- The Bitcoin miners’ reserve has declined considerably.

- Income has additionally plummeted to certainly one of its lowest ranges in historical past.

Bitcoin [BTC] miners confronted vital challenges because the Bitcoin hashrate has reached file ranges.

These difficulties are compounded by the current halving occasion and the substantial worth declines BTC has skilled over the previous few weeks.

Bitcoin hashrate spikes

Evaluation revealed that the Bitcoin hashprice, which measures earnings per unit of hashrate, declined to an all-time low final week.

On the 4th of August, miners earned simply $35 per petahash day by day, marking the bottom charge recorded traditionally.

Additionally, the Bitcoin hashrate peaked, attaining an unprecedented stage of 673 exahashes per second.

This surge in hashrate signifies elevated mining issue, making it more difficult for miners to mine new blocks efficiently.

This issue is exacerbated by current reductions in transaction charges, including additional monetary strain on miners.

Miners promote holdings as Bitcoin hashrate climbs

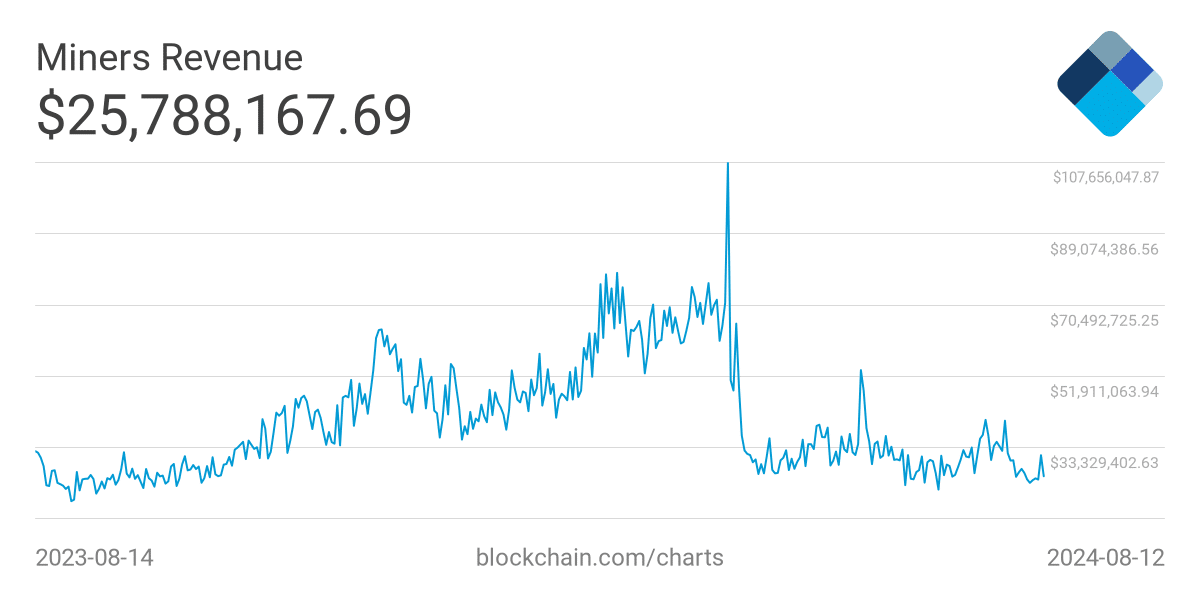

AMBCrypto’s evaluation of miner income revealed a big downturn following the Bitcoin halving occasion.

The chart confirmed day by day earnings dropping from roughly $50,000 to $30,000, in response to information from Blockchain.com.

This decline was additional exacerbated by a current surge within the Bitcoin hashrate, pushing revenues to round $25,000—a near-historic low for miners.

