- Lengthy-term holders have began promoting Bitcoin to short-term holders.

- Social media sentiment and crypto market information remained fairly constructive.

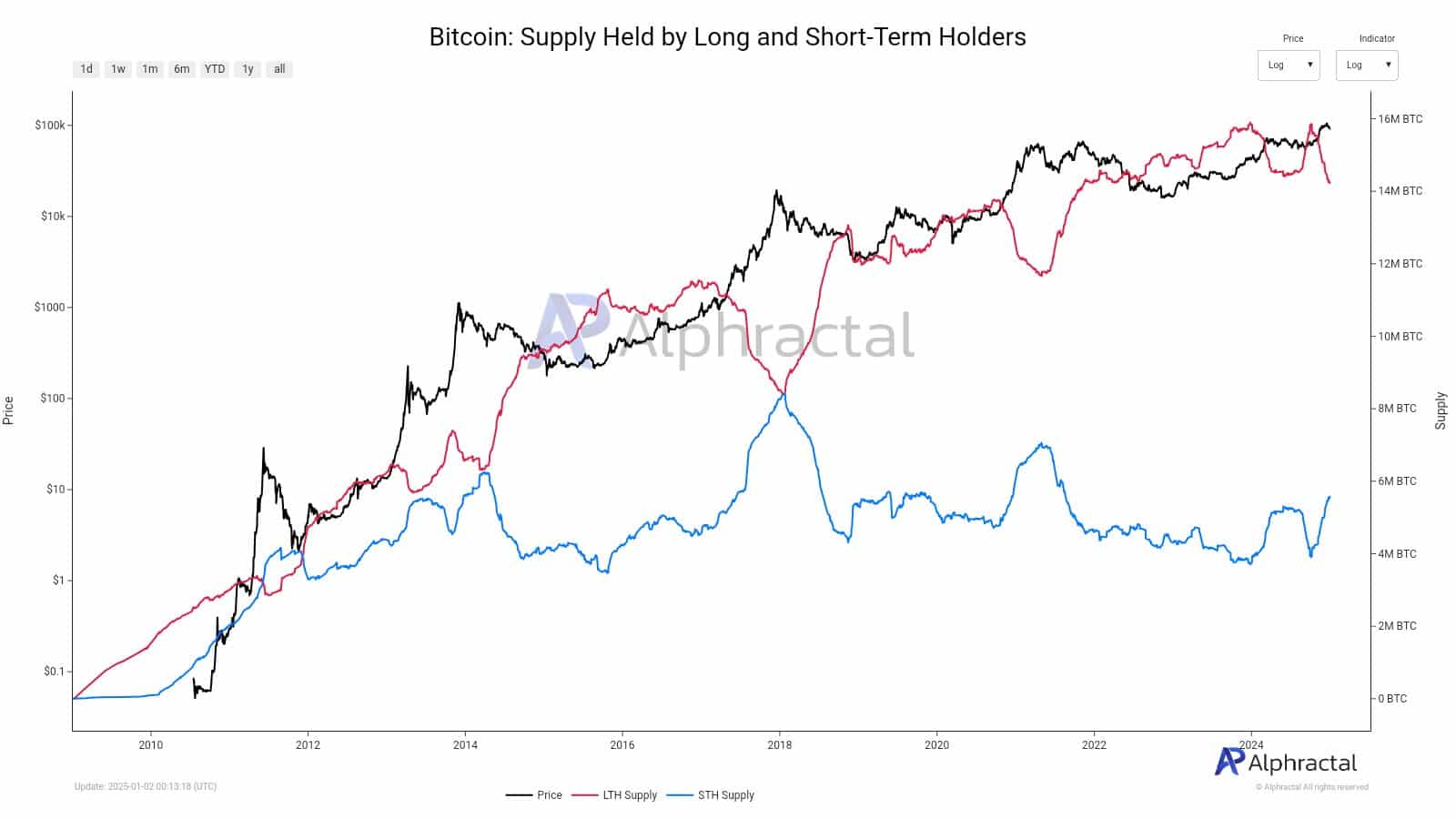

Bitcoin’s [BTC] historic information revealed important shifts between long-term (LTH) and short-term holders (STH). LTHs have begun offloading their holdings to STHs, marking a notable change in BTC’s possession dynamics.

The Coin Days Destroyed metric spiked, indicating that enormous, older holdings being offered, usually presaging volatility.

Concurrently, the availability held by STHs surged, capturing these cash, suggesting a shift from seasoned traders to newer market individuals.

This redistribution may probably destabilize costs within the brief time period, as newer holders might be much less prone to maintain by way of turbulence, resulting in elevated promoting stress.

Traditionally, such handovers have preceded both important worth corrections or consolidations, as new holders’ conduct throughout market swings may dictate the subsequent main transfer.

If LTHs proceed to promote into power, this might cap potential rallies or exacerbate downturns, relying on market reactions and broader financial indicators.

Bitcoin energy grid

Nonetheless, the Energy Grid which tracks Bitcoin’s power indicators by no means breached the 100% energy threshold till just lately, an space indicative of cycle tops.

The 2025 studying on the grid displayed an uptick, reaching 82.5% energy, signaling strong market momentum however falling wanting a definitive cycle peak.

This steered that whereas Bitcoin approached a big market juncture, a cycle high hadn’t conclusively fashioned because the market navigated by way of the beginning of 2025.

