- The Bitcoin Rainbow Chart and different key metrics signaled ‘BUY’ at press time.

- Market pundits anticipate bullish This fall and 2025 — Do you have to maintain on or soar in?

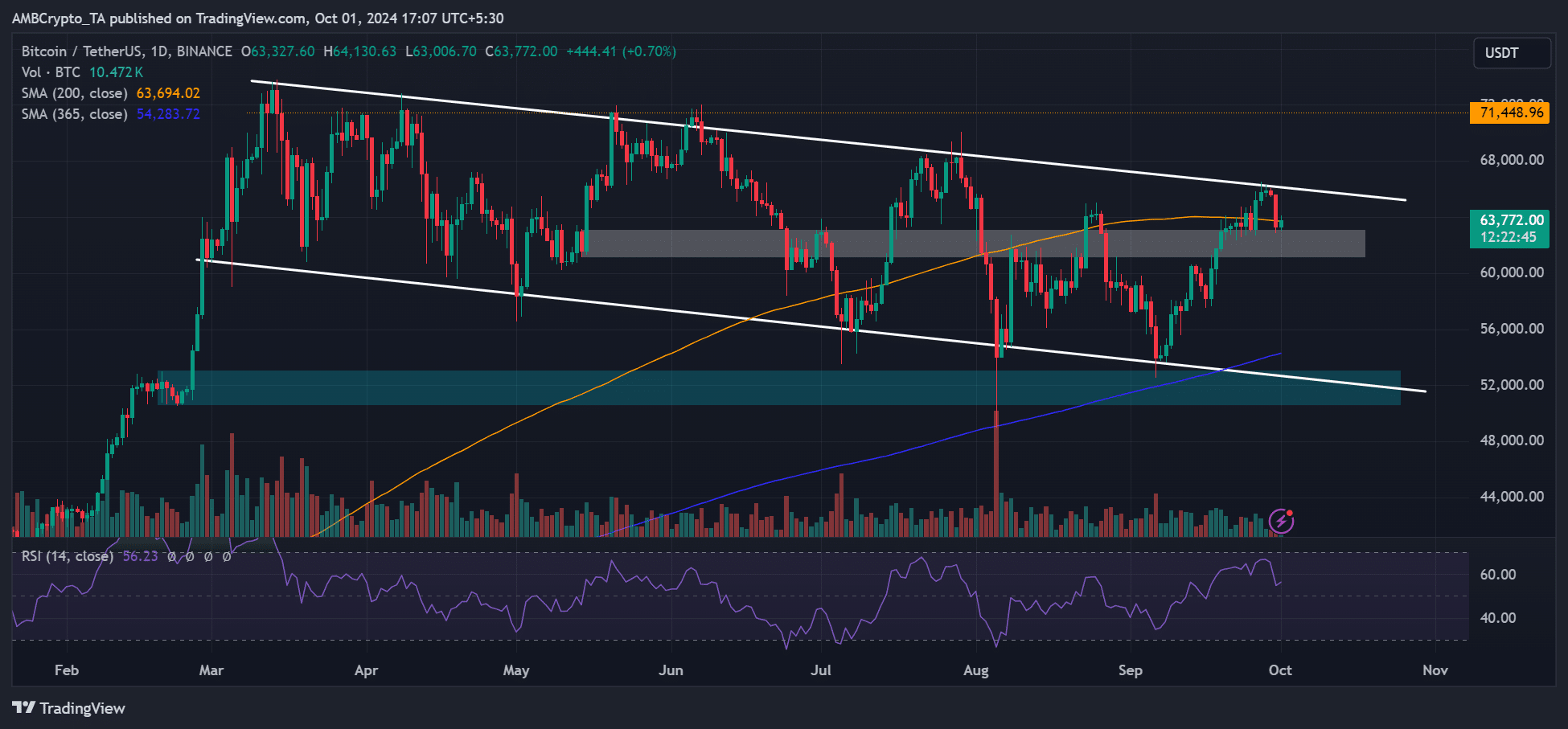

Bitcoin [BTC] has been consolidating inside $60K—$70K for the previous seven months. Regardless of the boring worth motion, the present BTC worth was nonetheless a terrific purchase alternative forward of a traditionally bullish This fall.

