- BTC miners have proven resilience, intensifying the probabilities at an incoming provide shock.

- Nonetheless, the market backside remained elusive, decreasing the influence of their efforts.

Bitcoin [BTC] bulls confirmed energy over the weekend, recovering from a dip at $52K. With ongoing volatility in leveraged positions, the backing of enormous holders is changing into more and more essential.

Amongst these massive holders are miners, who are inclined to both capitulate or HODL throughout prolonged intervals of bearish sentiment.

Due to this fact, for a provide shock to take maintain, AMBCrypto discovered that a couple of key components should align. If these situations are met, a possible value surge may observe as provide tightens out there.

BTC miners assist the crunch, whereas whales retreat

From an financial standpoint, a major crunch in BTC provide might be a vital catalyst for a value correction. For a provide crunch to materialize, miners should transition previous the distribution part.

Briefly, miners offloading much less BTC means the provision shock may turn into extra pronounced.

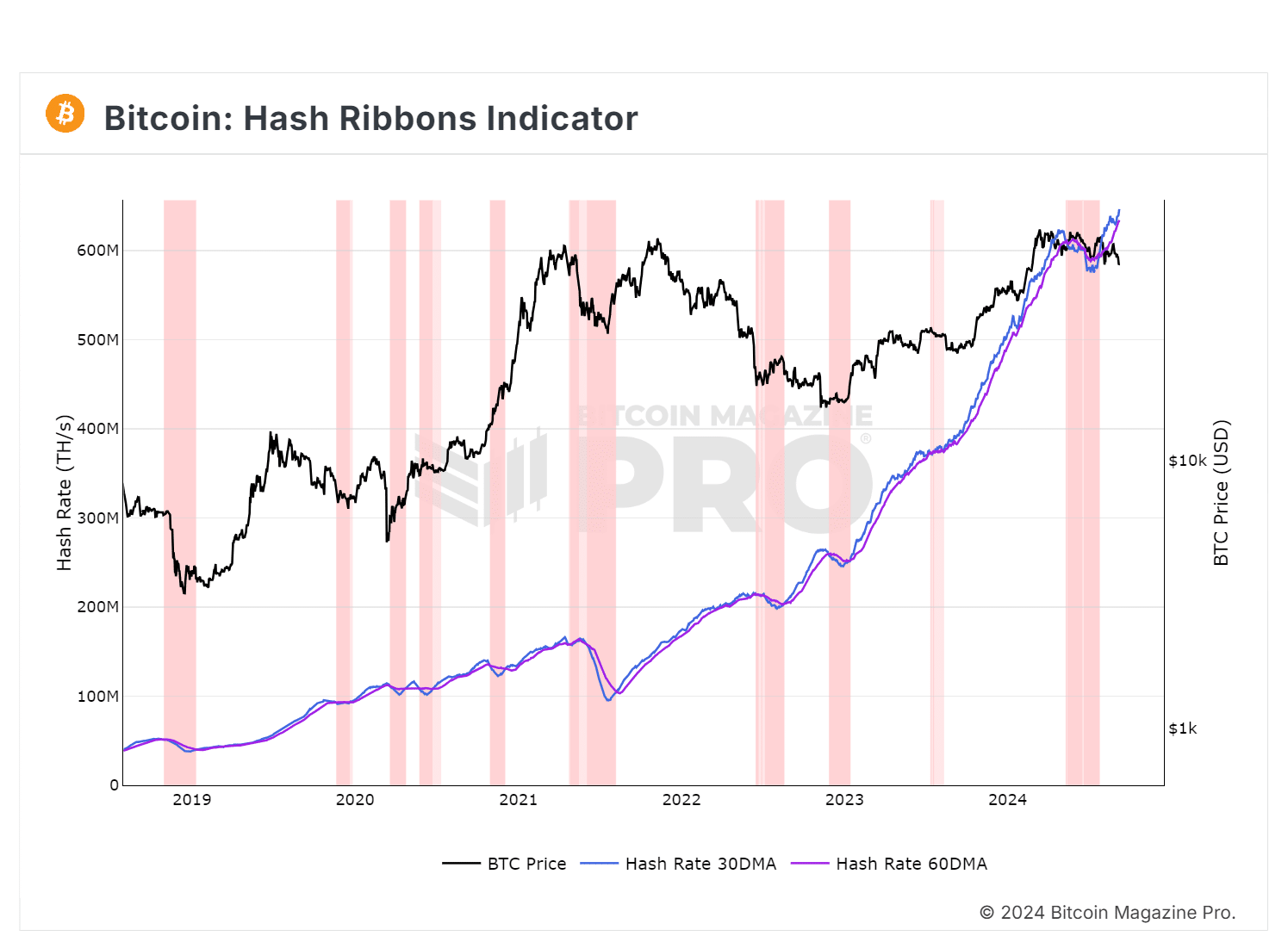

Apparently, the chart beneath revealed that the 30-DMA has lately moved again above the 60-DMA, producing a hash ribbon purchase sign.

