- Bitcoin miners’ reserves declined sharply, including promoting stress throughout This autumn 2024

- 2025 has to this point seen decreased sell-offs, hinting at a possible market shift in direction of consolidation

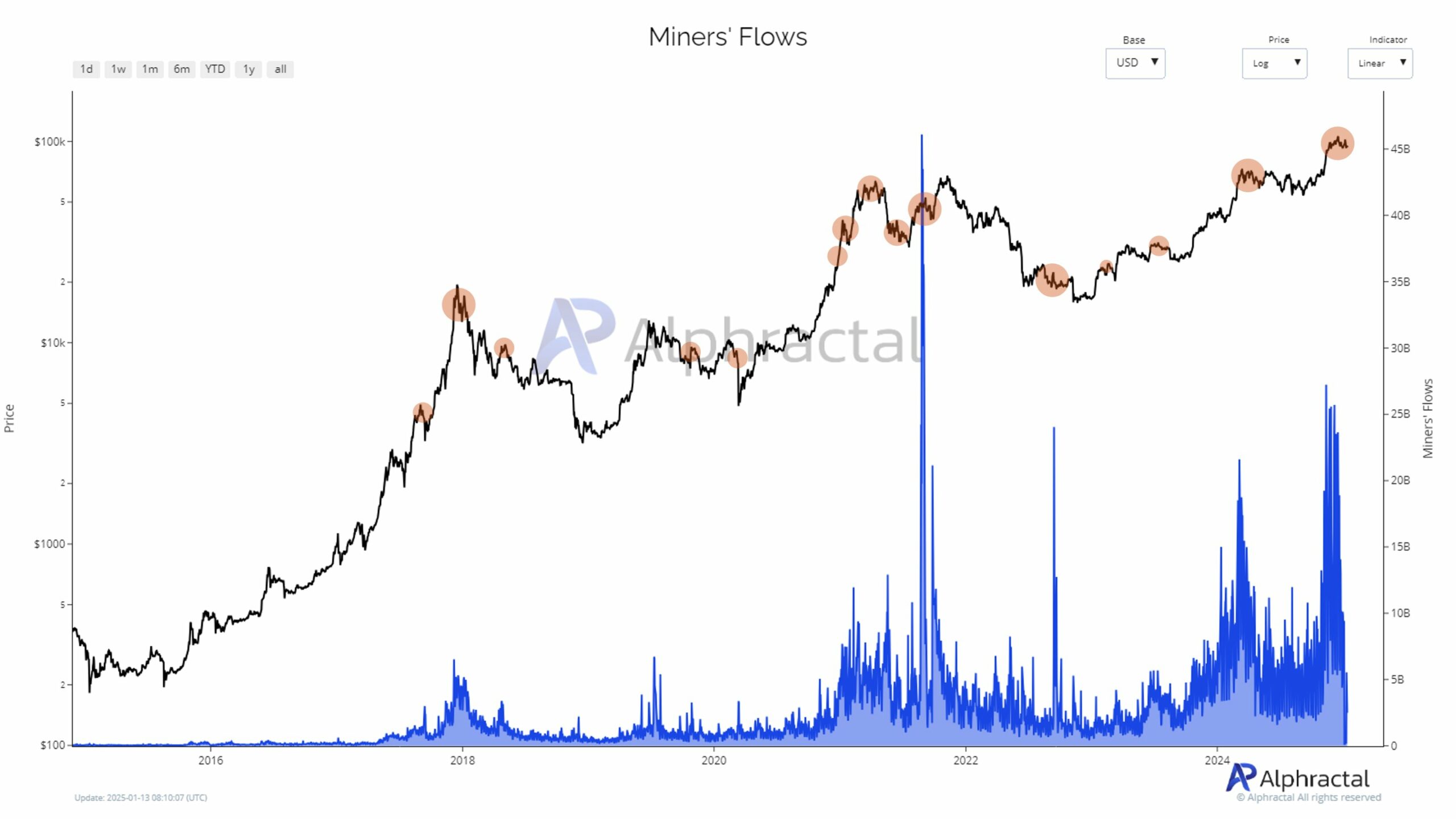

In late 2024, Bitcoin [BTC] miners set a brand new file for the best greenback worth ever moved, with important outflows from their reserves including promoting stress to the market. Report-high hash charges have pushed up mining prices, forcing miners to liquidate Bitcoin to cowl bills. Nevertheless, information from January 2025 revealed a slowdown in miner promoting, elevating questions concerning the market’s future.

Rising miner outflows

The top of 2024 noticed an unprecedented surge in Bitcoin miner outflows, with greenback values hitting new all-time highs. This heightened exercise aligns with marked promoting stress as miners opted to liquidate important parts of their reserves.

