- Bitcoin was experiencing a psychological surge, making a correction unlikely for now.

- Nevertheless, when the basics finally take over, panic might ensue.

Fears of market overheating are rising as Bitcoin [BTC] surges previous the $68K benchmark, breaking a four-month droop, even because the RSI sees a pointy decline.

Because of this, buying and selling simply above this crucial stage might sign a possible prime for BTC. If this vary is confirmed as a resistance level, a value correction could possibly be on the horizon, doubtlessly forcing mass capitulation. Nevertheless,

Bitcoin’s surge — Psychology over fundamentals

Firstly, it’s important to contemplate that Bitcoin is closely influenced by macroeconomic components.

At present, a confluence of occasions – such because the post-halving surge, the nearing finish of the election cycle, the “Uptober” frenzy, and cuts in Fed charges – has mixed to propel Bitcoin to $68K in simply ten days with none strong pullback.

That is essential as a result of, regardless of key technicals pointing to a near-term reversal, these macro components might strengthen giant holders’ perception that this can be a key shopping for zone.

In different phrases, large gamers may nonetheless see this stage as a chance, and this psychological momentum might draw in additional patrons, fueled by rising FOMO as market sentiment heats up.

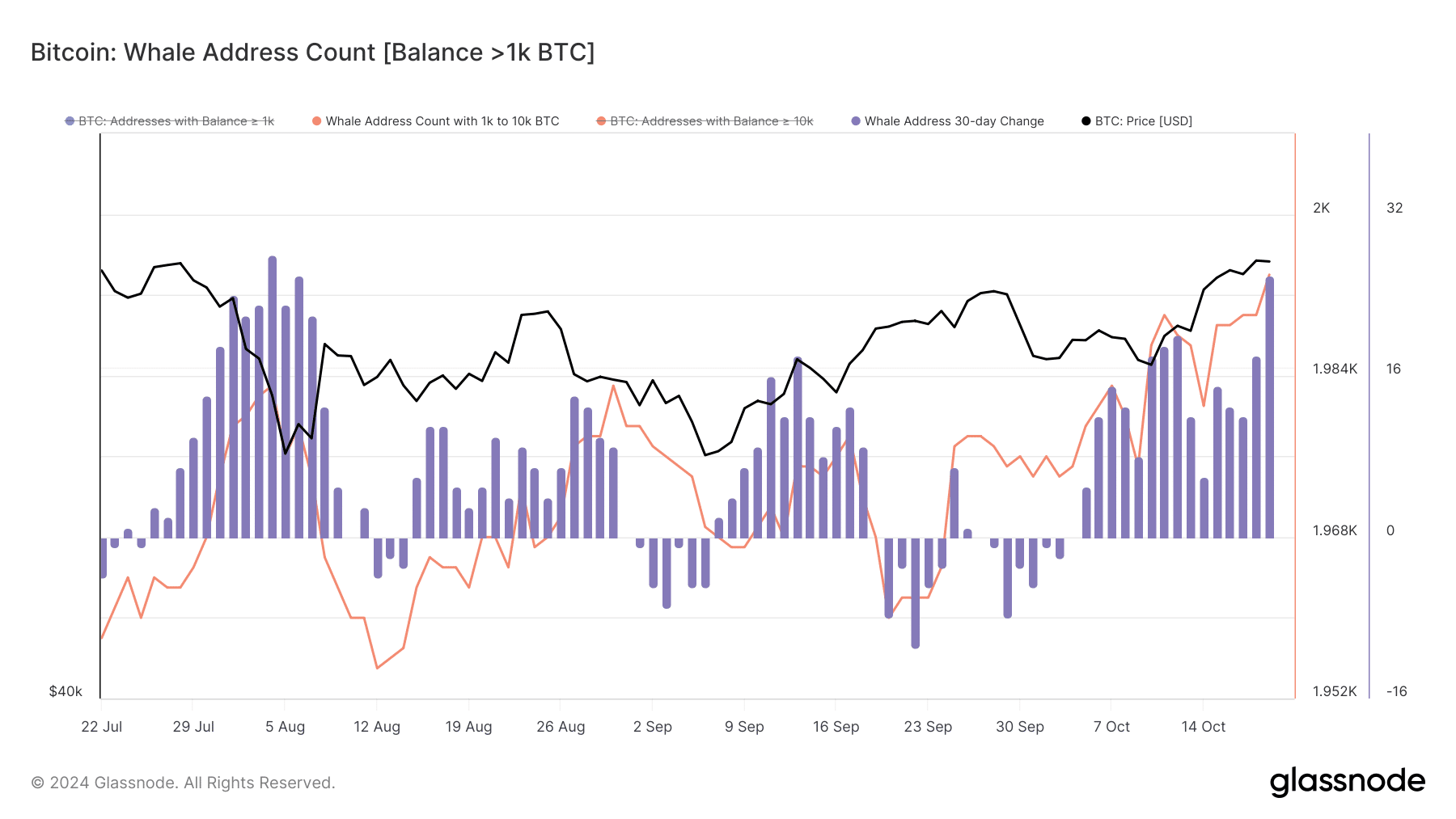

Supporting that is the rise in whale exercise: addresses holding 1K–10K BTC have hit a 3-month excessive. The final main spike occurred alongside a 5% day by day value surge, pushing BTC above $66K.

