- Bitcoin noticed elevated demand in the US.

- The Coinbase Premium was nonetheless close to the zero mark.

Bitcoin [BTC] was poised to see short-term worth volatility as a result of choices expiry on the finish of the week. A current AMBCrypto report additionally famous that the rise in alternate reserves might spark a bout of promoting.

The MVRV metric revealed that Bitcoin is at a vital resistance that, if damaged, might lead to a robust worth uptrend. The 155-day MA’s break might set the market up for a rally just like the one which started final October.

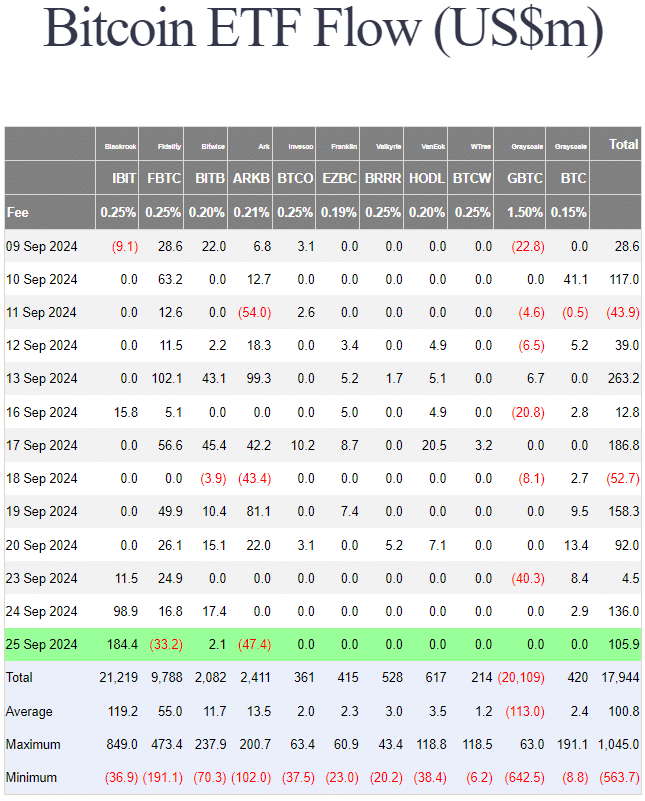

Supply: Farside Traders

The Bitcoin spot ETF move desk confirmed that the entire flows of the previous two weeks have a constructive pattern. This outlined the bullish expectations amongst retail traders.

The 30-day web change in holdings additionally turned constructive, Ki Younger Ju famous in a put up on X.

