- Bitcoin short-term holders realized losses, reflecting market uncertainty and potential turning factors.

- A drop in Bitcoin’s STH SOPR urged both the chance of deeper corrections or long-term alternatives.

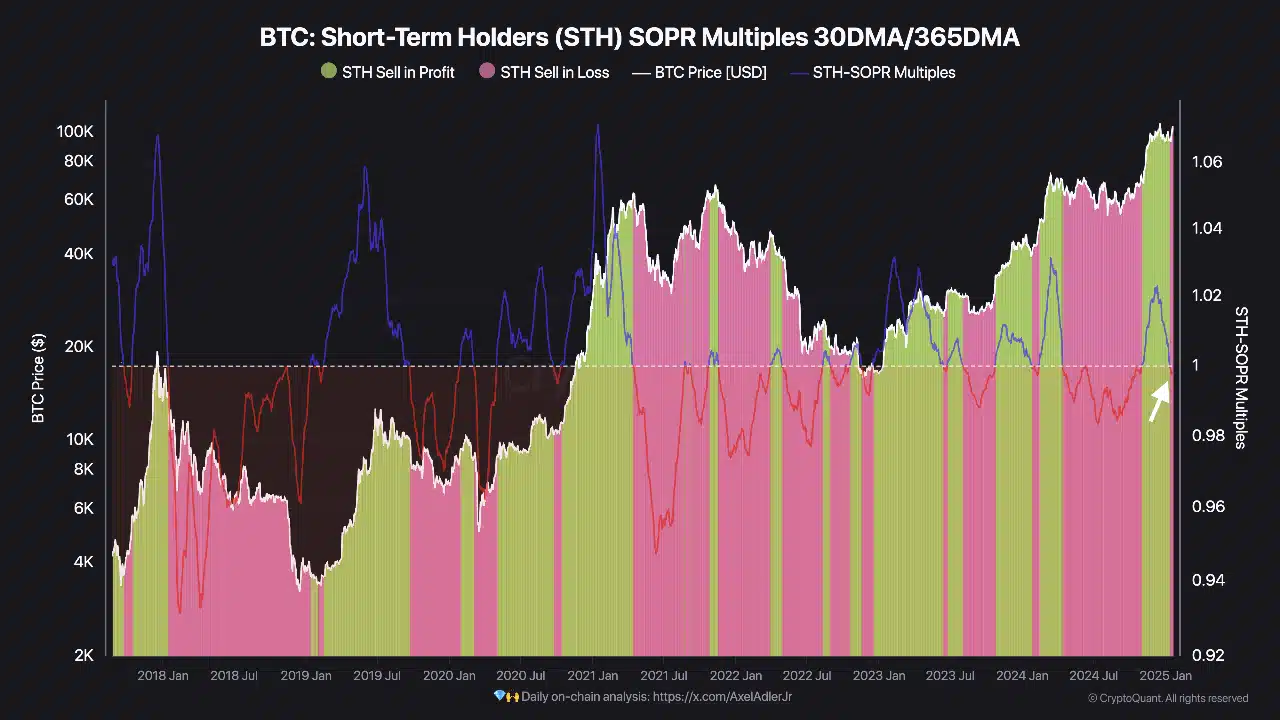

Bitcoin [BTC] short-term holders are actually promoting their holdings at a loss, with the Quick-Time period Holder Spent Output Revenue Ratio (STH SOPR) a number of turning damaging.

This metric, which compares the 30-day STH SOPR to its 365-day common, highlights a shift in STH profitability traits.

Traditionally, such moments have coincided with vital market turning factors, signaling both enticing long-term entry alternatives or heightened short-term dangers.

What the STH SOPR reveals about BTC

The STH SOPR measures whether or not Bitcoin short-term holders are promoting at a revenue or a loss. By evaluating the 30-day STH SOPR to its 365-day common, this metric supplies a transparent pattern of STH profitability.

Latest information has revealed that the STH SOPR a number of has entered damaging territory, indicating that STHs are promoting at a loss.

Traditionally, such dips typically replicate rising market stress however may also current accumulation alternatives for long-term buyers.

The chart highlighted this shift, with the current drop under 1.0 signaling waning confidence amongst STHs.

As this pattern unfolds, it raises questions on whether or not STHs will proceed to promote, deepening market corrections, or maintain agency, creating a possible worth ground.

Potential market outcomes amid STH losses

As Bitcoin short-term holders start realizing losses, two doable situations may form the market trajectory.

Within the first state of affairs, STHs might decide to carry quite than promote at a loss, permitting their realized worth to behave as a robust help degree. Such habits may stabilize Bitcoin’s worth and supply a basis for restoration.

Conversely, a wave of capitulation might happen if STHs proceed to dump their holdings. This might amplify promoting stress and set off a deeper market correction.

Traditionally, such capitulation occasions typically coincide with heightened volatility, however they might additionally sign enticing entry factors for long-term buyers.

The unfolding pattern will depend upon broader market sentiment and the habits of different market members.

Historic context and long-term outlook

Traditionally, damaging STH SOPR multiples have coincided with vital turning factors in Bitcoin’s market.

As an example, throughout the March 2020 COVID-19 market crash, the STH SOPR fell into damaging territory, signaling short-term holders capitulating at a loss.

This era later proved to be one of the crucial profitable entry factors, as Bitcoin surged from $4,000 to over $60,000 throughout the following 12 months.

Equally, in mid-2018, as Bitcoin retraced from its $20,000 peak, the STH SOPR confirmed sustained damaging readings.

Though it indicated capitulation on the time, it marked the buildup part earlier than Bitcoin’s rally to new all-time highs in 2020.

Learn Bitcoin’s [BTC] Worth Prediction 2025–2026

For long-term buyers, these damaging SOPR phases have typically preceded vital recoveries, as promoting stress subsides and accumulation begins.

Whereas the present pattern displays short-term uncertainty, historic patterns recommend potential for bullish outcomes over an prolonged horizon.