- The Norwegian sovereign wealth fund has elevated its publicity to Bitcoin.

- Governments now maintain over 400,000 BTCs.

In a stunning flip of occasions, Norway’s sovereign wealth fund has considerably elevated its oblique Bitcoin publicity, marking a pivotal second in cryptocurrency adoption.

This Bitcoin information highlights a rising pattern of institutional curiosity in digital property, with governments worldwide holding substantial Bitcoin reserves.

Norwegian sovereign fund expands oblique Bitcoin holdings

Within the newest Bitcoin information, K33Research reviews a big growth: Norway’s sovereign wealth fund (NBIM) has considerably elevated its oblique Bitcoin publicity.

The fund now holds the equal of two,446 BTC by means of strategic investments in crypto-exposed tech companies. This Bitcoin-related portfolio, valued at a powerful $143 million, has seen a notable progress of 938 BTC for the reason that shut of 2023.

In a daring transfer that’s making waves in Bitcoin information circles, Norway’s public fund has strategically reallocated its investments.

The fund decreased its stakes in Meta and different tech giants, as an alternative funneling capital into promising Web3 shares. Key beneficiaries of this shift embody business leaders corresponding to MicroStrategy, Coinbase, Block, and Marathon Digital.

International authorities Bitcoin holdings: A rising tide in adoption

The Bitcoin information from Norway is simply the tip of the iceberg when it comes to governmental cryptocurrency involvement.

A complete report from Coingecko sheds gentle on a broader pattern: governments worldwide now collectively maintain roughly 2.2% of the whole Bitcoin provide.

This interprets to an astounding 471,000 BTC, highlighting the rising institutional curiosity in cryptocurrency.

Main the pack on this Bitcoin information pattern is america, with holdings exceeding 212,000 BTC.

This important governmental stake in Bitcoin not solely legitimizes the cryptocurrency but in addition indicators a possible shift in how nations view digital property as a part of their funding methods.

Bitcoin Adoption Metrics Paint a Promising Image

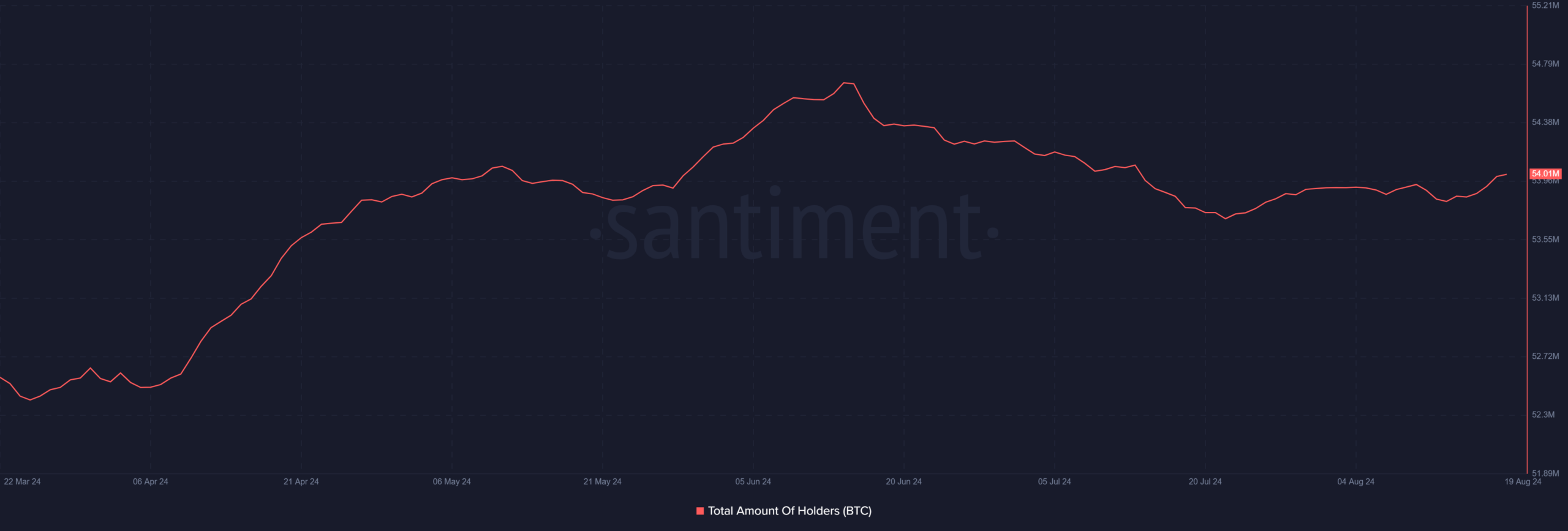

Delving deeper into Bitcoin information evaluation, current knowledge from Santiment reveals an encouraging pattern in consumer adoption. The variety of non-zero Bitcoin addresses has seen a notable uptick, rising from roughly 53 million to 54 million in current days.