This steered a possible bullish development, reinforcing the potential of a value correction pushed by miner accumulation.

As of now, the full circulating provide of BTC is nineteen.7 million. Miners maintain 1.8 million BTC, representing roughly 9.1% of the full provide.

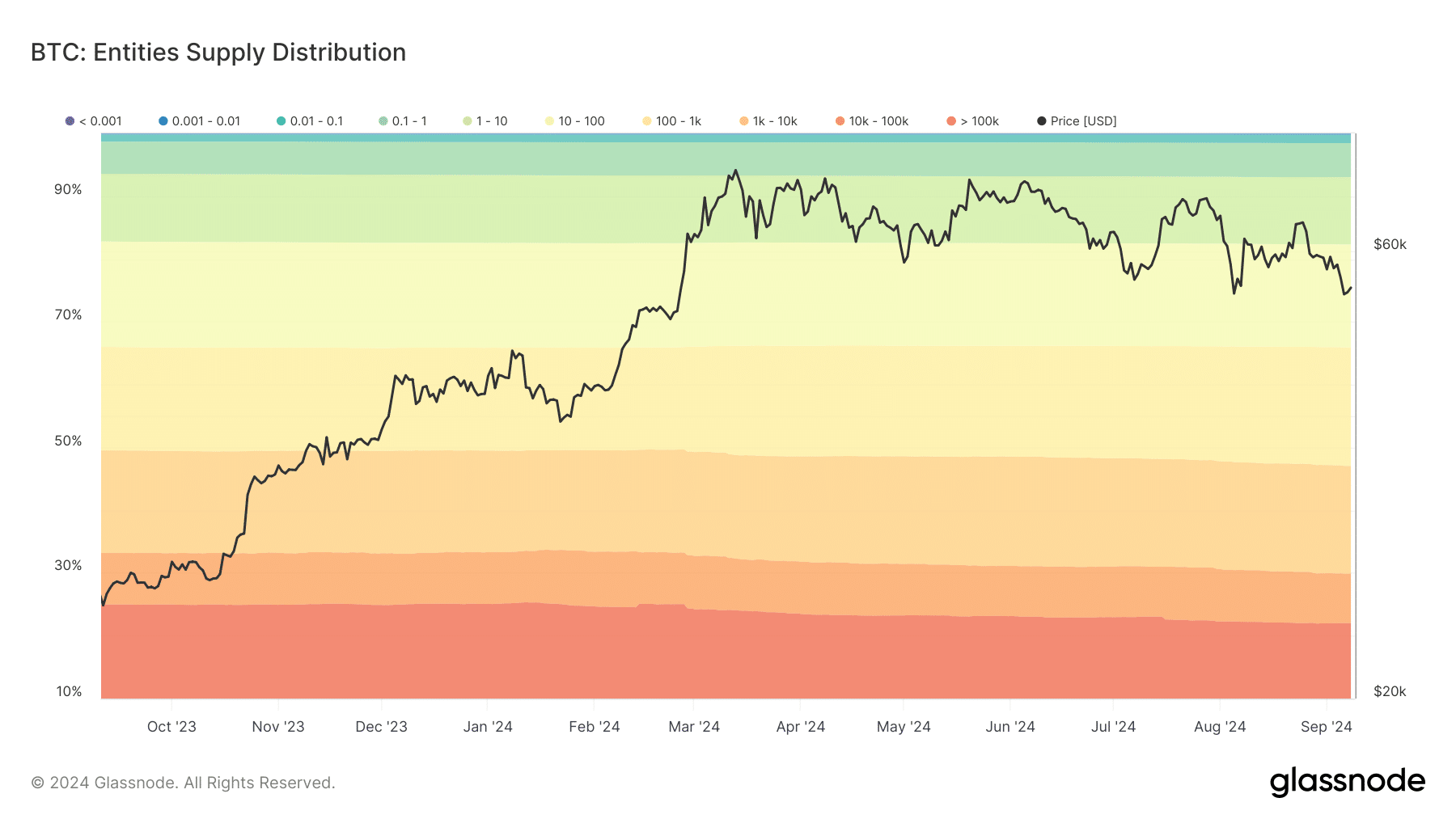

In the meantime, the share of BTC held by whale cohort wallets has decreased from 24% when BTC examined the $73K ceiling, to 21.9% at press time.

In accordance with AMBCrypto, this decline indicated a discount within the focus of enormous BTC holdings.

Whereas miner reserves have remained resilient , these routine deposits by whales have lessened the probability of a provide shock. That being stated, a turnaround remains to be doable if demand outweighs the promoting stress.

As BTC bulls preserve the worth above the $51K assist degree, there stays potential for an outright reversal if shopping for stress will increase.

If this elevated shopping for stress sustains the provision crunch, a provide shock may certainly be achieved. The important thing shall be whether or not demand continues to outpace the accessible provide.

