- A temporal fall in US financial institution reserves anticipated may increase BTC.

- Worth motion wanting good as BTC dominance continues.

Bitcoin [BTC] is poised for increased costs as market circumstances point out a possible increase to liquidity.

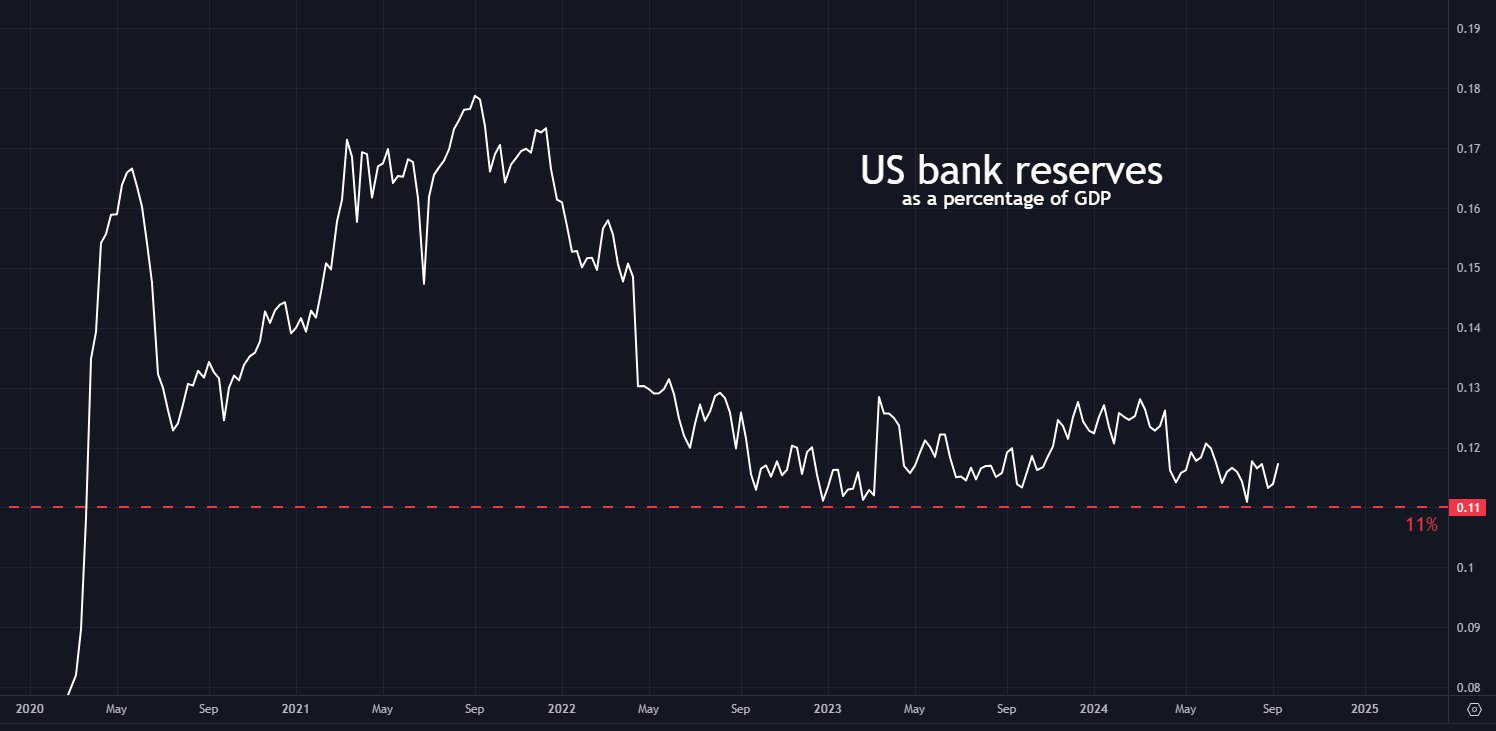

Analyst Tomas on X predicted a short lived fall in U.S. financial institution reserves to their lowest stage in over 4 years, which may consequence within the Federal Reserve halting Quantitative Tightening (QT).

When QT stops, it’s anticipated to result in a big liquidity improve that can doubtless profit danger property, together with Bitcoin.

