- One analyst pointed to Bitcoin’s fractal patterns as proof that holders are positioning the asset for sustained progress.

- Knowledge advised that Bitcoin is much from its cyclical market peak, leaving room for vital value good points.

Within the quick time period, Bitcoin’s [BTC] efficiency over the previous 24 hours displays weaker sentiment because it dropped by 1.53%, with bearish traits gaining momentum. Nevertheless, broader indicators counsel this pullback is non permanent, with the market anticipated to get well as sentiment improves.

For a deeper dive into Bitcoin’s potential trajectory, AMBCrypto gives an in depth evaluation of the important thing metrics shaping its outlook.

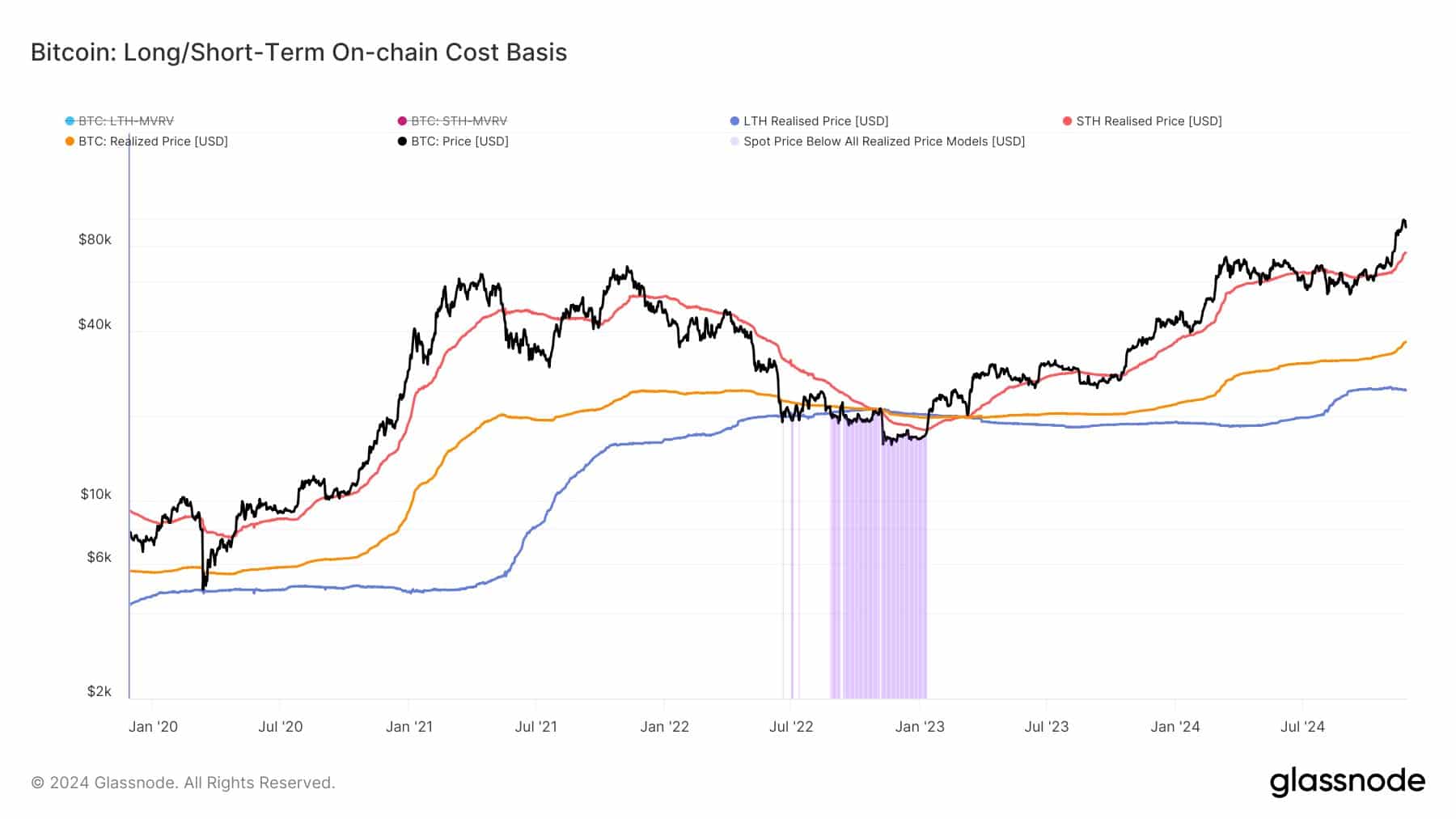

Lengthy-term holders keep regular as short-term patrons present key help

Analyst James Van Straten believes Bitcoin is at a pivotal second just like late 2020, when the asset dropped to $10,000 earlier than climbing to $60,000.

