- Bitcoin’s attract diminishes as Tether’s minting spree on Ethereum and Tron boosts capital inflows.

- USDT provide is hovering amid rising market volatility, taking part in an important position in shaping crypto developments forward.

November marked probably the most bullish month, pushed by the ‘Trump-pump,’ post-halving momentum, a positive inflation report, and Bitcoin’s [BTC] sturdy fundamentals reinforcing its place as a retailer of worth.

With $114 billion flowing into the crypto market and Tether’s [USDT] minting spree boosting liquidity. This highlights the energy of the previous 30-day rally, indicating the potential for continued short-term upside.

Nevertheless, uncertainty round Bitcoin’s subsequent psychological goal raises issues about potential bearish pressures, particularly as Q1 volatility may sign longer-term market instability.

On this local weather, may excessive liquidity push buyers towards a extra conservative method, utilizing it as a haven as a substitute?

Count on excessive volatility within the coming days

At the moment, the market could be summed up in a single phrase: “volatile.” That is mirrored within the rising crypto volatility index, signaling that buyers are anticipating larger returns inside a shorter time-frame.

Regardless of the optimism following the election outcomes, which helped push Bitcoin previous $100K, the breakthrough was short-lived. Large hypothesis within the perpetual market led buyers to shift focus, looking for instant returns by pushing BTC downwards.

This bubble impact has left each market makers and out of doors spectators unsure about Bitcoin’s subsequent resistance level, with many buyers getting ready to breaking even earlier than a possible correction units in.

In consequence, the best choice could also be to show towards stablecoins as a security internet, providing a cushion in opposition to potential market crises.

Nevertheless, this shift may spark bearish sentiment within the coming days. Bitcoin’s sturdy fundamentals would wish to ignite one other rally, turning $100K right into a steadfast help stage.

In any other case, a neighborhood high at this worth level may sign tight liquidity. Revenue-taking may intensify, and new patrons may hesitate to soak up the strain, resulting in an elevated reliance on USDT as a substitute.

So, is $100K a Bitcoin high or a backside?

At the moment, the market is gripped by conflicting predictions: one based mostly on ‘uncertainty’ and the opposite on ‘anticipation.’ Every drives completely different market actions.

This lack of affirmation leads many buyers to view the $100K mark as a neighborhood high. It prompts a major exodus of these taking part in it protected to interrupt even.

In consequence, previously 30 days, Tether minted round $19 billion in USDT. Within the final 4 days alone, $4 billion was minted throughout the Ethereum and Tron networks. Extra buyers are shifting towards high-cap altcoins, unsure about Bitcoin’s subsequent transfer.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Nevertheless, there nonetheless stays a powerful pool of stakeholders anticipating a serious breakthrough. Their long-term funding is inflicting USDT reserves to see a notable improve.

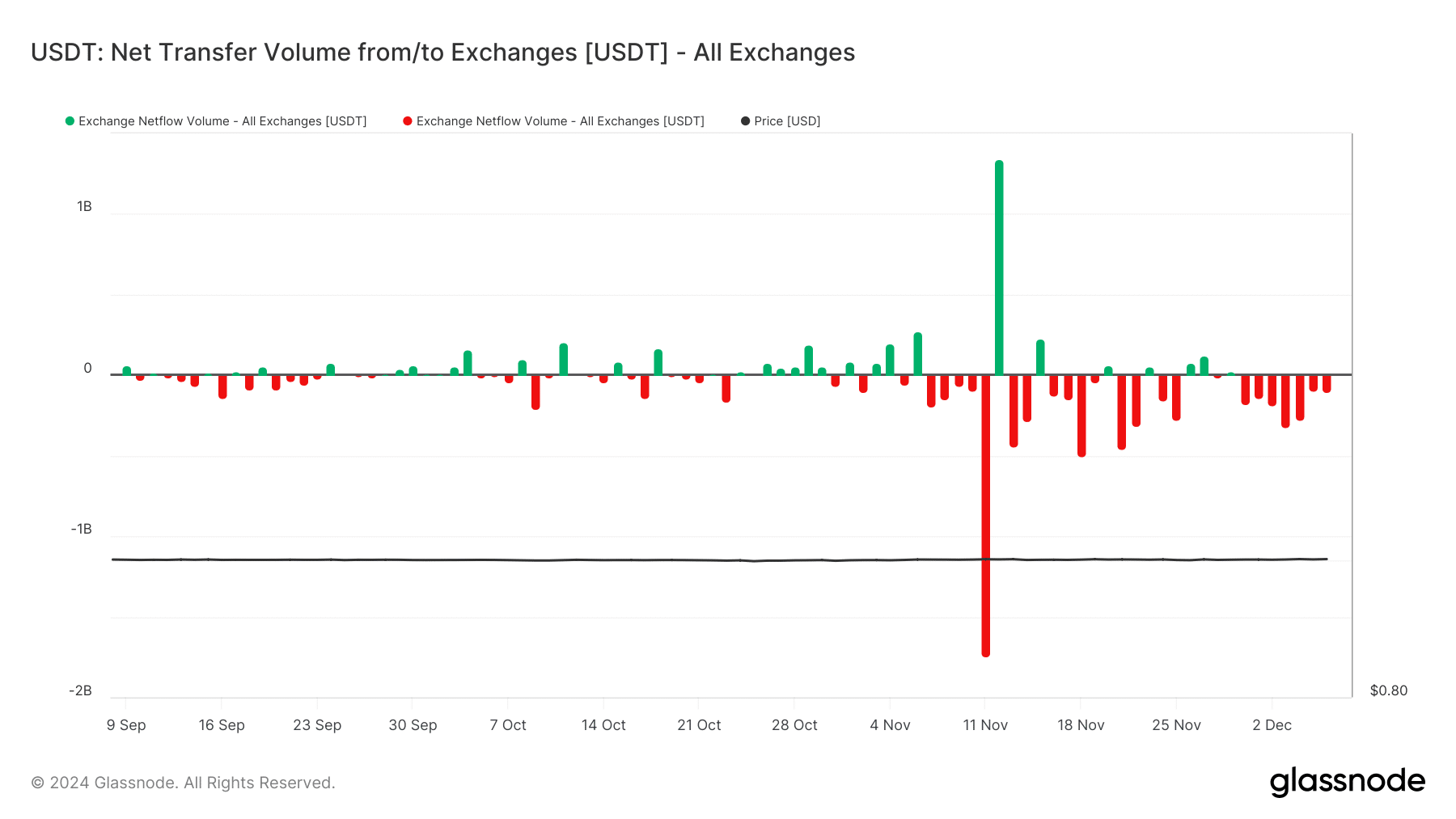

But, this alone gained’t be sufficient. Monitoring USDT alternate flows is essential to understanding how the market reacts to present worth ranges.

Whereas the minting spree has sparked a wave of bullish optimism – analysts are eyeing the inflow of liquidity as a possible catalyst for a Bitcoin rally, as buyers rush to swap USDT for BTC.

Nevertheless, rising volatility may throw a wrench within the plan, diminishing Bitcoin’s attract in opposition to its rivals, with USDT holding agency because the haven of alternative.