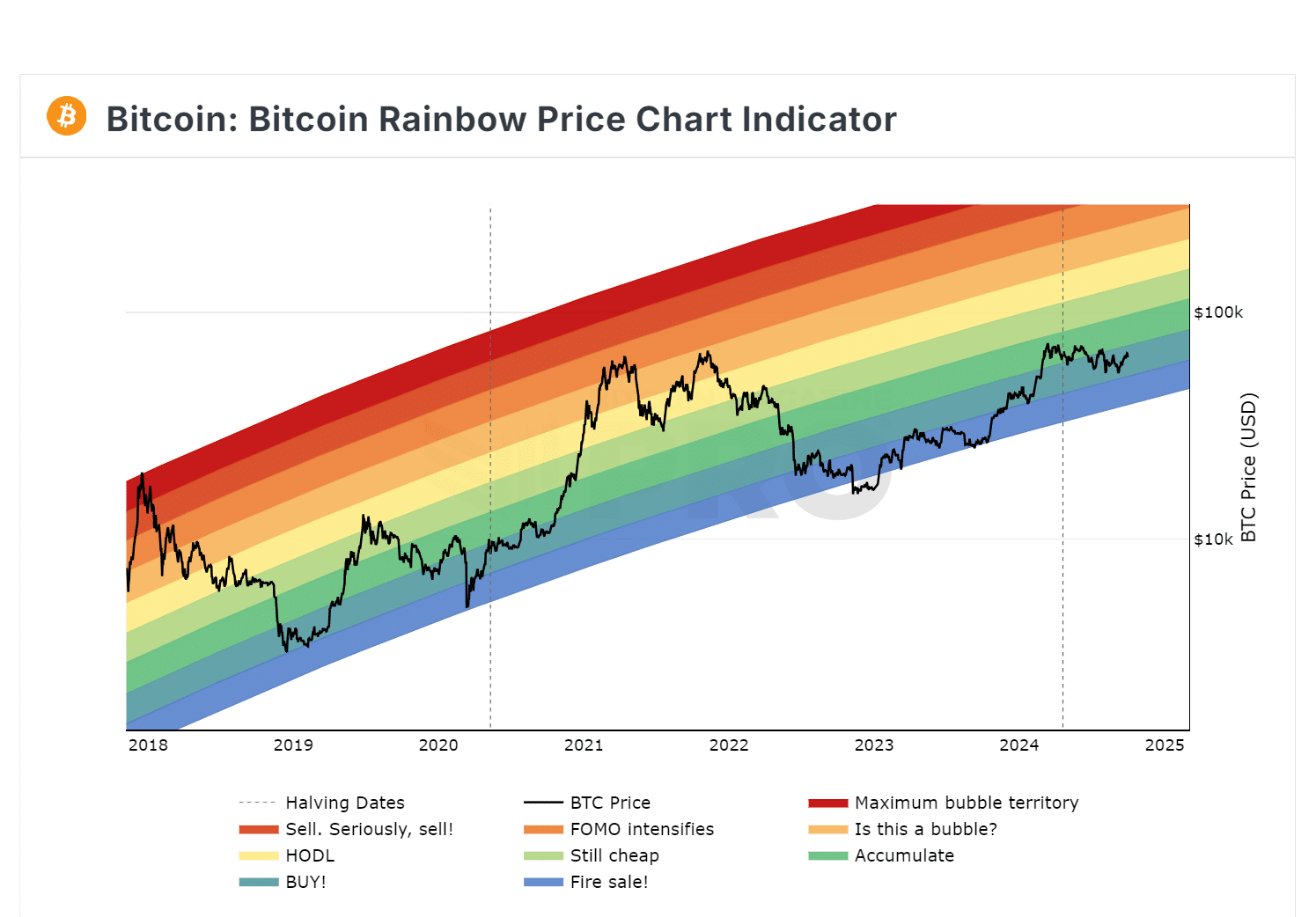

Based on the Bitcoin Rainbow Chart, BTC’s present worth was nonetheless inside the ‘buy’ zone.