This chance has sparked optimism, with many anticipating BTC to maneuver increased because the Federal Reserve adjusts its insurance policies in response to financial shifts.

Inspecting the shorter timeframes, such because the 15-minute chart, Bitcoin proceed to indicate blended indicators.

The TD Sequential indicator has flashed a promote sign for BTC/USDT, whereas the Relative Power Index (RSI) and Stochastic RSI are displaying overbought circumstances.

This means that whereas a possible correction could also be imminent, Bitcoin should still discover assist if it might probably shut and keep above the $60K stage.

The latest vary between $53K and $62K highlights the volatility in BTC’s worth motion over the previous six weeks. Merchants are awaiting a sustained breakout that would push the value of Bitcoin increased.

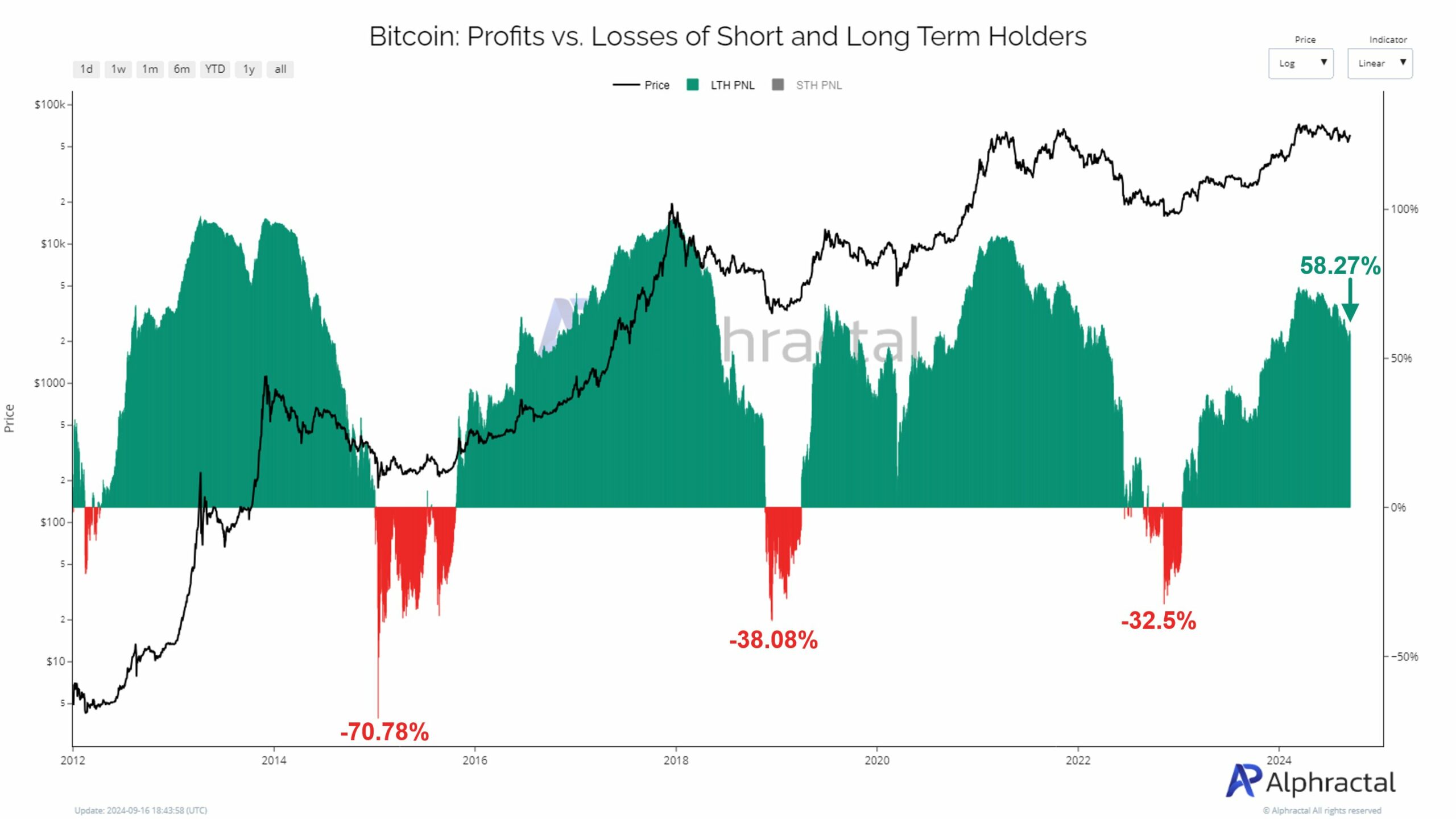

Earnings vs losses of brief and long run holders

Moreover, Brief-Time period Holders at the moment present resilience, with solely 4.46% in loss, suggesting no indicators of fast capitulation out there.