Spot ETF spurs rising shopping for stress in the US

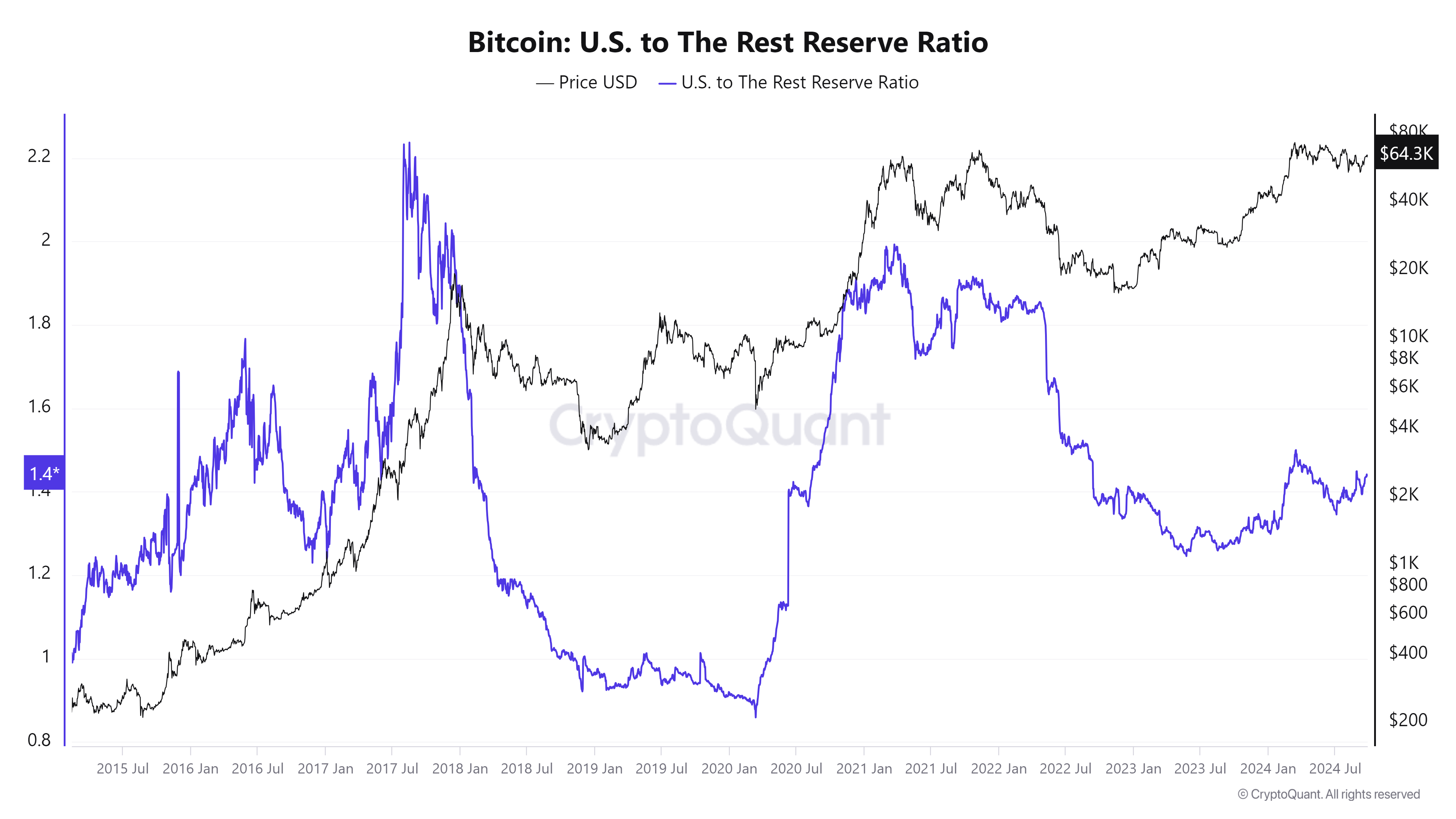

Supply: CryptoQuant

The Founder and CEO of CryptoQuant additionally identified that the U.S. Bitcoin reserve ratio was rising, possible spurred by the spot ETF demand. The rise has been gradual however regular over the previous fourteen months.

Prior to now two cycles, a speedy enhance within the U.S. reserve ratio got here a couple of months earlier than Bitcoin reached the ultimate part of the bull run.

If the sample holds up as soon as extra, a speedy enhance within the U.S. reserve ratio could possibly be an early signal of a possible BTC bull run.

It additionally begins to say no noticeably about 4–6 months earlier than the cycle tops. Whereas these observations don’t assure the same efficiency throughout this run, it’s one thing else for traders to regulate.

