- Bitcoin holder buys hit $10 billion for the primary time.

- Bitcoin massive holders provide hit 262,000 BTC over the previous 30 days.

Bitcoin [BTC], the biggest cryptocurrency by market cap, has not too long ago skilled a pointy decline in its costs. At press time, the king coin was buying and selling at $58679. This marked a 6.69% decline over the previous 24 hours.

Previous to this decline, BTC was in upward motion, reaching a excessive of $64,404 within the final week. Nonetheless, the sharp decline on every day charts has outweighed all of the weekly good points to document a 1.71% drop on weekly charts.

This sudden decline raises questions on panic promoting and the position of long-term holders in guaranteeing Bitcoin’s stability.

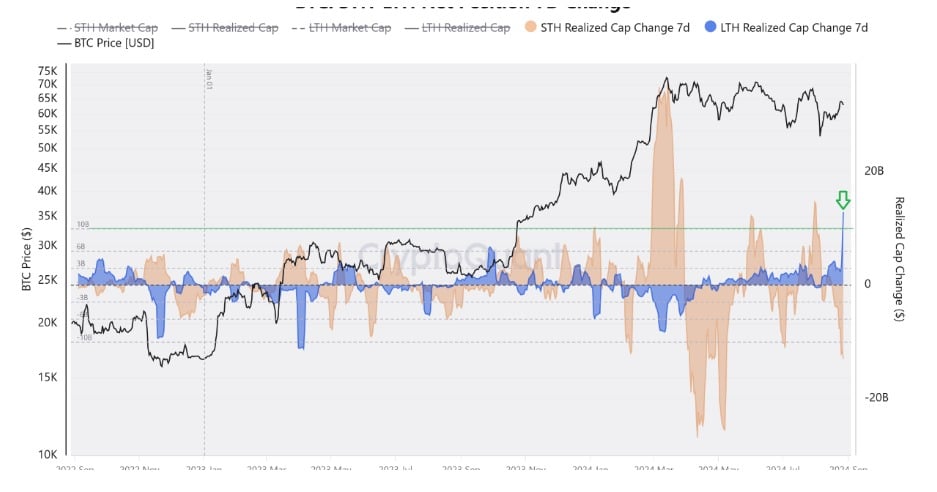

Lengthy-term Bitcoin holder buys hit $10 billion

In line with CryptoQuant analyst Amr Taha, long-term holders are much less prone to promote and to buy and maintain throughout market downturns.

In his evaluation, Amr Taha posited that long-term holders have spent $10 billion to buy the crypto. Additionally, these patrons have averted promoting because the market was at present in a downturn.

In a submit, the analyst shared,

“For the first time ever, the realized capitalization of long-term holders has exceeded $10 billion.”

Based mostly on this commentary, holders who handed the 155-day mark continued to carry their crypto. Moreover, as witnessed over the previous 30 days, establishments have elevated their purchases.

Massive BTC traders similar to Marathon, Blackrock, Galaxy Digital, Metaplanet amongst others have elevated their holdings over the previous 30 days.

These establishments are massive holders and have a tendency to build up their property for a chronic interval.

