- Bitcoin reveals indicators of enhancing market confidence however short-term headwinds are nonetheless in play, influencing its efficiency.

- Can Bitcoin drum up sufficient momentum amid indicators of declining dominance?

The Bitcoin [BTC] funding panorama is experiencing a resurgence of confidence regardless of struggling to remain above $60,000. That is proof in retail exercise, in addition to in Bitcoin miners.

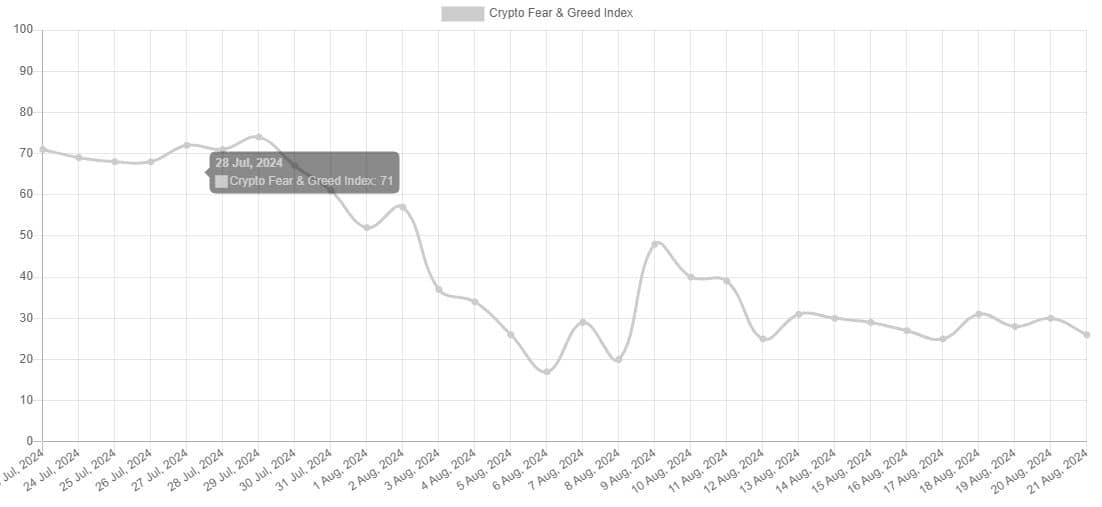

Bitcoin and the general crypto market are experiencing a confidence restoration, opposite to the scenario earlier within the month. The concern and greed index is presently at 26, however it peaked at 30 throughout Tuesday’s session.

The concern and greed index alerts that Bitcoin confidence is presently greater than it was at first of the 12 months. Nevertheless, this doesn’t essentially paint an image of confidence contemplating that it dipped to 26 within the final 24 hours.

The attainable purpose for this the truth that BTC slipped under $60,000 as soon as once more. An consequence that has been fairly frequent recently.

The explanation for the promote stress pushing BTC under $60,000 this time may very well be the revelation that Mt. GOX simply moved over 12,000 BTC value over $700 million.

Are miners accumulating Bitcoin?

