- Bearish sentiment round BTC was dominant available in the market.

- Promoting strain on the coin was excessive.

Bitcoin’s [BTC] value motion remained underwhelming, because it has failed to maneuver above $64k in the previous few days. Within the meantime, a key BTC metric entered a zone of indecisive route.

Does this imply traders have to attend longer to see BTC rise once more?

What’s happening with Bitcoin?

CoinMarketCap’s knowledge revealed that BTC was down by greater than 2% within the final seven days.

This pushed BTC’s value beneath $64k, as at press time it was buying and selling at $63,843.66 with a market capitalization of over $1.26 trillion.

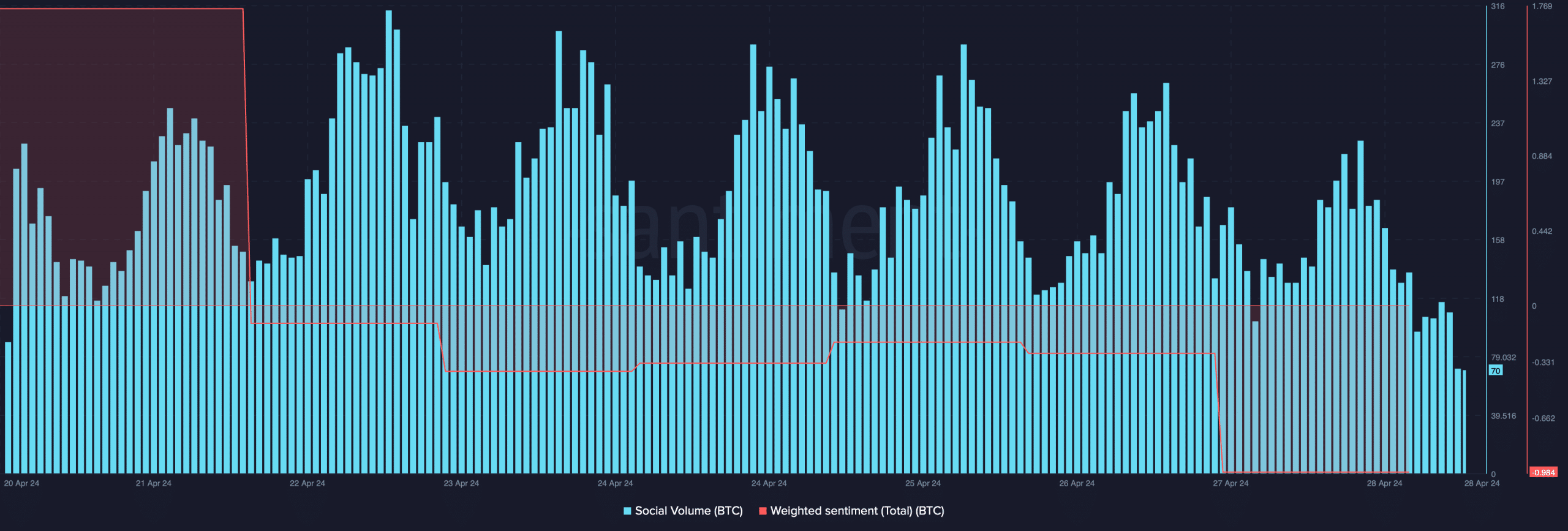

Due to the damaging value motion, Weighted Sentiment across the king of cryptos turned bearish on the twenty seventh of April.

Its Social Quantity additionally dropped barely final week, reflecting a decline in BTC’s reputation within the crypto area.

In the meantime, Phi Deltalytics, an writer and analyst at CryptoQuant, posted an evaluation utilizing a key BTC metric.

As per the evaluation, the adjusted Spent Output Revenue Ratio (SOPR) of Bitcoin continued to maneuver in a bullish route, whereas the short-term SOPR has entered a zone of uncertainty.

This discrepancy highlighted a posh atmosphere the place short-term traders confronted losses.

The evaluation talked about,

“While fluctuations of this nature are not uncommon, particularly during periods of price exploration toward new all-time highs, heightened vigilance is warranted.”

