- Hedge fund predicts that Bitcoin miners’ shares will go to zero.

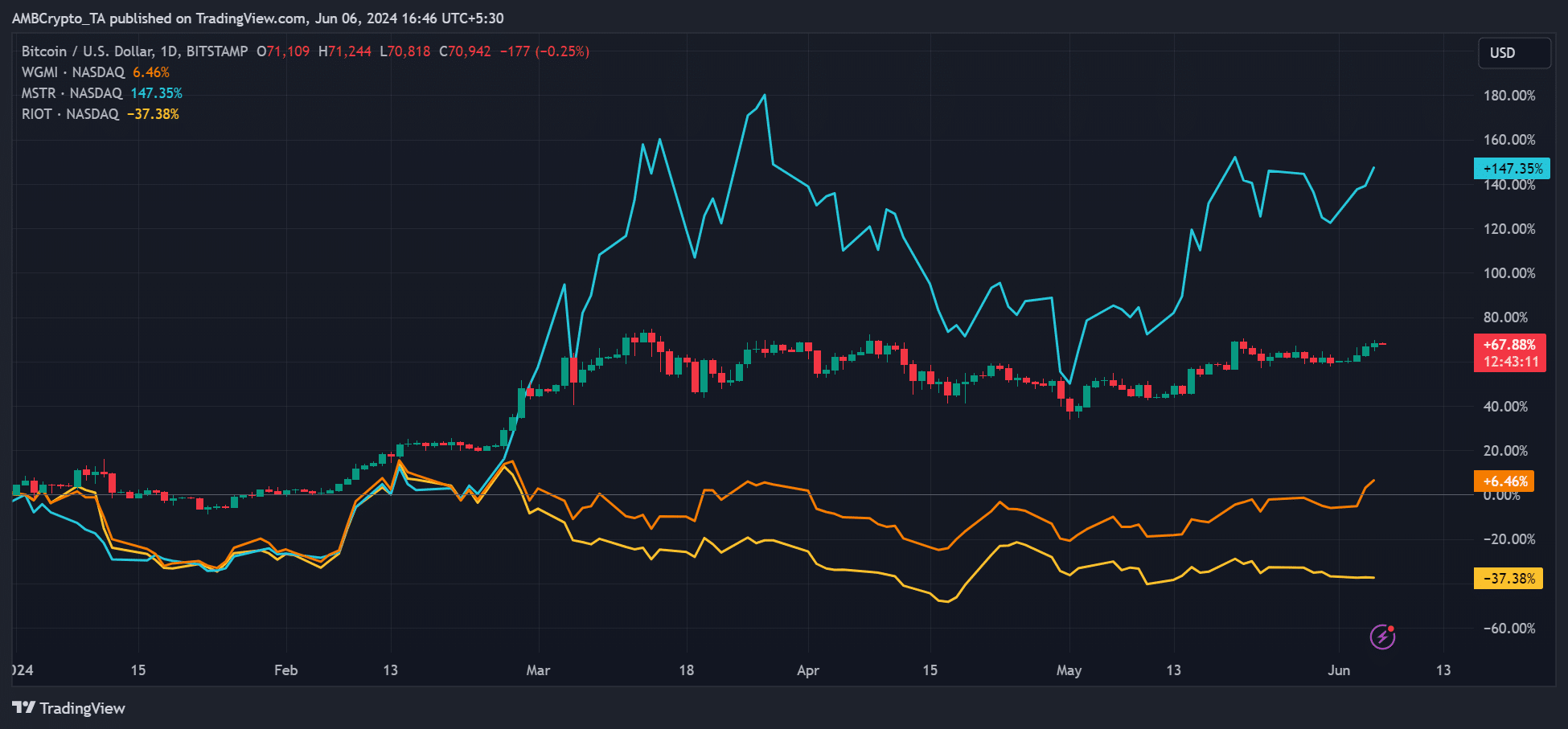

- BTC and MSTR have carried out higher than total BTC miner shares on a YTD foundation.

After going brief on MicroStrategy’s MSTR inventory in March, TradFi hedge fund Kerrisdale Capital is again with one other brief technique, this time concentrating on Bitcoin miner Riot Platform’s RIOT share.

So, what’s the meat with RIOT? Kerrisdale Capital’s CIO Sahm Andrangi advised Yahoo Finance that,

“Our funding thesis is that this sector isn’t going to be round in 5 years,’

On X (previously Twitter), the hedge fund slammed Riot additional and referred to as it a ‘dysfunctional hamster’ and ill-equipped to supply higher rewards to shareholders.

‘Like other US-listed miners, $RIOT’s biz mannequin is a dysfunctional hamster wheel of money burn, which is why it loots retail shareholders with continuous ATM issuance to fund operations. Even with $BTC close to all-time highs, post-halving $RIOT’s mining ops aren’t worthwhile.’

Apparently, Andrangi was towards the entire Bitcoin mining sector, termed it the ‘stupidest business model’, and predicted that it could ‘ultimately go to zero.’

Bitcoin as a hedge towards BTC miners

In such a bearish state of affairs, the hedge fund maintained that BTC would all the time carry out higher towards BTC miner shares. So, it could be used as a hedge towards BTC miner shares – lengthy BTC, brief BTC miners.

Nevertheless, since Kerrisdale Capital’s final brief technique towards MSTR in March, the inventory has soared 37%.

This tipped some market watchers to undertake a contrarian method and ‘thank’ the fund for calling BTC miners’ shares ‘bottom’ for the remainder of 2024.

One other X consumer outrightly questioned how flawed the fund’s technique was.

‘This genius is shorting #Bitcoin miners and $MSTR heading into the greatest crypto bull market in history.’

Nevertheless, the fund was proper on BTC outperforming miner shares. On a YTD (year-to-date) foundation, MSTR was up 147%, and BTC had 67% good points as of press time.

Nevertheless, RIOT was down 37%, whereas total BTC miner shares tracker, based mostly on Valkryie Bitcoin Miner ETFs (WGMI), was modestly up solely 6% over the identical interval.

That stated, the WGMI has been trending larger as BTC rises. However, it stays to be seen whether or not the hedge fund’s ‘BTC miners going to zero’ projection will prove.