Latest information indicated that these large-scale liquidations have corresponded carefully to native worth peaks, suggesting miners strategically bought into energy to maximise returns. This dynamic has amplified volatility in Bitcoin markets, making a suggestions loop the place larger miner exercise feeds bearish sentiment.

And but, the current tapering of outflows noticed in early 2025 appeared to trace at a possible shift in market circumstances, with miners showing much less incentivized to dump holdings regardless of elevated operational pressures.

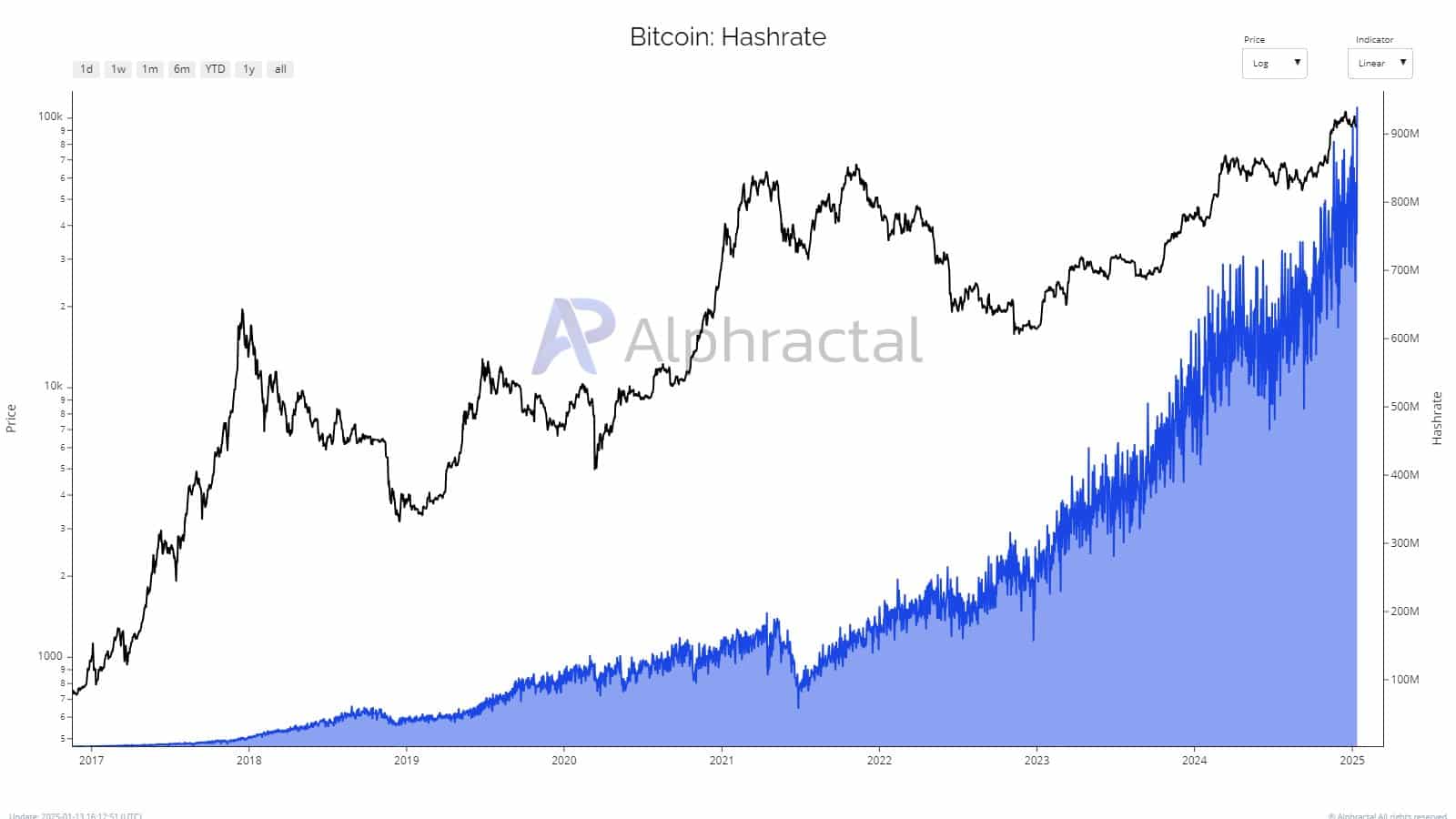

An ATH hashrate

Bitcoin’s hashrate reached an all-time excessive in late 2024, reflecting the community’s sturdy safety and fierce competitors amongst miners. The speedy ascent correlated with the growing issue in mining new Bitcoin, pushing operational prices to their peak.

Whereas larger hash charges sign confidence in Bitcoin’s underlying protocol, additionally they impose important monetary pressure on miners. Particularly since they need to then keep costly {hardware} and energy-intensive operations.