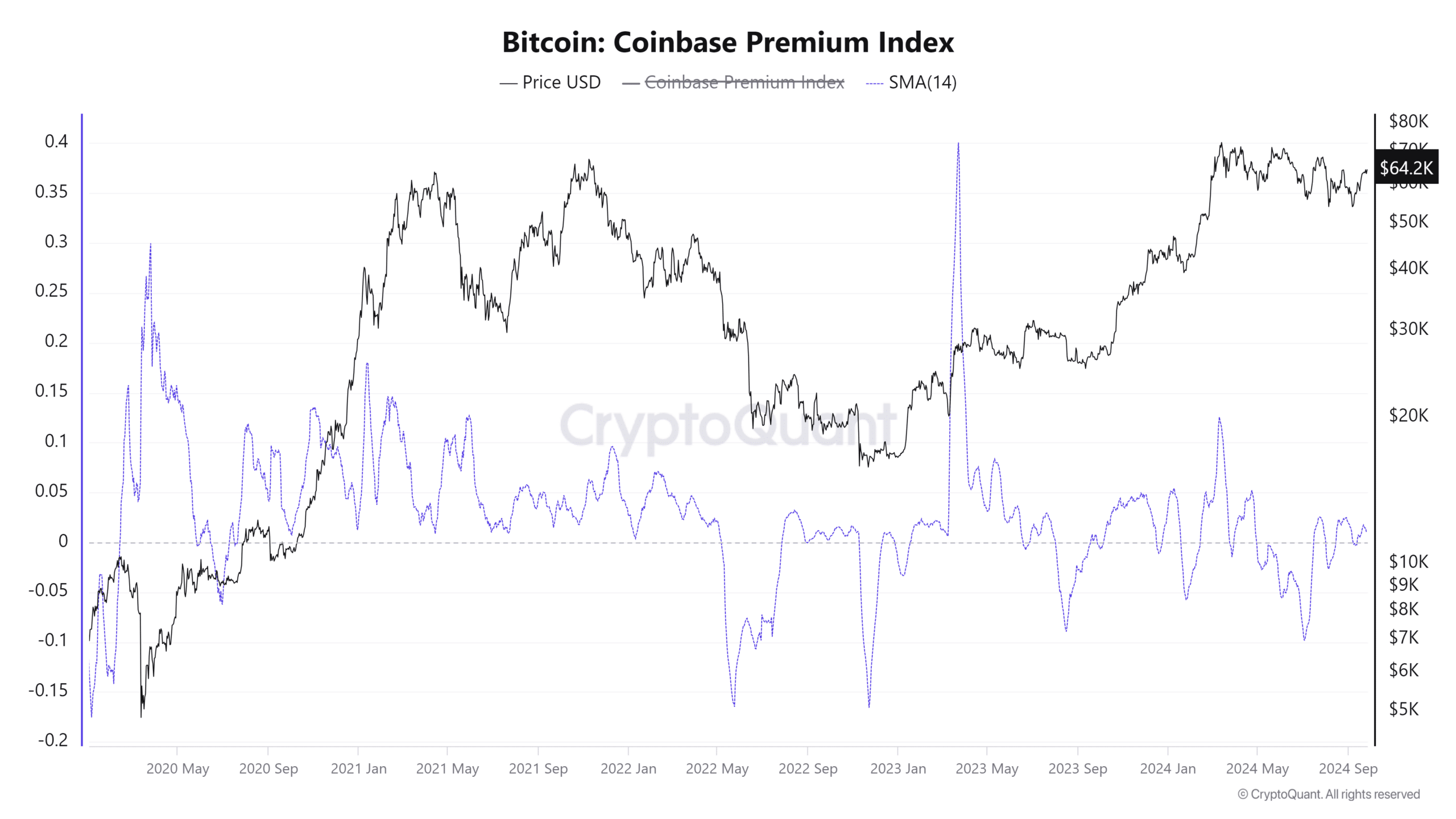

Bitcoin Coinbase premium confirmed demand has not peaked

Supply: CryptoQuant

The spot ETF flows, and the reserve ratio, confirmed demand from the US was on the rise.

Nevertheless, a take a look at the Coinbase Premium Index confirmed this demand was not excessive sufficient to command a big premium.

Coinbase, one of many largest crypto exchanges obtainable to U.S. traders, tends to see a excessive Bitcoin premium throughout a bull run. This was true throughout the 2020-21 run.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

It additionally utilized to the rally that started in October 2023 and continued until March 2024.

The low Coinbase premium doesn’t erode the earlier metrics’ findings, however reinforces the concept that a bull run was not but in play.