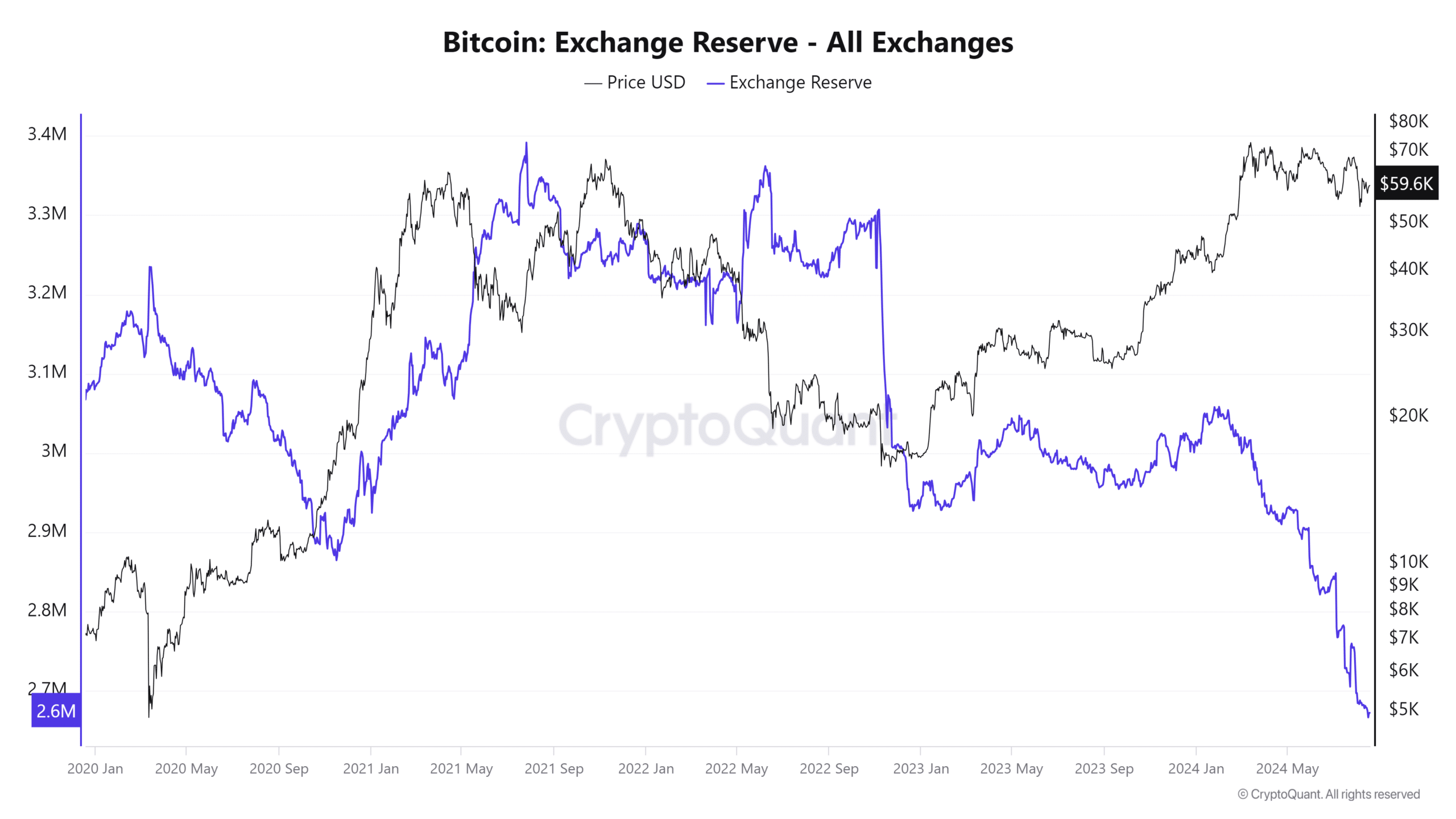

- The BTC trade reserve declined to round 2.6 million.

- That is the bottom stage in over 4 years.

Bitcoin’s [BTC] trade reserve has lately fallen to its lowest stage in years, a big improvement that comes at a time when BTC’s worth is struggling to achieve upward momentum.

Whereas the present worth motion could seem regarding, this drop in trade reserves could possibly be a optimistic sign for Bitcoin’s future worth.

Bitcoin trade reserves drop

AMBCrypto’s evaluation of Bitcoin’s trade reserves on CryptoQuant revealed important developments, with reserves declining to their lowest stage since 2020.

The chart indicated that Bitcoin’s reserves on exchanges have dropped from over 3.2 million BTC in early 2020 to roughly 2.6 million BTC.

Change reserves symbolize the quantity of Bitcoin held on exchanges, accessible for quick buying and selling.

When reserves are excessive, it suggests an elevated provide on exchanges, which might result in heightened promoting stress and doubtlessly decrease costs.

Conversely, as reserves lower, the accessible provide for buying and selling diminishes, which might assist worth will increase resulting from diminished promoting stress.

The continuing lower in trade reserves possible signifies that buyers are withdrawing their Bitcoin from exchanges to retailer it in non-public wallets.

This shift can result in decrease promoting stress available in the market, creating a positive setting for worth appreciation.

