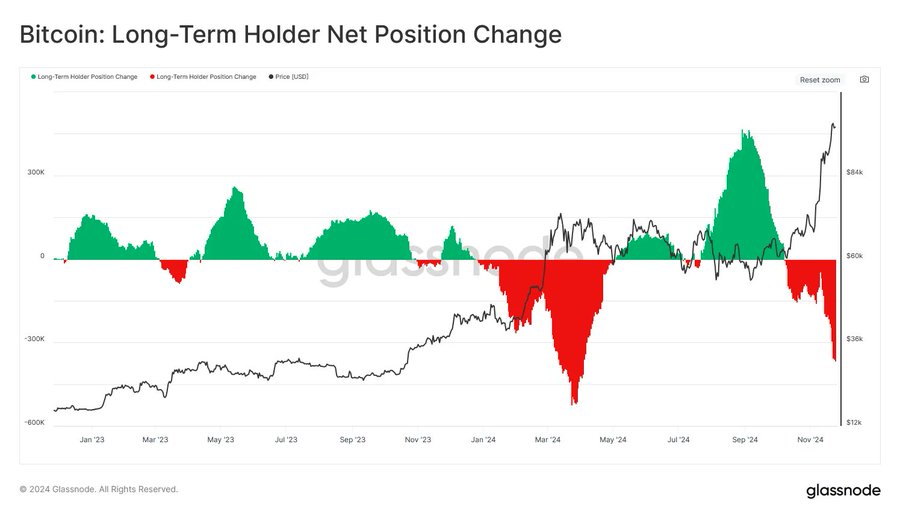

- Bitcoin LTHs offered 366k BTC, the very best degree since April.

- BTC declined by 4.47% over the previous 24 hours.

Since hitting an ATH of $99800, Bitcoin [BTC] has skilled a decline to hit a neighborhood low of $92584. In truth, on the time of writing, Bitcoin was buying and selling at $94972. This marked a 3.47% decline over the previous day.

Earlier than this, Bitcoin had been on an upward trajectory, climbing by 3.44% on weekly charts and by 41.61% on month-to-month charts.

Due to this fact, this sharp decline after a historic rally raises questions on what’s driving it. Nicely, in keeping with Glassnode, Lengthy-Time period Holders(LTHs) could be the cause.

Who’s promoting Bitcoin?

Of their evaluation, Glassnode posited that Bitcoin’s LTHs have come out to promote. As such, they’ve offered 366k BTC tokens, which is the very best degree since April. This might need induced promoting strain, leading to a market pullback.

Due to this fact, with the rising revenue margins witnessed up to now weeks, LTHs have turned to profit-taking.

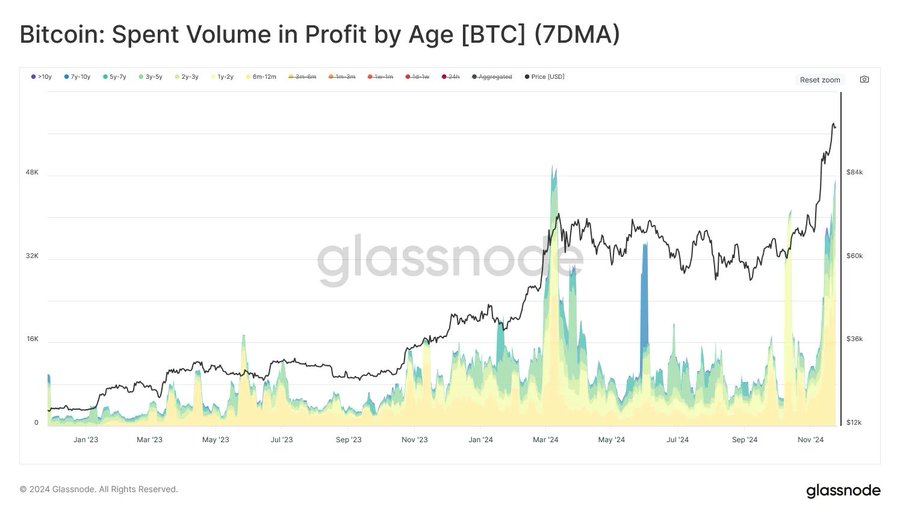

Amongst these LTHs are the 6 million to 12 million cohorts. They’ve led the cost, spending not less than 25.6k BTC tokens each day in revenue.

