- Bitcoin is prone to proceed to pattern downward within the coming weeks.

- The short-term holders’ common value foundation marked out a possible native prime for Bitcoin.

Bitcoin [BTC] skilled heightened volatility over the previous couple of days. It reached $61.8k on the twenty first of August, however a number of hours later fell to $59.7k a number of hours later.

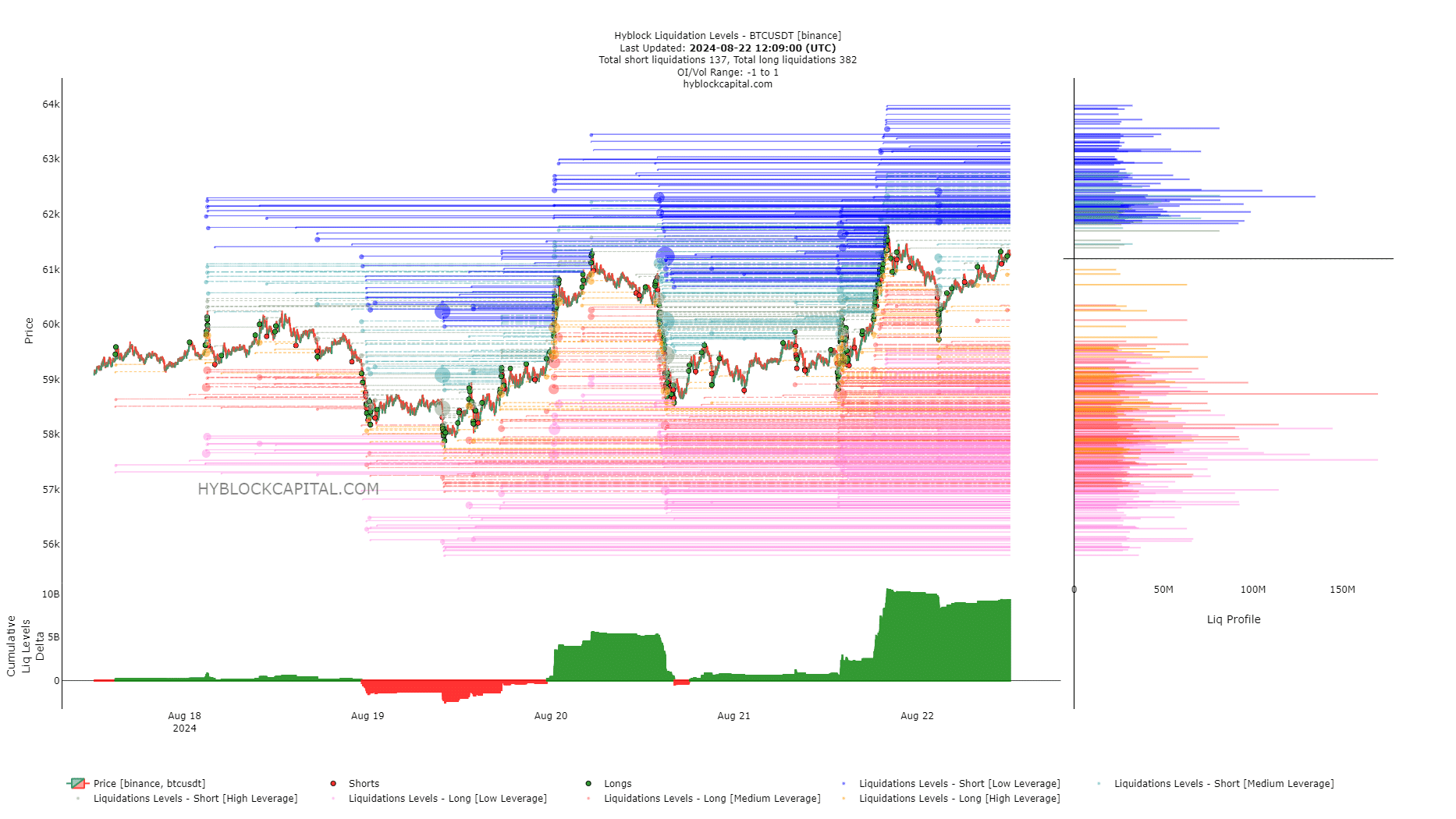

Supply: Hyblock Capital

These worth strikes may very well be pushed by the liquidity swimming pools which have constructed round BTC over the previous week.

