- Bitcoin rallied to $64,000, however the U.S. market’s absence raises issues in regards to the rally’s sustainability.

- Metrics present a decline in Bitcoin’s Open Curiosity and retail exercise, signaling potential warning for traders.

The worldwide crypto market has skilled a big enhance prior to now few days, with an increase of over $60 billion in valuation.

This improve comes as Bitcoin’s worth surged as soon as once more to the $64,000 mark, reigniting optimism amongst traders.

Whereas this rally has grabbed the eye of many, some analysts are questioning the sustainability of this progress, noting sure uncommon tendencies behind the scenes.

Market pushed by Asian capital, not U.S. patrons?

A CryptoQuant analyst, utilizing the pseudonym BQYoutube, has just lately highlighted a important commentary on the CryptoQuant QuickTake platform.

In a put up titled “We are going up. But Coinbase Ain’t Buying,” the analyst identified that the U.S. market, represented by Coinbase, has not been collaborating within the latest rally.

BQYoutube famous that whereas Bitcoin’s worth was climbing, Coinbase Premium, a metric that tracks the distinction between Bitcoin costs on Coinbase and different exchanges, has been falling into destructive territory.

This drop within the Coinbase Premium signifies that the U.S. market may not be as enthusiastic in regards to the rally, doubtlessly weakening the general bullish sentiment.

One of many key causes behind Bitcoin’s latest rally could possibly be attributed to capital flows from Asia, in line with BQYoutube. The analyst steered that the China charge lower and influx of Asian capital could be driving costs upward.

Nonetheless, this rally lacks full assist with out important U.S. participation.

The U.S. market has historically performed a vital function in sustaining long-term Bitcoin worth rallies, and its absence would possibly sign potential vulnerabilities within the present worth motion.

BQYoutube cautioned that the rally could possibly be dangerous if the U.S. market stays disengaged, as sustained worth momentum typically depends on broader international participation.

Retail curiosity in Bitcoin rebounds barely

Other than these observations, it’s important to take a look at Bitcoin’s key on-chain metrics to grasp the broader image.

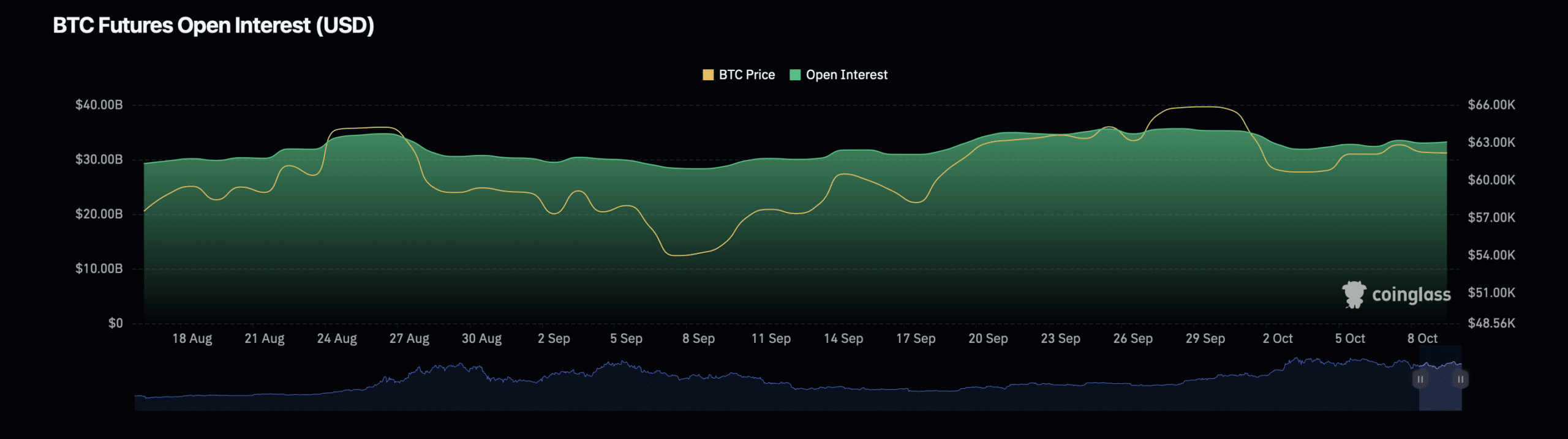

Knowledge from Coinglass exhibits a decline in Bitcoin’s Open Curiosity, which refers back to the whole variety of excellent spinoff contracts.

This metric has dropped by 0.83%, bringing its worth to $33.25 billion.

Equally, Bitcoin’s Open Curiosity quantity, which displays the overall variety of trades, has additionally seen a pointy decline of 31.04%, standing at $45.49 billion at press time.

