- The BTC Hodler’s steadiness has seen a slight drop just lately.

- BTC’s value has maintained a robust development regardless of this drop.

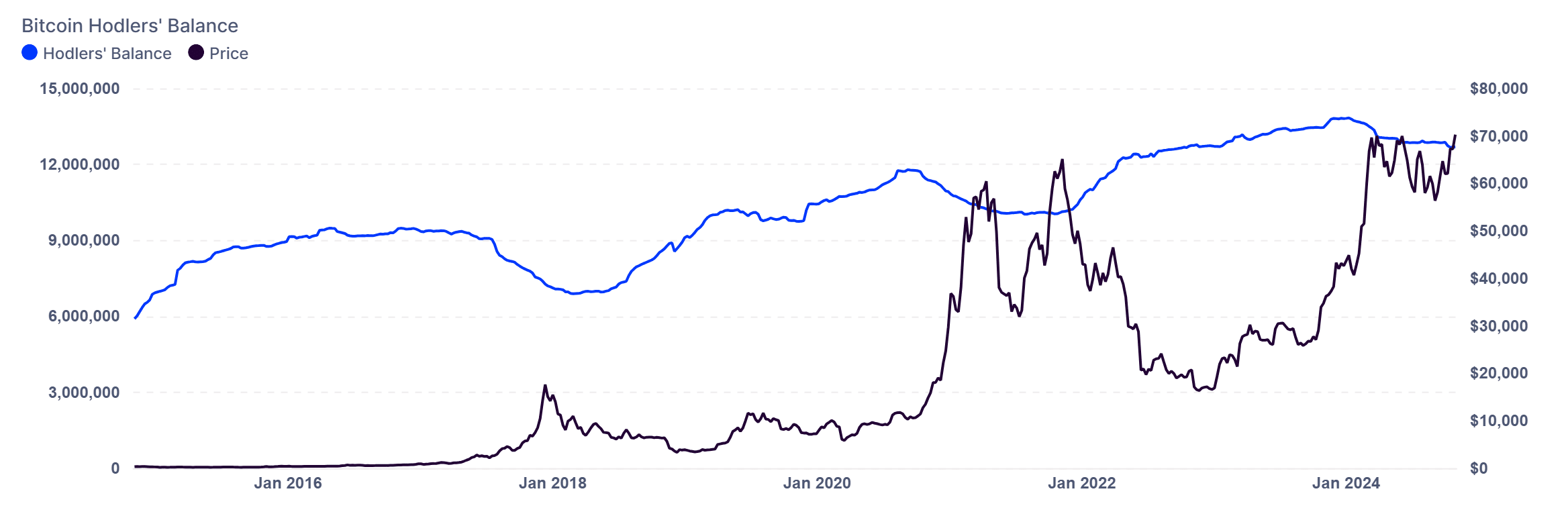

Bitcoin [BTC] is witnessing an intriguing shift in market dynamics as long-term holders, or “Hodlers,” undertake a extra restrained method to promoting within the present market cycle.

In contrast to earlier bull runs marked by aggressive sell-offs, information now reveals a modest decline in Hodlers’ balances. This habits suggests warning regardless of Bitcoin’s rising costs, doubtlessly marking a brand new development in Bitcoin’s market habits.

Bitcoin hodlers’ steadiness exhibits gradual decline

In keeping with current information from IntoTheBlock, Hodlers’ Bitcoin steadiness has steadily, albeit mildly, decreased in current weeks.

On 4th November, the Hodlers’ steadiness stood at roughly 12,681,159 BTC, a slight drop from 12,686,790 BTC recorded on twenty eighth October.

In contrast to previous cycles, the place important sell-offs usually coincided with peak costs, this measured discount suggests a shift in technique amongst Hodlers, reflecting warning and a want to carry via the present value appreciation.

This tempered method contrasts with historic habits, the place speedy value will increase led to extra aggressive promoting.

Now, as Bitcoin’s value traits upward, Hodlers appear extra affected person, progressively decreasing their holdings as a substitute of overwhelming the market with a speedy sell-off. This alteration may replicate a extra mature method to managing positive aspects amid an evolving market panorama.

Bitcoin value dynamics amid average promoting stress

Bitcoin’s present value motion displays stability within the face of average promoting from Hodlers. As Bitcoin trades round $68,789, it exhibits resilience regardless of the delicate promoting exercise by long-term holders.

Technical indicators additional illustrate this balanced setting. The Relative Energy Index (RSI), which presently stands at 54.66, alerts neutral-to-slightly bullish sentiment, with a studying above 50 suggesting that purchasing stress is barely stronger than promoting stress.

The RSI stays effectively under the overbought threshold of 70, indicating that the asset nonetheless has room to develop earlier than it faces stronger promoting resistance.

The Choppiness Index (CHOP) additionally factors to stability, standing at 49.90, which signifies a comparatively balanced development with out extreme volatility. A CHOP studying round 50 often implies that the market is neither in a robust development nor extremely risky.

This aligns effectively with the gradual decline in Hodlers’ balances, suggesting that the promoting exercise is being met by regular shopping for curiosity with out inflicting main value swings.

This stability could also be interesting to each retail and institutional buyers in search of much less risky entry factors.

A brand new market cycle dynamic?

The current habits of Bitcoin Hodlers may trace at an evolving cycle dynamic. Their reluctance to promote aggressively, even in a good value setting, would possibly counsel sustained and even additional value development expectations.

This conservative method may additionally replicate cautious optimism, as Hodlers seem like testing the market by making smaller, incremental gross sales slightly than taking important income abruptly.

Learn Bitcoin (BTC) Value Prediction 2024-25

As Bitcoin’s market matures, the development of gradual promoting slightly than sharp sell-offs may sign a shift towards a extra steady market setting.

This habits would possibly assist mitigate the acute volatility historically related to Bitcoin cycles, supporting the asset’s resilience. If this development continues, it may symbolize a long-term shift in how Bitcoin holders interact with the market.