- BTC worth may soar greater, based mostly on the Bitcoin Macro Oscillator Momentum (BMO).

- Regardless of short-term promote stress, the upside potential of BTC stays massive.

Bitcoin [BTC] has been caught in a worth consolidation part ($60K—$72K) for over two months, which is painful, particularly for short-term holders anticipating large worth upswings.

Nevertheless, crypto analyst Willy Woo believes the consolidation was ‘very good’ for BTC’s upside potential.

‘This 2.5 months of consolidation under bullish demand has been very good for #Bitcoin, it means the price has more room to run before topping out.’

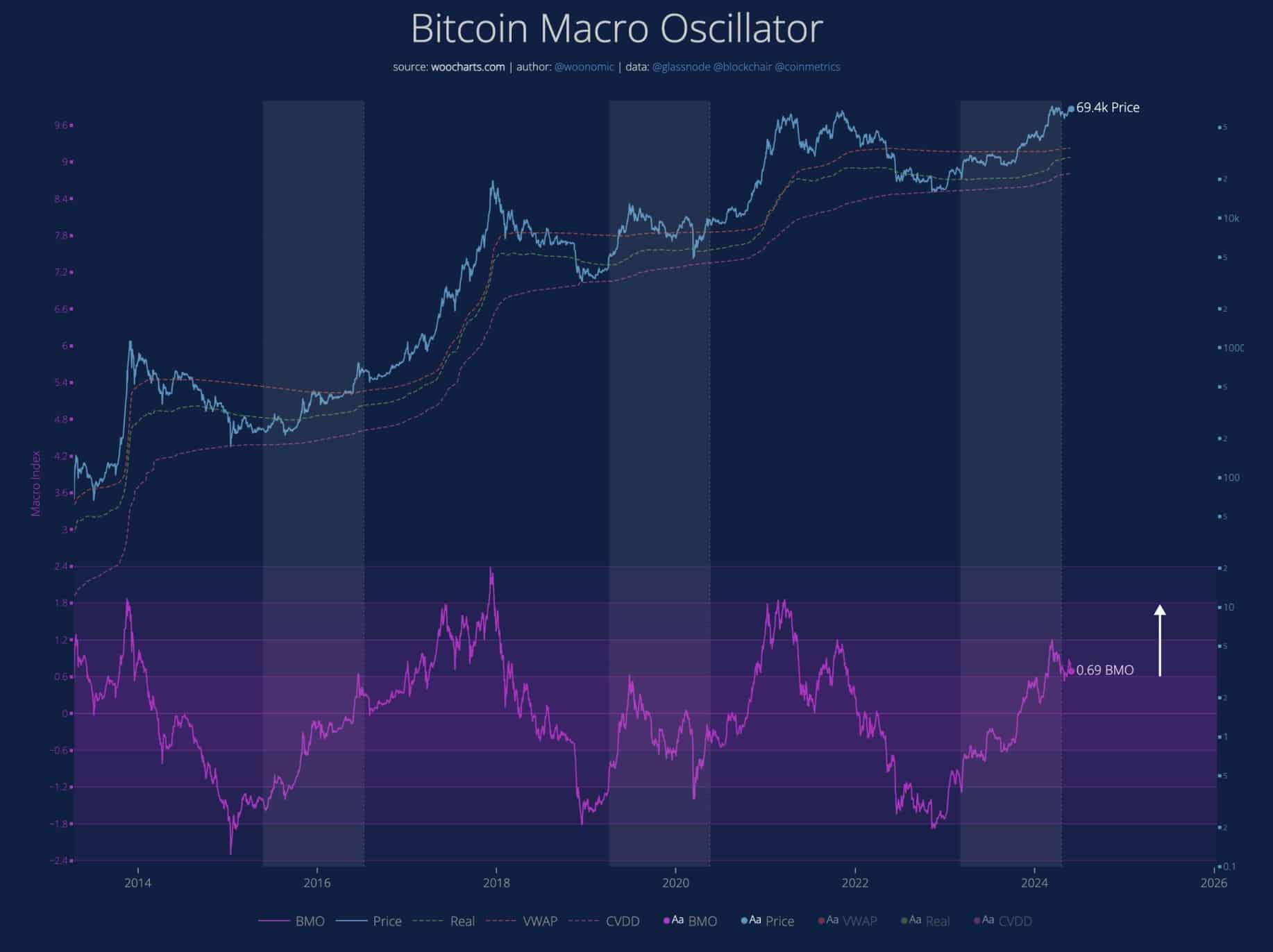

Woo’s projection was based mostly on the Bitcoin Macro Oscillator (BMO), which confirmed further upside strikes have been doable.

The BMO is a collective momentum metric that comprises different key indicators, akin to MVRV (Market Worth to Realized Worth), VWAP (Quantity-Weighted Common Worth), CVDD (Cumulative Worth Days Destroyed), and the Sharpe ratio.

Briefly, the BMO reduces the short-term worth noise and captures whether or not BTC has bottomed or topped from a long-term perspective.

Within the 2017 and 2021 market cycles, BTC topped after BMO hit 1.8, but the indicator’s studying was under 1 at press time.

So, based mostly on BMO, Woo projected that the indicator may transfer to 1.8 once more, marked by a white arrow on the chart, permitting BTC’s worth extra room to the upside.

BTC worth: What’s the subsequent transfer?

Regardless of the bullish outlook, the resistance close to the final cycle excessive of $69K was nonetheless a key hurdle, in line with Peter Brandt, a famend BTC technical chart analyst.

Per Brandt, BTC should make ‘new highs to confirm the bull trend.’

Nevertheless, a current AMBCrypto report established that almost all metrics nonetheless chalked a bullish situation for the king coin. Specifically, Miners weren’t promoting their holdings, and the market sentiment signalled ‘greed.’

However the one drawback for the BTC worth was the short-term holders. Most of them have been in revenue and will ebook income, inducing short-term promote stress.

Nevertheless, one other crypto analyst, Cryp Nuevo, forecasted {that a} liquidity hunt may override short-sellers given that almost all liquidity was located close to the range-highs at $72K.

That mentioned, AMBCrypto’s Bitcoin worth prediction confirmed that if BTC clears the month-long vary highs, the $79K might be the subsequent bullish goal for the king coin.

The bullish sentiment was additional echoed by crypto buying and selling agency QCP Capital.

In its Telegram replace to its neighborhood, the agency downplayed current short-term BTC promote stress from the Mt Gox replace as ‘blips’ for a ‘higher trend.’

“These bouts of provide anxiousness are more likely to be blips in a broader pattern greater into the tip of the 12 months.’