The MVRV chart tells you..

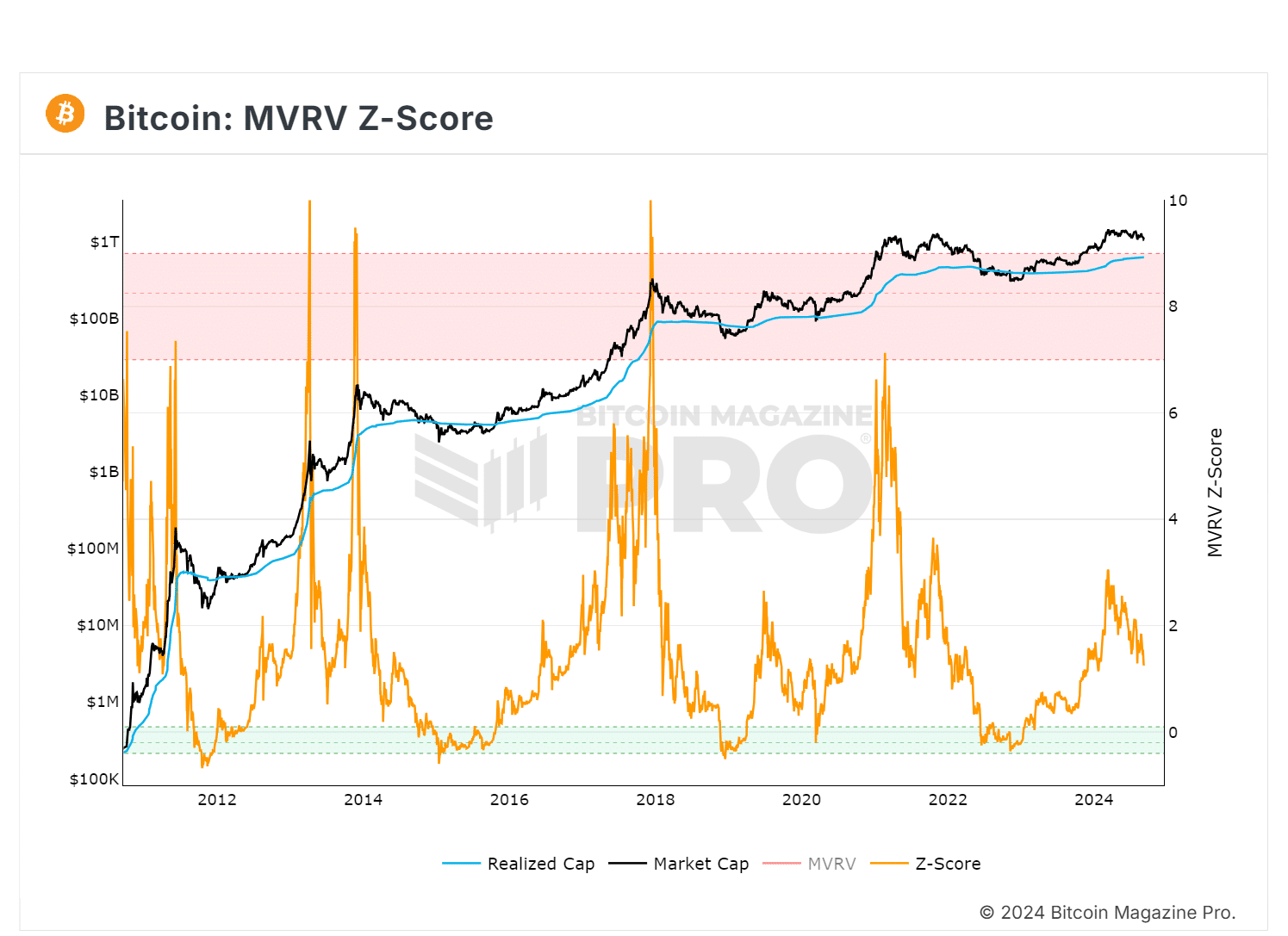

The MVRV Z-score has traditionally been very efficient in figuring out intervals the place market worth is shifting unusually excessive above realized worth.

Apparently, when the Z-Rating (orange line) enters the pink field, it typically indicators the height of a market cycle. Traditionally, this indicator has been capable of pinpoint the market highs inside about two weeks.

Conversely, when the Z-Rating enters the inexperienced field, it signifies that BTC could also be undervalued. Shopping for Bitcoin throughout these intervals has traditionally produced outsized returns.

Due to this fact, a sophisticated dealer will monitor for the market backside to determine the optimum “buy the dip” alternative.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

That is evidenced by the bull rally that usually follows every time the market reaches a value backside.

Put merely, demand is unlikely to surpass provide except the underside zone is examined. Briefly, AMBCrypto notes {that a} reversal stays unlikely. With out enough holding proof, the possibilities of a rebound diminish.