This imbalance compelled many to liquidate belongings over the last quarter of 2024, exacerbating downward worth momentum. With early 2025 exhibiting steady hash fee ranges, miners might discover short-term reduction. Nevertheless, sustainability considerations loom as power costs and competitors proceed to climb.

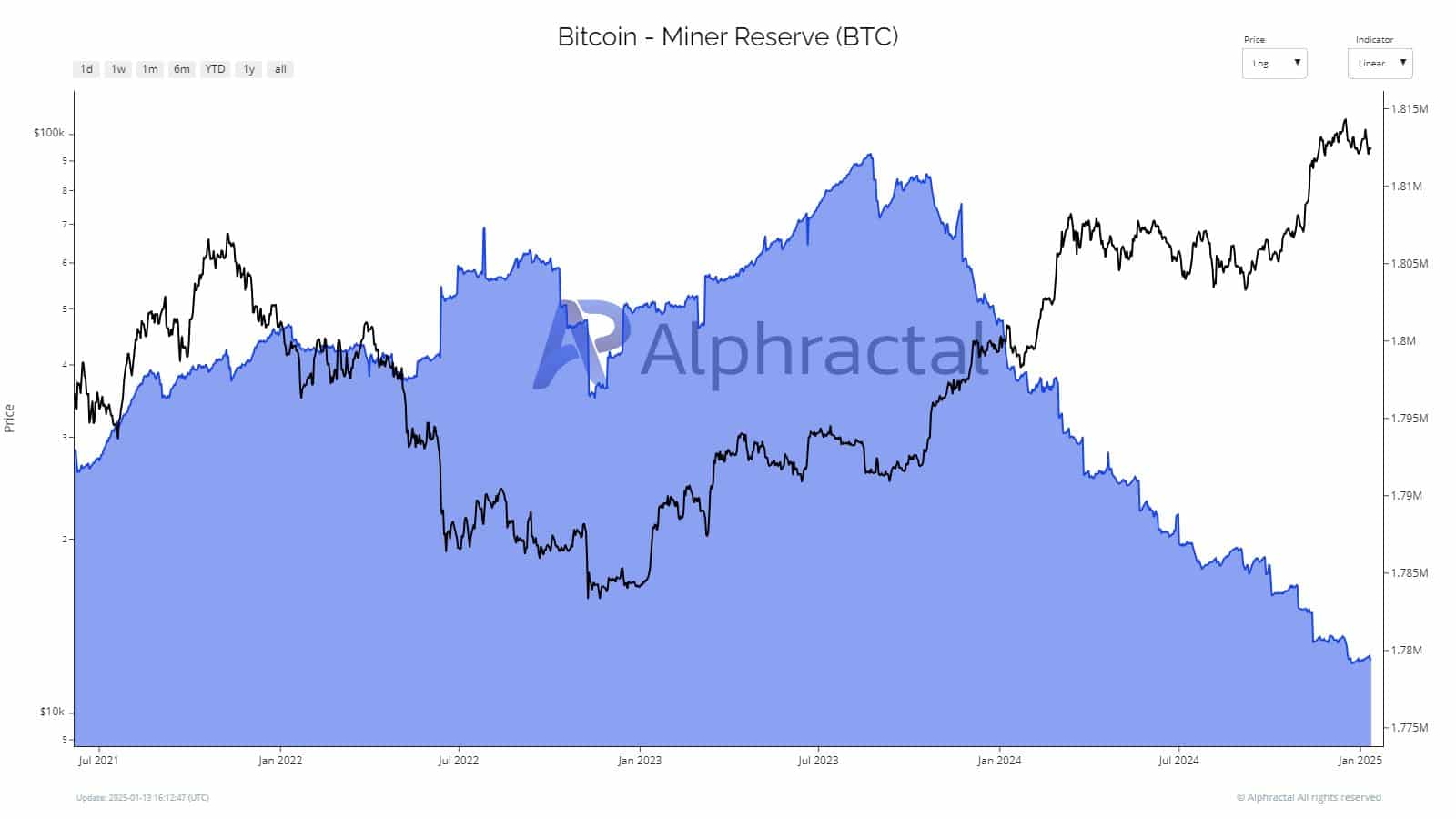

Declining miner reserves and sell-off dynamics

Bitcoin miners have been steadily lowering their reserves since mid-2023, pushed by hovering operational bills on account of file hash charges and rising power prices. This strategic shift highlights miners’ want for liquidity in an more and more unsure market, with most important reserve reductions occurring throughout native worth peaks.

As reserves strategy multi-year lows getting into 2025, considerations have grown about miners’ diminishing potential to stabilize the market throughout corrections.

