- The Pi Cycle Prime indicator revealed that BTC was close to its market backside.

- BTC was testing a resistance, and a breakout may start a bull rally.

Bitcoin [BTC] continued to stay bearish as each its every day and weekly charts remained crimson. Nonetheless, the most recent evaluation steered a pattern reversal quickly. Due to this fact, AMBCrypto investigated additional to seek out whether or not a pattern reversal is feasible.

Bitcoin to the touch $120k within the coming months?

The king coin witnessed a 3% worth drop final week. The bearish pattern continued within the final 24 hours, and at press time it was buying and selling at $68.4k. Whereas the bears remained dominant, a CryptoQuant evaluation hinted at a significant rally forward.

CoinLupin, an writer and analyst at CryptoQuant, not too long ago posted an evaluation that took into consideration BTC’s MVRV ratio. As per the evaluation, the MVRV stood round 2, indicating that the market’s floor worth was twice the on-chain estimated worth.

The analyst used the 365-day Bollinger Band for MVRV and the 4-year common. The metric usually displays Bitcoin’s cycle. This metric’s studying revealed that the upward pattern stays intact, and customarily, the cycle peak tends to happen when the MVRV reaches ranges between 3 and three.6.

The evaluation talked about {that a} 43%–77% rise is required if the realized worth (RV) stays the identical. This corresponds to an purpose of $95k to $120k when utilized to Bitcoin.

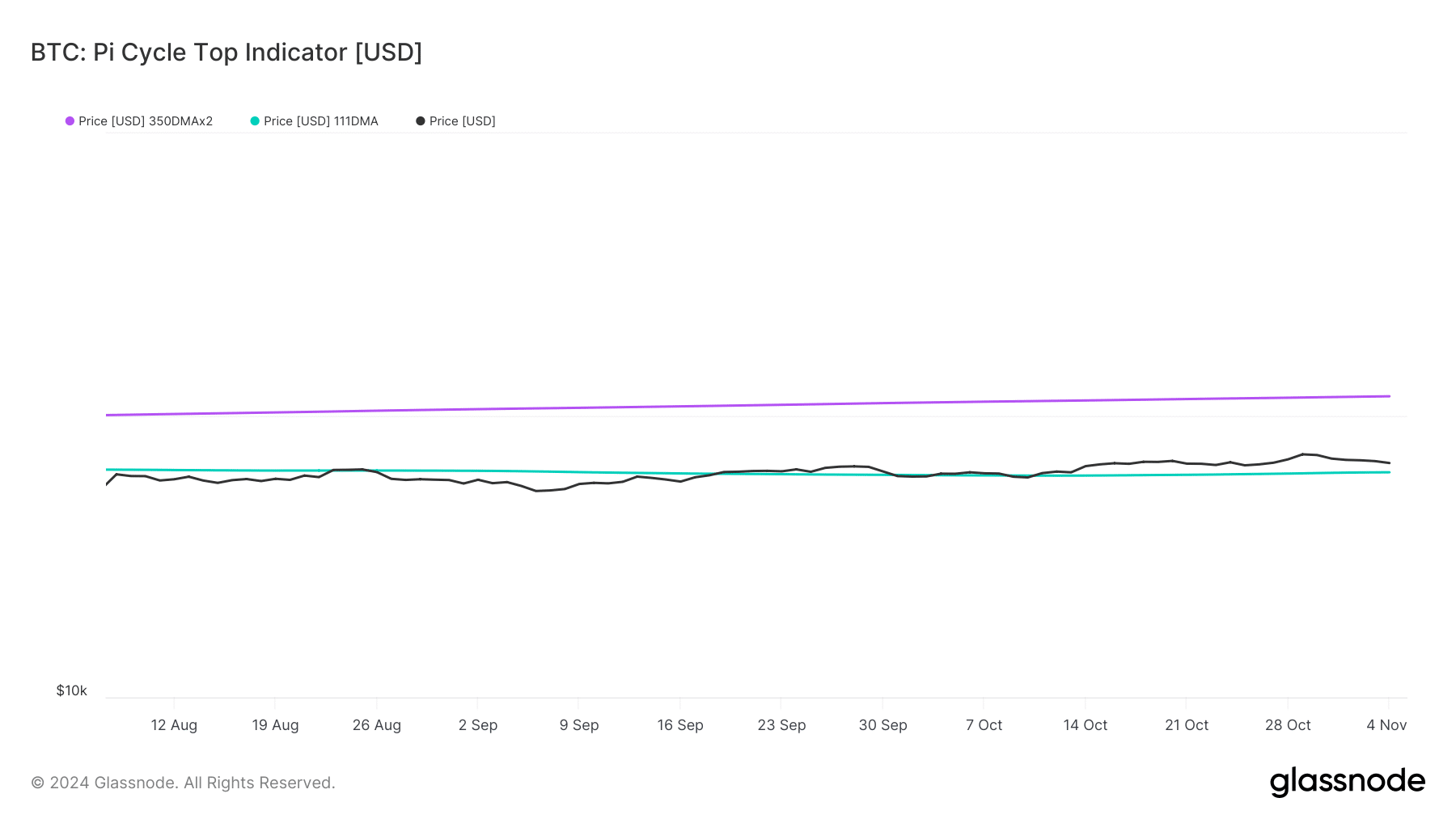

To test the chance of BTC shifting in the direction of $120k, AMBCrypto assessed Glassnode’s knowledge. The Pi Cycle Prime indicator revealed that Bitcoin’s worth was quick approaching its potential market backside of $62.7k.