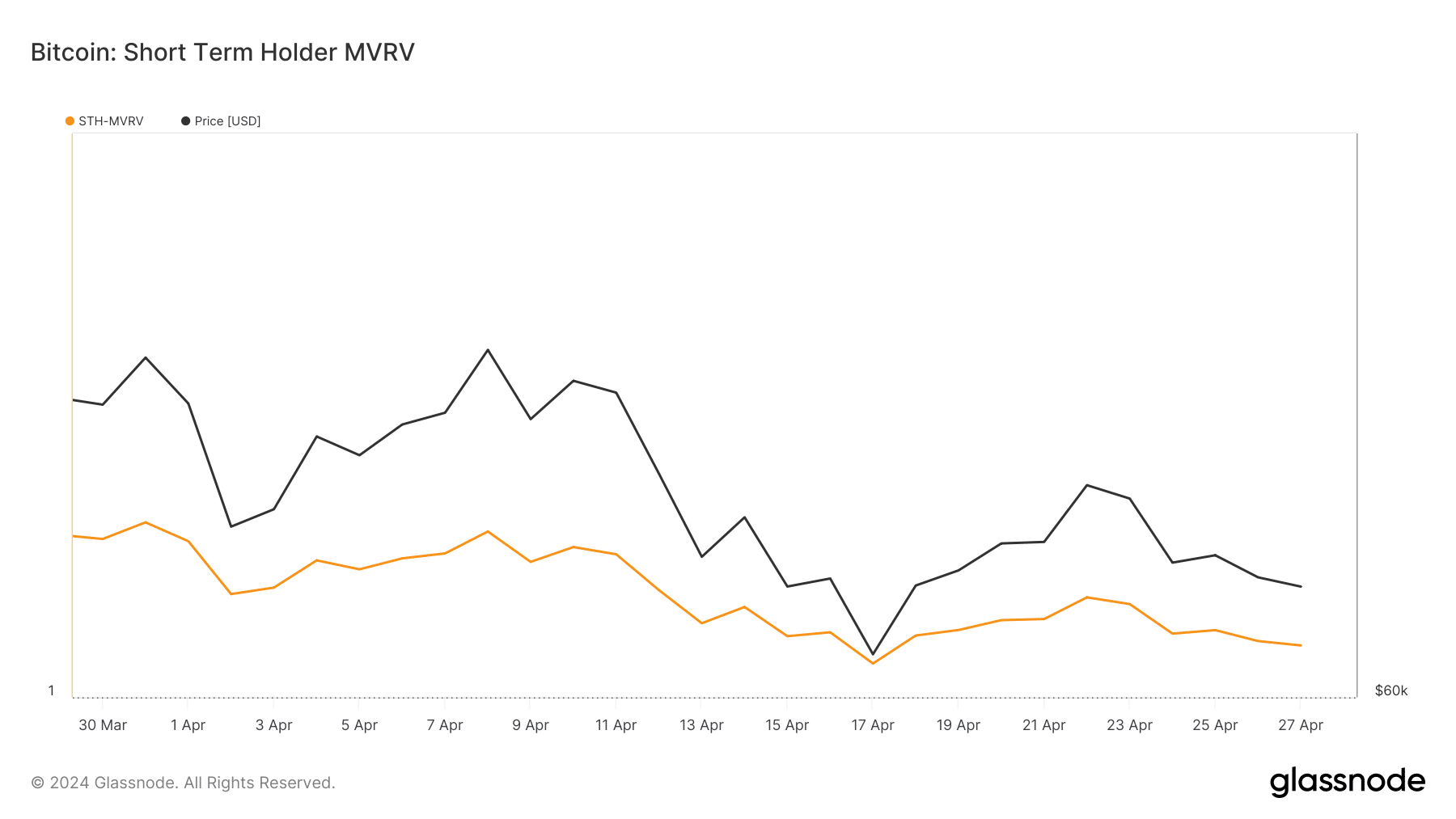

AMBCrypto’s evaluation of Glassnode’s knowledge additionally identified an fascinating improvement associated to short-term holders. We discovered that BTC’s STH MVRV dropped over the previous few weeks.

For the uninitiated, a low MVRV means that the present value of Bitcoin is comparatively decrease in comparison with the final transaction costs.

Does this trace at a value uptick?

