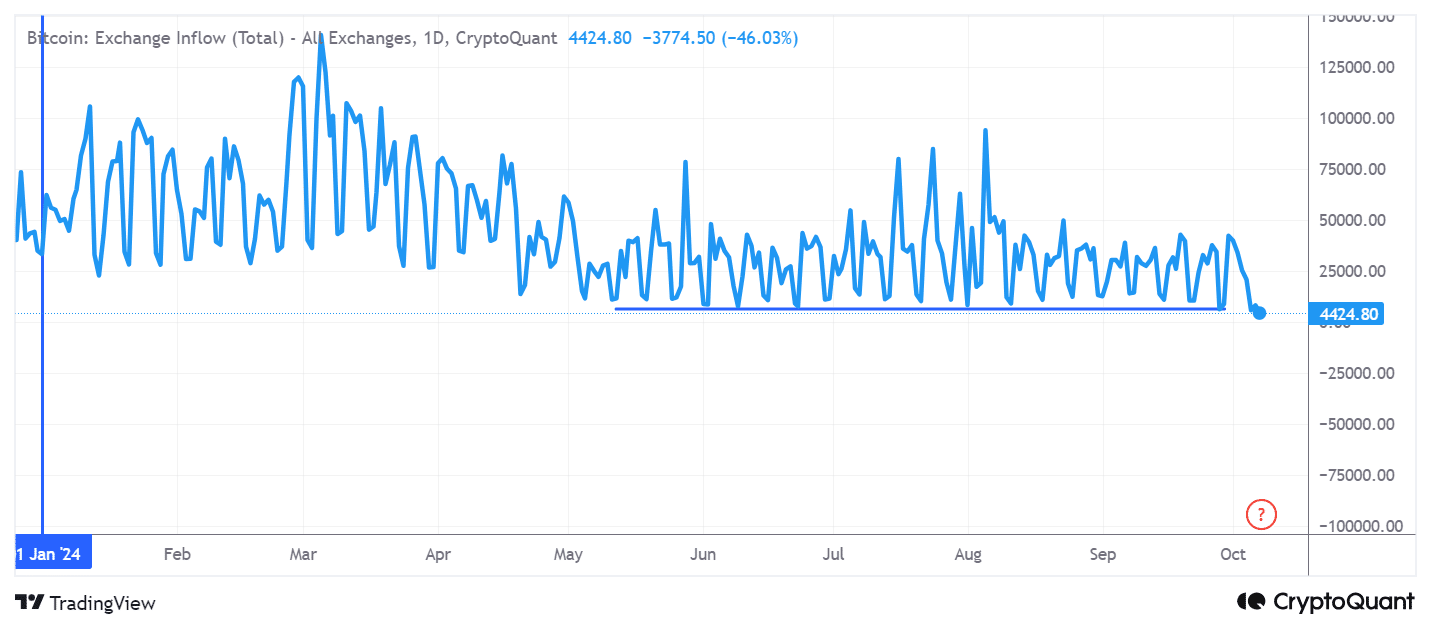

- Bitcoin trade inflows had been declining.

- China liquidity can propel BTC to $77K.

Bitcoin [BTC] continues to attract consideration from buyers, together with conventional finance establishments, who’re more and more trying to Bitcoin as a long-term retailer of worth.

In contrast to in earlier cycles the place Bitcoin was incessantly traded for short-term income, a lot of it’s now saved in chilly wallets, signaling robust investor confidence.

The start of This autumn has seen Bitcoin trade inflows hit their lowest ranges of the yr, indicating that buyers and establishments are anticipating long-term positive factors for BTC as its market cap continues to develop with widespread adoption.

China liquidity stimulus

Chinese language shares are outperforming international markets, largely because of a authorities stimulus bundle that has injected vital liquidity.

This surge in liquidity is impacting risk-on belongings like BTC, which has traditionally proven a robust correlation with Chinese language inventory efficiency.

Following the Folks’s Financial institution of China’s largest stimulus for the reason that pandemic in late September, Chinese language web shares have soared by $2 trillion.

Many merchants view this surge in Chinese language shares as a possible sign for the same upward motion in Bitcoin. This reinforces why BTC has seen diminished trade inflows setting the stage for larger costs.

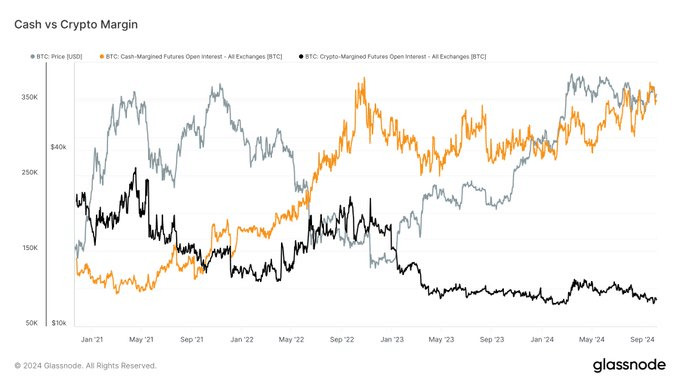

Along with the liquidity stimulus, final week noticed the biggest divergence between crypto and cash-margined Bitcoin futures open curiosity.

