- BTC was buying and selling in a symmetrical triangle sample that would set off a serious breakout to the upside.

- Market sentiment additionally suggests room for Bitcoin to climb even increased, doubtlessly reaching $71,000.

Over the previous month, Bitcoin [BTC] has gained 7.87%, exhibiting regular progress. On a weekly foundation, it has risen by 8.97%, whereas day by day features stand at 0.18%. These numbers point out a gradual but constant uptrend, reinforcing the present bullish outlook.

AMBCrypto has analyzed the potential for this rally and the elements that may affect BTC’s value motion.

BTC is bullish, however should overcome resistance

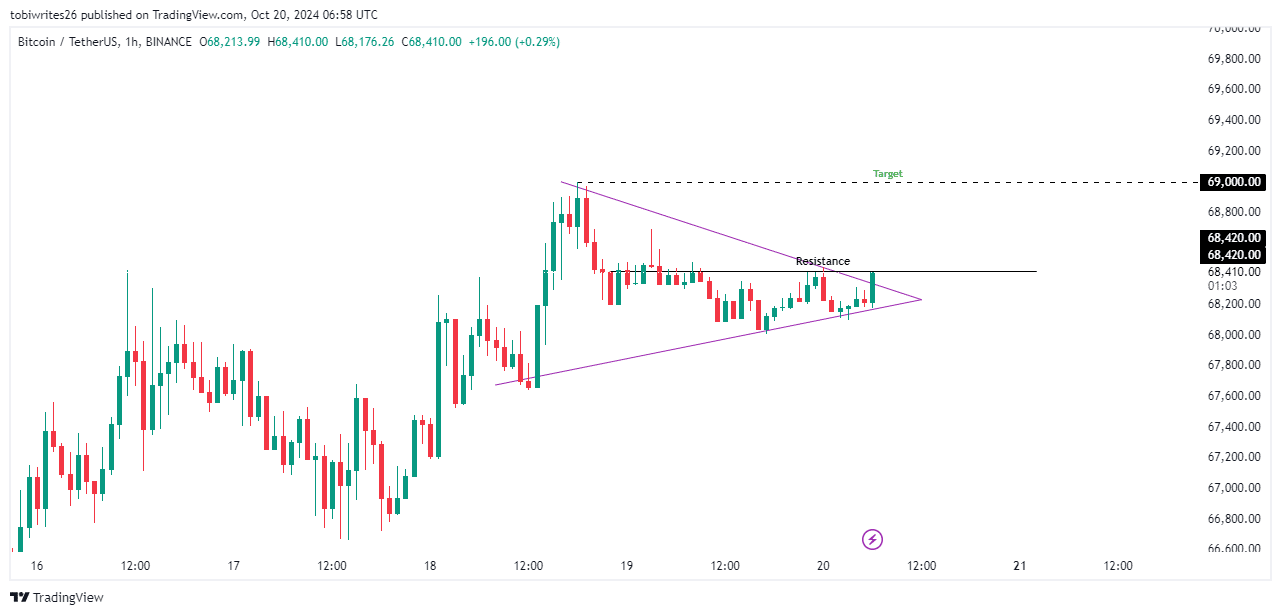

Bitcoin was buying and selling inside a one-hour symmetrical triangle at press time, oscillating between converging help and resistance traces. This sample is indicative of a bullish accumulation section, which suggests a possible upward momentum.

For this rally to materialize, BTC should break by means of the resistance stage at $68,420. This stage changing into a brand new help is necessary for sustaining additional upward motion.

If BTC efficiently breaches this resistance, the subsequent main goal will probably be $69,000, the place the channel peak lies.

Conversely, if this breakthrough doesn’t happen, BTC could proceed to exhibit bullish tendencies however stay in an accumulation section till stronger shopping for momentum emerges.