Notably, the chart highlights sharp drops in trade reserves round late 2022 and mid-2023, coinciding with Bitcoin’s worth climbing.

This sample helps the concept that decrease trade reserves contribute to bullish worth motion. Lowered availability on exchanges can drive up costs when demand stays regular or will increase.

The present worth pattern

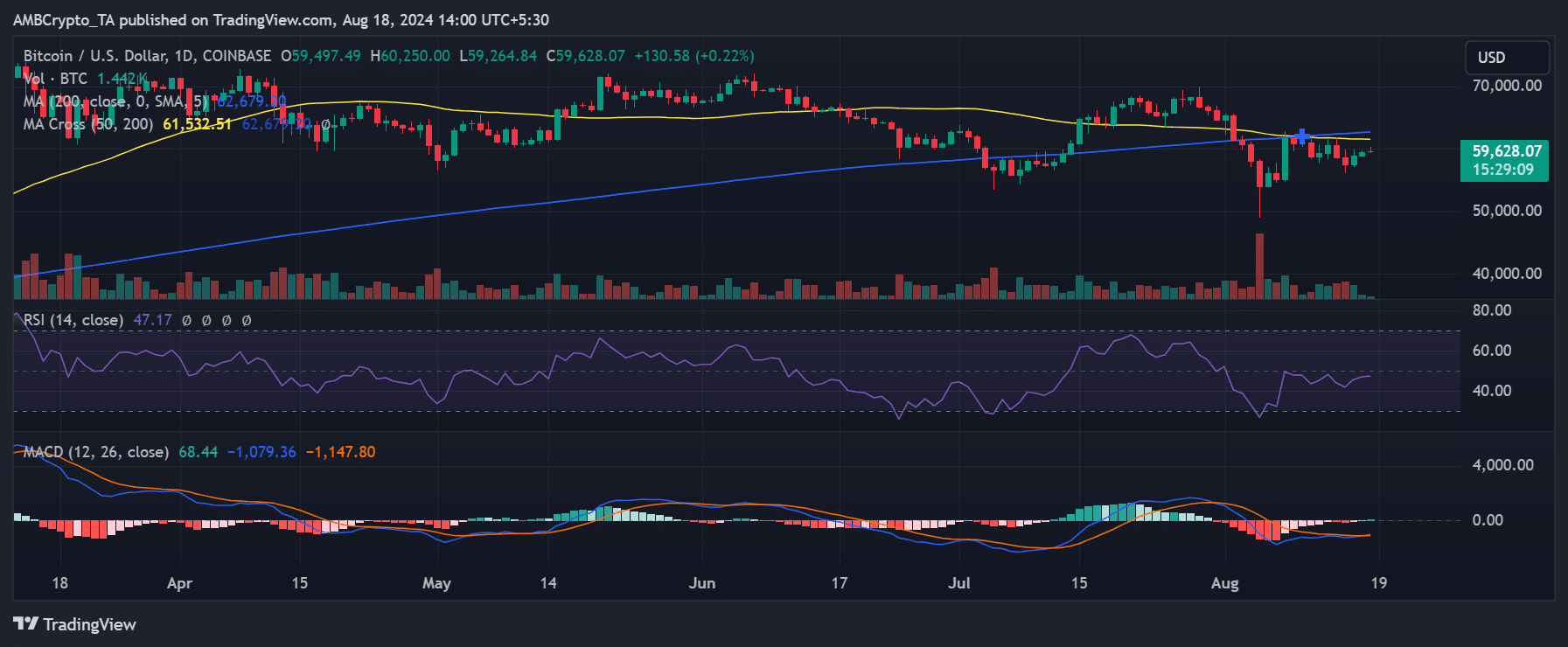

In response to AMBCrypto’s evaluation, Bitcoin was buying and selling at roughly $59,628.07 at press time, exhibiting a slight improve of over 0.22%.

Nevertheless, it confronted important resistance on the $61,532.51 and $62,679.20 worth ranges, marked by the lengthy and quick shifting averages (blue and yellow strains).

The Relative Power Index (RSI) was at 47.17, barely under the impartial 50 stage, suggesting gentle bearish momentum available in the market.

Though the Shifting Common Convergence Divergence (MACD) was optimistic at 68.44, the sign line remained damaging at -1,147.80.

The MACD histogram indicated diminishing bearish momentum, however has not but strengthened sufficient to sign a bullish reversal.

How the reserve pattern may affect BTC

Regardless of the present bearish indicators on Bitcoin’s chart, the continued decline in trade reserves advised a distinct narrative could unfold.

Market individuals had been shifting their Bitcoin off exchanges, doubtlessly for long-term holding, which may cut back promoting stress and supply underlying assist for the worth.

If this pattern of declining trade reserves continues, it may act as a counterbalance to the bearish technical setup.

Although technical indicators at present level to weak spot, the diminished availability of BTC on exchanges may stabilize the worth and even contribute to a gradual rise resulting from shortage.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Nevertheless, if Bitcoin’s worth continues to battle under these shifting averages and the RSI weakens additional, there may nonetheless be room for a deeper decline earlier than discovering significant assist.

Whereas the declining trade reserves may restrict the severity of any sell-off, they might not fully stop it.