- The absence of great catalysts has left the crypto market delicate to US macro information prints.

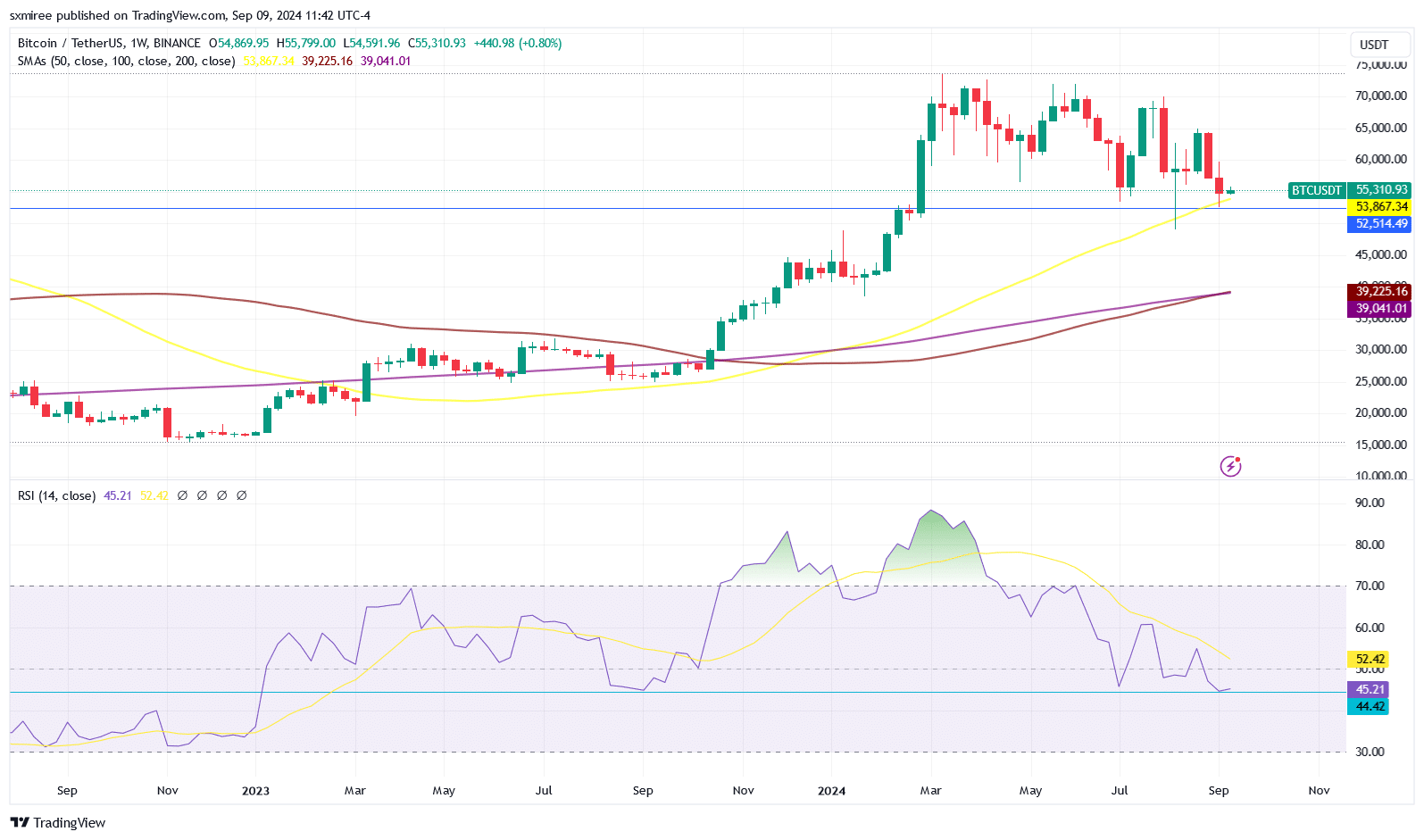

- Bitcoin’s weekly Relative Energy Index studying closed at its lowest stage since January 2023.

Bitcoin [BTC] briefly climbed above $55,500 on ninth September after gentle losses heading into the weekend, which cemented detrimental returns of 4.26% for the just-concluded week.

Although not as deep because the 11% slide within the previous week, the marginally underwhelming shut marked consecutive weekly losses for the crypto asset since tenth June, when it tracked declines for 4 straight weeks.

Observers chalked up final week’s dip to the U.S. non-farm payroll information and detrimental flows from Bitcoin ETFs. The newest U.S. jobs report revealed the financial system added 142,000 non-farm payrolls in August, in need of the expectations of 160,000.

In the meantime, information from SoSo Worth confirmed Bitcoin spot ETFs are on an eight-day streak of outflows.

Last week of inflation information earlier than FOMC assembly

This week, market individuals welcome extra U.S. financial information that might affect the Fed’s 18th September fee choice and influence the general market path.

The Bureau of Labor Statistics will launch August’s U.S. Client Worth Index report on Wednesday, eleventh September, adopted by the Producer Worth Index information on Thursday.

The releases come after Tuesday’s US Presidential debate between candidates Kamala Harris and Donald Trump. Forward of the talk, analysts at Bernstein have identified that the election’s final result and the character of the regulatory surroundings usually are not accounted for within the present market.

The analysts led by Gautam Chhugani forecast that Bitcoin may fall to the $30,000 to $40,000 vary if Democrat nominee and VP Harris is elected as President.

A Trump victory within the November elections may, however, propel Bitcoin above $80,000 by the fourth quarter.