In easy phrases, whales have performed a key position in countering bearish stress. For the reason that begin of October, their exercise has bolstered AMBCrypto’s preliminary speculation: macro components are drawing in large gamers.

General, this cycle seems to be psychologically pushed. So, regardless of bearish makes an attempt to quick Bitcoin, the probability of a major correction appears slim for now.

Market buzz main the way in which to $73K

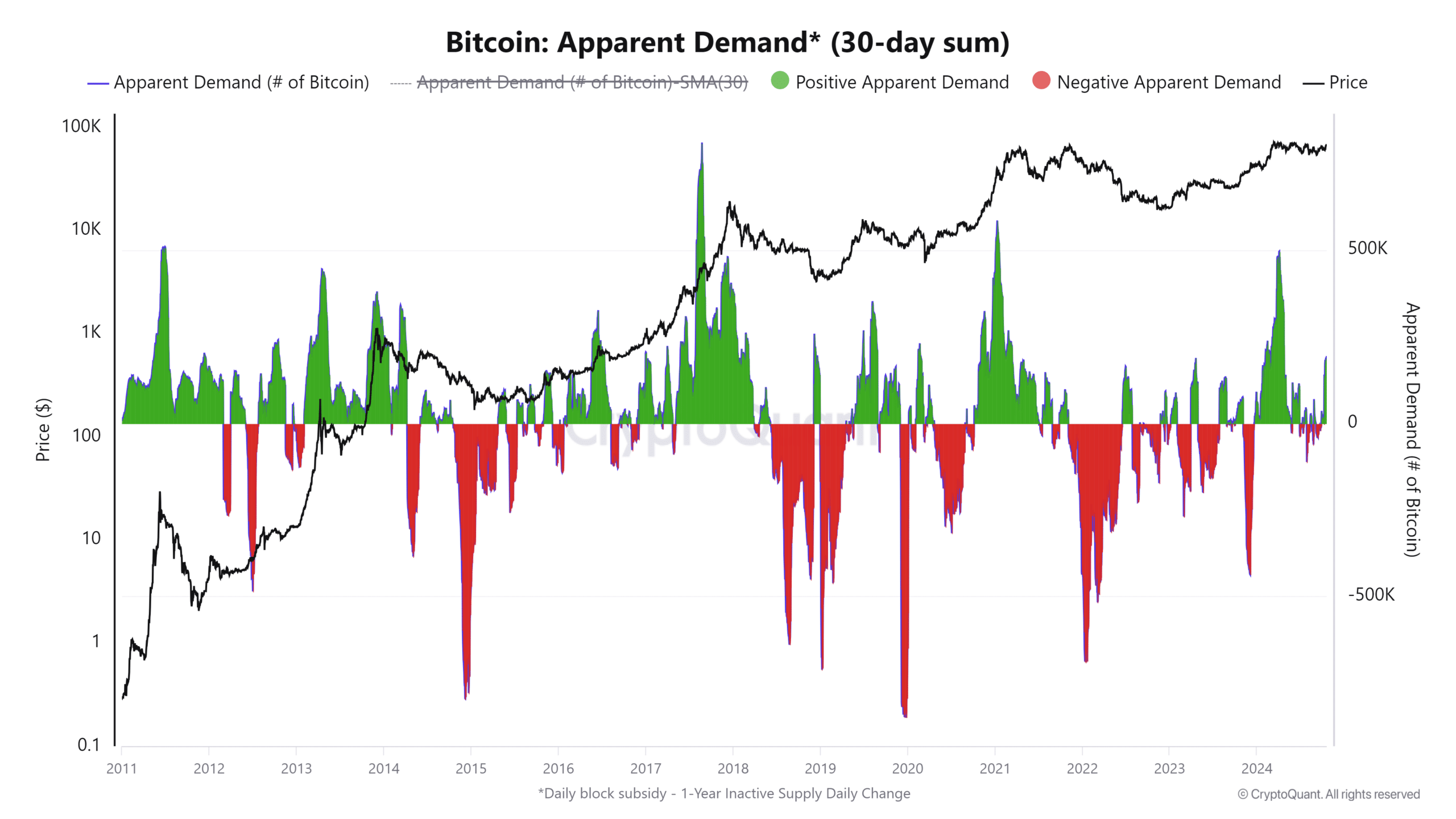

Traditionally, the halving 12 months has been a dependable indicator of when a bull cycle may happen. Spikes within the 30-day demand common (marked in inexperienced) have persistently coincided with Bitcoin provide cuts throughout halving occasions.

These provide reductions usually spark long-term rallies, delivering outsized returns to stakeholders.

Apparently, even when the basics don’t instantly play out, the widespread anticipation alone can set off a breakout.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

This cycle is a primary instance: the market buzzed with expectations of a halving-driven rally, and true to kind, Bitcoin surged to $68K in a remarkably quick timeframe.

That stated, if whale exercise continues on this upward development— which appears probably—Bitcoin could possibly be set to hit its all-time excessive of $73K earlier than the top of This autumn.