- After consolidating, Bitcoin as soon as once more jumped above the $91k mark.

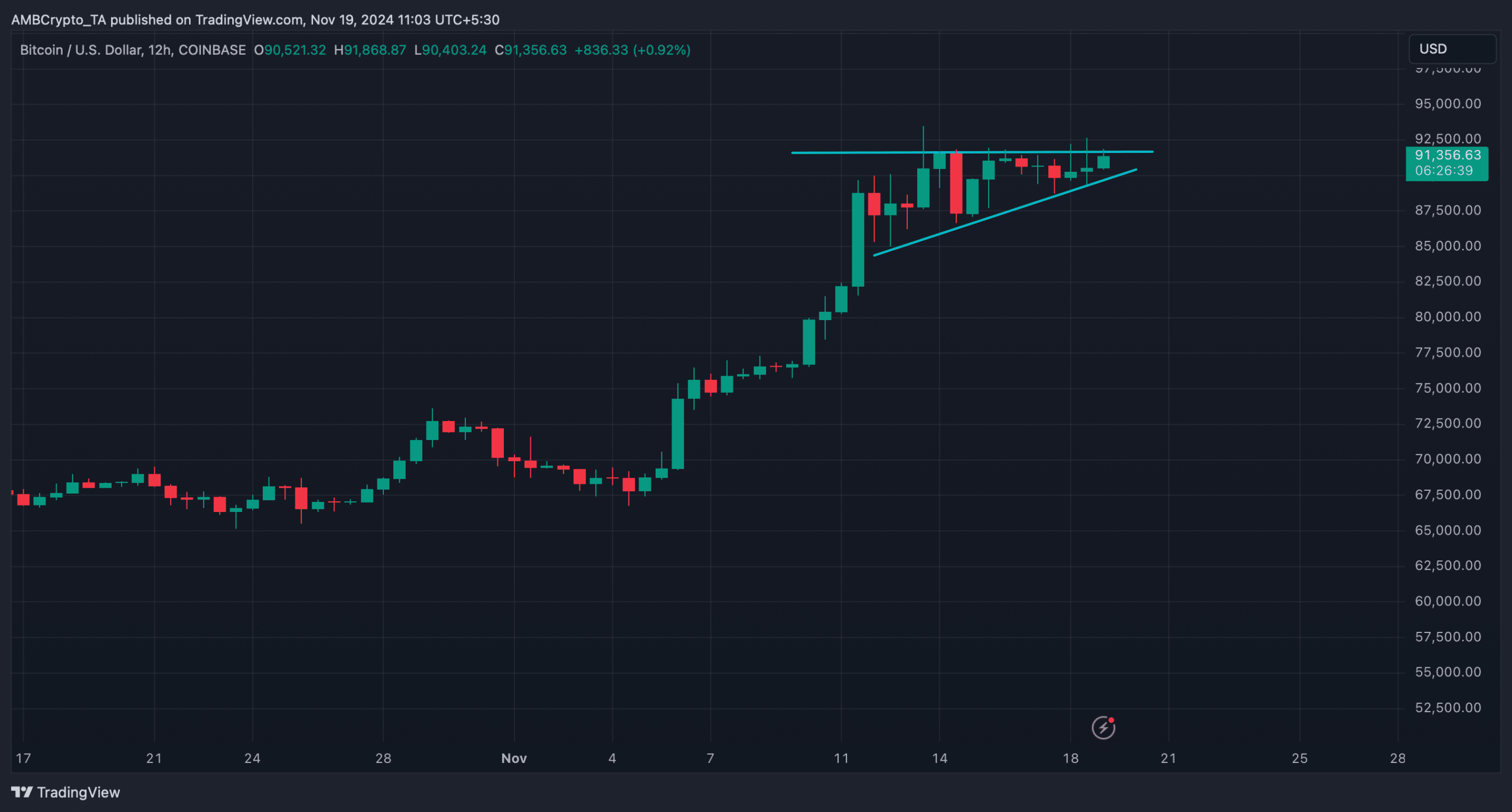

- BTC was testing the resistance of a bullish ascending triangle sample.

In contrast to the final time, Bitcoin [BTC] took just a few days to lastly go above the $91k mark acquire. However this simply could be the start of a recent rally. This gave the impression to be the case as BTC was mirroring its previous pattern, which steered that the king coin may hit $100k earlier than anticipated.

Bitcoin turns bullish once more

After touching an all-time excessive, BTC witnessed a pullback, nevertheless it managed to commerce above the $90k mark because it began to consolidate. AMBCrypto reported earlier {that a} potential purpose behind this might be the three,000 BTC sell-off by miners.

Bitcoin’s capability to keep up above $90,000 indicated vital market confidence, although miner profit-taking resulted in a rise in provide.