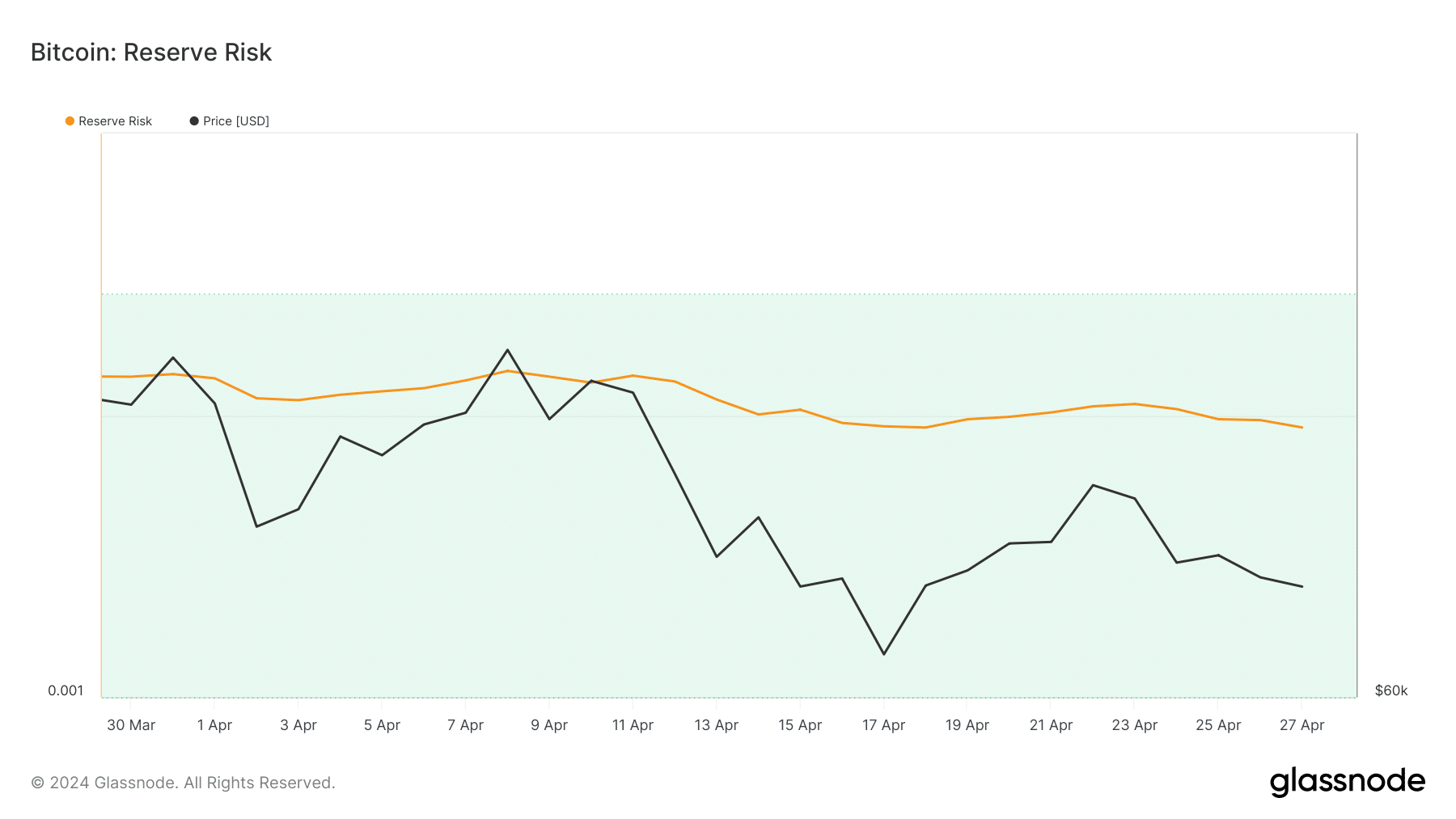

Since BTC gave the impression to be undervalued, AMBCrypto took a more in-depth take a look at its state to raised perceive whether or not a value rise was across the nook. As per our evaluation, BTC’s reserve threat was low.

This metric indicated that confidence in BTC was excessive. Nevertheless, its value lay low at press time, which could possibly be inferred as a bullish sign.

Not every little thing seemed optimistic for BTC. For example, AMBCrypto’s take a look at CryptoQuant’s knowledge revealed that promoting strain on BTC was excessive as its change reserve was rising.

Its internet deposit on exchanges was additionally excessive in comparison with the final seven days’ common.

