- Bitcoin has climbed to a 20-week excessive above $71,000 amid constructive market sentiment.

- With 98% of holders in income, FOMO might propel BTC to a brand new ATH earlier than the top of Uptober.

Bitcoin [BTC] has been trending up this month and lately reached a 20-week excessive above $71,500. At press time, BTC traded at $70,900 and was solely 3.7% shy of its all-time highs.

A number of bullish indicators at the moment recommend that Bitcoin might kind a recent ATH earlier than the top of “Uptober” amid constructive market sentiment.

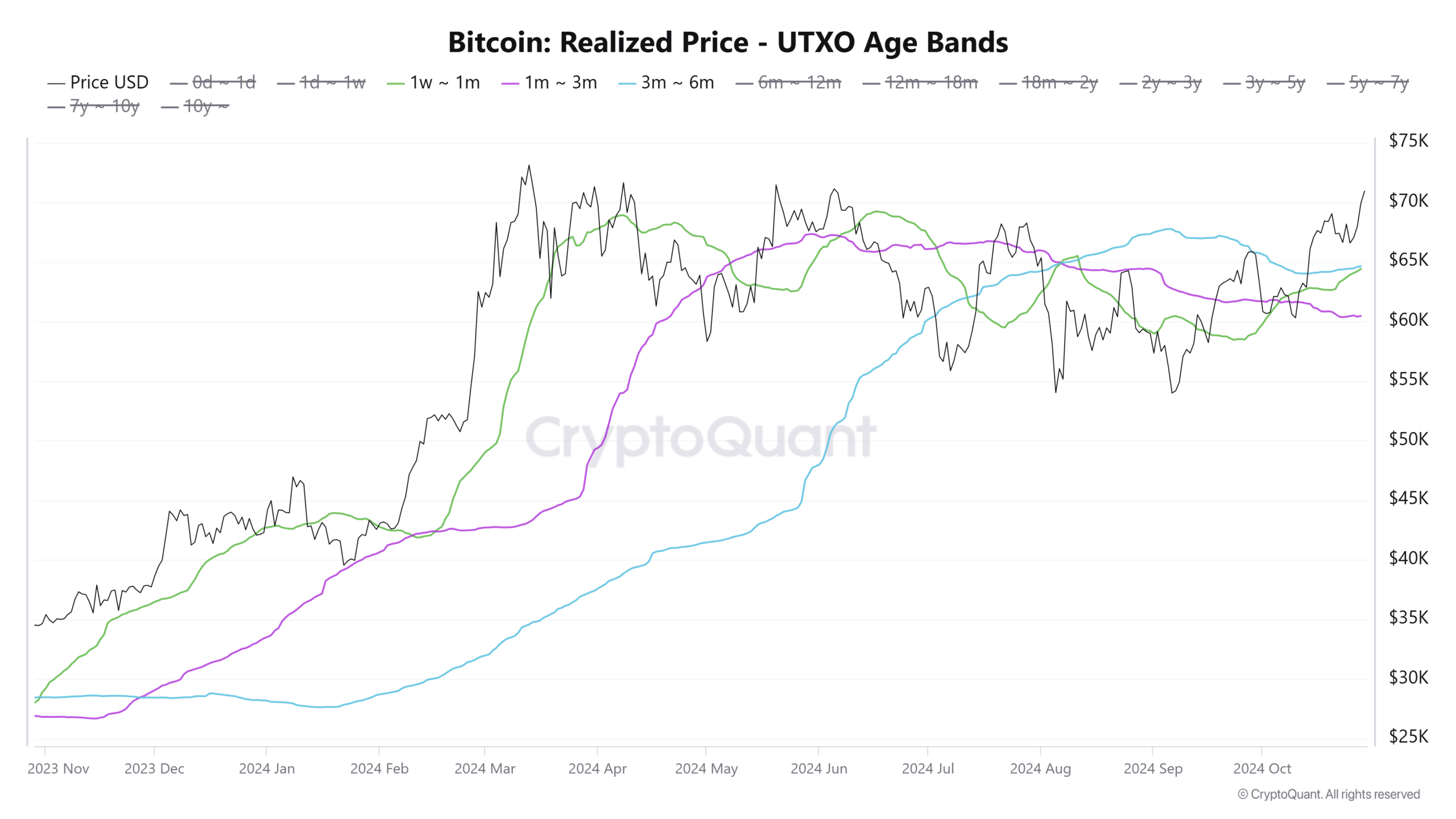

Bitcoin UTXO Realized Worth

A have a look at the Bitcoin UTXO Realized Worth for short-term holders means that costs might proceed to rise within the brief time period.