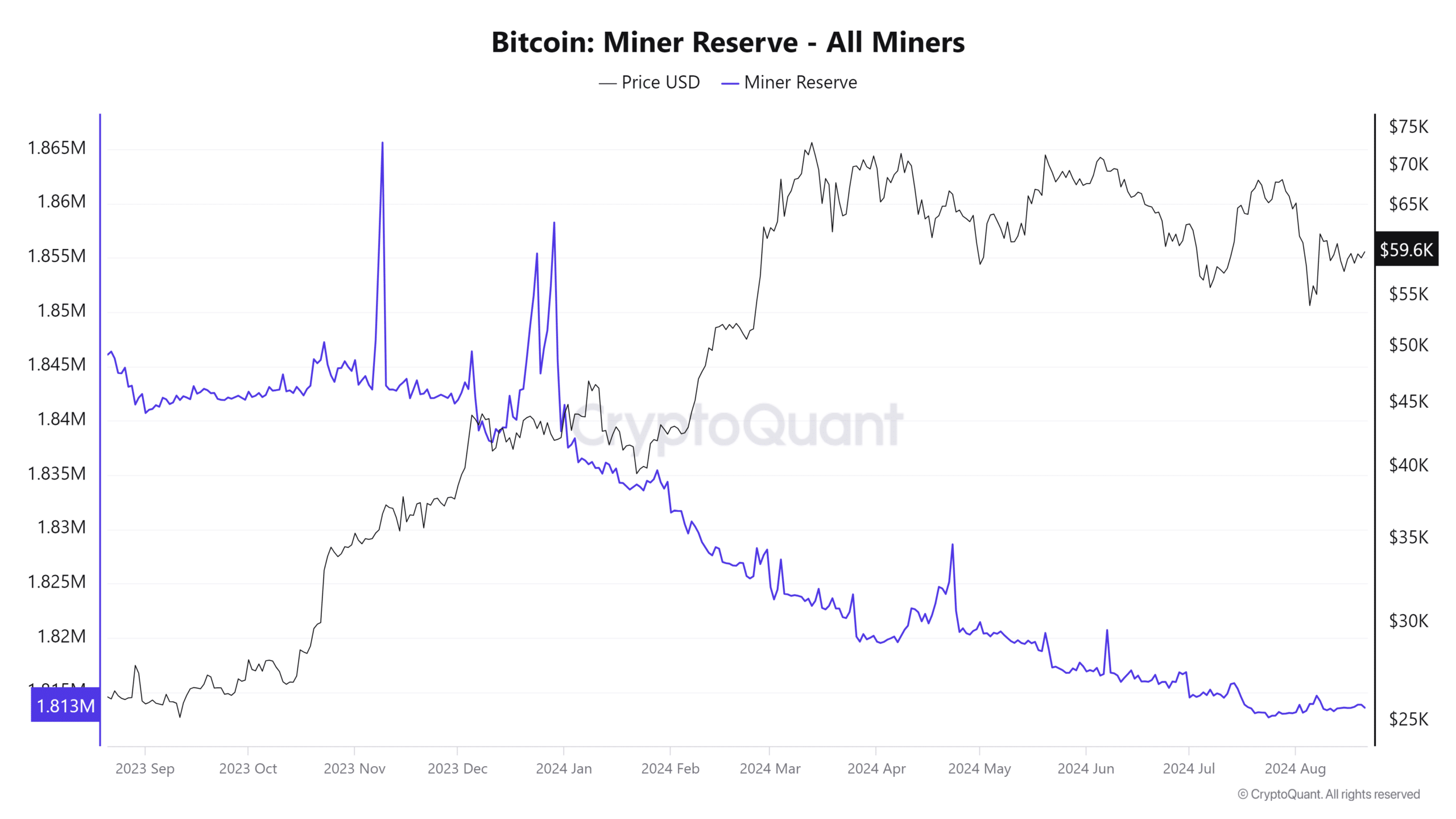

Bitcoin miner reserves have been on an total downward trajectory within the final 12 months. Reflecting the state of promote stress as bars grew to become the dominant drive.

Nevertheless, miner reserve information signifies an inversion within the curve to date this month from July lows. This means that the variety of miners HODLing their BTC has been rising.