This improve, regardless of some market fluctuations, strongly signifies that extra people and entities are coming into the Bitcoin ecosystem.

This progress in non-zero addresses is especially important Bitcoin information because it suggests a broadening base of Bitcoin holders.

Whereas current Bitcoin information has reported a slight dip in every day lively addresses, the general image stays robust. The variety of every day lively Bitcoin addresses continues to exceed the essential 500,000 threshold.

This metric, which beforehand fluctuated between 600,000 and 700,000, now stands at over 592,000.

Bitcoin worth replace: Navigating under the $60,000 milestone

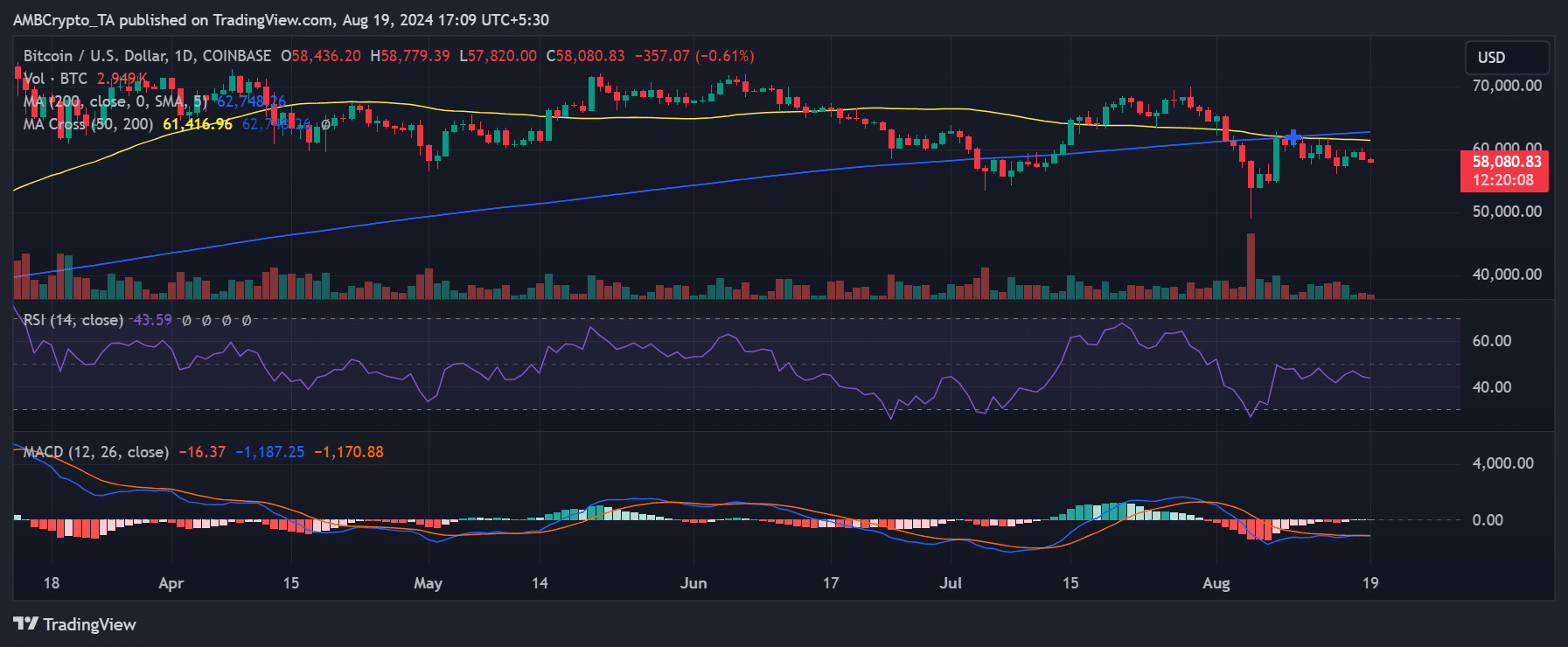

Regardless of the optimistic developments in institutional adoption and consumer engagement, Bitcoin’s worth is under the psychologically vital $60,000 mark.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Latest evaluation from AMBCrypto highlights that Bitcoin has encountered some downward stress over the previous 24 hours. On the time of this report, BTC is buying and selling at roughly $58,000, reflecting a marginal decline of 0.5%.

This worth motion, juxtaposed in opposition to the backdrop of accelerating adoption and institutional curiosity, presents an intriguing narrative in present Bitcoin information.