- Bitcoin is experiencing a rise in institutional demand.

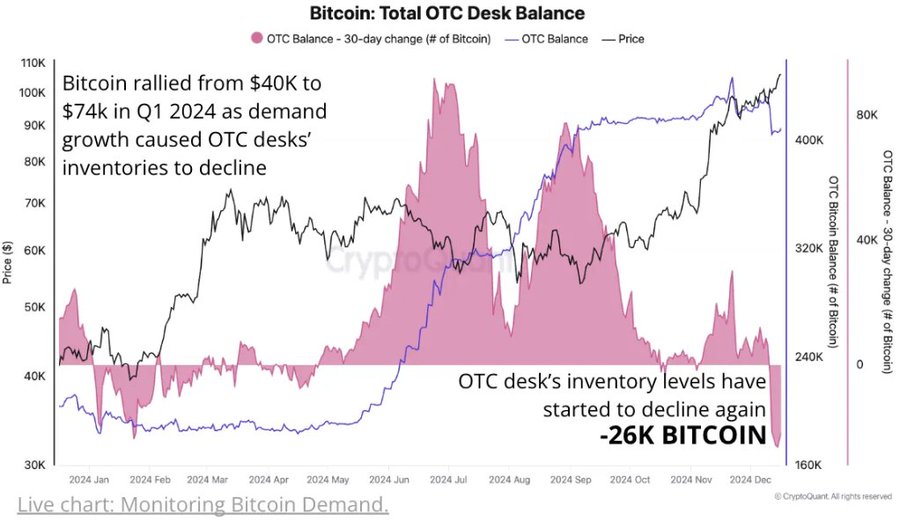

- OTC desks see their largest month-to-month stock decline for 2024 dropping by 26k BTC.

After declining to a 2-week low of $92,118 previously day, Bitcoin’s [BTC] has proven resilience and made a substantial restoration.

BTC has recovered from the market crash, reaching a excessive of $98,125. Nevertheless, it has skilled a slight pullback. On the time of writing, Bitcoin was buying and selling at $98,086, marking a 1.25% improve over the previous day.

This market energy is basically credited to the elevated demand BTC is experiencing, particularly amongst establishments, in line with Cryptoquant evaluation.

Rising institutional demand for Bitcoin

Of their evaluation, Cryptoquant noticed that Bitcoin demand is surging. In keeping with them, OTC desks are experiencing their largest month-to-month stock decline of 2024. That is at present down by 26k BTC tokens for this month alone.

Because the twentieth of November 2024, Bitcoin’s provide has declined by 40k BTC, signaling continued provide tightening.

The numerous drop in provide signifies elevated institutional demand for Bitcoin. Present market situations place Bitcoin for a possible provide squeeze.

When Bitcoin’s provide decreases and demand continues to extend, the value usually rises. Restricted provide, coupled with rising demand, drives costs up.