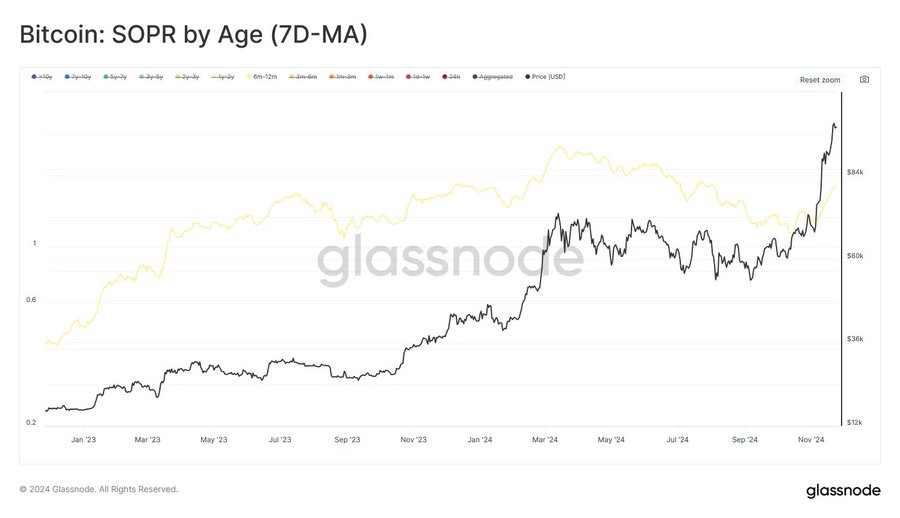

Thus, this group spent BTC with a mean price foundation of 71% decrease than the typical worth of $57.9k. And, with BTC hitting a document excessive of $99k, these LTHs capitalized massive on the rally.

Based mostly on this commentary, the current market correction arises from elevated promoting exercise from LTHs.

Impacts on BTC Charts?