BTC accumulation section is confirmed

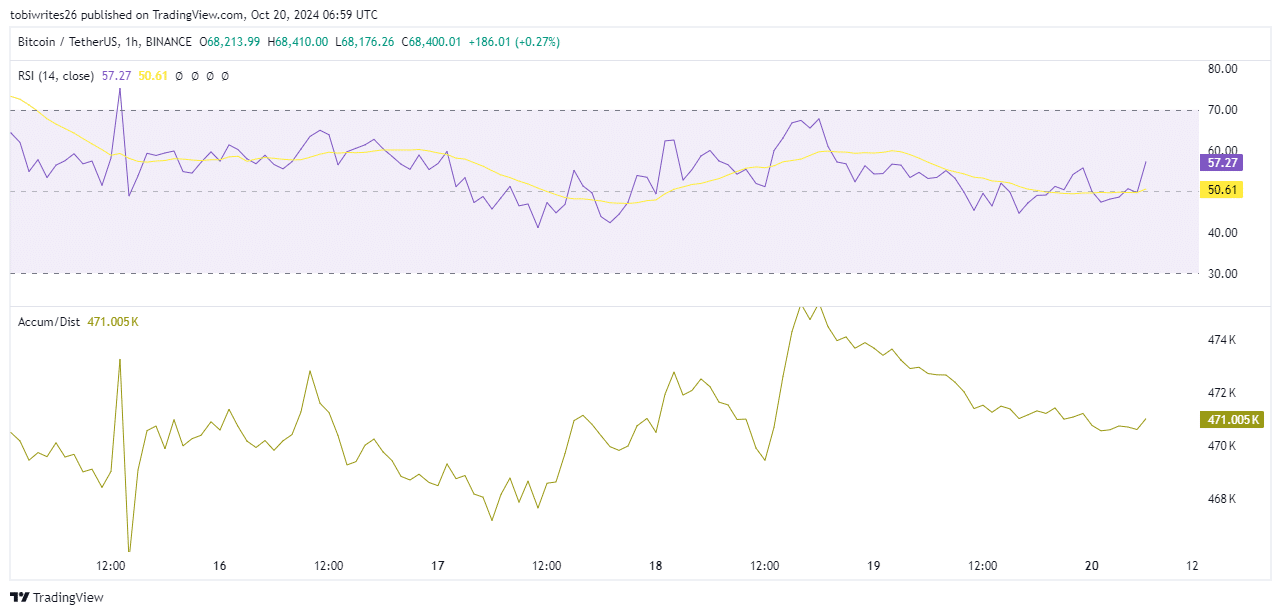

Market curiosity in Bitcoin has surged, as evidenced by the Accumulation/Distribution (A/D) indicator and the Relative Power Index (RSI).

The A/D indicator, which displays liquidity stream, exhibits that buyers are presently accumulating BTC with the expectation of a big upward transfer. This means a powerful shopping for curiosity amongst market individuals.

Equally, the RSI has additionally proven an upward pattern, gaining momentum above the impartial zone with a present studying of 57.27. This implies that BTC is more likely to proceed trending increased, doubtlessly offering higher returns for long-term merchants and holders.

This upward momentum is predicted to persist towards a short-term goal of $69,000, at which level a reevaluation of future targets will probably be carried out primarily based on market momentum.

Lengthy-term bullish outlook

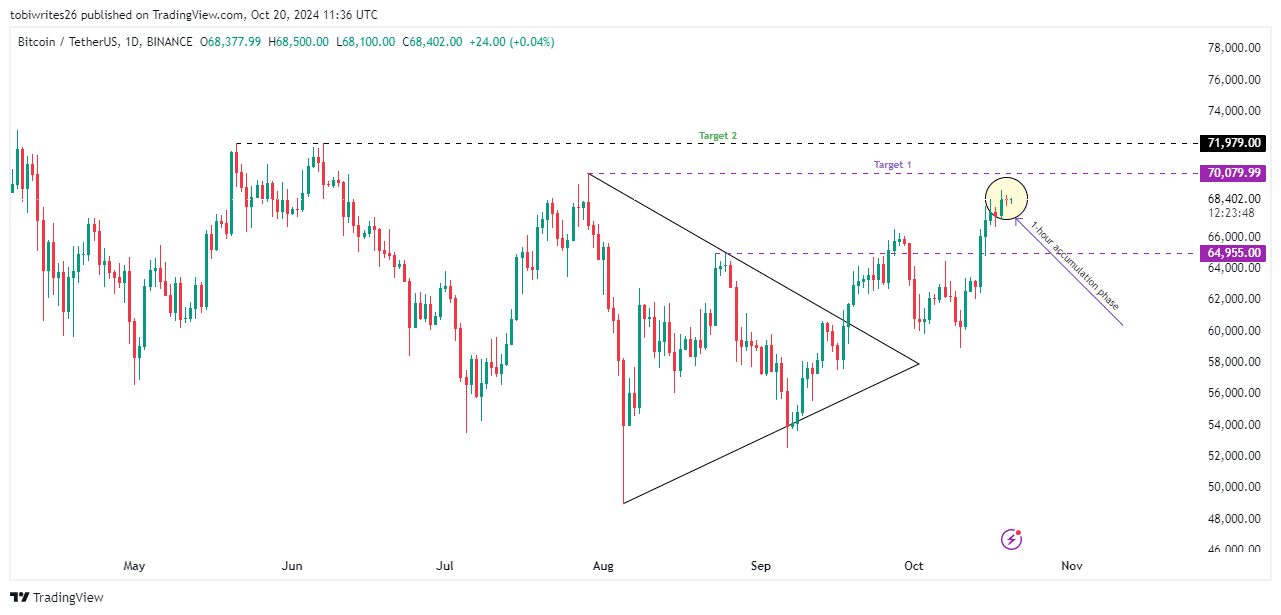

On the day by day timeframe, BTC stays bullish because it approaches the height of the symmetrical sample it has been buying and selling inside.

Learn Bitcoin (BTC) Worth Prediction 2024-25

The primary goal for BTC from its present stage is predicted to be $70,079.99, the place the height of the channel is positioned. The second goal is ready at $71,979.00, the place a notable liquidity cluster is discovered.

If the present metrics proceed to favor the bulls, it’s solely a matter of time earlier than BTC reaches these new targets.