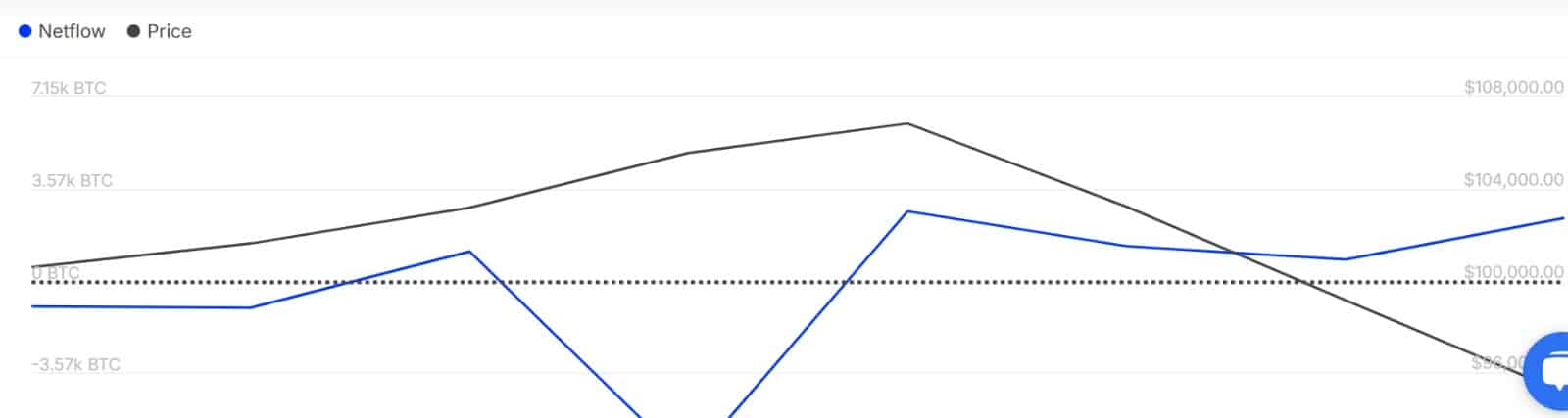

AMBCrypto noticed this demand amongst massive holders by means of the rising massive holder netflow. It has surged from -7.15k to 2.44k over the previous week, signaling elevated capital influx from massive holders into BTC.

These elevated purchases from establishments may cut back provide, thus inflicting upward stress on costs.

What do BTC’s charts say

Whereas the evaluation offered above presents a promising outlook for BTC, it’s important to counter-check different market indicators and decide what they counsel.