The cumulative liq ranges delta was enormously constructive and promised a worth pullback within the brief time period to flush overeager bulls out.

To grasp if Bitcoin can resume its uptrend after a worth dip, AMBCrypto appeared nearer at different metrics and whale accumulation tendencies.

The short-term holder value foundation could be a powerful barrier

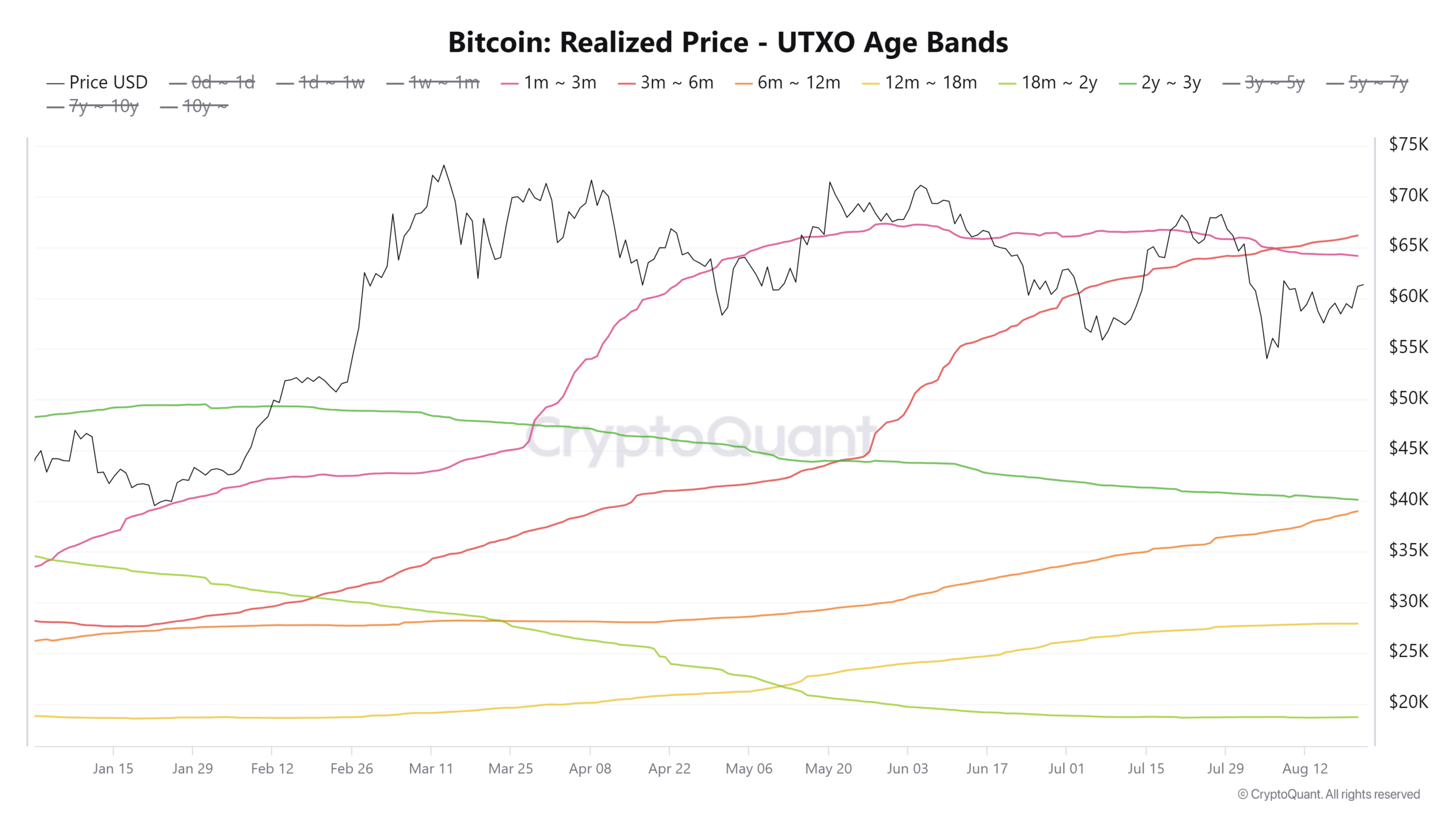

Supply: CryptoQuant

CryptoQuant analyst Burak Kesmeci famous that the short-term Bitcoin holders’ realized costs may very well be used to mark out resistance zones. Quick-term holders are those that have held BTC of their wallets for underneath 155 days.