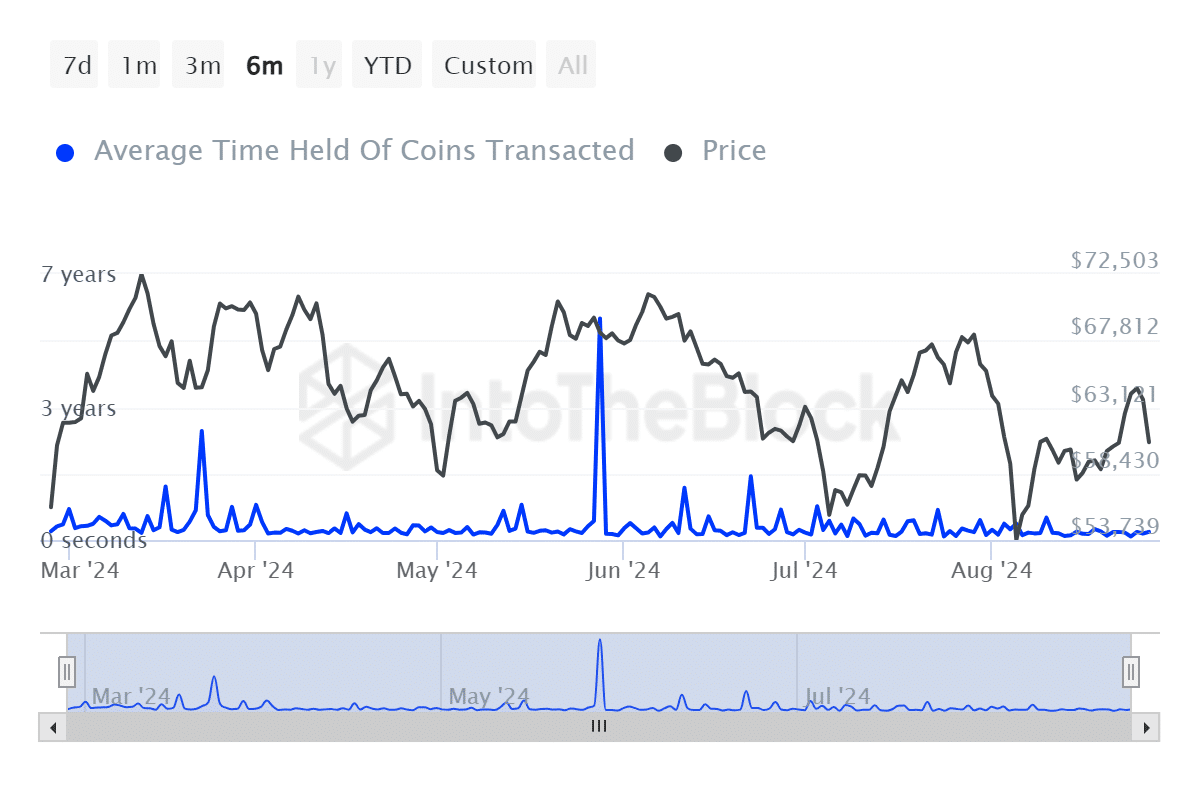

This phenomenon means massive holders have lengthy accumulation phases. As information from IntoTheblock reveals, massive holders take at the very least 5 months to 3 years to promote their property, whereas small holders are inclined to promote their holdings.

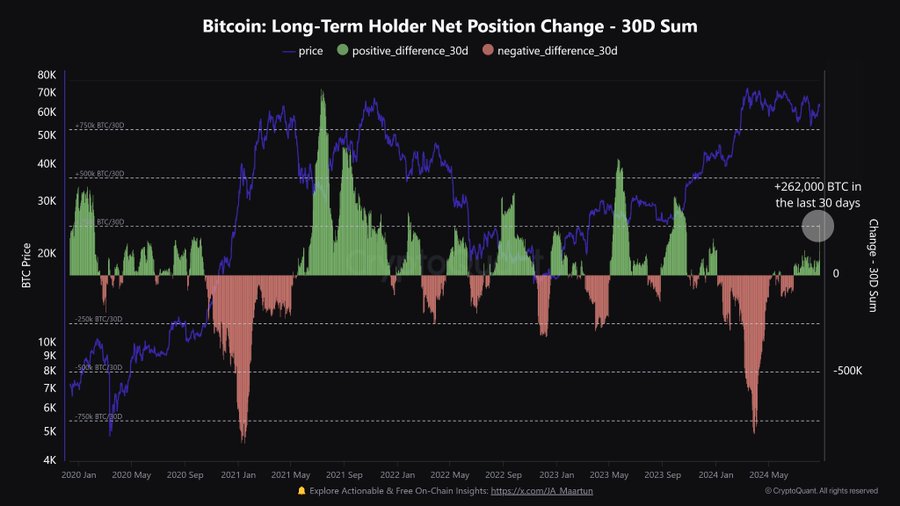

Lengthy-term holders provide elevated by 262,00 BTC

Whereas long-term holders are much less prone to promote, their provide has skilled exponential development. As shared by Cryptoquant, long-term holders management over 75% of the whole BTC provide.