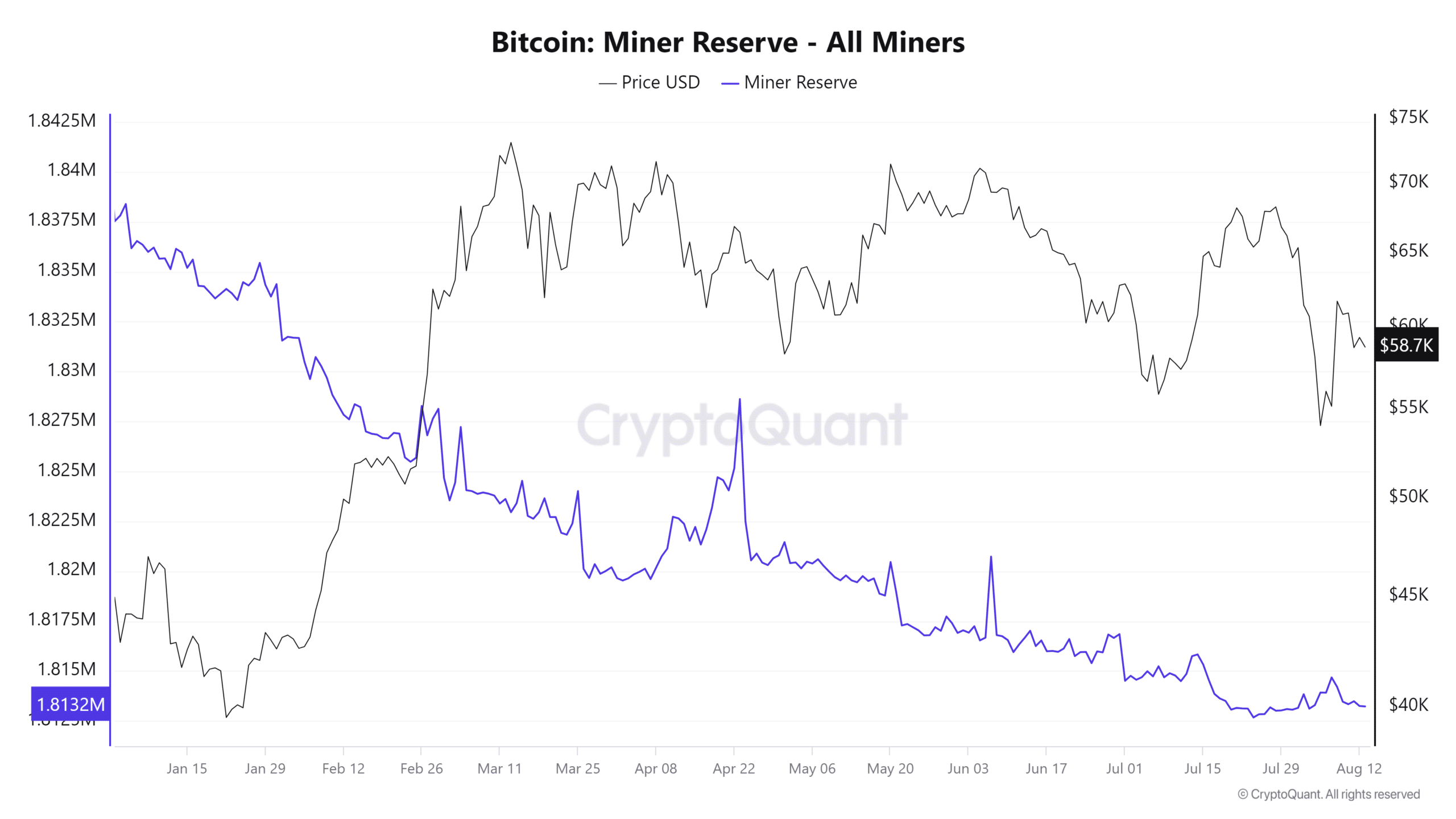

This discount in income, coupled with the continued decline in Bitcoin costs, has additionally impacted the miner reserve.

Knowledge from CryptoQuant confirmed a noticeable lower in reserves since April, at roughly 1.813 million BTCs at press time.

If the hashrate stays elevated, miner reserves will probably diminish within the forthcoming months.