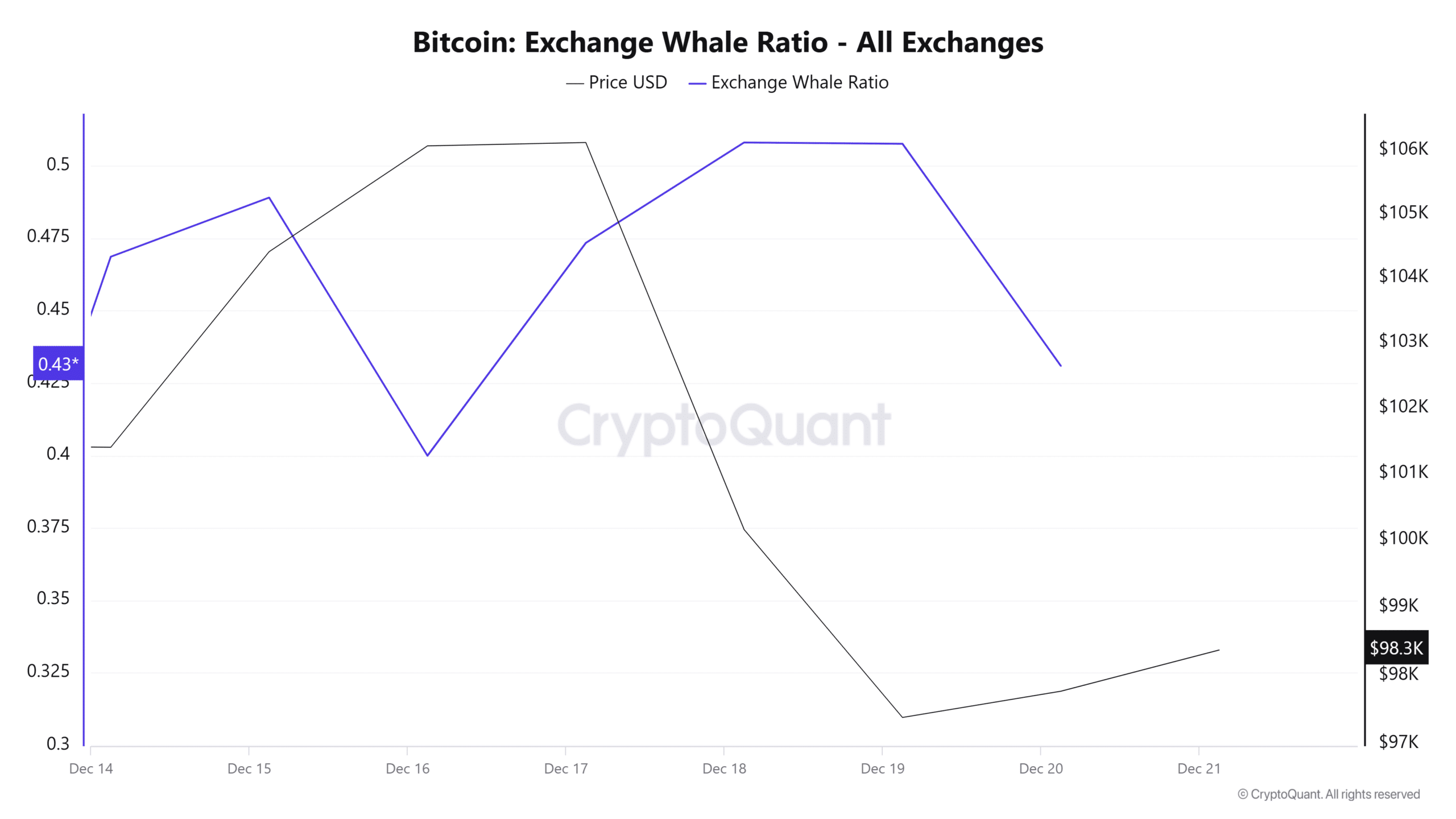

For starters, Bitcoin’s alternate whale ratio has declined over the previous three days, from 0.5 to 0.43. This drop suggests that enormous holders and institutional buyers are accumulating BTC by means of OTC markets or non-public transactions, avoiding exchanges.

Such accumulation is a bullish sign because it displays rising institutional confidence in Bitcoin’s long-term potential.

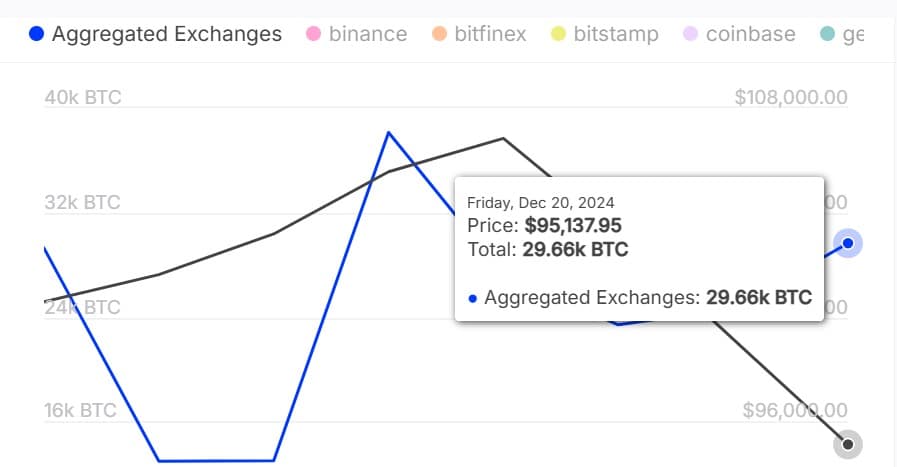

Moreover, Bitcoin’s outflow quantity from aggregated exchanges has elevated after the preliminary drop, rising from 23.2k to 29.66k over the previous three days. When outflow from exchanges spikes, it displays accumulation and holding habits.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Merely put, BTC is experiencing important demand amongst buyers, which continues to extend upward stress on BTC costs. If these sentiments maintain, Bitcoin will reclaim the $99,206 resistance within the brief time period.

Nevertheless, if sellers reenter the market, as witnessed previously day, BTC will discover help round $95,830.