By way of their X (previously Twitter) web page, they shared the evaluation, noting that,

“In the past 30 days, Long Term Holders supply increased by 262,000 $BTC.They now control 14.82 million Bitcoin, which accounts for 75% of the total supply.”

The final 30 days have witnessed excessive BTC volatility hitting a low of $49577. These worth fluctuations defined the elevated accumulation by long-term holders.

These holders have a tendency to buy extra property throughout market downturns and reintroduce them to the market throughout a chronic bull market. The technique ensures they purchase cheaply and promote later at excessive returns.

Thus, for long-term holders, low BTC costs are a shopping for alternative to build up.

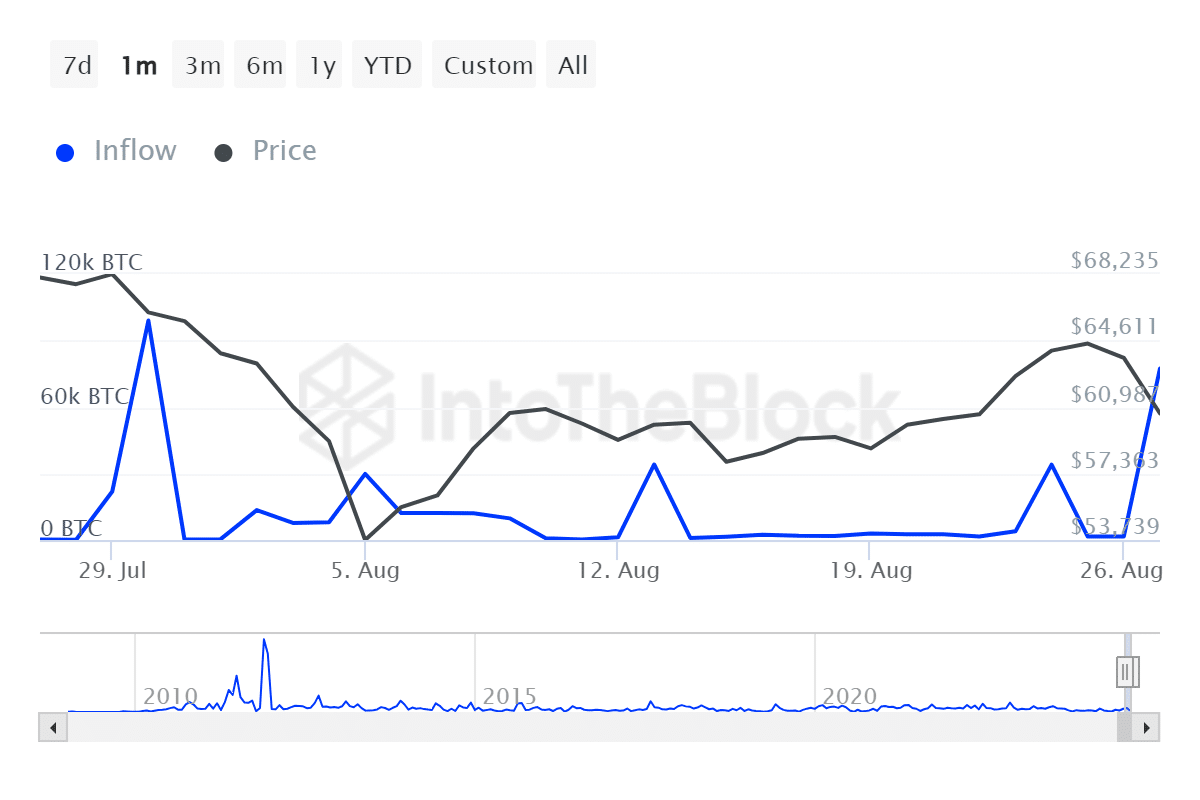

Subsequently, though Bitcoin is experiencing a downturn, this offered a shopping for alternative for long-term holders. Elevated shopping for actions lead to shopping for strain, which in flip drives costs up.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

As such, when the market crashed earlier this month, massive holders influx elevated between the fifth and the ninth of August, driving costs again to $60,662 resistance degree.

Thus, such a cycle will doubtless repeat itself to drive costs above $60k.