Actually, buyers’ confidence did repay as BTC’s worth elevated by practically 2% up to now 24 hours, permitting it to leap above $91k.

In the meantime, Ali, a well-liked crypto analyst, not too long ago posted a tweet highlighting a notable improvement.

As per the tweet, Bitcoin was mimicking a previous pattern. In 2020, after Bitcoin broke its earlier all-time excessive of $19,700, it surged 26%, consolidated for every week, then jumped to $40,000.

An identical pattern was seen this time. To be exact, BTC has risen 28% after surpassing its earlier ATH and has been consolidating for the previous six days. As historical past was repeating itself, BTC subsequent to focus on $100k isn’t a too formidable expectation.

Is BTC focusing on $100k subsequent?

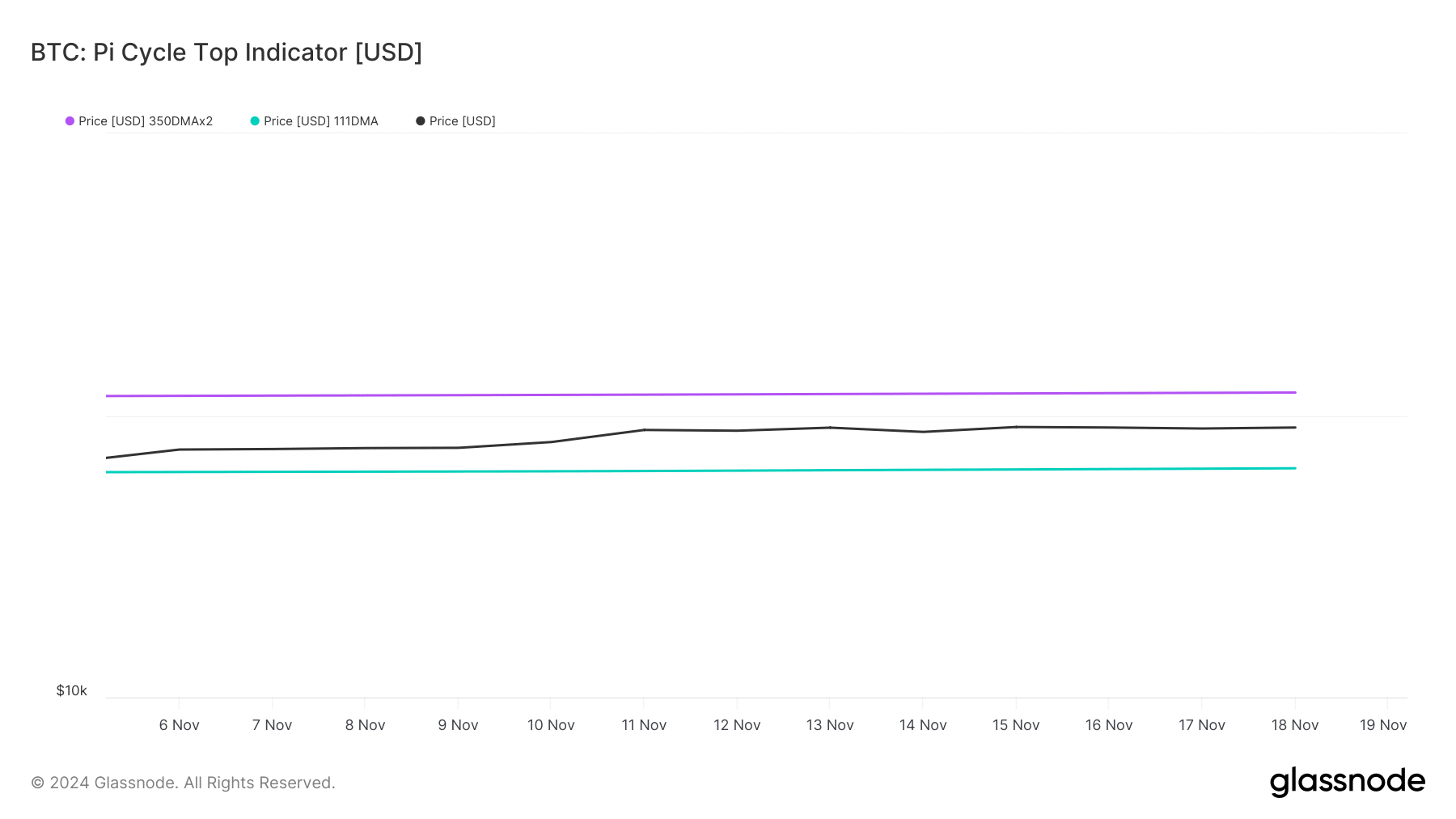

The Pi Cycle Prime indicator identified that Bitcoin was buying and selling properly above its supposed market backside of $64.9k. If the indicator is to be believed, then BTC’s potential market prime was at $120k.