Utilizing the UTXO age bands, he noticed that the 1-3 month BTC holding cohort had a median value foundation of $64k. Equally, the 3-6 month class had a median value foundation of $66k.

With market costs beneath this zone, most of those holders had been possible at a loss.

Subsequently, a worth bounce into this space would possible see underwater holders exit the market at close to break-even, which might gas promoting strain.

The range-like worth motion of BTC in latest months implies that a transfer towards $66k would possible even be a superb profit-taking alternative.

Assessing whale accumulation/distribution tendencies

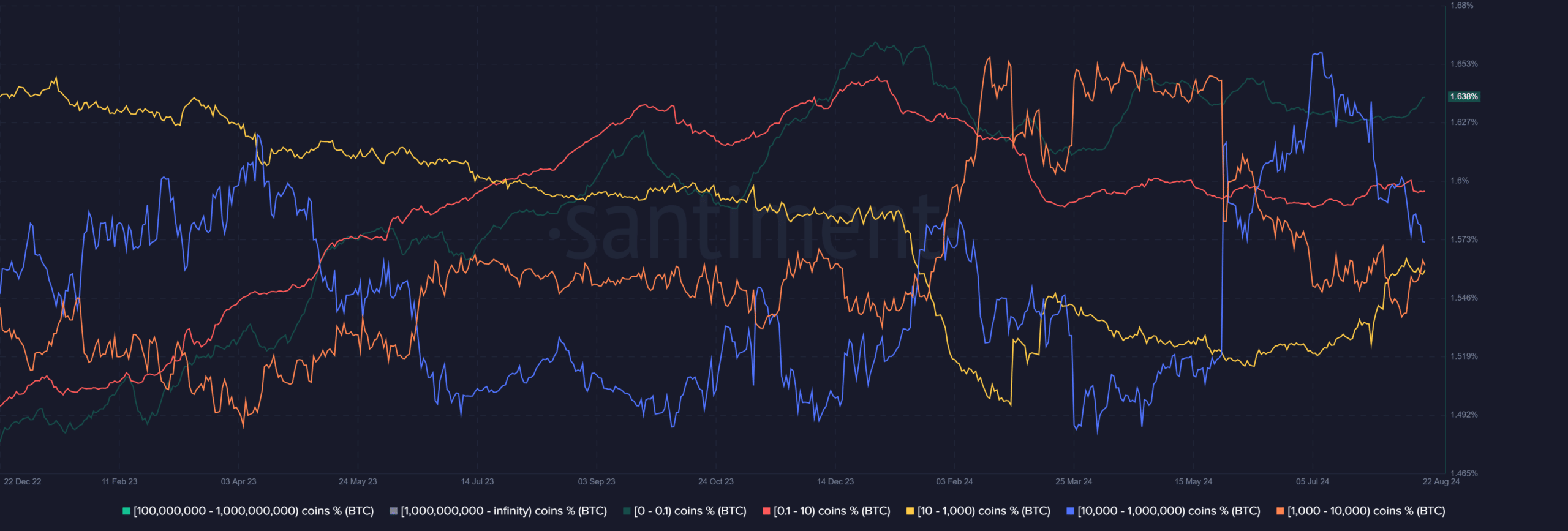

Supply: Santiment

The wallets with 10k-1M BTC noticed a sustained accumulation part from early December 2023 to late January 2024. Throughout this era, the value of the king of crypto appreciated by 16%.

Quick-forward to March, and BTC was up one other 70%, however this got here alongside the BTC whale cohort (above 10k coin holdings) distributing and taking earnings in the course of the rally.

Equally, this whale cohort noticed a distribution part over the previous six weeks, regardless that Bitcoin worth efficiency was not strongly bullish.

The implication was an expectation of a worth dip and continued downtrend.

