- Miners have added 153,000 BTCs to their OTC reserve within the final three months.

- BTC’s worth development has remained barely bearish.

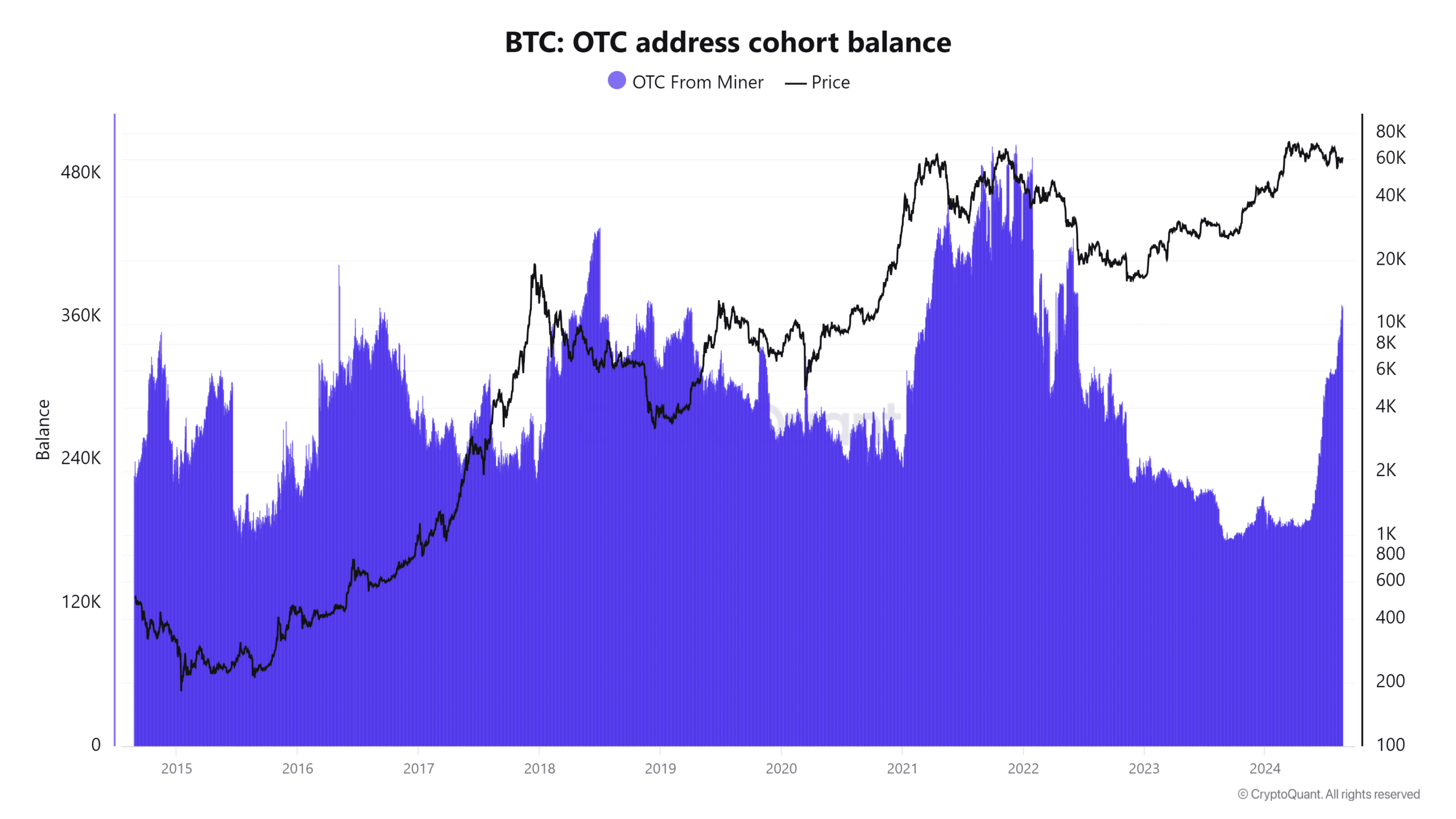

Latest evaluation reveals that the Bitcoin Miner OTC reserve has surged to its highest stage in years.

Traditionally, spikes on this metric haven’t at all times been favorable for Bitcoin’s worth, and this development seems to be persevering with, as BTC has confronted important struggles in current weeks.

Bitcoin miner OTC spikes

Latest information from CryptoQuant reveals that the Bitcoin Miner OTC reserve has surged to its highest stage since 2022.

The info confirmed that over the previous three months, the reserve has elevated by greater than 70%. It climbed from 215,000 BTC in June to 368,000 BTC in August, which was a big rise of 153,000 BTC.

Miners sometimes use OTC (over-the-counter) gross sales to keep away from triggering unfavourable worth reactions from large-scale transactions.

Nonetheless, historic evaluation signifies that even with this technique, Bitcoin’s worth has struggled to keep away from the impression of such substantial will increase within the OTC reserve.

How worth has responded

In Could 2018, after the Bitcoin Miner OTC desk balances surged above 400,000 BTC, the worth of Bitcoin was round $8,475. By December 2018, the worth had declined by 63%, falling to $3,183.

An analogous sample occurred in November 2021, when Bitcoin was buying and selling at roughly $64,000, and OTC desk balances for miners reached an all-time excessive close to 500,000 BTC.

Two months later, in January 2022, Bitcoin’s worth had declined by 45%, dropping to $35,058. These historic examples spotlight the numerous impression that spikes in OTC balances can have on Bitcoin’s worth.

This enhance within the OTC reserve might sign potential promoting strain from miners, contributing to the challenges in sustaining worth stability.

Unfavorable market, resulting in sell-offs

The present worth volatility within the Bitcoin market has additional intensified the current spike within the miner OTC reserve.

Moreover, the current halving occasion, which led to a lower in miner rewards, has prompted miners to promote extra of their holdings to safe earnings.

Compounding this concern is the current enhance in mining problem.

When this heightened problem is in contrast with the lowered charges, it turns into clear that BTC mining has grow to be much less worthwhile, driving miners to liquidate extra of their reserves.

As of this writing, Bitcoin is buying and selling at roughly $61,000, reflecting a rise of over 1%. Suppose the worth can maintain this upward momentum.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

In that case, Bitcoin Miner profitability might stabilize, offering a extra favorable setting for miners amid the present challenges.

Sustaining optimistic worth developments might assist offset the current pressures from elevated mining problem and lowered charges.