- Bitcoin transactions have dropped.

- Miners are at the moment underpaid as Runes transactions dropped.

After the halving occasion, Bitcoin [BTC] charges skilled an sudden spike, resulting in a corresponding enhance in miner charges.

Runes had emerged as a major contributor to the community’s transactions put up the halving occasion. Nonetheless, this spike has since subsided, leading to declining transaction charges and miner income.

Runes proceed to contribute to Bitcoin transactions

In line with information from Glassnode, Runes has contributed roughly $117 million to transaction charges so far. Notably, greater than half of those charges have been generated on the day of the Bitcoin halving.

These transactions and related charges led to a spike in community exercise, offering miners a considerable charge enhance.

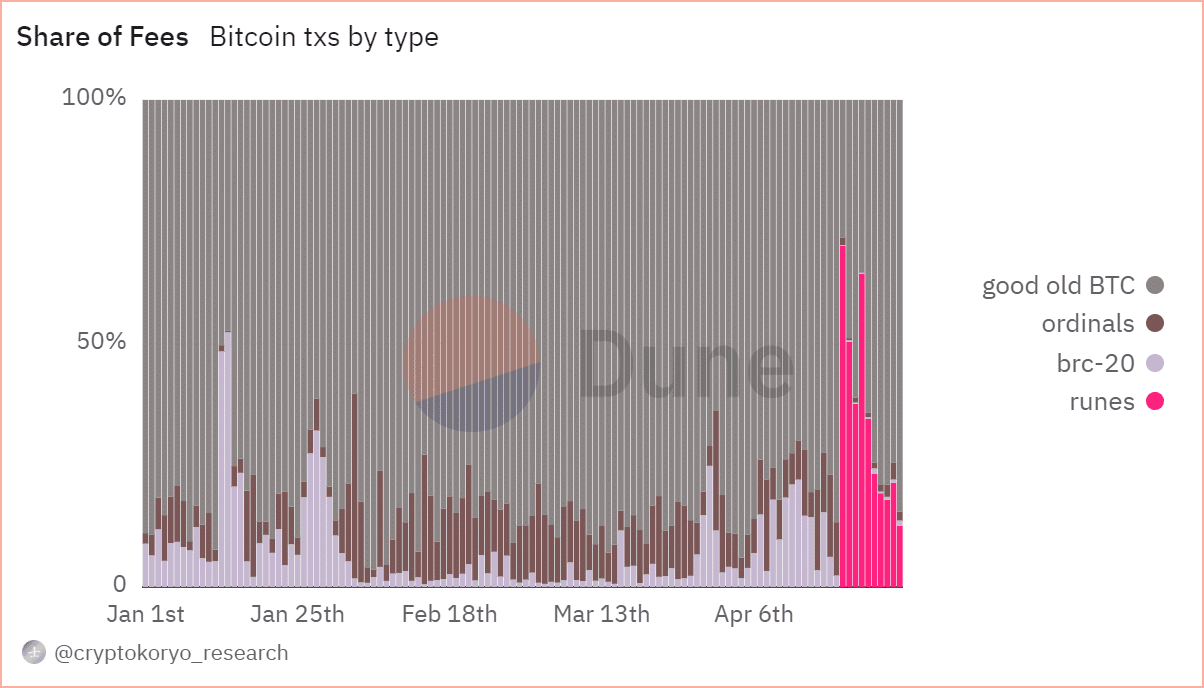

Additional evaluation performed on Dune revealed that Runes ranked second when it comes to transactions on the community.

Till press time, Runes accounted for over 19% of complete transactions, and was the second-highest contributor to community charges, though its contribution has decreased notably.

At press time, Runes contributed over 12% of complete community charges.

Runes impact fading on Bitcoin miners

AMBCrypto’s evaluation of Bitcoin miners’ charges revealed that they have been experiencing a interval of underpayment.

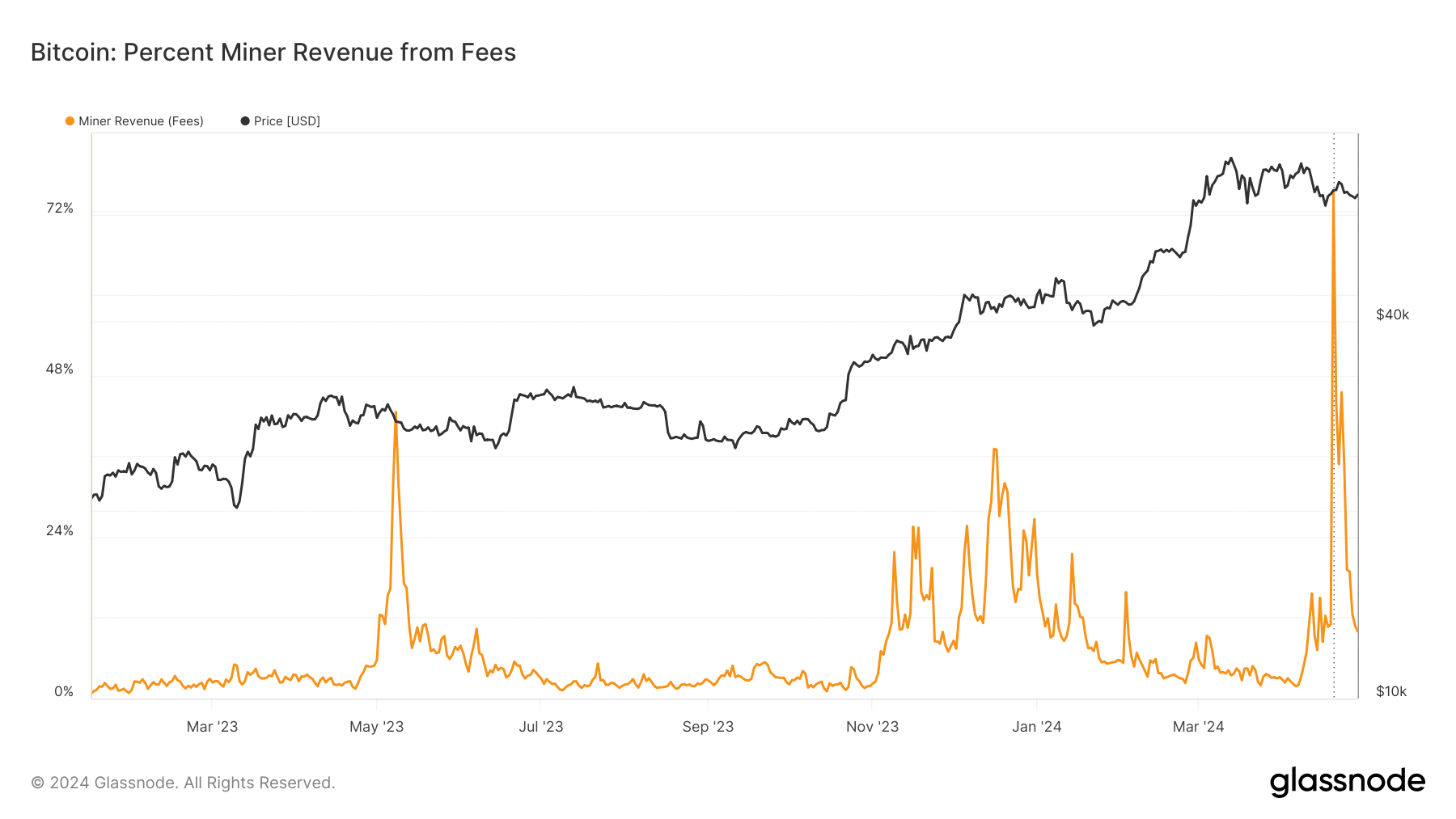

As depicted by a Glassnode chart, miner income has dropped into unfavorable territory, indicating that mining problem exceeded the reward earned.

Moreover, the charge metric on Glassnode confirmed a major decline, hovering round 45 BTC at press time.

The miner income proportion metric has additionally skilled a notable drop, sitting at roughly 10% at press time. Earlier than this decline, miner income and costs have been above 40% and 1,200 BTC, respectively.

This surge in metrics was primarily pushed by the spike in transactions attributable to Rune. Nonetheless, with a lower in Rune transactions, charges, and related metrics have additionally declined.

General, transaction quantity stays low as merchants await a extra constructive development within the worth of Bitcoin.

BTC wipes off preliminary features

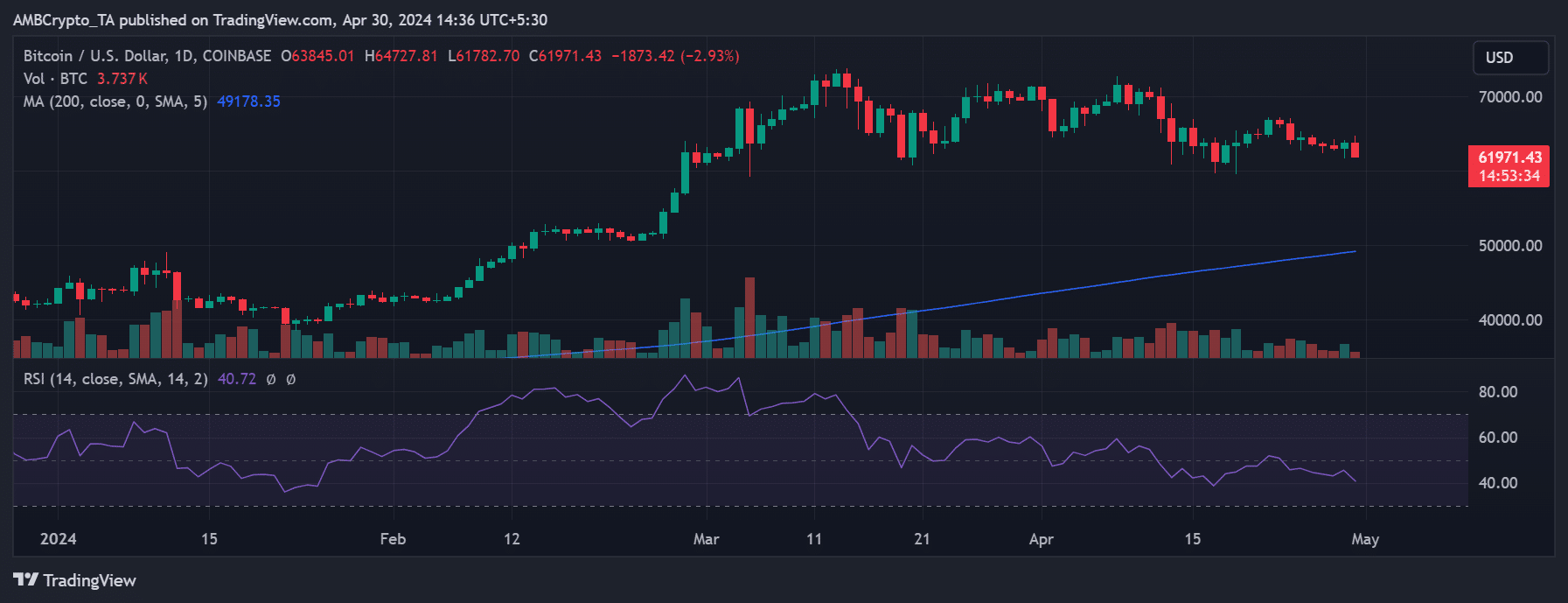

In line with AMBCrypto’s day by day worth development chart evaluation, Bitcoin was experiencing a unfavorable development. On the time of this writing, BTC was buying and selling at roughly $61,900, reflecting a decline of practically 3%.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

This represented a reversal from the constructive development noticed within the earlier buying and selling session, throughout which BTC noticed a rise of over 1%.

Moreover, its Relative Power Index (RSI) indicated that its bearish development intensified because it moved farther away from the impartial line.