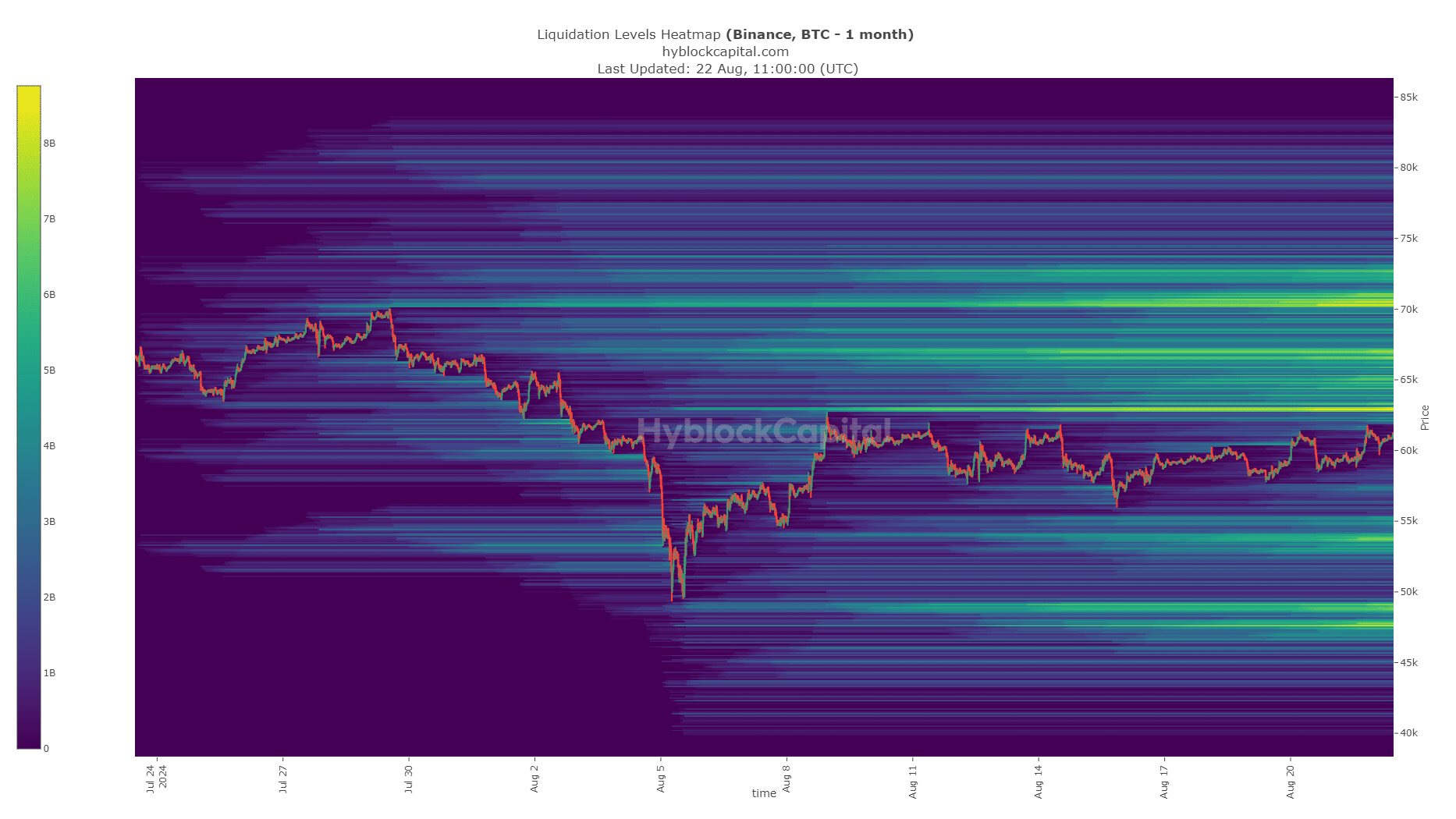

Supply: Hyblock Capital

Learn Bitcoin’s [BTC] Value Prediction 2024-25

The 1-month liquidation heatmap highlighted the vary potential extra clearly. The deep pockets of liquidity at $63k, $67k, and $70k are prone to appeal to costs to them within the coming weeks.

But, the liquidity constructed as much as the south at $54k and $49k had been additionally vital magnetic zones. As issues stand, the value motion and whale accumulation tendencies don’t favor a breakout previous $66k.