- Bitcoin skilled a pointy decline, falling under $60K, with analysts predicting a possible restoration because of a CME hole.

- Whale exercise has elevated regardless of the value drop, indicating robust market curiosity and potential bullish momentum.

Bitcoin [BTC] has skilled a sudden and important drop previously 24 hours, shocking many within the crypto neighborhood.

After briefly buying and selling above $63,000 within the early hours of yesterday, Bitcoin noticed a pointy decline, dropping by over 6% to the touch the $57,000 area.

Though the cryptocurrency has since rebounded barely, now buying and selling at $59,103, it remained down by 5.7% over the previous day.

This bearish worth motion has sparked widespread dialogue amongst analysts and merchants, who at the moment are re-evaluating their short-term outlooks for the digital asset.

Fast restoration forward?

The surprising drop has led a number of distinguished analysts to share their up to date views on Bitcoin’s future trajectory.

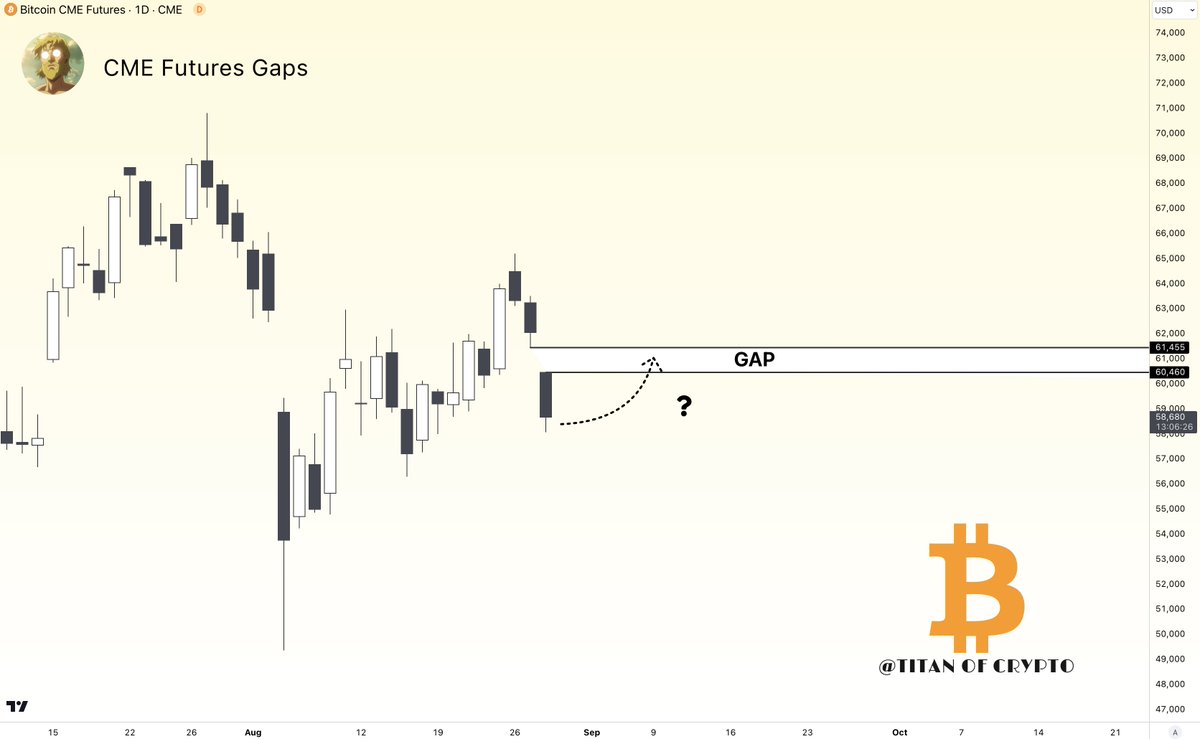

One such analyst, Titan of Crypto, took to X (previously Twitter) to counsel that Bitcoin would possibly recuperate shortly to the $61,000 area.

Titan of Crypto identified the emergence of a CME Futures hole on the every day timeframe, stating,

“Bitcoin Short-Term Update. A CME futures gap has appeared on the daily timeframe. BTC might pull back to around $61,400 to fill it.”

A CME Futures hole happens when the value of Bitcoin on the Chicago Mercantile Trade (CME) opens at a considerably completely different degree than the place it closed within the earlier buying and selling session.

This hole is usually seen as a key indicator by merchants, who imagine that Bitcoin tends to “fill” these gaps by shifting again to the extent the place the hole originated.

On this context, Titan of Crypto’s evaluation prompt that Bitcoin could rise to round $61,400 to shut this hole, offering a possible short-term restoration alternative.

Nonetheless, different analysts have adopted a extra cautious method in response to the present worth decline.

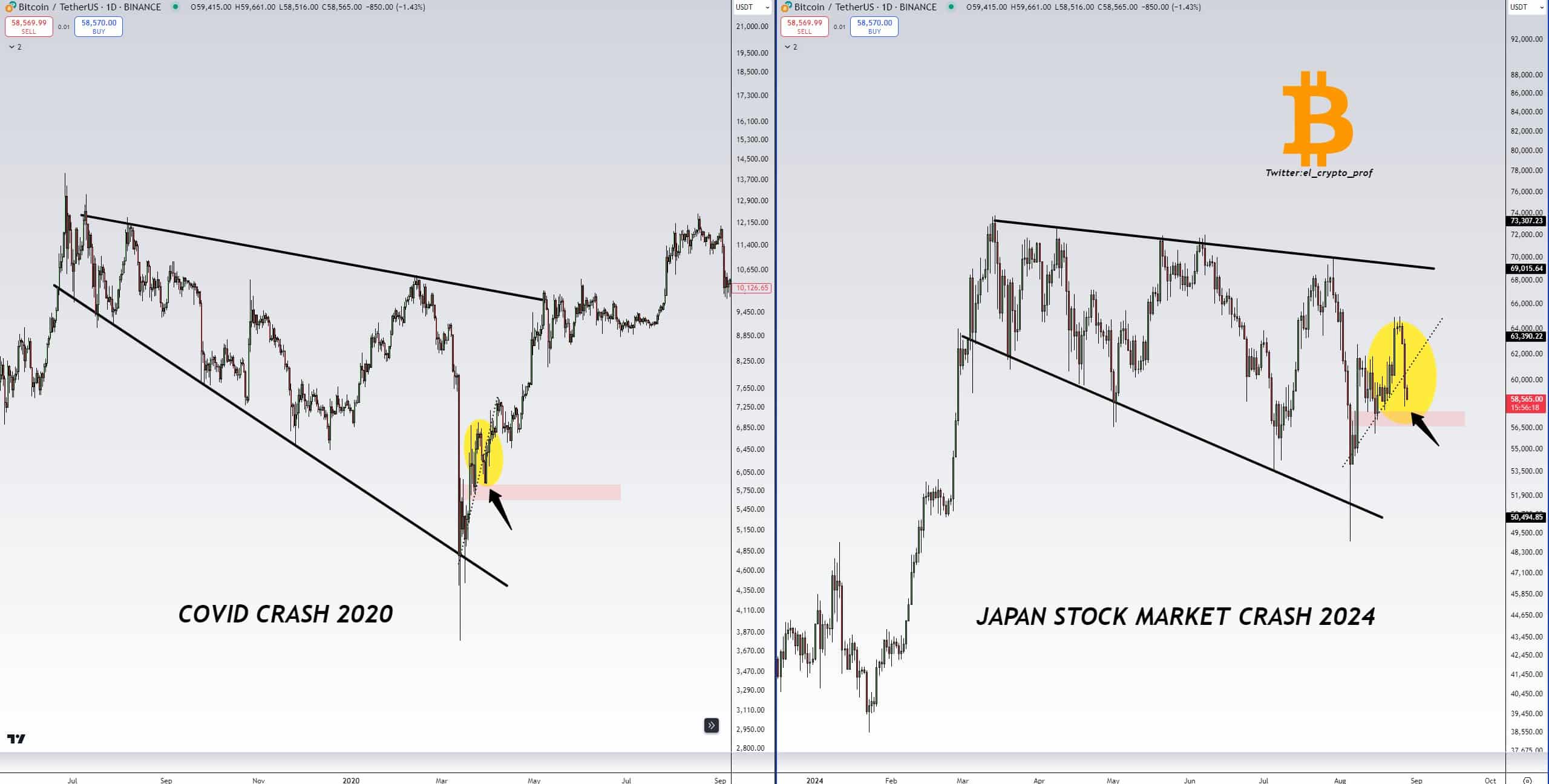

Moustache, one other well-known determine within the crypto area, urged calmness by drawing parallels between the present market state of affairs and previous occasions.

Moustache shared two photos evaluating Bitcoin’s worth chart from 2020, when the cryptocurrency skilled a pointy decline earlier than a big rally, with the present worth motion following the Japan inventory market crash in 2024.

Moustache commented,

“Covid crash 2020 vs. Japan stock market crash 2024. No need to worry here imo. BTC continues to copy the fractal from 2020 almost 1:1.”

Bitcoin’s fundamentals present blended indicators

Regardless of the continued volatility, Bitcoin’s fundamentals supplied some insights into the asset’s potential course.

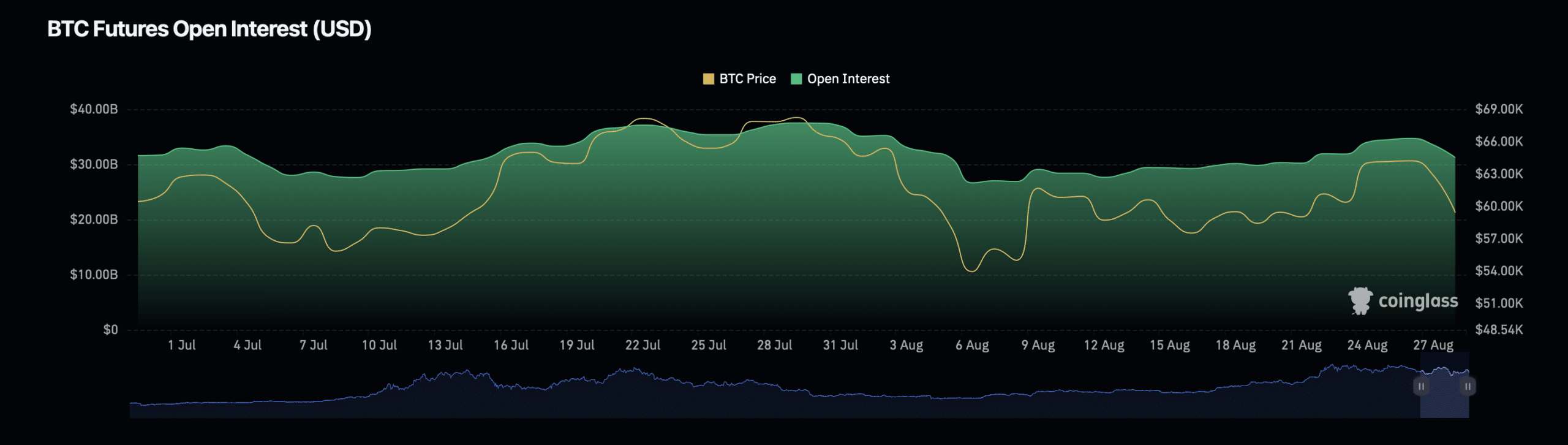

Information from Coinglass revealed an fascinating pattern in Bitcoin’s Open Curiosity, which has declined by almost 7% over the previous day, reaching a press time valuation of $31.02 billion.

