- Bitcoin HODLers exited the cycle after cashing in on enormous good points.

- Is the daybreak of a ‘new cycle’ round, or are we witnessing the top?

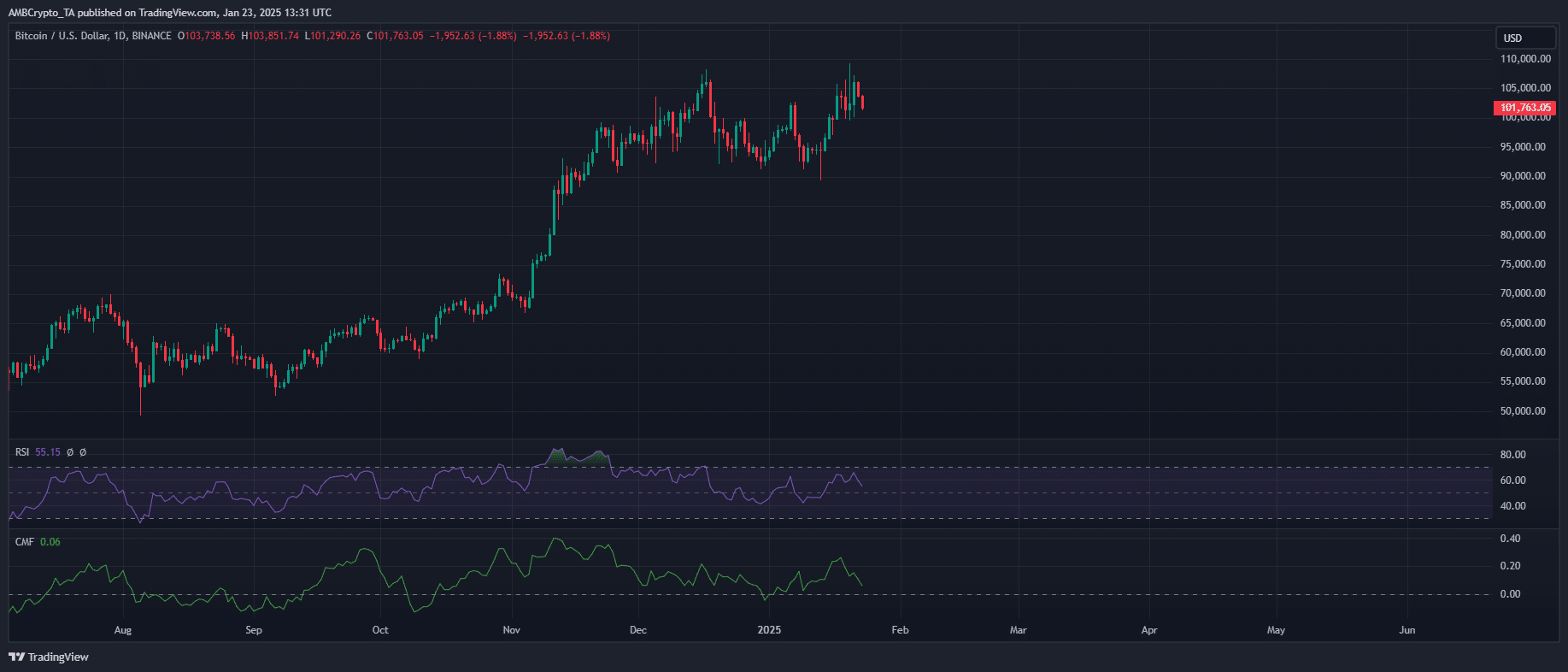

Bitcoin[BTC] kicked off November at $68K, however simply two months later, it soared to a brand new all-time excessive of $109K – a large 60% surge.

With such good points, profit-taking was sure to occur, and in December alone, traders cashed out a staggering $3 billion in earnings.

Now, the market awaits a restoration. In any other case, even holding Bitcoin at $100,000 might turn out to be a nightmare.

FOMO or Greed: Which aspect will dominate?

