- Bitcoin reserves have sparked intense controversy, with nations deeply divided on their potential.

- As Japan faces mounting financial stress, may its struggles present the right case examine?

The talk over Bitcoin [BTC] reserves is dividing the market. Some see it as a vital hedge towards the greenback’s volatility, whereas others stay deeply cautious, involved in regards to the speculative dangers tied to it.

The divide is so sharp that even the Fed and the Trump administration are at odds, every taking a starkly totally different stance on the problem.

Now, Japan is becoming a member of the dialog, elevating considerations in regards to the potential dangers of together with Bitcoin in its overseas reserves.

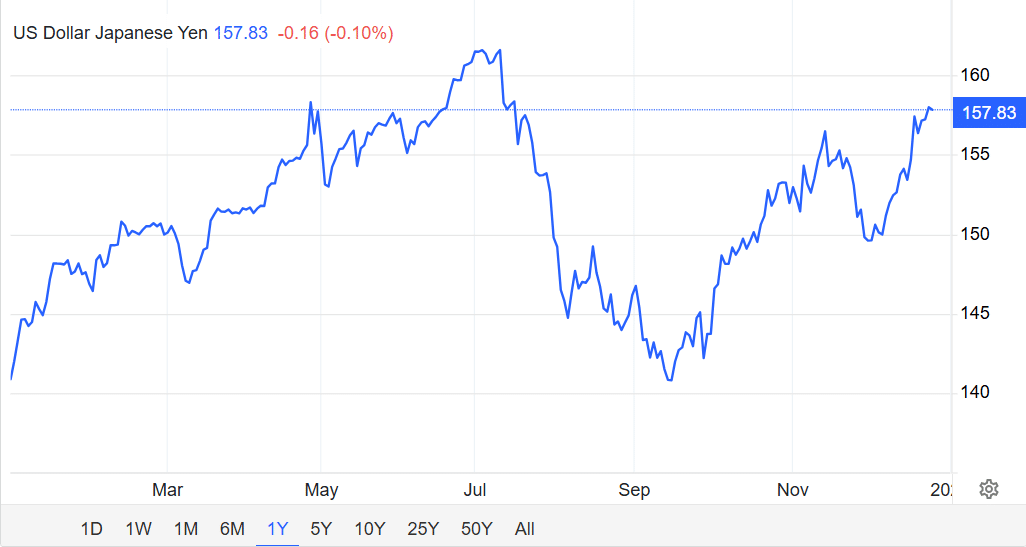

However right here’s the catch: The Japanese yen has hit a five-month low towards the U.S. greenback, becoming a member of a rising record of G20 currencies struggling to maintain up with the greenback’s dominance.

So, will Japan’s cautious method to Bitcoin reserves be seen as a missed alternative? Or will this financial stress push Japan – and different nations – to lastly acknowledge BTC as a severe various?

Unraveling Japan’s financial storm in 2025

The current FOMC fee lower triggered a ripple impact throughout markets, sparking an ‘unexpected’ twist.

On the 18th of December, because the Fed’s resolution made headlines, the U.S. greenback index surged to a staggering two-year excessive of 108.54.

The fallout was fast and brutal. Bitcoin plunged 14% in simply three days, whereas international currencies crumbled underneath the stress. The Japanese yen wasn’t spared, plunging to a five-month low of 158 per greenback.

In rapid response, the Financial institution of Japan (BOJ) held its floor, holding rates of interest regular. However the actual storm could also be forward.

The long-term impression of a surging greenback could possibly be far-reaching, with inflationary pressures set to climb.

The indicators are already right here. Japan’s annual inflation fee spiked to 2.9% in November 2024, up from 2.3% the earlier month, marking its highest studying since October 2023 – and it’s greater than only a quantity on a chart.

This inflation surge is a transparent sign of what’s to return. Rising inflation, coupled with the sturdy greenback, is placing Japan in a troublesome spot. Imports are rising costlier, squeezing each companies and shoppers.

All of that is unfolding towards the backdrop of Japan’s demographic disaster – an growing older inhabitants and declining delivery charges.

This shift is weakening the labor drive, making the challenges of 2025 much more daunting.

So, are Bitcoin reserves the precise resolution?

The reply isn’t clear-cut – it’s each a ‘yes’ and a ‘no’. On one hand, Bitcoin’s restricted provide makes it a robust hedge towards rising inflation.

In contrast to the U.S. greenback, which will be printed at will, Bitcoin’s capped provide provides Japan and different economies a safeguard towards foreign money devaluation.

Nonetheless, there’s a big draw back. Bitcoin’s value will be extremely unstable, making it a dangerous asset for a rustic like Japan, which values stability above all.

That mentioned, with Japan’s economic system dealing with growing pressure, the thought of embracing Bitcoin reserves will not be as far-fetched because it as soon as appeared. In actual fact, it may quickly grow to be a necessity for financial resilience.

And this shift isn’t nearly nationwide economies. On a smaller scale, main exchanges are additionally stacking Bitcoin. As an example, Bitfinex’s Bitcoin reserve just lately hit over $230 million, a stage final seen three years in the past.

As extra nations eye Bitcoin as a ‘safety net’ towards the rising volatility of worldwide markets, excessive liquidity is predicted to flood the market, with exchanges readying for elevated demand.

Learn Bitcoin’s [BTC] Worth Prediction 2025-26

So, whereas the U.S. greenback continues to dominate, many economies are trying to find alternate options. Bitcoin could possibly be the reply, however provided that its value stabilizes within the 12 months forward.

If it does, the potential of utilizing Bitcoin as a hedge and even a mode of fee could not be a distant dream.