Supply: Cryptoquant

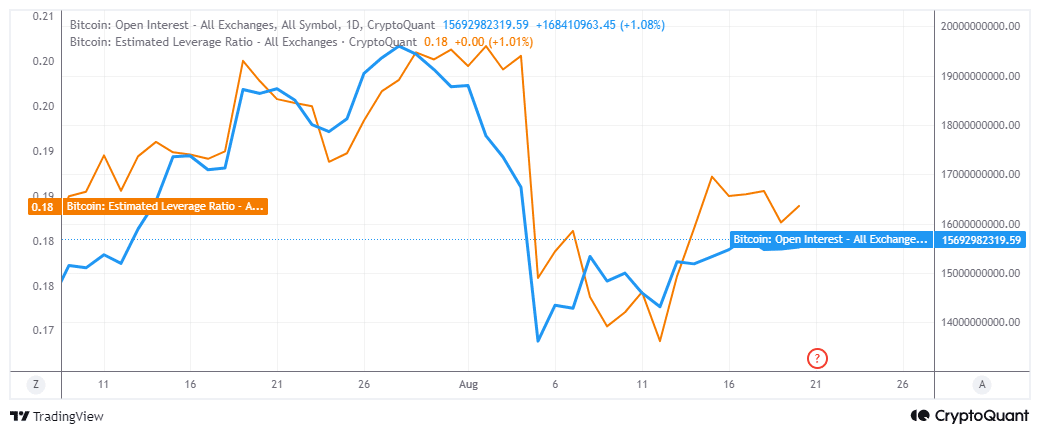

Demand for Bitcoin within the derivatives phase can be recovering. This was evident within the rising open curiosity after a tough begin earlier this month. Equally, we additionally noticed rising urge for food for leverage, resurgence.

Supply: CryptoQuant

Regardless of the resurgence in open curiosity and leverage, it’s clear that the market remains to be in a cautious temper. Latest liquidations have many merchants on edge particularly with the prevailing directional uncertainty.

Whereas the present market situations counsel an enchancment within the degree of market confidence, Bitcoin remains to be uncovered to sure and unsure dangers. Mt. Gox-induced promote stress is one among them.

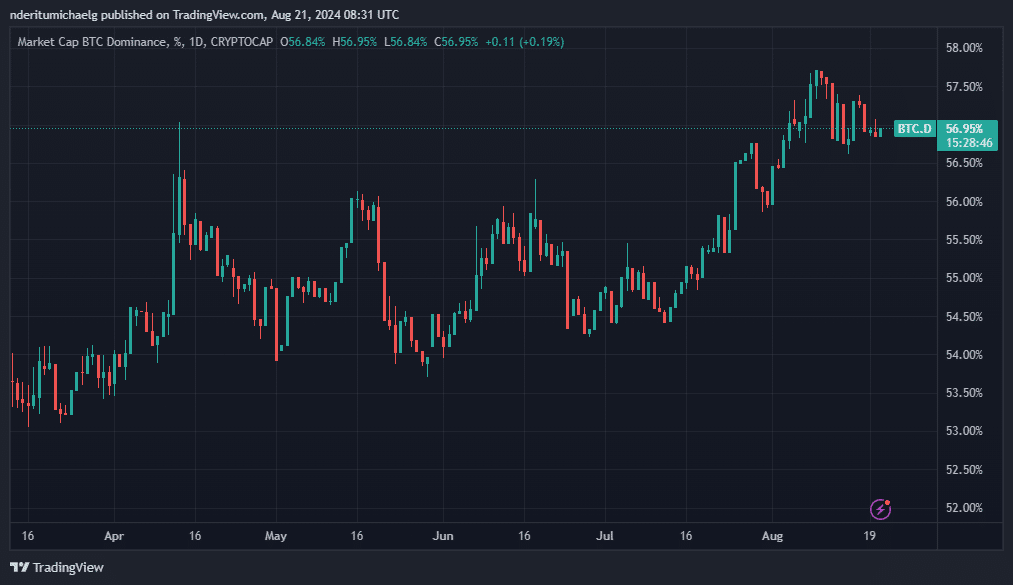

Nevertheless, there may be one other danger that’s much less pronounced. BTC dominance has been declining since 10 August.

A small retracement is completely regular contemplating that Bitcoin dominance achieved a powerful rally since 13 July. However, this may very well be the beginning of a stronger downtrend to return.

If so, then liquidity could begin flowing in favor of the altcoins, consequently limiting BTC’s potential upside.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

In the meantime, Bitcoin demand from main establishments signifies rising competitors. For instance, Microstrategy has been the main institutional investor however not anymore.

Latest information reveals that Blackrock has been aggressively shopping for Bitcoin. Its BTC holdings at the moment are nearly twice the quantity owned by Microstrategy.