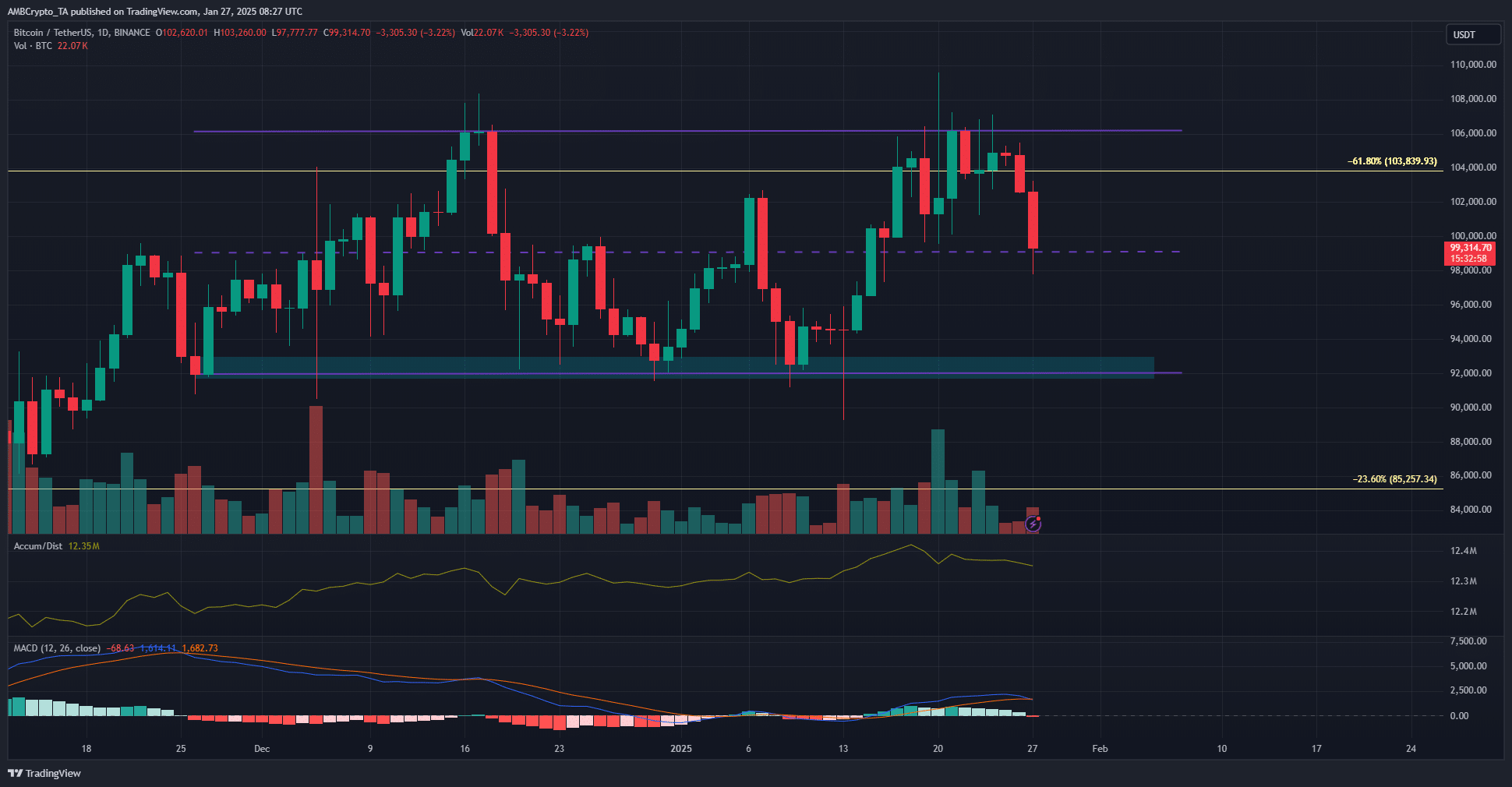

Over the previous two months, Bitcoin has traded inside a spread that prolonged from $92k to $106k. The mid-range stage at $99k has been essential in current weeks as a assist/resistance stage.

The promoting stress in current hours introduced BTC to the mid-range assist.

It should be famous that the buying and selling quantity remained muted, however this might change in the course of the New York buying and selling session open. Therefore, merchants should stay cautious within the brief time period.

A drop under the mid-range stage would seemingly see a deeper value correction to $92k.

Due to this fact, the Bitcoin value prediction was bearish within the brief time period. The MACD on the every day chart had shaped a bearish crossover to sign bulls had been starting to lose power.

Conversely, the A/D indicator made larger lows. From the A/D indicator, we will see that the promoting stress was a response to the U.S. inventory market expectations and never essentially weak spot from BTC.

Supply: Coinalyze

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

The Coinalyze knowledge confirmed bearish sentiment had been sturdy in current hours. The funding fee fell into adverse territory in the course of the fast value drop, whereas Open Curiosity noticed an uptick as costs fell under $102k.

This implied elevated short-selling and bearish sentiment within the derivatives market. Crypto analyst Axel Adler famous in a submit on X that panic promoting was not underway, as seen on the short-term holder revenue loss to exchanges.

Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion