- Bitcoin’s worth went slightly below the $70k mark.

- Metrics counsel that BTC will witness an extra worth correction.

Bitcoin’s [BTC] worth has been considerably in a consolidation part close to the $70k mark for fairly a couple of days. If the newest evaluation is to be believed, then traders won’t witness an unprecedented worth rise within the close to time period.

Due to this fact, AMBCrypto deliberate to examine BTC’s metrics to see what to anticipate from it within the coming week.

Bitcoin has issues forward

Based on CoinMarketCap, BTC’s worth simply dropped below the $70k mark. The token’s worth went down marginally within the final 24 hours. At press time, it was buying and selling at $69,973.35 with a market capitalization of over $1.38 billion.

Nonetheless, it was attention-grabbing to notice that, regardless of the latest drop, over 97% of BTC holders have been in revenue. Moreover, as per IntoTheBlock’s information, the marketplace for BTC was nonetheless bullish.

Within the meantime, Michael van de Poppe, a well-liked crypto analyst, posted a tweet highlighting Bitcoin’s present state. As per the tweet, the possibilities of BTC reaching $100k anytime quickly have been low, as we have been nonetheless following the trail of the 4-year cycle.

Moreover, the tweet talked about that BTC consolidating in between $60k and its ATH appeared prone to occur.

Will BTC’s worth fall additional subsequent week?

AMBCrypto checked BTC’s metrics to seek out out whether or not BTC will proceed to stay much less risky within the upcoming week. Our evaluation of Hyblock Capital’s information additionally revealed an analogous state of affairs to the aforementioned evaluation.

We discovered that northward BTC’s liquidation will improve sharply to $72k. Excessive liquidity may act as sturdy resistance for the king of cryptos and prohibit its worth from shifting up.

Equally, southward BTC’s help lies close to $69k. If it fails to check that help, then BTC’s worth may as properly attain $63k.

