- Bitcoin retail investor quantity alongside its value rising.

- BTC completely swept liquidity triggering excessive slippage.

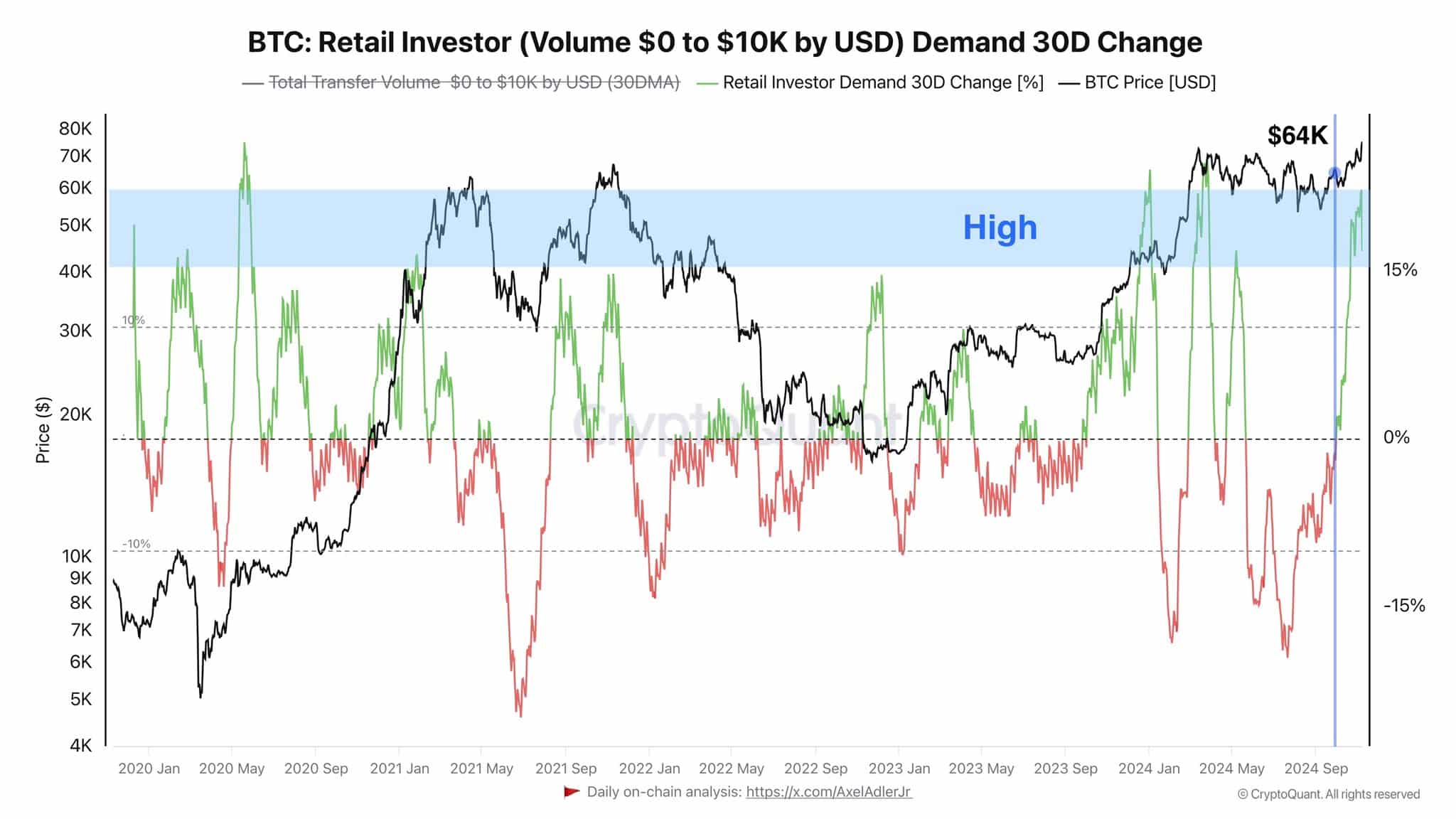

The Bitcoin [BTC] retail investor quantity has been rising alongside its value, showcasing a transparent relationship between elevated retail exercise and value actions.

Notably, since BTC reached the $64K peak, there was a big resurgence of retail curiosity, notably as retail demand change surged above 15%.

This indicated that retail buyers have been capitalizing on value dips, contributing to purchasing strain that usually precedes value recoveries.

The spikes in retail demand change correlated with intervals the place the worth of Bitcoin stabilized or elevated, suggesting that lively retail participation is a bullish sign for Bitcoin’s value trajectory.

As retail investor exercise continues to rise above these ranges, it might probably result in sustained upward strain on Bitcoin’s market value.

Peak in slippage

Following this value surge, excessive slippage in Bitcoin buying and selling on perpetual futures market have been skilled. BTC value swiftly moved up, coinciding with a pointy peak in slippage, which steered a fast execution of trades at various costs on account of sudden liquidity adjustments.

Retail quantity has been more and more influencing Bitcoin’s value, pushing it increased and this specific occasion of slippage doubtless resulted from BTC “sweeping” accessible liquidity at cheaper price ranges earlier than abruptly transferring increased.