Subsequently, anticipating BTC focusing on $100k subsequent, in case of an increase in volatility, wouldn’t be a protracted shot.

Glassnode’s knowledge additionally identified whales’ confidence within the king coin elevated over the previous few weeks. This was evident from the rise within the variety of BTC addresses holding greater than $1 billion, which may gasoline a worth rise.

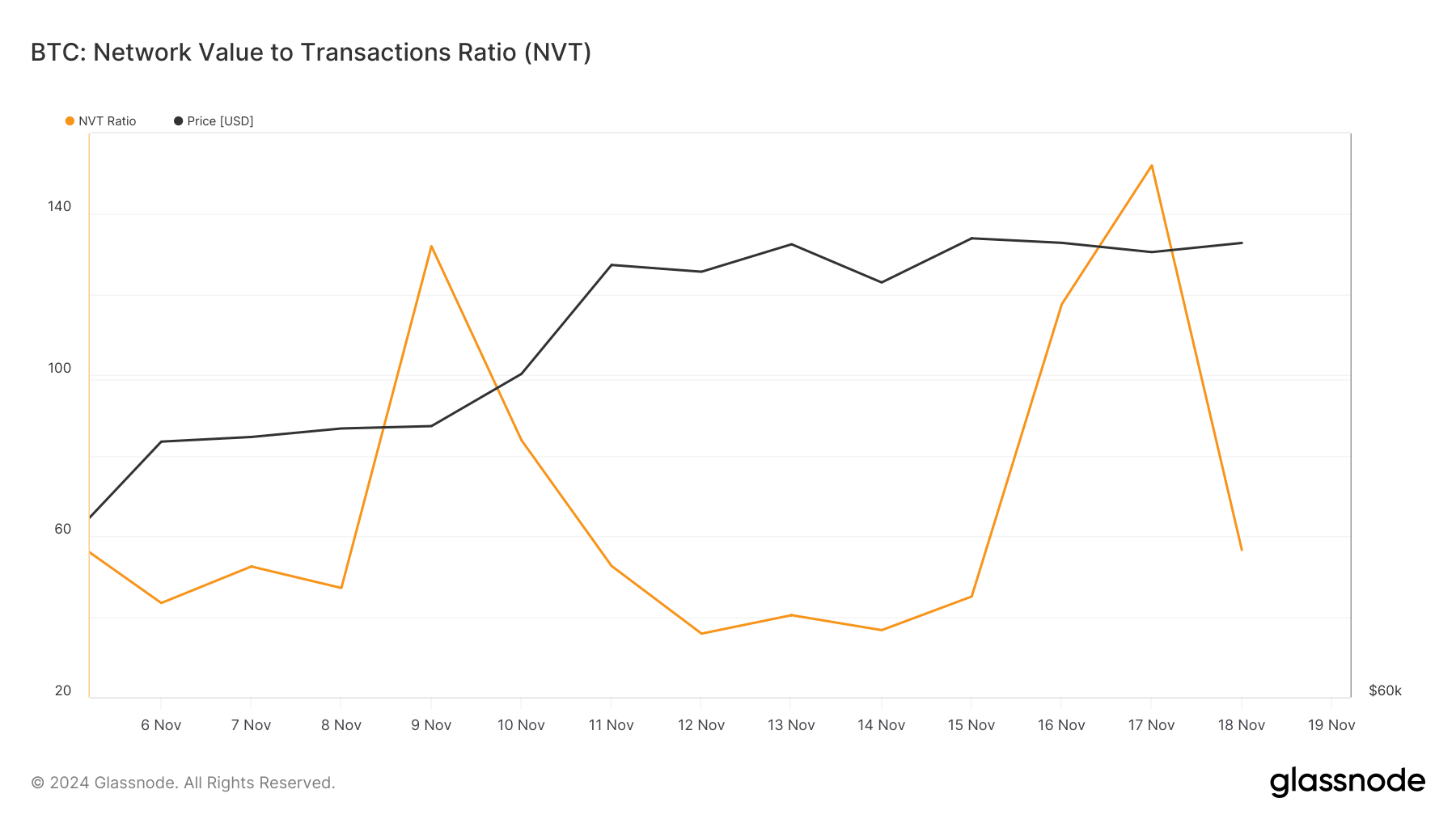

Moreover, after a pointy rise, BTC’s NVT ratio dipped. A decline within the metric implies that an asset is undervalued, suggesting a worth hike quickly.

AMBCrypto’s evaluation revealed {that a} bullish ascending triangle sample fashioned on BTC’s 12-hour chart. At press time, the king coin was testing the resistance of the sample.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

If Bitcoin manages to interrupt above that stage, then it gained’t be shocking to see a recent bull run, pushing the coin to $100k.