If the metric is to be believed, then BTC’s potential market high was close to $116k.

Due to this fact, contemplating the Pi Cycle Prime indicator and the CryptoQuant evaluation, anticipating BTC to start its journey in the direction of $120k within the coming months didn’t appear too bold.

What’s subsequent for BTC within the short-term

Although the long run prospect of BTC appeared optimistic, the current scenario remained questionable.

Due to this fact, AMCrypto assessed its on-chain knowledge to seek out extra about the place BTC was headed because the world awaits the U.S. presidential election outcome. Our evaluation revealed that BTC’s binary CDD turned crimson.

This meant that long-term holders’ motion within the final 7 days was decrease than the common. They’ve a motive to carry their cash. Its NULP was additionally bearish, because it indicated that traders have been in a perception section the place they’re at the moment in a state of excessive unrealized income.

Learn Bitcoin (BTC) Worth Prediction 2024-25

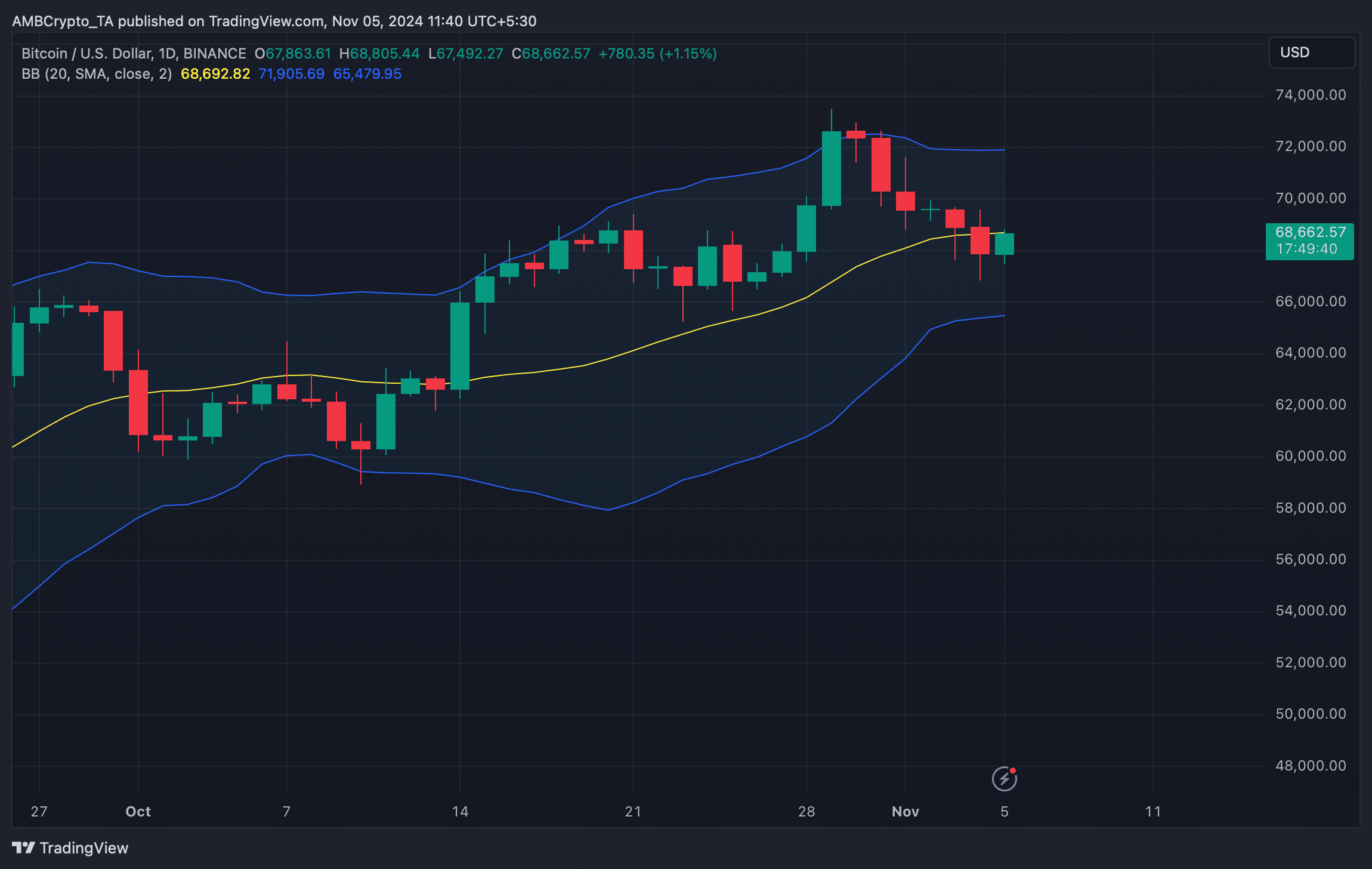

We then took a fast take a look at BTC’s every day chart to see what market indicators steered. On the time of writing, Bitcoin was testing its resistance at its 20-day Easy Transferring Common (SMA).

A profitable breakout may start a bull rally. But when it will get rejected, then BTC may fall to $65k once more.