- BTC trade deposits have shrunk to 2016 lows.

- CryptoQuant analyst deem this a sign for a serious rally for BTC in the long term.

Because the nineteenth of December, Bitcoin [BTC] has struggled beneath $100K, however the cryptocurrency’s long-term outlook stays optimistic.

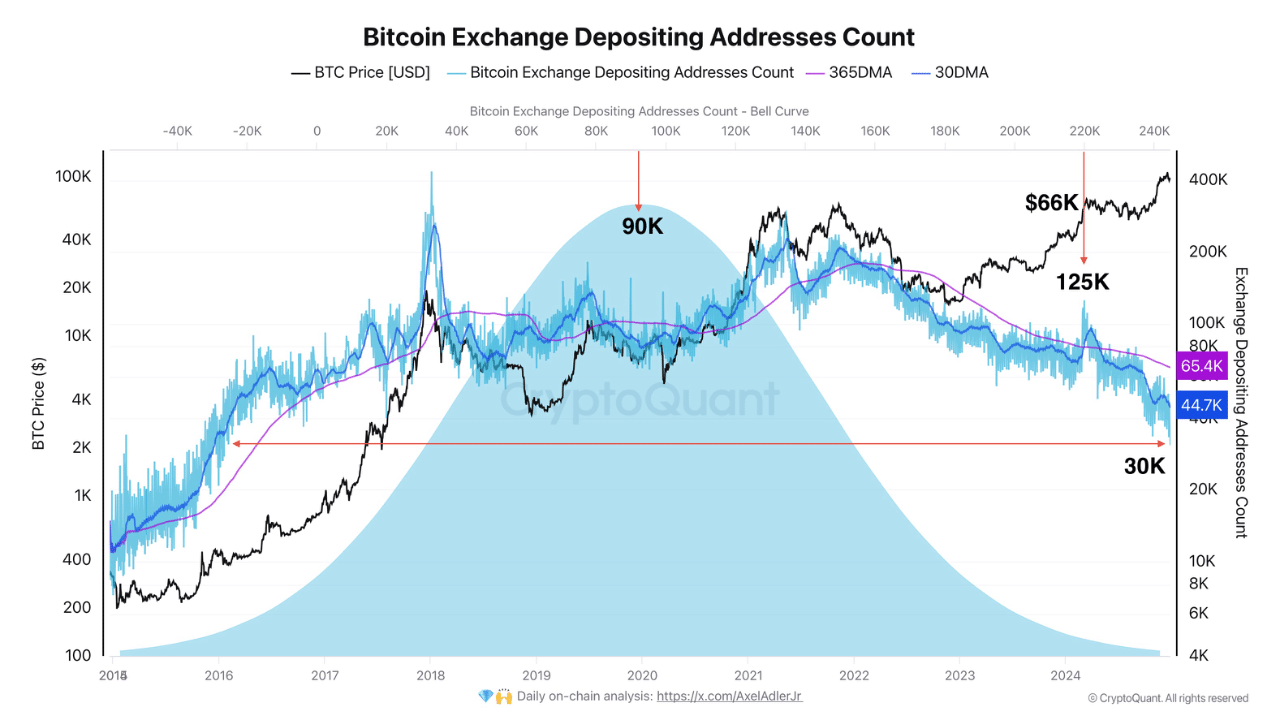

In response to CryptoQuant analyst Axel Adler, the quantity of BTC being moved to exchanges has dropped to 2016 ranges. Adler added that the final time BTC deposits on exchanges dropped this low, a serious rally adopted.

“It typically suggests they prefer to keep their BTC in personal wallets rather than gearing up to sell.”

In comparison with early 2024, when BTC each day deposits peaked at over 125K cash, the present studying declined beneath 45K BTC, mirroring 2016 ranges.