Actually, since its March and subsequent retracement, the asset has been firmly inside the ‘accumulate’ and ‘buy’ zones.

For context, the Rainbow Chart gauges BTC valuation based mostly on historic costs however is offered visually by rainbow colours.

Decrease shade bands sign undervalued BTC, whereas greater bands denote overheated market and potential corrections.

Is BTC nonetheless discounted?

Different key valuation metrics additionally signaled that BTC was comparatively ‘cheap’ at press time worth.

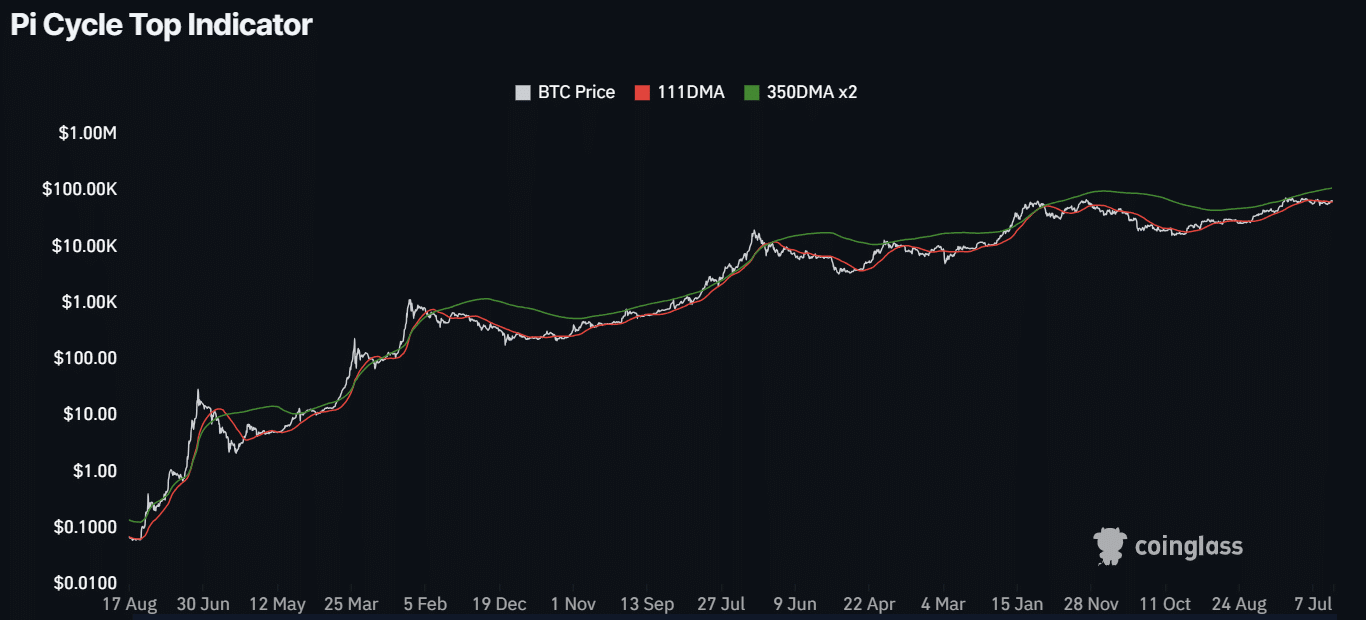

Based on the Pi Cycle Prime indicator, BTC was removed from hitting this cycle’s prime, as denoted by the huge hole between the 111-day MA (Shifting Common) and 350-day MA a number of (350 DMAx2).

