- The variety of lengthy positions within the Bitcoin market elevated.

- The Rainbow Chart identified that BTC’s value was significantly lower than it must be.

Bitcoin [BTC] remained bearish, because the king coin was buying and selling below $57k at press time. Whereas this initially seemed disastrous, for savvy buyers, this may as nicely be a proper alternative to purchase the dip.

Based on CoinMarketCap, BTC’s value dropped by greater than 3% within the final seven days. Within the final 24 hours alone, the king coin witnessed an almost 4% value fall.

On the time of writing, BTC was buying and selling at $56,760.06, with a market capitalization of over $1.12 trillion.

Must you purchase Bitcoion’s dip?

In the meantime, Ali, a well-liked crypto analyst, posted a tweet revealing a bullish growth. High BTC merchants on Binance confirmed a slight bullish tilt, with 51.79% buyers holding lengthy positions on BTC.

Usually, an increase within the variety of lengthy positions available in the market trace at a rise in bullish sentiment round an asset.

Due to this fact, AMBCrypto deliberate to have a deep take a look at BTC’s state to search out out whether or not buyers ought to think about shopping for the dip.

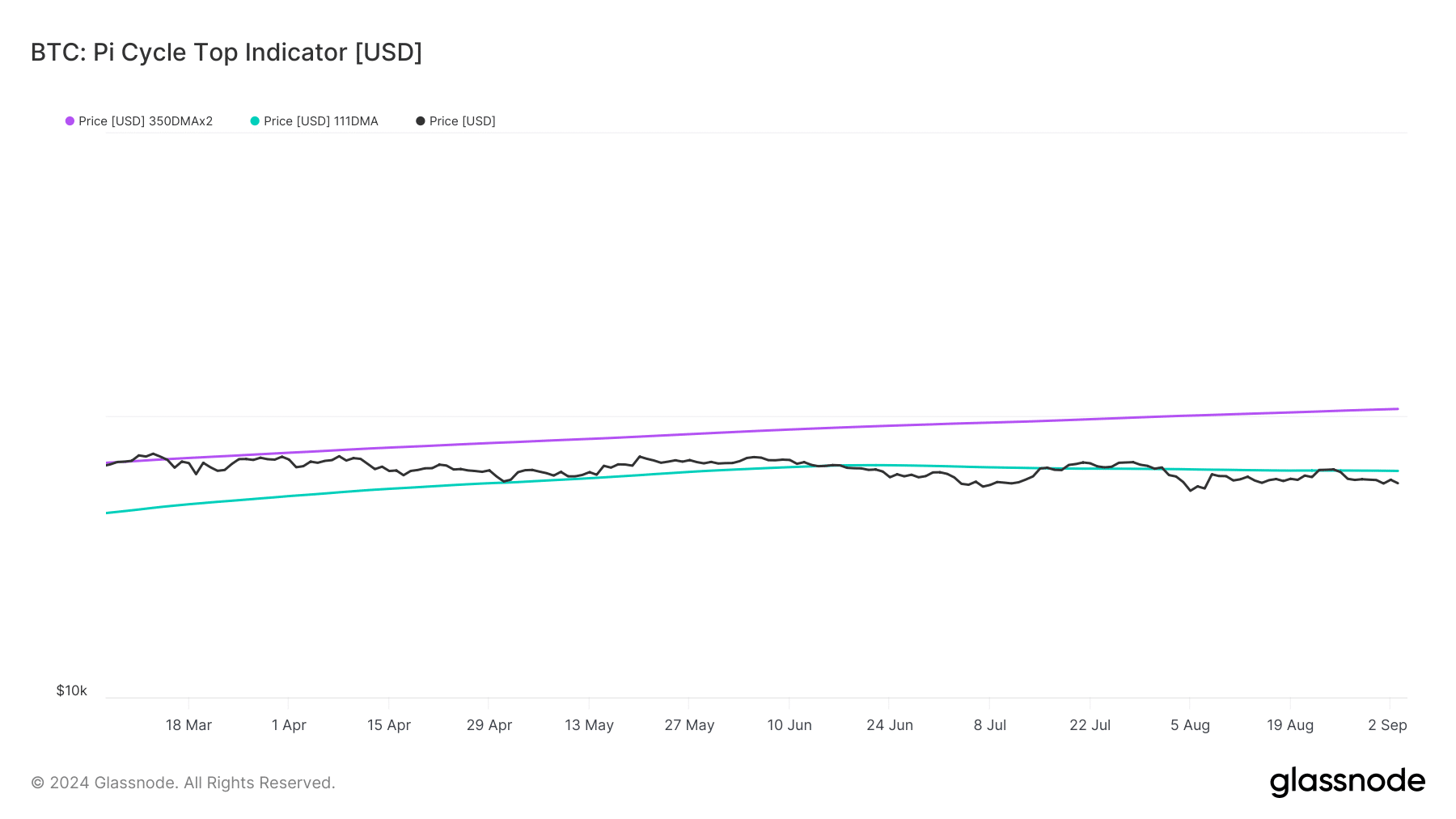

Our take a look at Glassnode’s information revealed that BTC was buying and selling nicely under its attainable market backside. As per the Pi Cycle High indicator, BTC’s attainable market backside was at $58.9k.