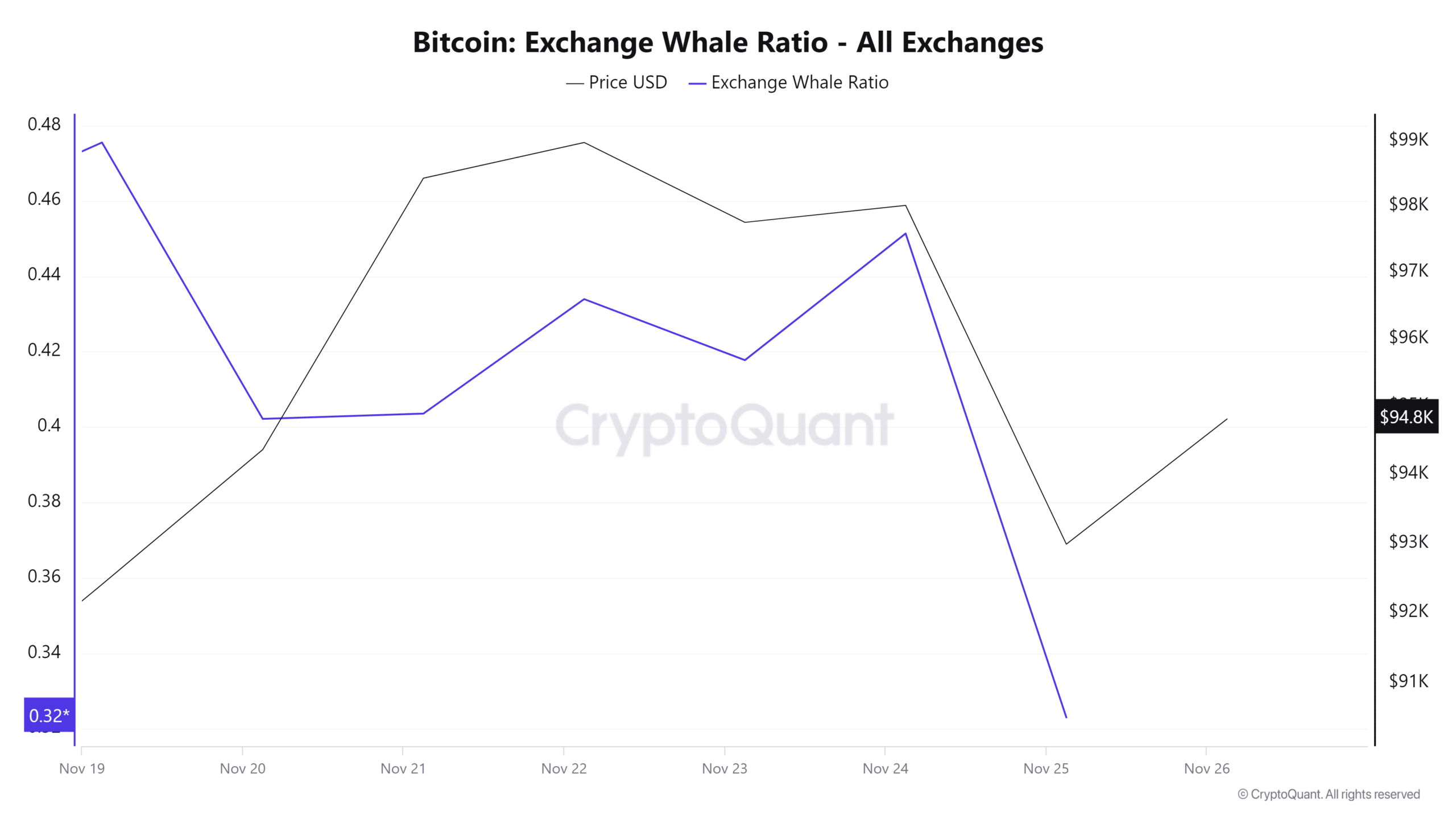

In response to AMBCrypto’s evaluation, though BTC has declined on each day charts, it remained in a bullish section. This current pullback has allowed whales and retail merchants to build up.

For starters, Bitcoin’s Whale Alternate Ratio has declined over the previous week from 0.4 to 0.32. This exhibits that though LTHs have been promoting, whales proceed to build up BTC.

Due to this fact, whales usually are not actively transferring their BTC holdings to exchanges, which is commonly a precursor to promoting. This alerts a bullish outlook amongst whales as they intention to carry for long-term beneficial properties.