Traditionally, intervals of excessive retail curiosity, have contributed to cost volatility as seen within the sharp uptick and subsequent value corrections.

Subsequent liquidity clusters to affect BTC subsequent transfer

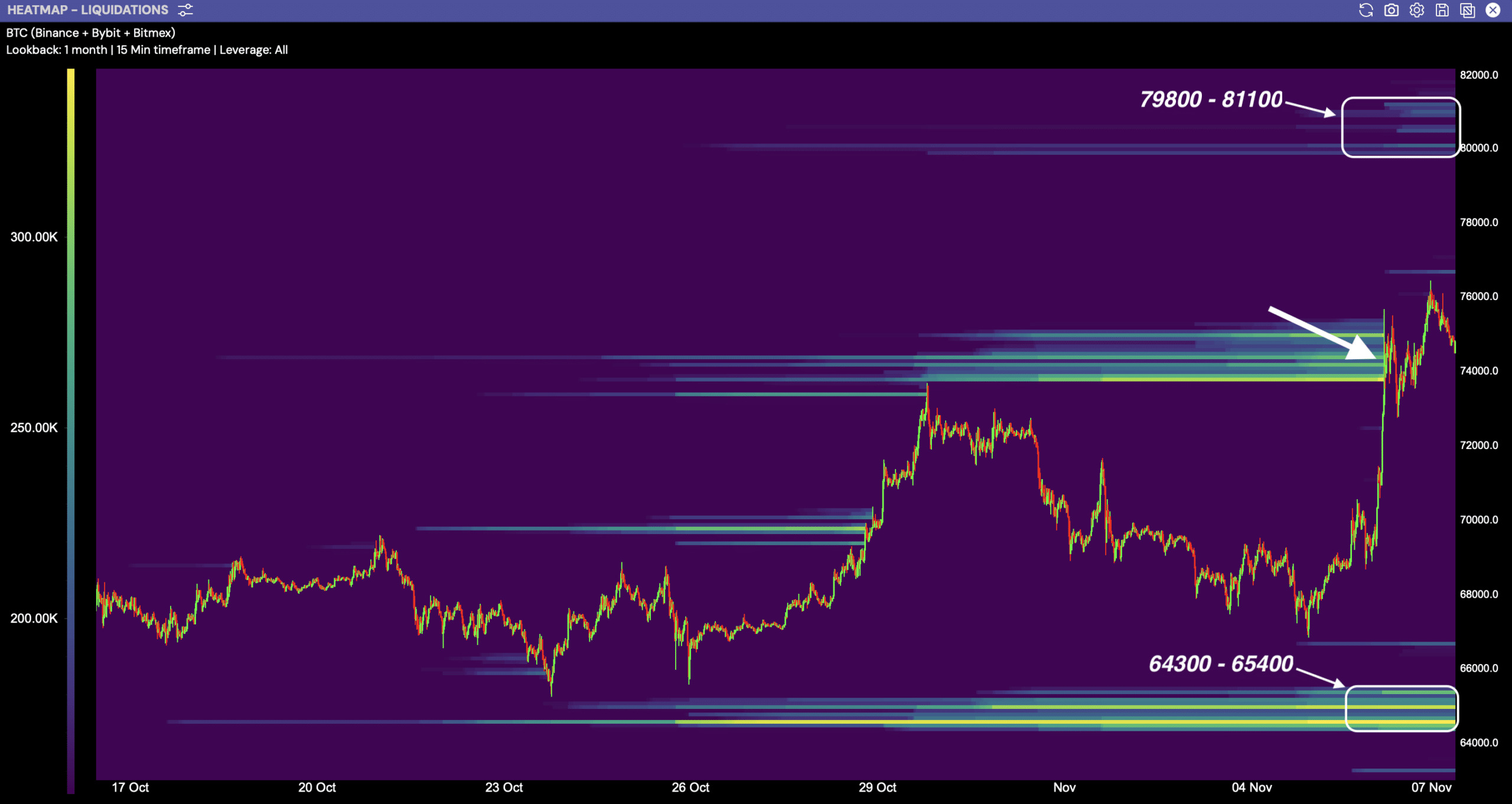

The liquidity heatmap for Bitcoin revealed essential clusters round $64K and $79K, highlighting areas the place substantial transaction volumes are prone to happen.

Lately, retail buyers have propelled Bitcoin in direction of these increased costs, and now BTC appeared poised to focus on the $79K cluster on account of its proximity and up to date formation.

As Bitcoin approaches this vital degree, the potential for one more rally will increase. The flexibility of retail buyers to proceed driving the worth increased might hinge on their confidence and market sentiment.

Ought to Bitcoin keep optimistic momentum, it might efficiently breach the $79K barrier and probably reverse to check the $64K degree once more.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Nevertheless, if concern and uncertainty creep into the market, the newfound enthusiasm would possibly wane, inflicting BTC to stabilize and even retreat from these ranges.

Quickly, it will likely be decided if retail buyers have sufficient affect and resilience to push Bitcoin to those formidable value targets, or if market fears will mood their bullish drive.