- Marathon Digital’s MARA surged 17.98% on Monday after its itemizing on the S&P SmallCap 600 index

- Firm set to launch its quarterly earnings report on 9 Could

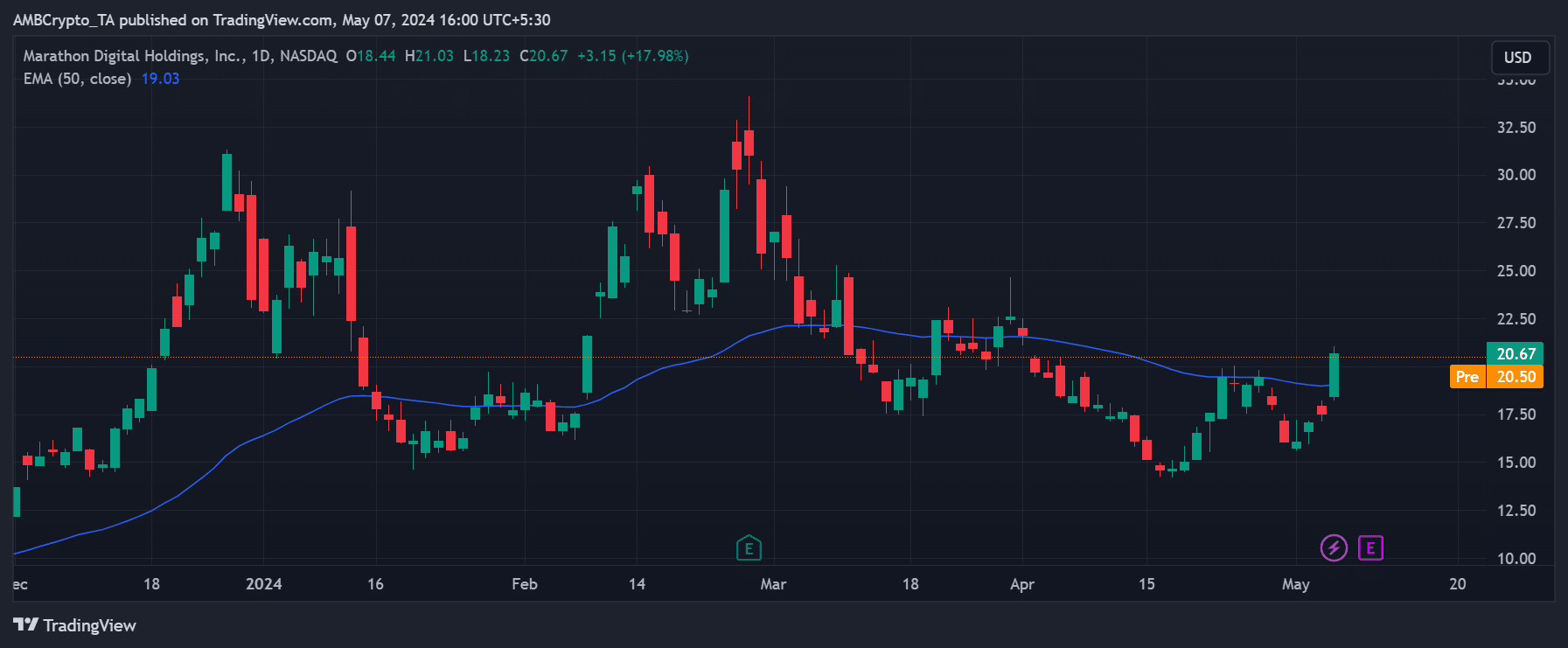

Bitcoin’s [BTC] largest miner by market cap, Marathon Digital, noticed its shares (MARA) hike by 17.98% throughout Monday’s buying and selling session. By climbing because it did, MARA marked an prolonged restoration, pushing it nearer to $20 because it successfully reversed over 90% of its losses in April.

Bitcoin miner joins S&P 600

The huge single-day leap adopted the S&P World itemizing final Friday. Marathon Digital was included within the S&P 600, an index that tracks the smallest traded public U.S corporations based mostly on market cap.

The event occurred final Friday after market hours, however was solely priced on Monday, as underlined by the aforementioned leap. The S&P 600, often known as the S&P SmallCap 600, requires a market cap of $1 billion—$6.7 billion for itemizing. Moreover, companies need to document optimistic earnings for the final 4 quarters.

After Monday’s rally, MARA had a market cap of $5.64 billion. With a Q1 earnings report scheduled for 9 Could, staying on the index will rely upon future quarterly earnings.

Regardless of the Monday leap and total restoration in Could, nevertheless, MARA’s YTD (year-to-date) efficiency was down 9.86% at press time. Actually, the YTD efficiency throughout most miners’ shares, like Riot Platforms and Hut 8, have fallen by double-digits.

Other than mining rewards, which dropped by half after the halving, transaction charges have change into a key income stream for Bitcoin miners.

Nonetheless, the enlisting of MARA on the S&P 600 marks one other related chapter for Bitcoin-linked publicly traded corporations. It’s going to improve the visibility of Marathon Digital and the potential to draw extra funding within the mining ecosystem.

Nonetheless, BTC closed within the crimson throughout MARA’s Monday rally. Ergo, it will likely be attention-grabbing to see how BTC reacts to Marathon Digital’s quarterly earnings report on 9 Could.