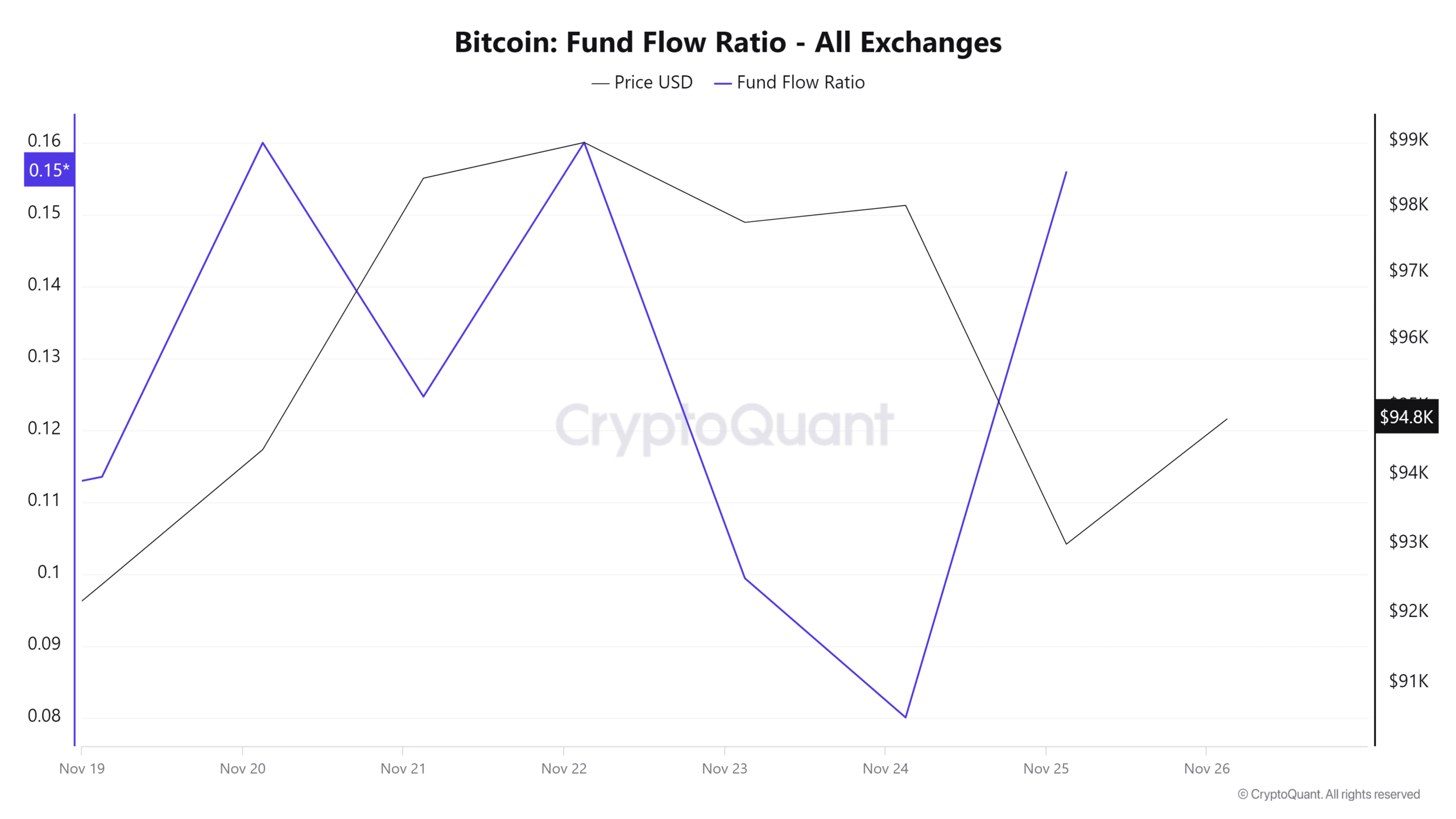

Moreover, Bitcoin’s Fund circulation ratio has surged from 0.08 to 0.15 signaling elevated shopping for strain as there’s extra funds influx than outflow.