In the meantime, the continuing sell-offs have intensified market stress. Nevertheless, the BTC miner reserves pointed to a slowdown in promoting exercise as miners balanced rising prices with revenue margins. This tapering may sign improved operational effectivity or exterior assist, probably resulting in decreased volatility and a extra steady market within the coming months.

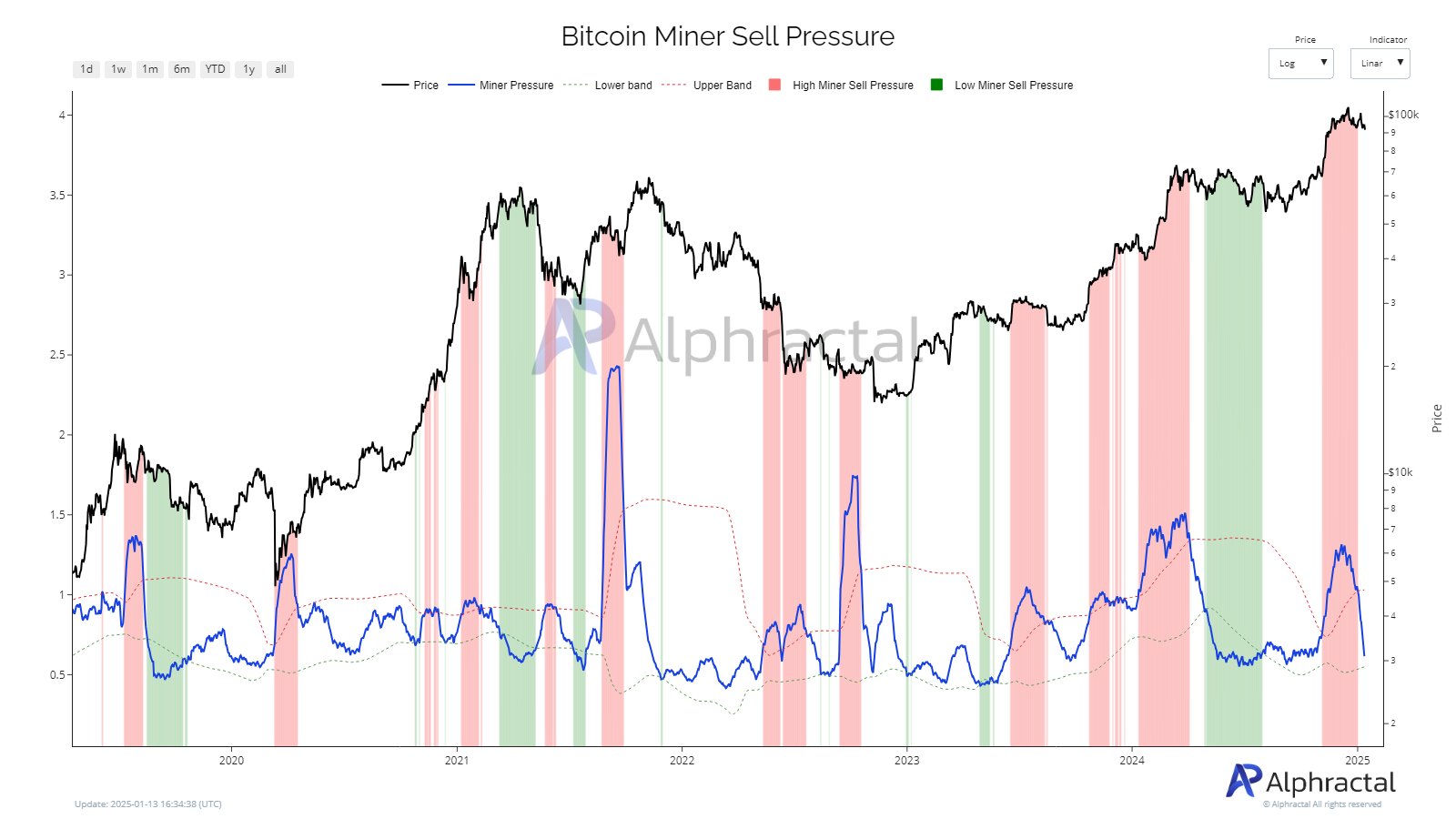

Fall in promoting exercise in 2025

January 2025 has to this point marked a noticeable drop in Bitcoin miner promoting stress. The miner promote stress chart revealed a pointy decline in outflows in comparison with late 2024, signaling a possible shift in market dynamics.

This recommended that miners are adopting a extra strategic strategy, presumably holding reserves in anticipation of upper costs. Moreover, operational changes or exterior funding might have alleviated the necessity for aggressive liquidations, lowering the bearish affect of miner exercise on Bitcoin markets.

Learn Bitcoin (BTC) Worth Prediction 2025-26