Additional decline under $50,000 on the playing cards

In his newest evaluation involving Bayesian possibilities, chart dealer Peter Brandt famous that technical indicators have been more and more leaning in favor of his preliminary low $30,000 vary projection.

He mentioned,

“Currently, my Bayesian Probability for sub-$40,000 is at 65% with a yet-to-be-achieved top at $80,000 at 20% and an advance during this halving cycle to $130,000 by September 2025 at 15%.”

Brandt’s evaluation builds on his preliminary value forecasts. In April, he noticed that BTC value had reached a market prime after setting an all-time excessive of $73,835, and in Could, he projected a continuation of a bull development on the time.

Brandt isn’t alone within the bearish evaluation. 10x Analysis founder Markus Thielen additionally opined that Bitcoin reached a cycle prime in April drawing consideration to diminished Bitcoin community exercise after Q1.

Thielen additionally recognized regular Bitcoin ETF outflows and a weak US financial system as different bearish components that might drive BTC down additional.

Halving thesis nonetheless in play

Bitcoin made a brand new all-time excessive this 12 months earlier than the halving and has been buying and selling sluggishly because the occasion. Nonetheless, some analysts contend that Bitcoin is poised for additional beneficial properties based mostly on the worth motion in earlier halving years.

Bitcoin persistently tracked beneficial properties throughout October, November, and December 2016 and 2020.

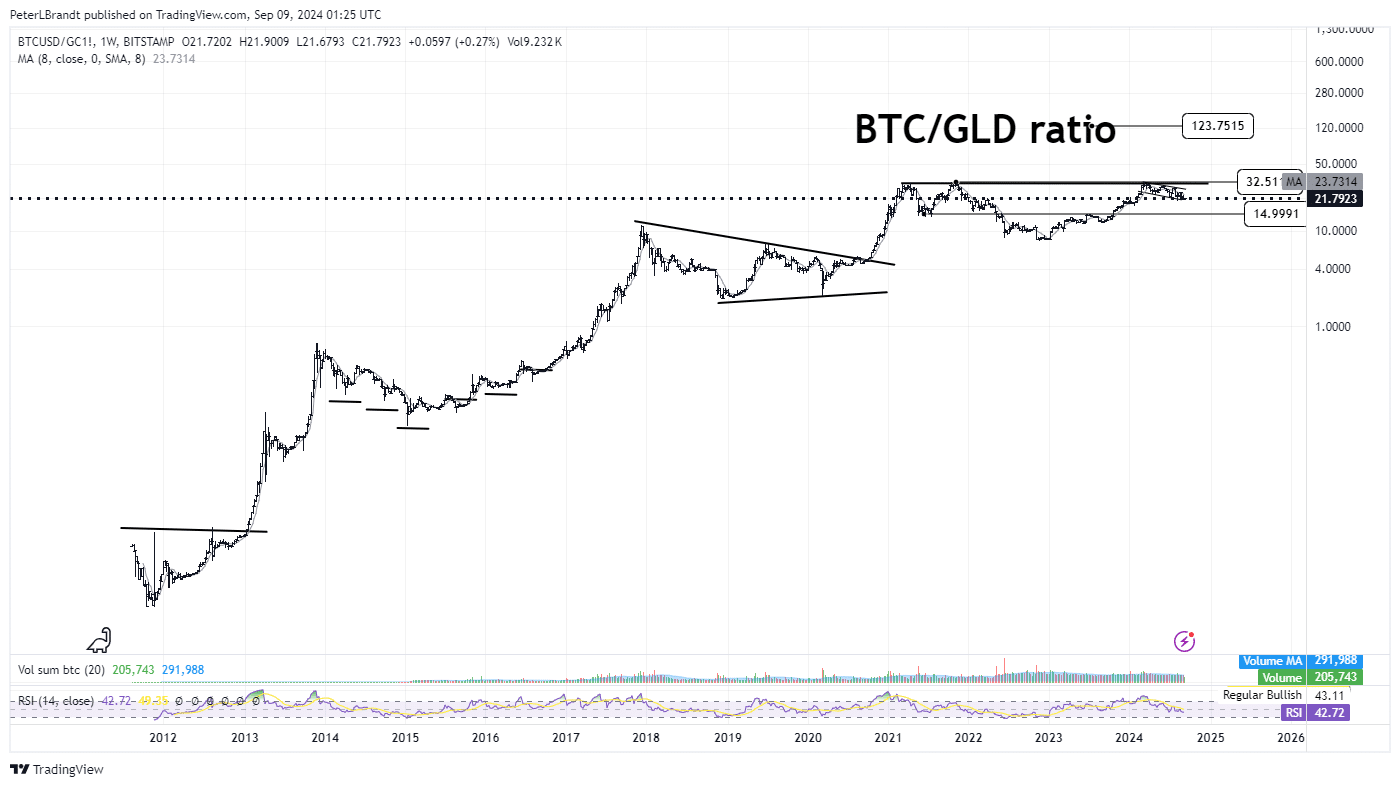

Supply: Peter Brandt

Value noting, Bitcoin’s value relative to gold has been making decrease highs this 12 months regardless of a lift from spot Bitcoin ETFs debut and March’s halving occasion. Brandt believes this continued value weak spot may drive the BTC/Gold ratio to achieve 15 to 1.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

BTC/USDT potential rebound

Bitcoin is buying and selling close to $55,400 at writing after posting the bottom weekly shut since late February. The BTC weekly RSI equally closed at its lowest stage because the begin of 2023.

Curiously, Bitcoin order books trace at a possible bullish setup on the horizon as does the Bitcoin CME futures chart. Bitcoin futures opened larger than final week, transferring again right into a descending wedge sample after briefly breaking under it.