Supply: Cryptoquant

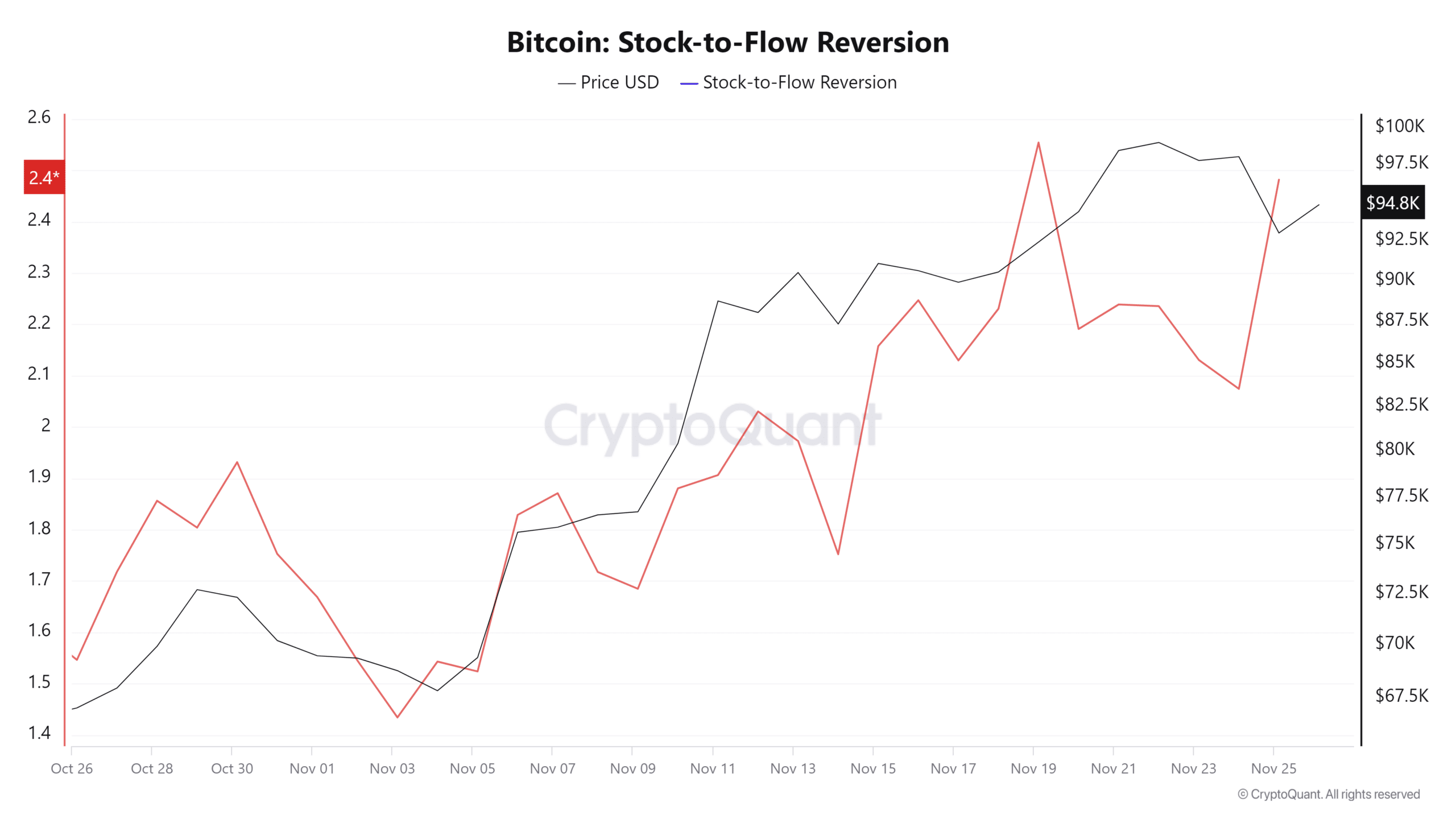

Lastly, we will see this bullishness, via the rising Inventory-to-Circulation(SFR) reversion. When SFR reversion rises, it suggests rising market confidence in BTC’s worth, typically on account of elevated demand and adoption.

Merely put, though Bitcoin LTHs have turned to profit-taking over the previous week, BTC stays in a bullish section. Due to this fact, we will see that regardless of these LTH’s promoting actions, whales are accumulating whereas funds influx stays excessive.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

With these situations, BTC may make extra beneficial properties. As such, BTC will reclaim $99,000 resistance the place it has confronted three rejections. Above these ranges, there’s no vital resistance and the crypto may make one other ATH.