Van Straten’s evaluation highlights the significance of Quick-Time period Holders’ Realized Revenue (STH RP) as a key help degree. Traditionally, when BTC retraces to this degree, shopping for exercise picks up, serving to push the value again up.

He famous:

“Notice how realized price has started to climb, while Long-Term Holders’ Realized Profit (LTH RP) remains flat or trends downward.”

When long-term holders’ realized earnings stay flat or decline, it usually signifies they’re assured within the asset’s long-term worth and are holding or accumulating fairly than promoting. This conduct helps bullish momentum and stabilizes the market.

If the development continues, BTC is prone to get well from its current dip, with a rebound to the STH RP degree implying a return to upward motion.

Additional findings by AMBCrypto align with this outlook, pointing to extra indicators that help the potential for a value restoration.

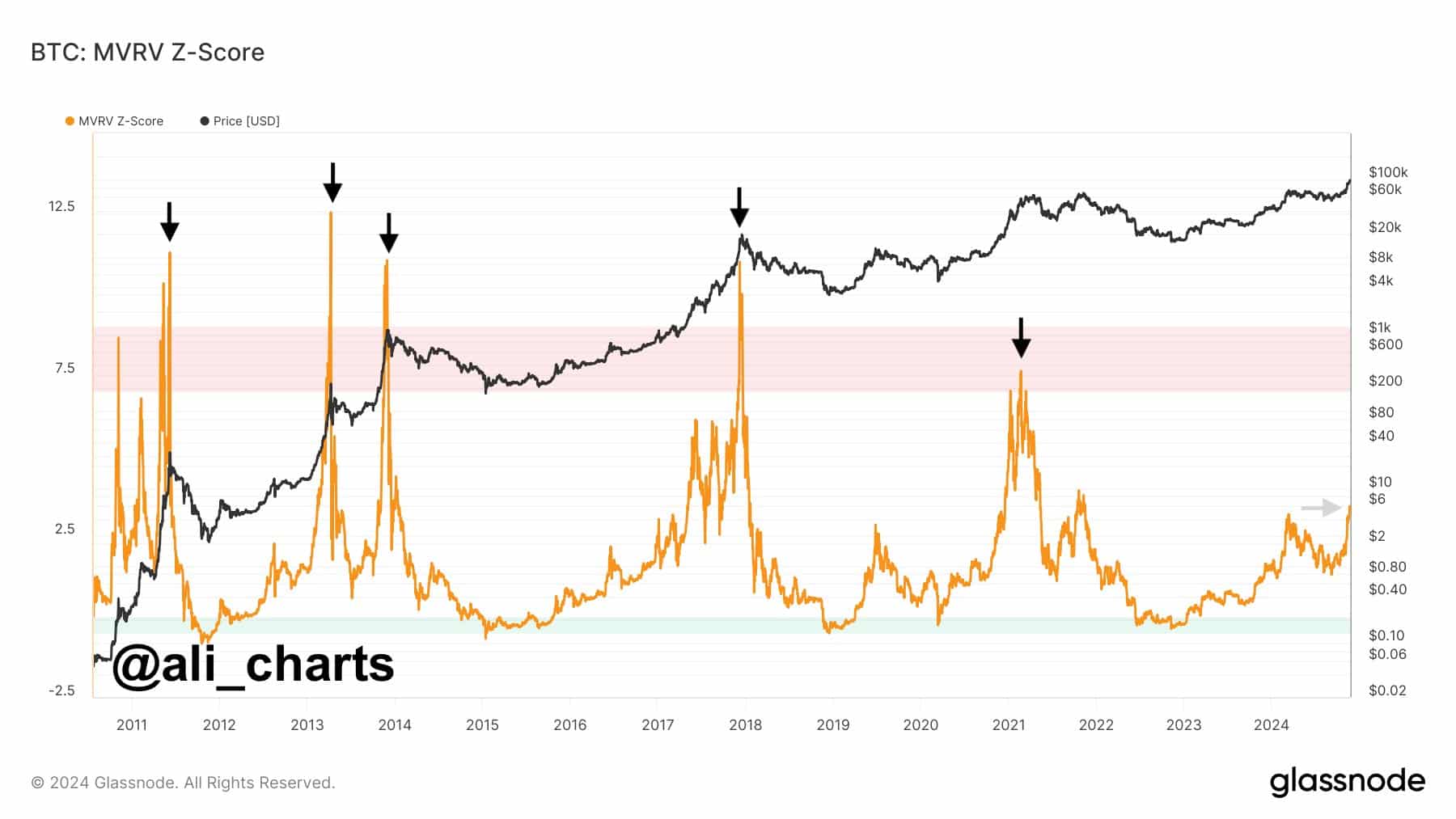

Bitcoin market outlook: Room for additional good points

Crypto analyst Ali Chart maintains that Bitcoin nonetheless has good upside potential in a current submit, with broader market sentiment remaining bullish. In line with Ali, BTC is much from reaching a cyclical market prime — a peak sometimes adopted by a serious decline.