For the unfamiliar, the Pi Cycle Prime metric has successfully captured BTC cycle tops with a 3-day accuracy. Traditionally, cycle tops have been hit after 111 DMA hiked and crossed 350DMAx2.

The huge hole at press time meant BTC’s bull run might lengthen.

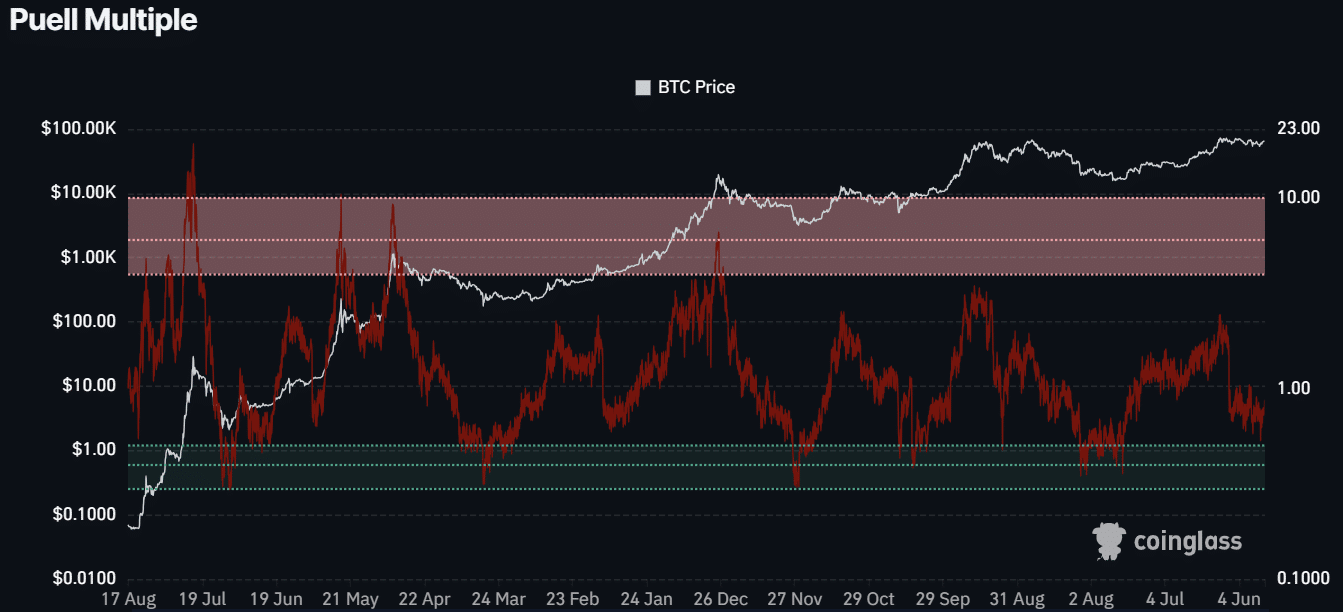

Briefly, BTC was comparatively undervalued at press time. An identical outlook was illustrated by the Puell A number of, which evaluates whether or not BTC is overpriced utilizing BTC miners’ profitability.

The inexperienced zone is synonymous with undervalued BTC, whereas the overhead zone alerts an overheated market.

Based mostly on the press time studying, 0.73, BTC was grossly underpriced, suggesting a terrific shopping for alternative for traders.

Moreover the above valuation metrics, key trade figures and companies have made excessive BTC worth targets for end-2024 and 2025. Commonplace Chartered Financial institution predicted the asset might hit $250K by 2025.

On his half, CK Zheng, founding father of crypto-focused hedge fund ZX Squared Capital, BTC, would hit an ATH in This fall 2024, no matter who wins the US elections.

The manager cited excessive US nationwide money owed and financial deficits as the reason why BTC would develop into extra profitable amid the Fed charge lower cycle.

If the predictions come true, This fall 2024 and 2025 would supply large BTC returns, doubtlessly breaking above the 7-month lengthy worth vary. In that case, the present BTC worth might be deemed grossly discounted.