Extra merchants at the moment are utilizing money to again their leveraged positions, slightly than Bitcoin itself. This shift is a optimistic, as money margins cut back volatility and the chance of compelled liquidations, making a extra steady buying and selling setting.

In the meantime, retail merchants proceed to chase high-leverage positive factors, contributing to the market’s volatility.

This divergence between institutional warning and retail enthusiasm highlights a maturing Bitcoin market. Now, long-term sustainable development is more and more pushed by institutional exercise.

Can BTC attain $77K?

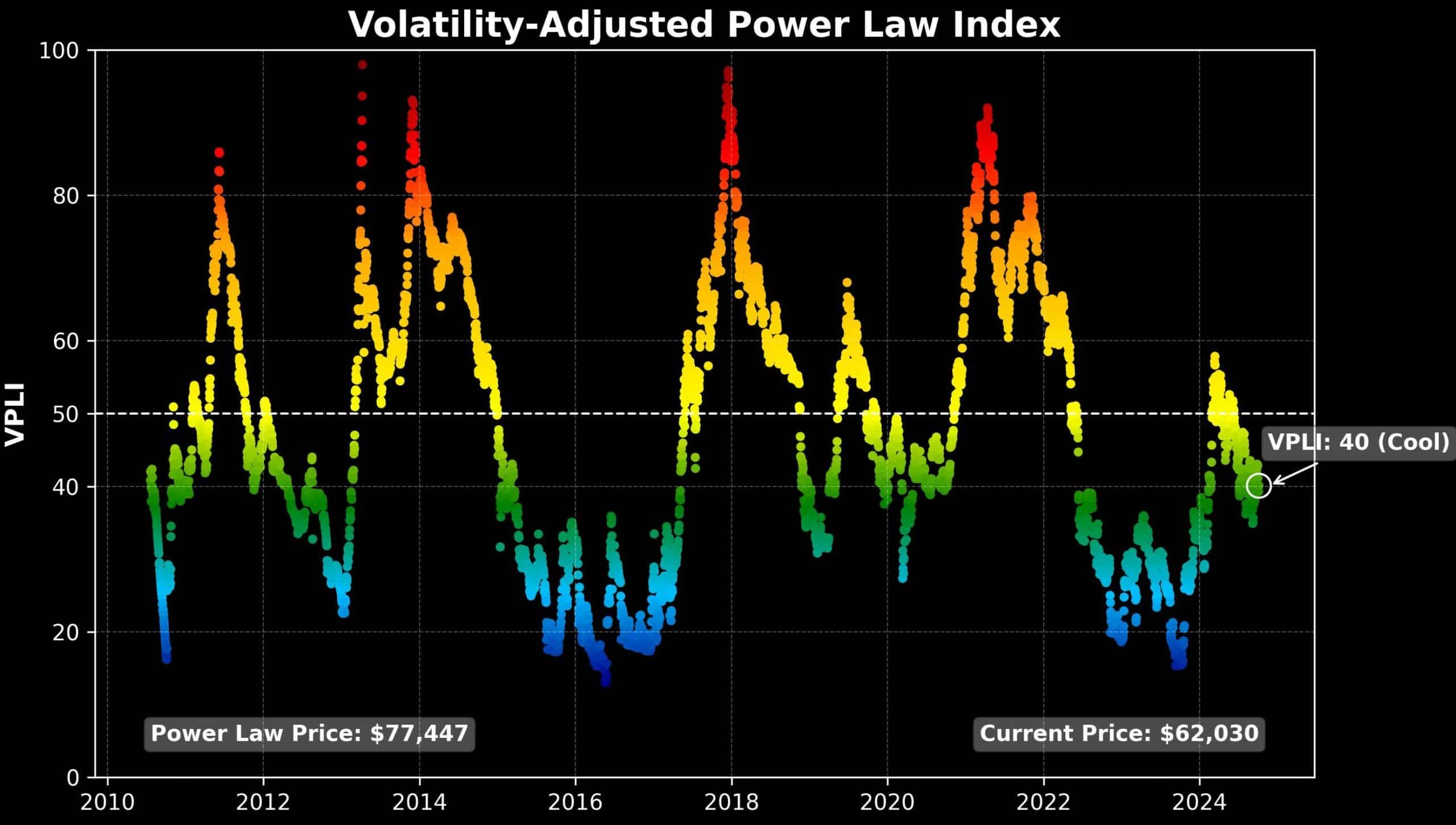

The Volatility Adjusted Energy Legislation Index tasks BTC’s honest worth at $77K, contemplating long-term development and volatility. Regardless of worth consolidation round $60K, the honest worth has risen from $70K to $77K prior to now month.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Rising liquidity from China’s stimulus and diminished futures market volatility recommend Bitcoin is gaining momentum for a breakout. Bitcoin seems prepared to interrupt larger, with potential to succeed in $77K as This autumn progresses.

Supply: Sina/X

With international liquidity surging, BTC reaching $77K appears extra practical. That is very true if financial situations and institutional assist drive development.