Bitcoin’s feeble climb challenged

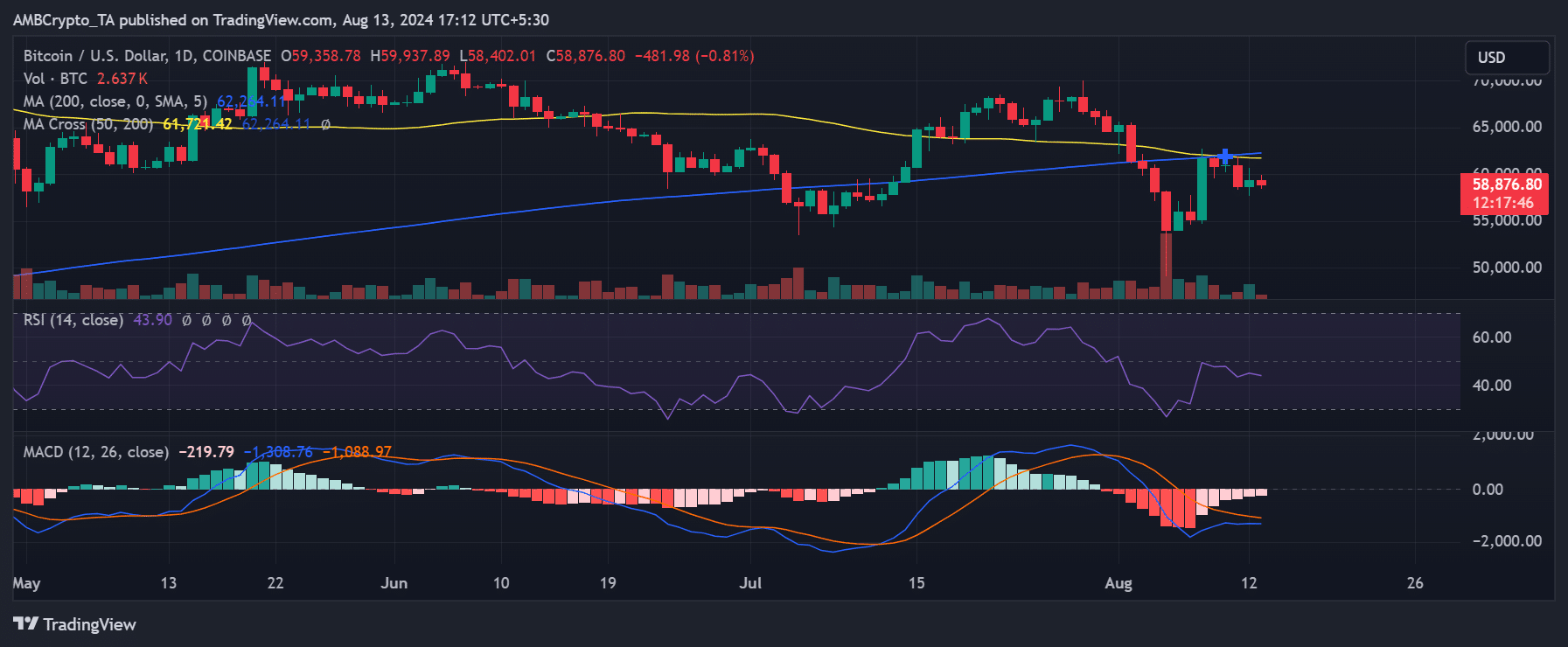

Bitcoin skilled a slight rebound in its final buying and selling session, rising over 1% to round $59,358. Nevertheless, it has since shed almost 1% of these features, buying and selling at roughly $58,800.

This current worth motion extends the sample of volatility seen in current weeks.

AMBCrypto’s take a look at Bitcoin’s technical indicators, together with the Shifting Common Convergence Divergence (MACD) and the Relative Power Index (RSI), indicated a continued bearish pattern.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

At press time, the RSI remained under the impartial threshold, and the MACD traces, together with the histogram, have been positioned under zero, suggesting ongoing bearish momentum.

A shift in the direction of a optimistic worth trajectory might assist miners mitigate the challenges posed by the presently excessive Bitcoin Hashrate.