This steered that BTC may transfer in the direction of $58.9k within the coming days.

Assessing BTC’s street forward

Since BTC was buying and selling nicely under its market backside, AMBCrypto checked different datasets to search out out whether or not this was the proper time to build up.

Based on the Bitcoin Rainbow Chart, BTC’s value was within the “Basically a Fire Sale” zone. This meant that BTC’s present value was significantly decrease than what it must be, revealing an important alternative for accumulation.

AMBCrypto then checked CryptoQuant’s information to see whether or not buyers have already began to purchase extra BTC. We discovered that the king coin’s Alternate Reserve was dropping, signaling an increase in shopping for strain.

Its Korea Premium was additionally inexperienced, that means that purchasing sentiment was dominant amongst Korean buyers. Nevertheless, its Coinbase Premium turned crimson. This steered that U.S. buyers had been contemplating promoting BTC.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

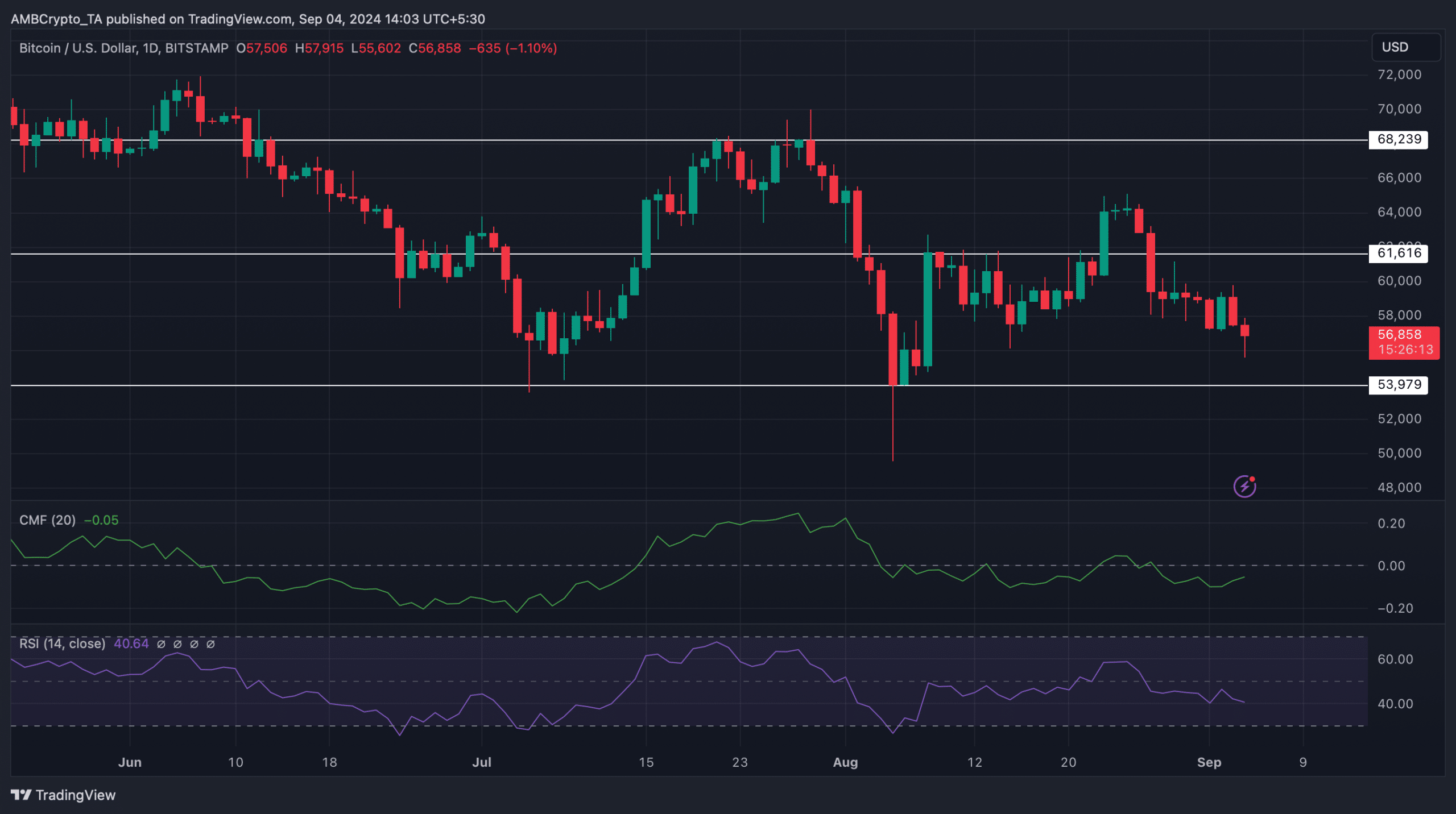

The Chaikin Cash Stream (CMF) registered an uptick. This indicated that BTC’s bearish value motion may finish quickly.

Nevertheless, the Relative Energy Index (RSI) moved southwards, that means that the opportunity of BTC falling additional can’t be dominated out but.