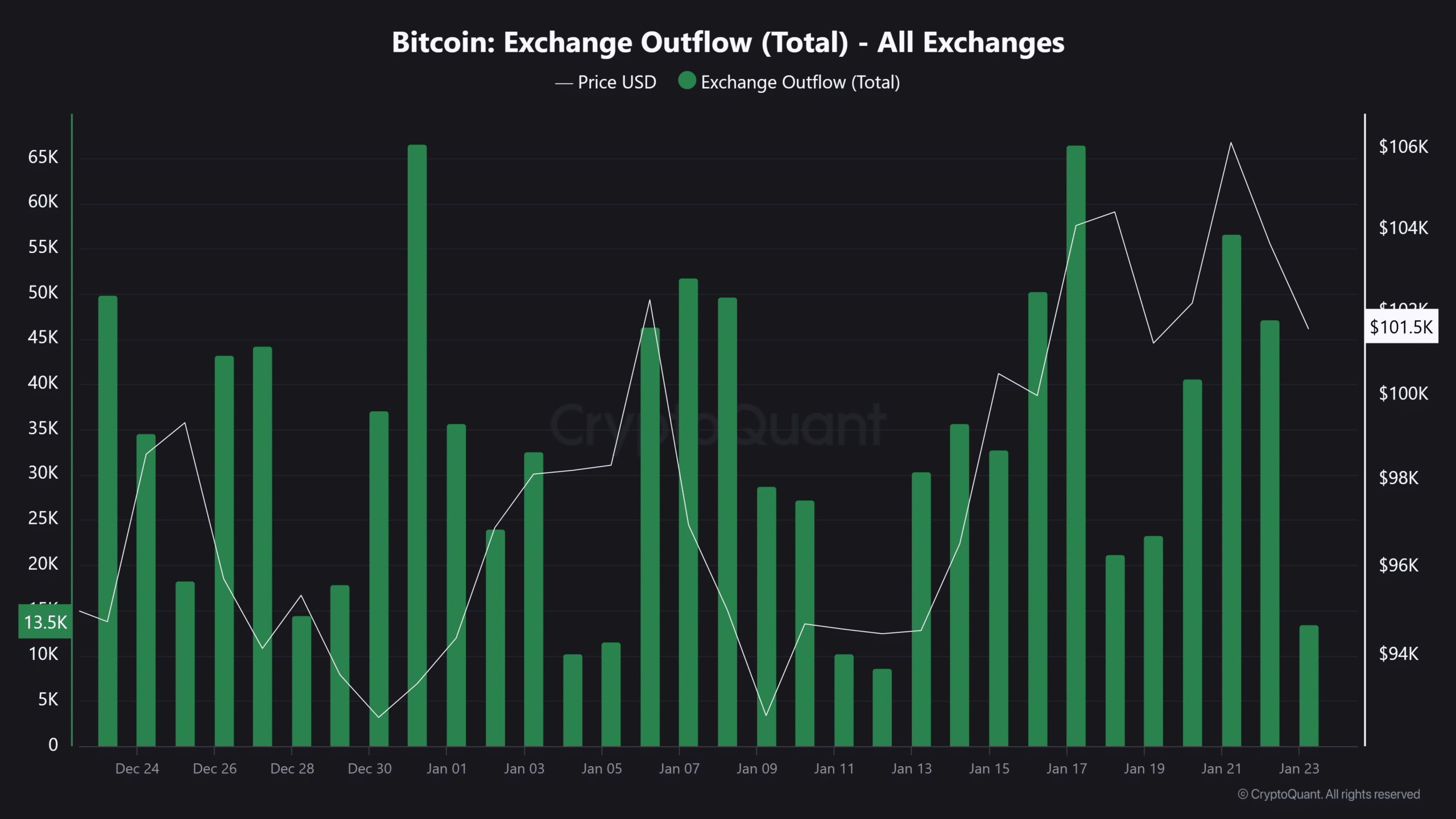

Merchants are getting much less dangerous within the derivatives market, the place the leverage ratio is shrinking quick. This reveals they’re not sure the place Bitcoin’s value will go subsequent. Additionally, fewer persons are transferring Bitcoin off exchanges.

In truth, the change outflows noticed a staggering 16% drop in a single day.

Collectively, these components counsel that FOMO is fading. Nonetheless, the greed has bounced again from “extreme” ranges – a bullish signal. Why? Revenue-taking could be nearing its peak, as indicated by a Glassnode report.

As per the report, profit-taking is approach down, falling from $4.5 billion in December to only $316 million now – a 93% drop. In keeping with AMBCrypto, if FOMO returns whereas extreme greed subsides, it might set the stage for a big value enhance.

A take a look at the Bitcoin market

Bitcoin dropped 3.26% in a day, however the market isn’t overheating. This implies robust shopping for, possible fueled by FOMO, is required to push the value again up.

Nonetheless, the upcoming FOMC assembly might considerably affect Bitcoin’s restoration. With the assembly only a week away, uncertainty is more likely to persist, making a robust rebound much less possible within the close to time period.

Apparently, this consolidation interval could be a constructive signal. It might permit establishments to quietly accumulate Bitcoin whereas the market stabilizes after a interval of great profit-taking.

The hot button is what the Fed does. In the event that they reduce charges, issues might get attention-grabbing. But when they shock us, Bitcoin would possibly dip additional.

Learn Bitcoin’s [BTC] Value Prediction 2025–2026

For now, the market’s displaying indicators of life. Greed is again, and profit-taking is cooling down. This might ignite a brand new shopping for frenzy, particularly as soon as the Fed mud settles.

Keep watch over the U.S. financial calendar – it would in the end decide whether or not excessive greed takes over or FOMO makes a comeback.