Per CryptoQuant, the UTXO Realized Worth for wallets which have held BTC for underneath a month is near surpassing that of wallets which have held Bitcoin for between three to 6 months.

Previous crossovers have usually preceded important value will increase. An analogous crossover is about to occur, which might strengthen the bullish narrative round BTC.

Quick-term holders normally decide the sustainability of a rally. Subsequently, if new transactions begin occurring at increased costs, it can enhance market sentiment and pave the best way to an ATH.

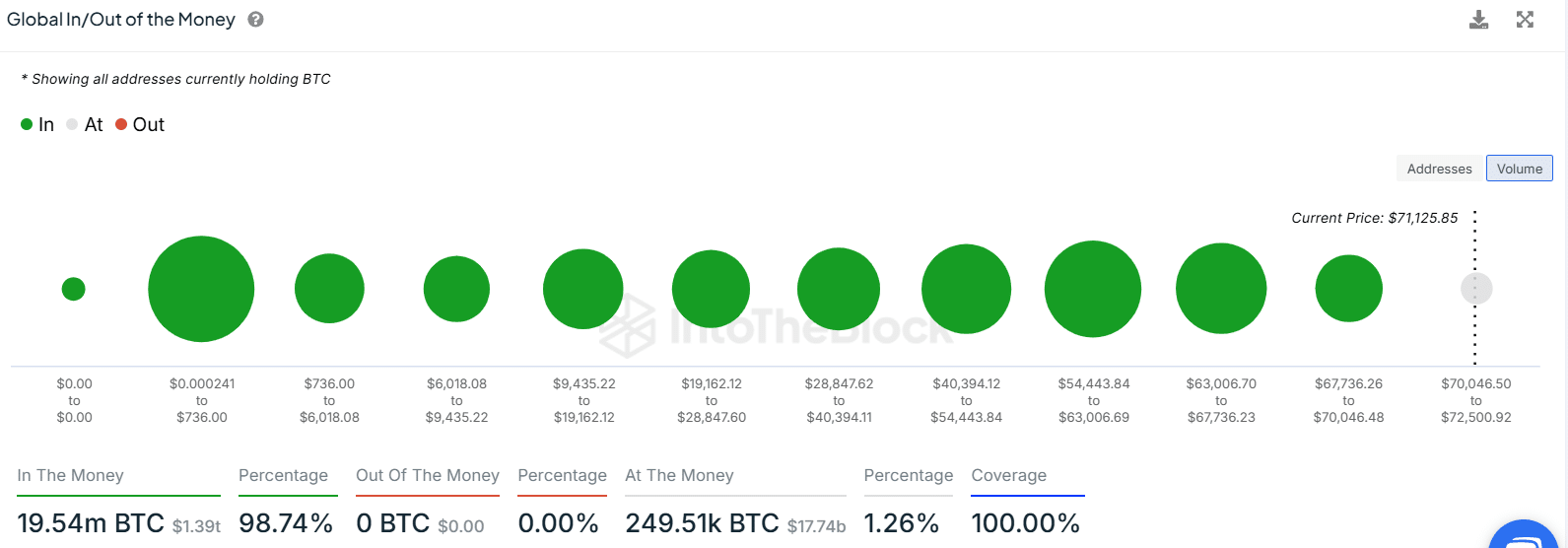

98% of holders are in income

Knowledge from IntoTheBlock exhibits that 98% of BTC holders are sitting in income whereas 1.26% are at a break-even level.

