- Bitcoin cooled off after its newest rally, however Futures demand soared to ranges final seen over a 12 months in the past

- Market is now embracing warning amid rising ranges of uncertainty over main occasion

Bitcoin’s newest rally raised hopes of the crypto’s worth doubtlessly hovering to new highs. Nevertheless, regardless of a quick hike to $73k, the crypto has since dipped beneath $70,000. Whereas this indicated that profit-taking has been happening, latest observations recommend there could also be uncertainty in November.

Will Bitcoin bulls regain management or is that this the beginning of a serious pullback? Effectively, in line with a latest CryptoQuant evaluation, Bitcoin has been recording strong shopping for strain from Bitcoin Futures whales.

In keeping with the identical, the final time the Futures demand was so excessive was in September 2023. Following this occasion, Bitcoin launched into a stable bullish run till April. Will issues prove related this time?

The hike in Bitcoin Futures could also be according to bullish expectations or sentiment amongst Futures buyers. Nevertheless, BTC demand slowed significantly over the previous few days. For instance, there appeared to be a surge in Bitcoin Spot ETF inflows during the last 7 days.

Nevertheless, the final day of October was characterised by the bottom inflows through the week.

Bitcoin merchants embrace a cautious method

The sudden decline from institutional consumers (ETFs) signaled a sudden shift in direction of the facet of warning. This was a mirrored image of the latest worth shift and demand dynamics.

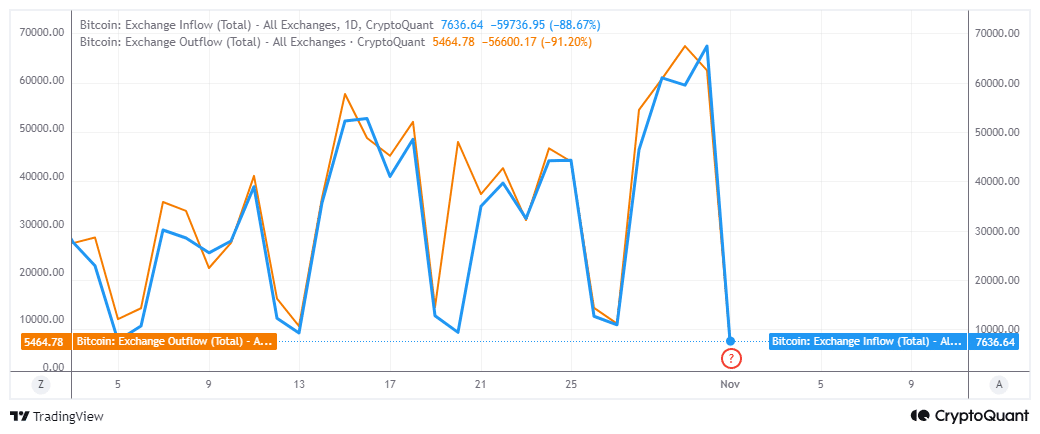

Bitcoin trade flows peaked at 67,373 BTC on 31 October, notably larger than outflows which peaked at 62,024 BTC on the identical day.

Bitcoin trade flows have since dropped to their decrease vary, with inflows nonetheless notably larger than outflows. This confirmed that promote strain has since outweighed demand, therefore the worth dip.

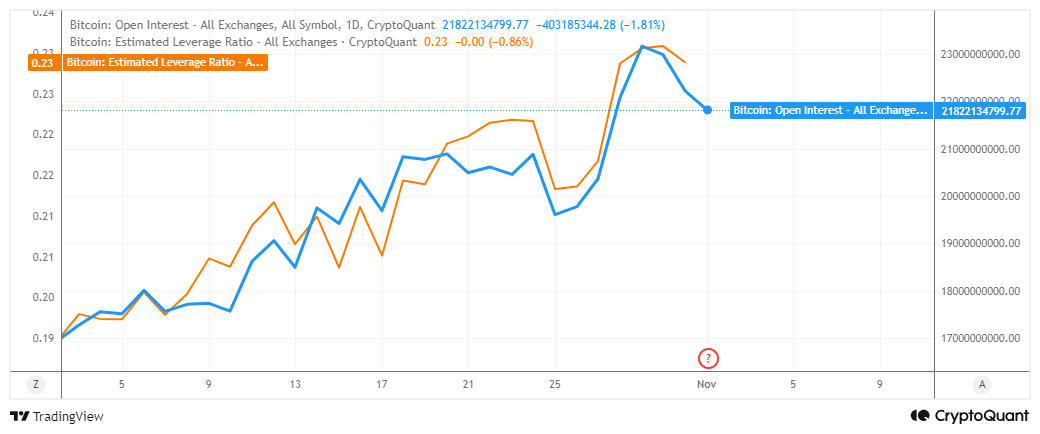

The market additionally demonstrated a decline within the urge for food for leverage during the last 2 days. This instructed that buyers have been uncertain concerning the extent of the newest retracement. This, as a result of the newest wave of bullish optimism has many anticipating larger costs within the coming weeks.

Bitcoin’s Open Curiosity additionally dipped considerably, confirming that derivatives merchants are additionally exercising warning. Each the Estimated leverage ratio and the Open Curiosity metrics beforehand soared to their highest 2024 ranges in direction of the top of October.

One purpose why individuals are cautious is as a result of they anticipate the U.S elections to yield some volatility. This additionally signifies that Bitcoin may resume regular provide and demand exercise after the elections are carried out.

The result may affect the extent of demand. This, mixed with the surge in Futures, could result in extraordinarily unstable actions.