This information portended continued market power for Bitcoin, aligning with predictions that 2025 would emerge as a peak 12 months for crypto, reflecting an optimistic outlook for sustained progress and funding enthusiasm.

What’s the sentiment amongst holders?

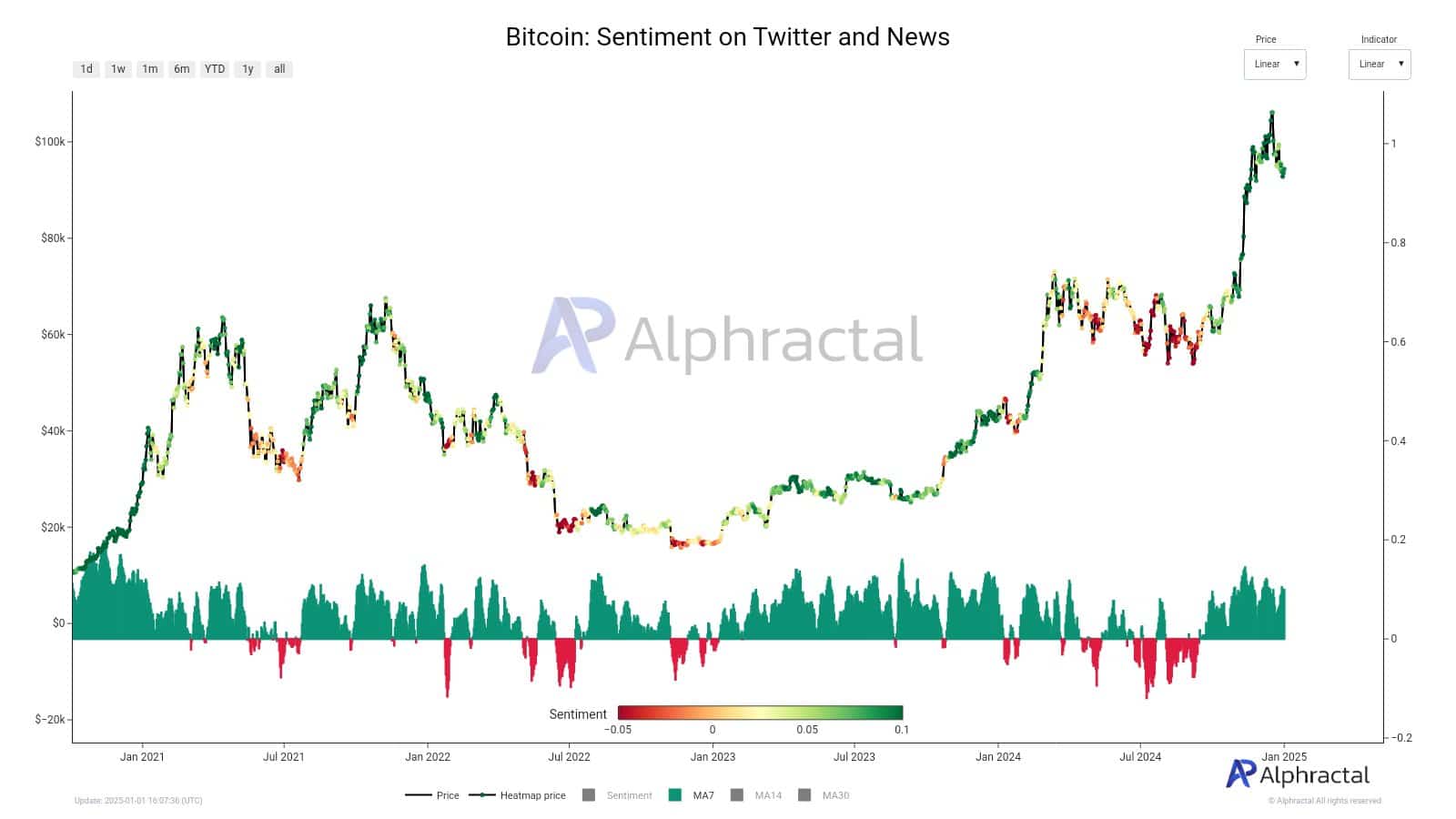

Once more, the sentiment evaluation for Bitcoin, depicted on Twitter and in crypto market information, confirmed an overwhelmingly constructive pattern.

There have been solely sparse cases of detrimental sentiment among the many public, coinciding with notable worth fluctuations.

Particularly, regardless of BTC’s worth oscillating between $108K and $92K, traders confirmed lack of worry.

Historic patterns steered that when sentiment drastically drops, it usually heralds a worth backside, signaling opportune moments for buying. This has been famous a couple of occasions yearly.

Lastly, the Worry & Greed Index, marked at 66 in early January 2025, indicated a slight discount in greed, the bottom since November 2024.

Regardless of this dip, the prevailing sentiment remained predominantly grasping, suggesting sustained shopping for curiosity in Bitcoin.

Because the index stayed above the impartial 50 mark, Bitcoin’s worth hovered round $95K, displaying stability after current fluctuations.

Learn Bitcoin’s [BTC] Value Prediction 2025–2026

This sentiment alignment indicated no instant worth surge, but the groundwork for continued funding was evident.

It steered that important market corrections may nonetheless entice strong shopping for from these betting on future good points.