- Bitcoin’s back-to-back ‘Super Signals’ trace at explosive good points—final seen earlier than 10,000% rallies.

- Over 94% of Bitcoin holders had been in revenue as quantity tendencies urged sturdy bullish sentiment forward.

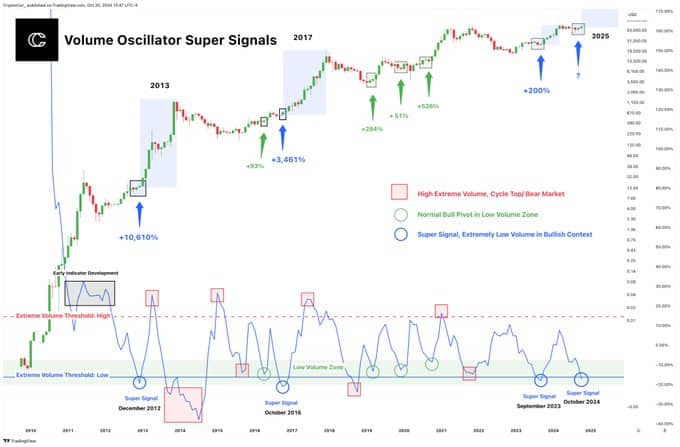

Bitcoin’s [BTC] quantity oscillator has not too long ago signaled back-to-back ‘Super Signals,’ a uncommon occasion that has solely occurred throughout main bull runs.

Traditionally, such alerts preceded huge rallies, together with good points of over 10,000% in 2012 and three,000% in 2016.

The newest prevalence, seen in September 2023, adopted a +200% rise in Bitcoin’s worth, with one other tremendous sign showing in October 2024.

The ‘Super Signal’ seems when buying and selling quantity is extraordinarily low in a bullish market. Analysts recommend that these circumstances point out accumulation, as sellers dwindle whereas shopping for curiosity stays regular.

The absence of prior high-volume spikes additional helps a bullish outlook, differentiating this section from bearish low-volume patterns.

Bitcoin’s worth good points and market information

As of press time, Bitcoin was priced at $68,378.05, with a market cap of $1.35 trillion and a 24-hour buying and selling quantity of $24.5 billion.

This marks a 5.96% enhance over the previous seven days, showcasing regular good points. Bitcoin’s circulating provide stands at 20 million BTC.

Open Curiosity in Bitcoin Futures has risen by 2.39%, at $40.69 billion at press time, indicating elevated buying and selling exercise and potential bullish sentiment.

CoinGlass information confirmed a 90.33% leap in buying and selling quantity to $42.62 billion, whereas choices quantity soared by 182.07% to $1.60 billion.

Choices Open Curiosity additionally elevated by 2.29%, now at $24.31 billion. The alignment of those metrics with Bitcoin’s worth actions suggests rising optimism amongst merchants.

Bullish sentiment

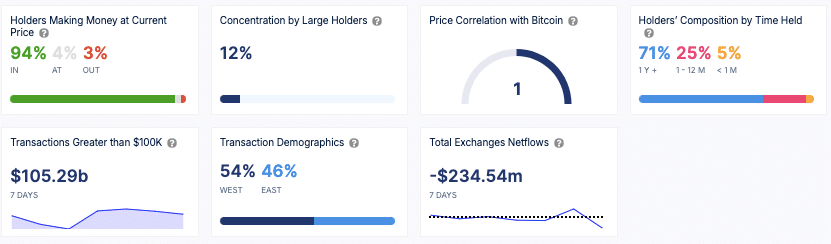

Information from IntoTheBlock confirmed that 94% of Bitcoin holders had been in revenue at present costs, signaling constructive market sentiment.

The evaluation additionally revealed that 71% of Bitcoin holders have maintained their positions for over a 12 months, suggesting sturdy long-term holding conduct.

In the meantime, 12% of Bitcoin’s provide had been held by massive holders, indicating a average focus of possession amongst whales.

Moreover, there was a internet outflow of $234.54 million from exchanges over the previous week, pointing to potential accumulation as buyers transfer property into chilly storage.

Over $105.29 billion in transactions larger than $100K occurred during the last week, pushed by institutional buyers and enormous merchants.

Learn Bitcoin’s [BTC] Worth Prediction 2024 – 2025

The geographical distribution of transactions is pretty balanced, with 54% from Western areas and 46% from Japanese areas.

Total, the presence of back-to-back tremendous alerts a novel occasion in Bitcoin’s historical past, creating anticipation for potential worth actions just like earlier bull cycles.