Traditionally, native bottoms in Bitcoin’s worth are inclined to happen when this proportion reaches round -60%.

The low proportion of loss amongst Brief-Time period Holders factors to market stability with out panic or compelled promoting.

However, Lengthy-Time period Holders have seen a lower of their total revenue margin, with 58.27% nonetheless in revenue, down from a peak of 74% in March.

This drop could point out that whereas Bitcoin stays worthwhile for a lot of however a possible bearish pattern may emerge sooner or later if revenue margins proceed to weaken.

Bitcoin base price evaluation

By way of market individuals, new whales and Binance merchants have been actively shopping for Bitcoin, whereas older whales stay holders.

The shopping for curiosity from new traders and outdated whales suggests the market is positioned for potential worth development.

A possible slip in financial institution reserves could end in a liquidity pump, benefiting Bitcoin and comparable danger property. This mixture of things factors to a good atmosphere for Bitcoin’s future development.

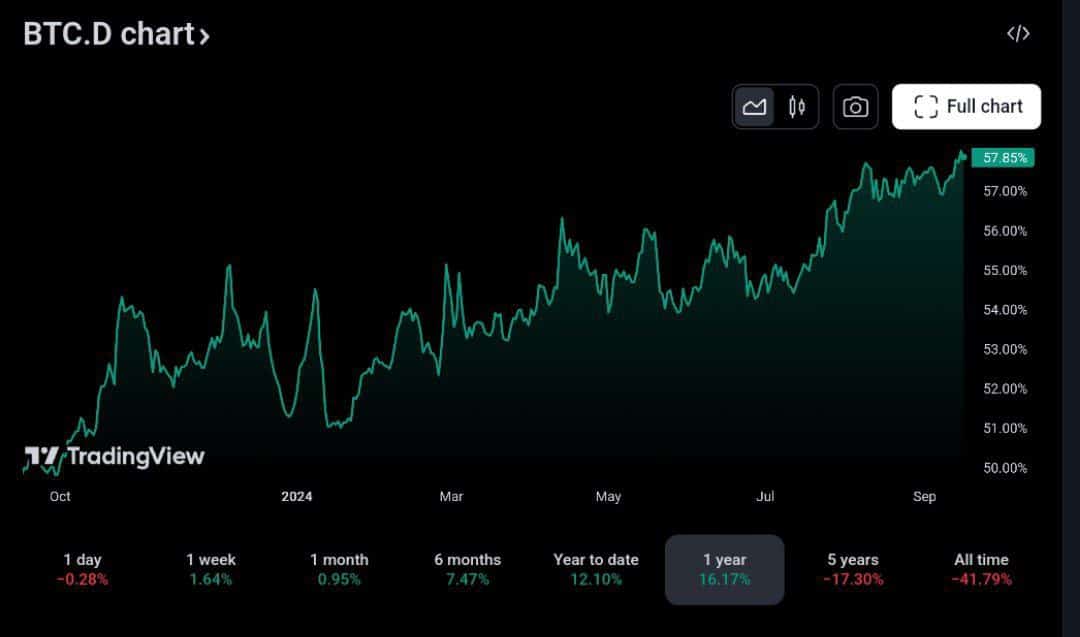

Bitcoin dominance continues to rise

Bitcoin’s dominance within the cryptocurrency market has surged to over 57.86%, marking its highest stage since April 2021.

This improve in dominance is a powerful indicator that BTC is main the market and could also be poised for a big rally.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

As Bitcoin continues to outperform different cryptocurrencies, this shift may additionally considerably impression the broader crypto ecosystem long-term.

Buyers are intently monitoring this pivotal second for indicators of additional motion in Bitcoin’s favor. Bitcoin’s rising market share may set the stage for future good points and drive costs increased quickly.