Extra BTC leaving exchanges

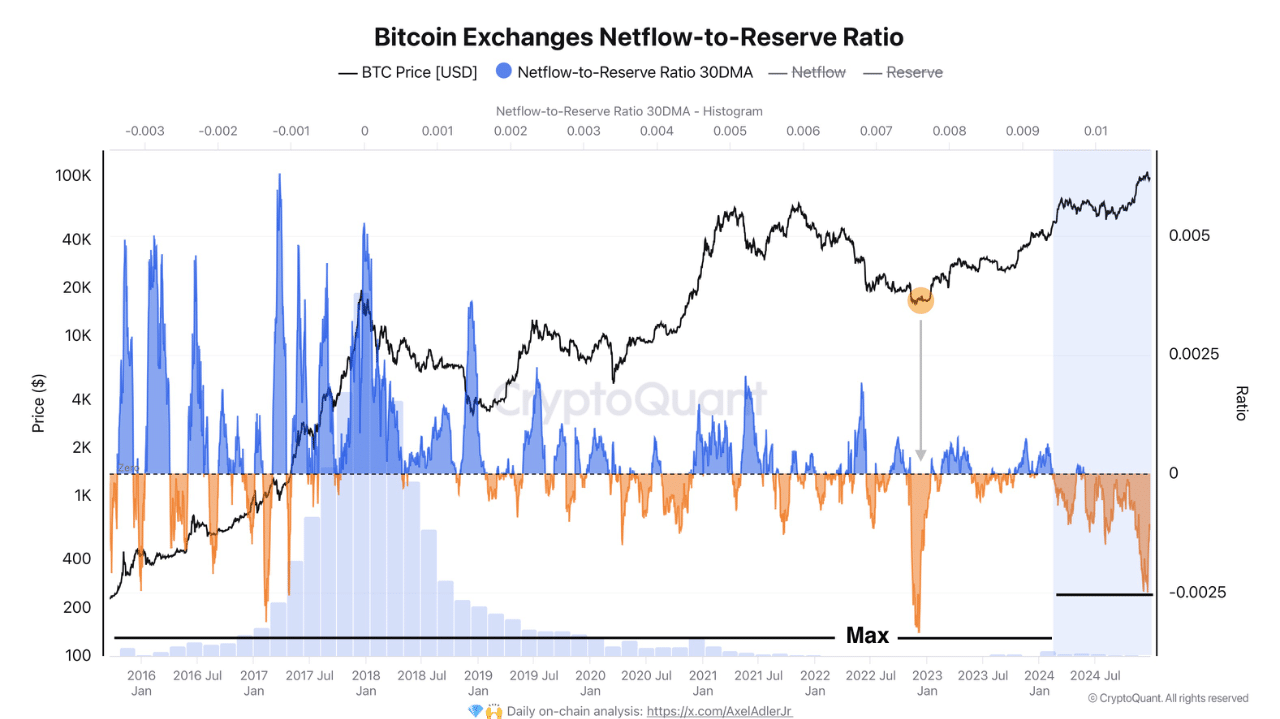

Curiously, the above optimistic outlook was additionally strengthened by extra BTC being moved from the exchanges.

Utilizing the BTC netflow-to-reserve ratio, Addler famous that the metric was unfavourable, underscoring dominance in trade outflows.

The ratio gauges the correlation between web inflows/outflows relative to trade BTC reserves.

The unfavourable studying advised that, on common, extra BTC left exchanges than recorded deposits. It is a typical bullish sign.

Briefly, BTC’s long-term prospect was nonetheless optimistic regardless of the current spike in promote stress that has stored the asset beneath $100K.