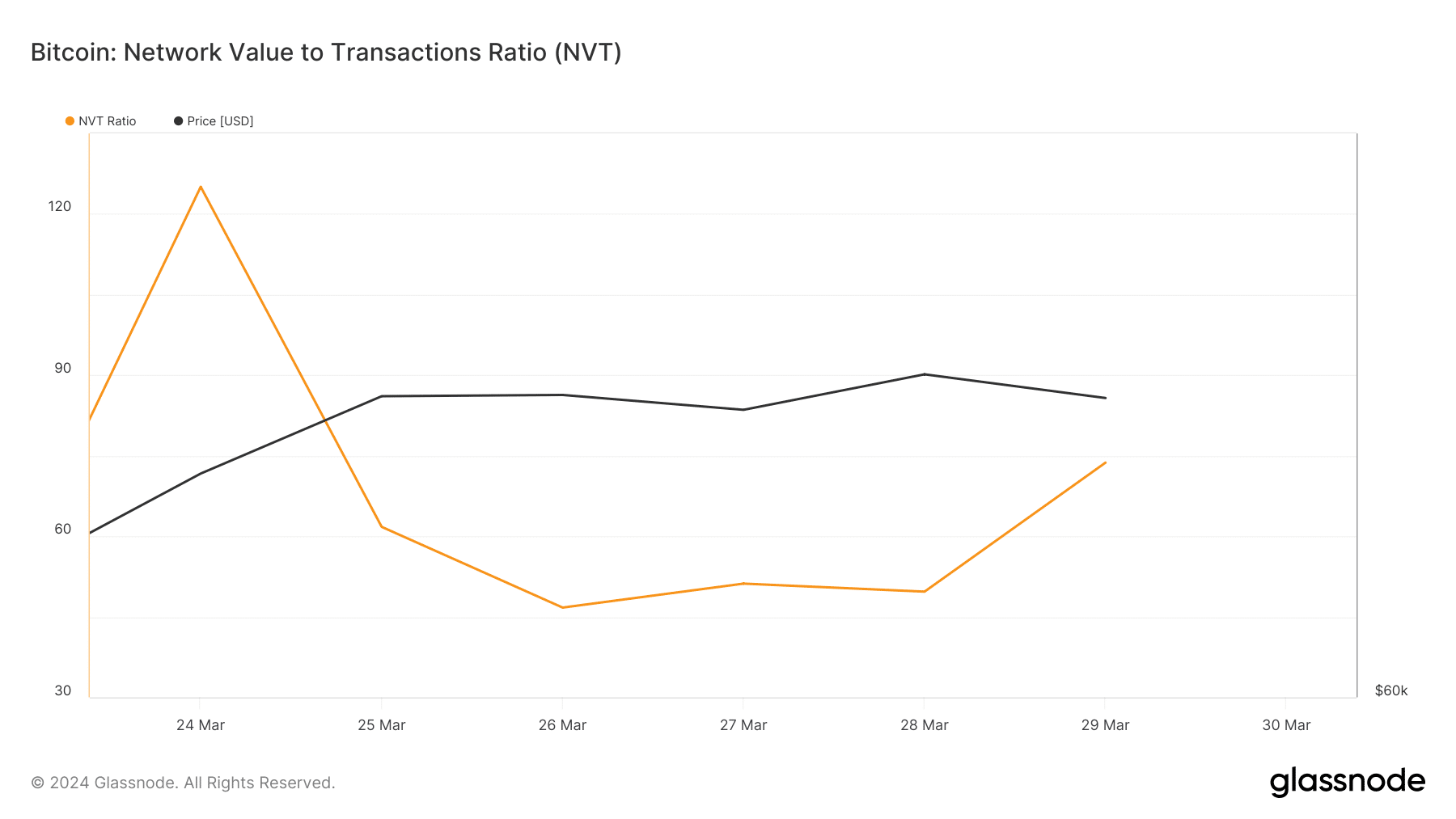

An evaluation of Glassnode’s information revealed that BTC’s network-to-value (NVT) ratio elevated in the previous few days. Every time the metric rises, it signifies that an asset is overvalued, suggesting that the possibilities of a worth correction are excessive.

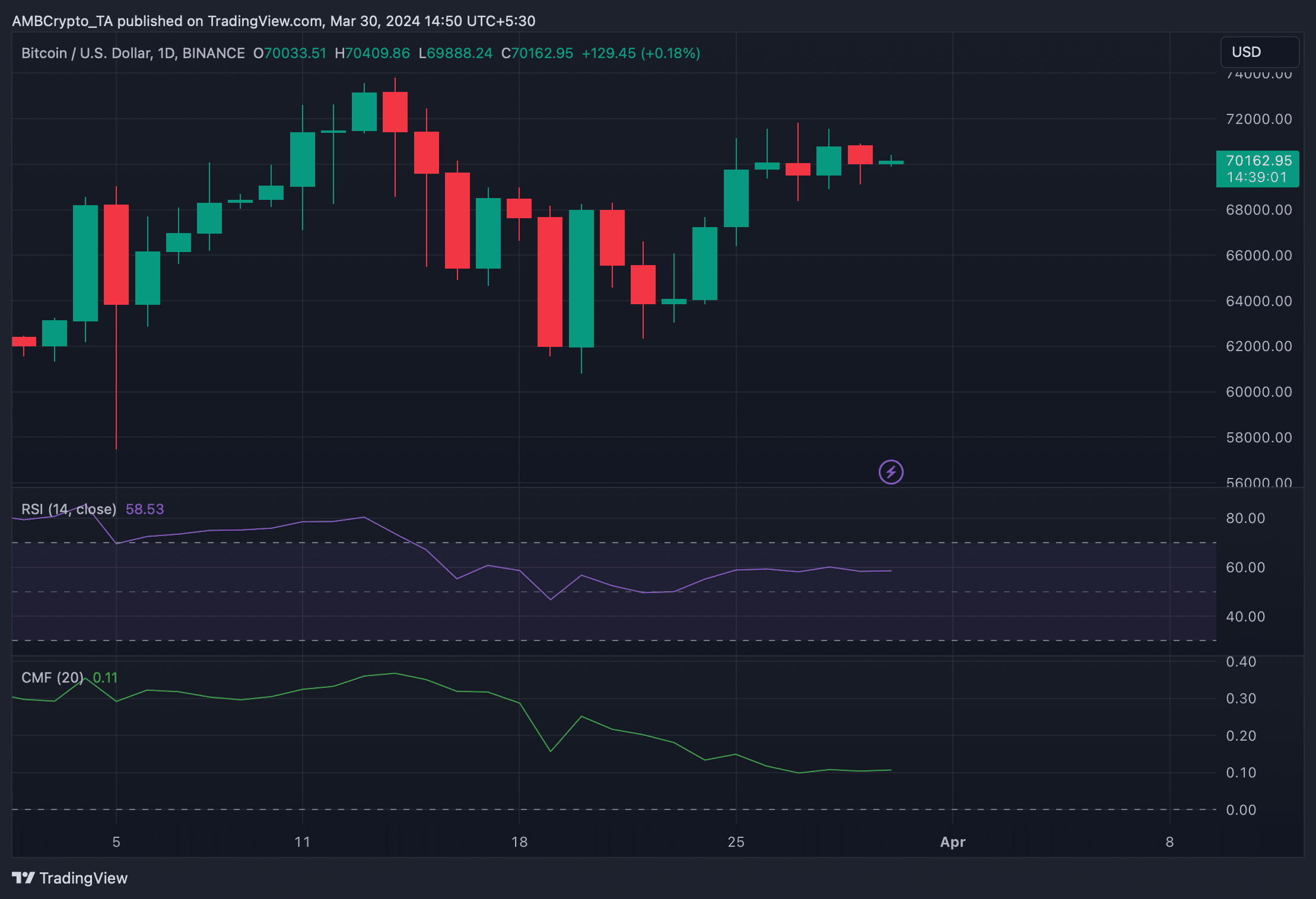

To double-check whether or not a worth correction subsequent week is inevitable, AMBCrypto took a have a look at its every day chart. We discovered that BTC’s Relative Power Index (RSI) took a sideways path.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

On prime of that, its Chaikin Cash Circulation (CMF) additionally adopted an analogous route. The symptoms, mixed with different metrics, gave a bearish notion.

Due to this fact, the possibilities of BTC reaching its help stage have been excessive. Nonetheless, contemplating the unpredictability of the crypto market, nothing may be stated with the utmost certainty.