Nonetheless, the asset’s Open Curiosity quantity advised a distinct story, with a considerable enhance of 62.93% to a press time valuation of $83.73 billion throughout the identical interval.

This divergence between Open Curiosity and quantity prompt that whereas fewer merchants had been holding positions, the depth and measurement of the trades have considerably elevated.

This indicated heightened market exercise that might result in additional worth fluctuations.

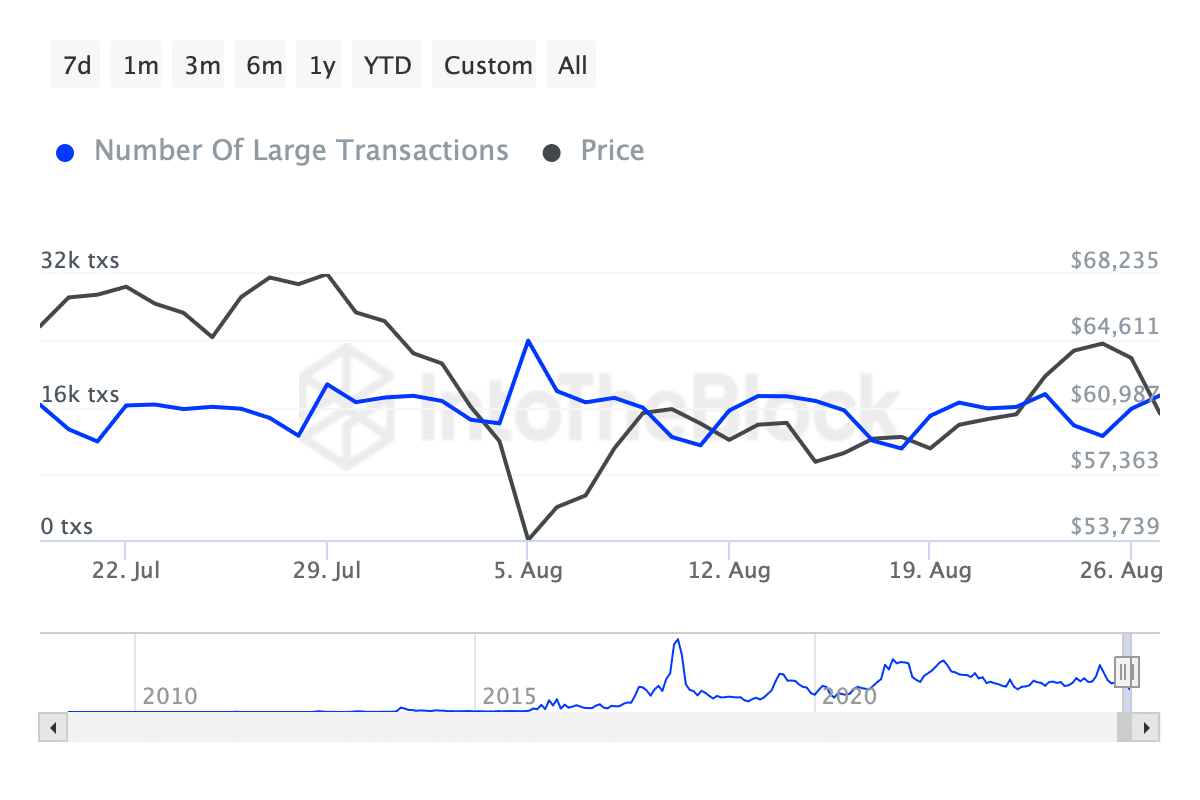

Furthermore, knowledge from IntoTheBlock confirmed a notable enhance in Bitcoin whale transactions, particularly these higher than $100,000, over the previous week.

Regardless of the current worth decline, whales—giant holders of Bitcoin—gave the impression to be accumulating extra of the asset.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

The variety of whale transactions has additionally risen from under 13,000 over the weekend to over 17,000 as of press time.

This enhance in whale exercise prompt that important gamers available in the market could also be positioning themselves for a possible upward transfer, even amid the present bearish pattern.