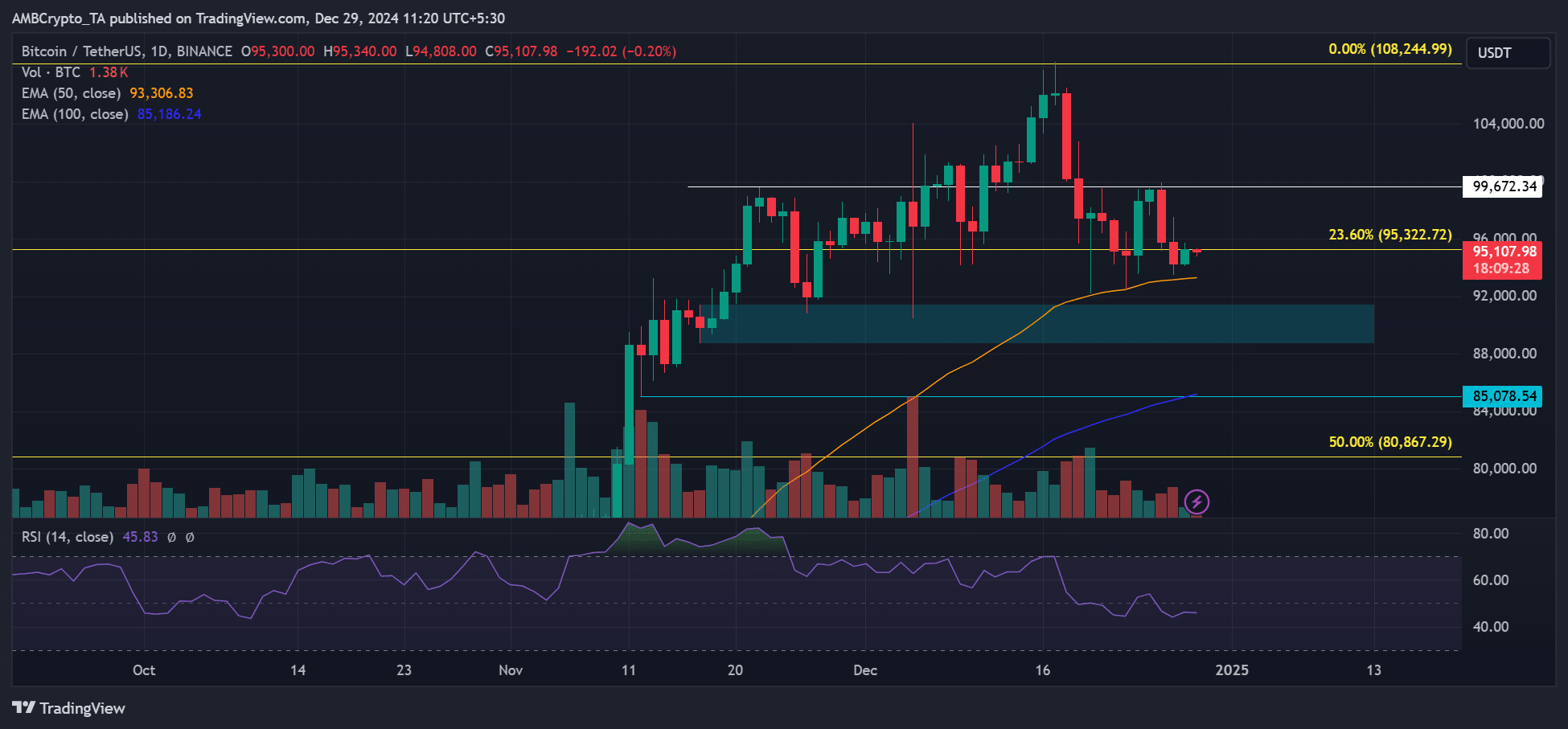

Within the meantime, BTC worth remained range-bound in the course of the vacation season, consolidating between $100K and the 50-day EMA (Exponential Shifting Common).

Moreover, the each day RSI slipped beneath 50, indicating a short-term weakening in demand.

Learn Bitcoin [BTC] Value Prediction 2025-2026

Ought to bearish stress persist within the quick time period, a drop to $90K or $85K might be on the playing cards.

Nonetheless, holding above the dynamic assist of a 50-day EMA might improve the chances of retesting $100K or a bullish breakout.