Learn Bitcoin’s [BTC] Worth Prediction 2024-2025

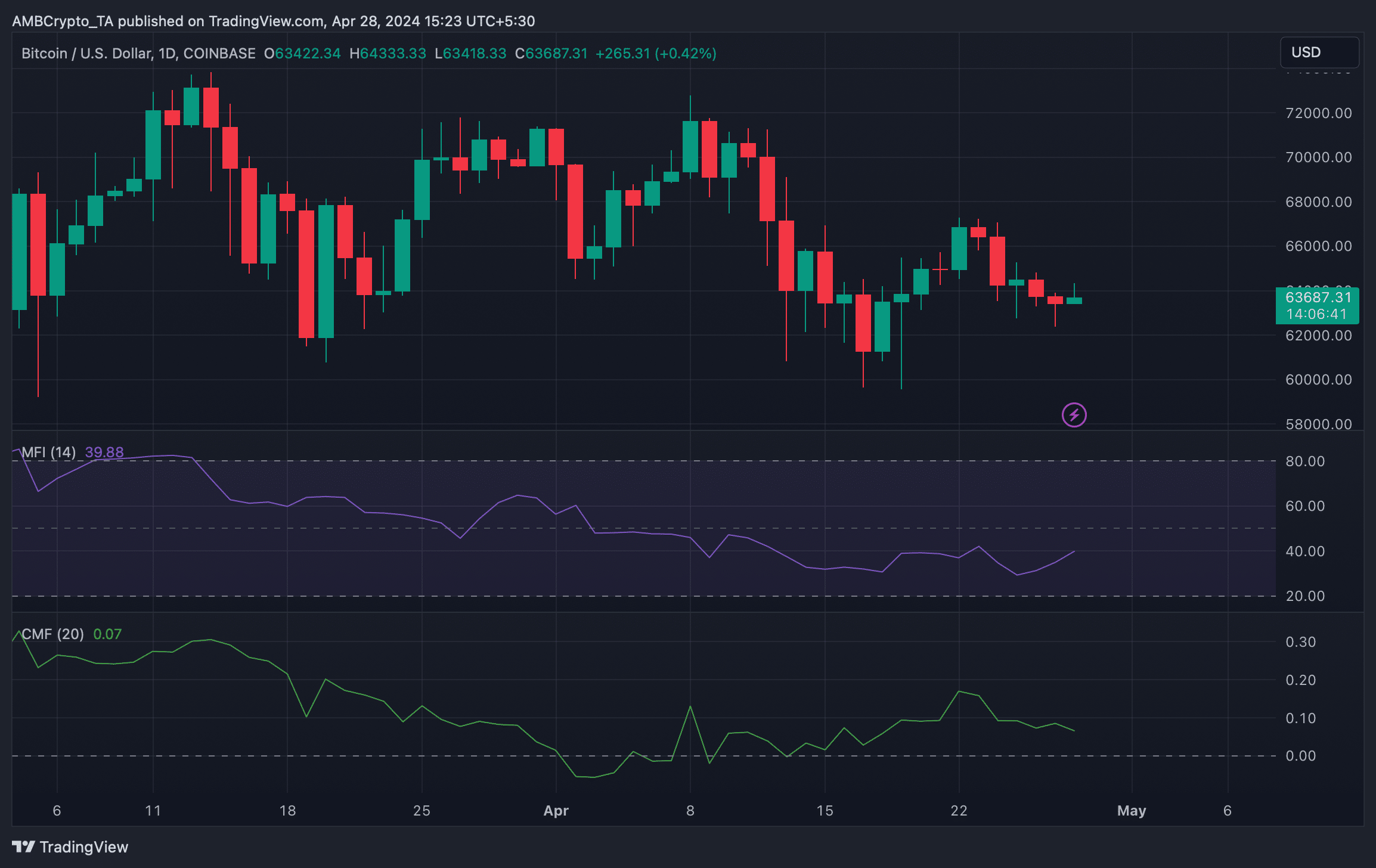

We then took a take a look at BTC’s each day chart to see what market indicators needed to recommend relating to BTC’s upcoming value motion.

As per our evaluation, the Cash Circulation Index (MFI) hinted at a value uptick because it moved upwards. Nevertheless, the Chaikin Cash Circulation (CMF) remained bearish.