These declines might point out that merchants have been much less optimistic in regards to the asset’s future motion within the brief time period.

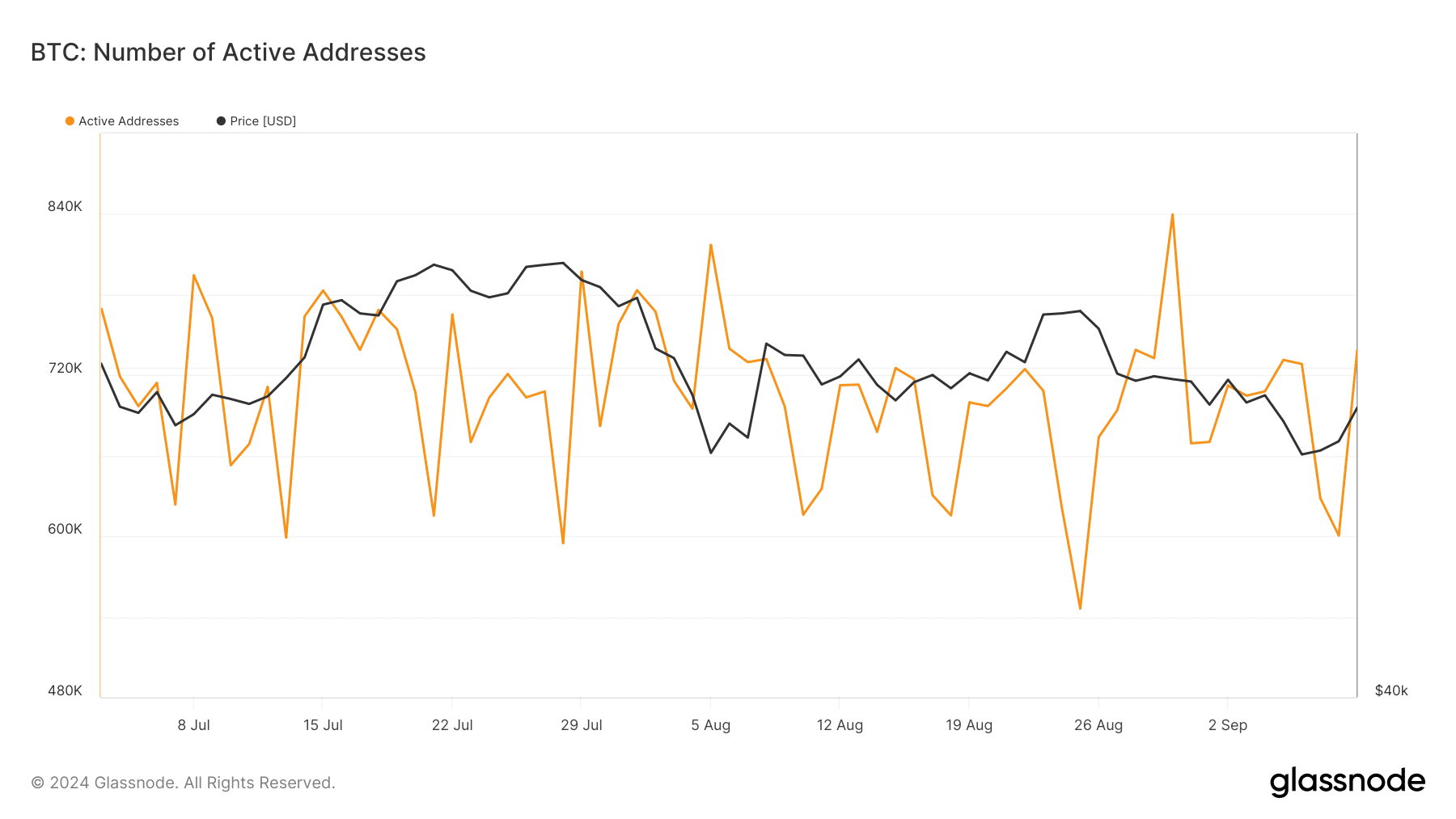

One other important metric to observe is Bitcoin’s lively addresses, which function a key indicator of retail curiosity.

Knowledge from Glassnode revealed a considerable drop in lively Bitcoin addresses over the previous few months, significantly after peaking at 839,000 on the thirtieth of August.

This drop noticed lively addresses plunge to round 600,000 by the top of September, reflecting a decline in retail curiosity.

Nonetheless, latest information steered a minor restoration, with lively addresses climbing again above 700,000 in latest days.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Notably, whereas the present rally has sparked pleasure, the dearth of U.S. participation and declining open curiosity could current challenges for Bitcoin’s short-term prospects.

Nonetheless, the rebound in retail curiosity might sign renewed confidence out there.