When pockets profitability will increase, it boosts investor confidence as holders turn out to be extra prepared to carry their property quite than promote. This situation may stir the concern of lacking out (FOMO). In consequence, new consumers might enter the market, reinforcing the uptrend.

FOMO is already evident because the Concern and Greed Index sits at 72. This exhibits that the market is in a state of greed.

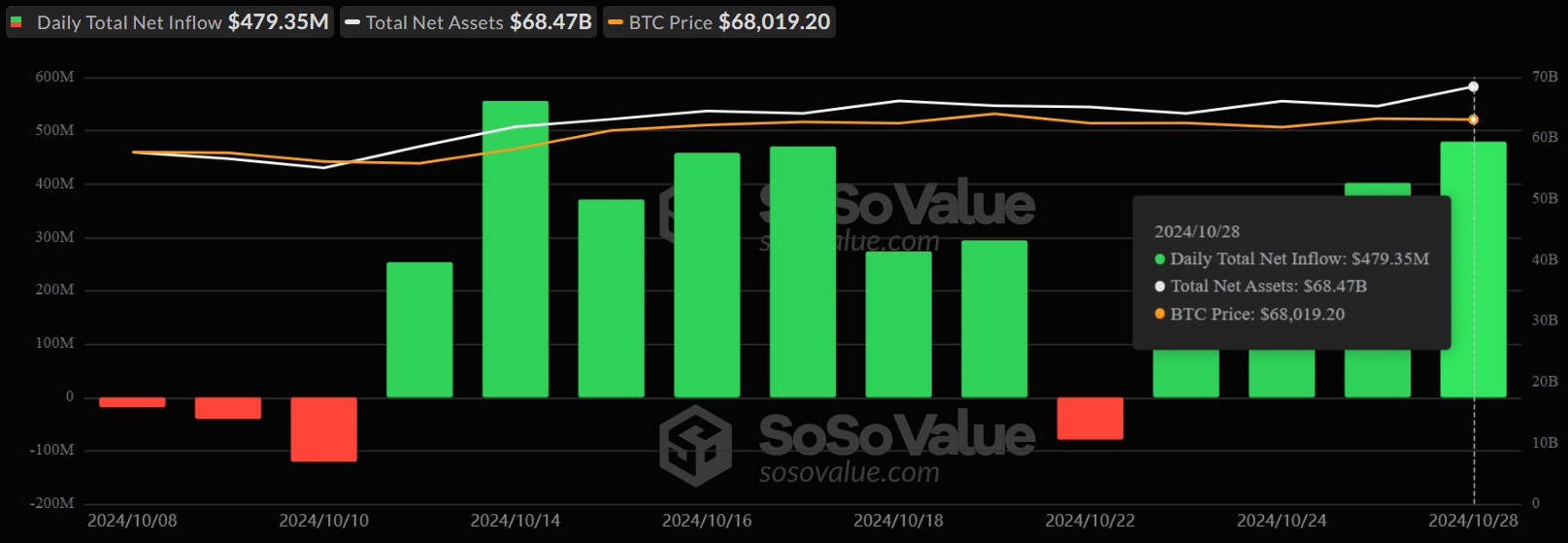

Rising demand for BTC ETFs

On twenty eighth October, US spot Bitcoin exchange-traded funds (ETFs) recorded their highest inflows in two weeks. Per SoSoValue, inflows through the day got here in at $479M, with Blackrock taking the biggest share with $315M inflows.

As AMBCrypto reported, BlackRock’s BTC holdings have surpassed 400,000 cash, with the asset supervisor being on monitor to flipping Satoshi and changing into the biggest Bitcoin holder.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

US spot Bitcoin ETFs collectively maintain $68.47 billion price of property, which is 4.9% of Bitcoin’s provide. In simply two weeks, these ETFs have recorded $3 billion in netflows.

As Bitcoin attracts new curiosity from each retail and institutional traders, its market dominance over altcoins has continued to soar. At press time, Bitcoin’s dominance stood at 60% whereas the altcoin season index had dropped to 27.