In his phrases:

“BTC is far, far, far away from a market top!”

Ali’s evaluation relies on the Market Worth to Realized Worth (MVRV) Z-Rating, which at the moment locations BTC within the decrease vary of the chart. This means ample room for progress, because the metric signifies that BTC has but to method overvalued territory.

If the MVRV Z-Rating begins trending upward, BTC’s value is prone to comply with, doubtlessly indicating the beginning of a sustained rally.

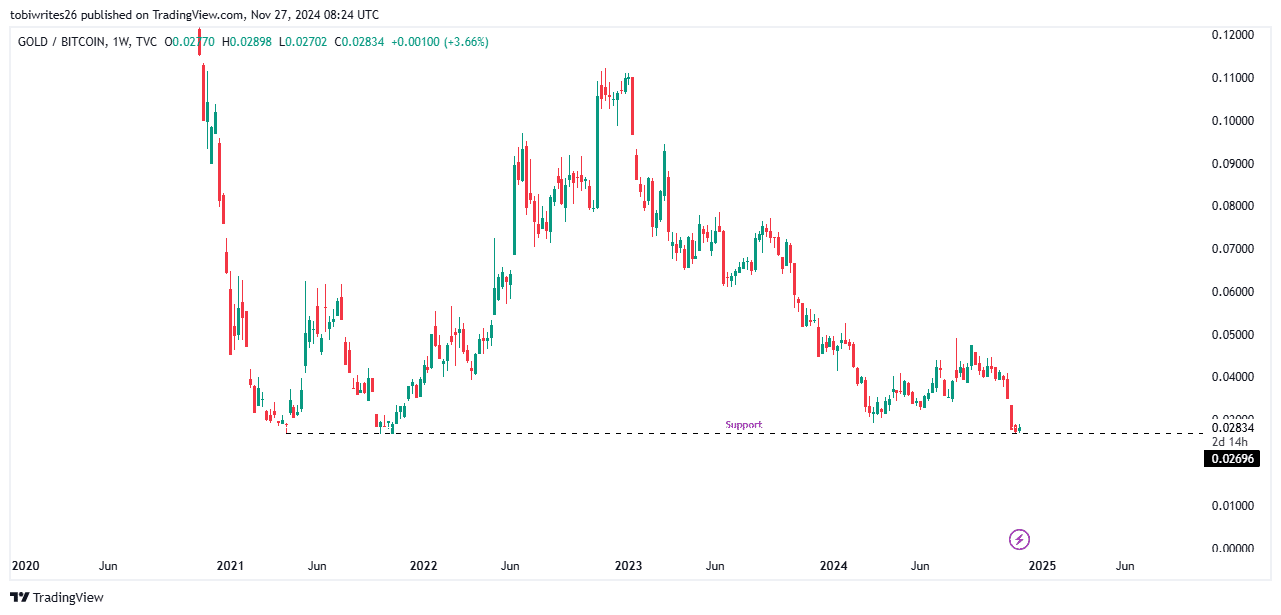

Will Bitcoin overtake Gold?

Latest evaluation means that if Bitcoin continues to realize worth relative to gold, it could finally surpass the dear steel in greenback phrases, as proven within the chart.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

This shift might happen if BTC breaks by way of its present help degree, which has been limiting additional declines.

A breakdown right here would additionally spotlight a change in market sentiment, with extra traders viewing digital belongings as a severe financial power — a growth that will be bullish for Bitcoin.