- Whales gathered vital quantities of BTC over the previous few days.

- Retail curiosity was excessive, open curiosity additionally surged.

Whales gathered a big quantity Bitcoin [BTC] over the previous few weeks. Knowledge recommended a renewed surge in Bitcoin shopping for by whales, reaching a two-month excessive.

Their Bitcoin holdings have additionally hit a report peak. This renewed shopping for spree signifies that enormous traders understand present costs, that are already extraordinarily excessive, as a sexy entry level for accumulating Bitcoin.

Whereas previous efficiency just isn’t essentially indicative of future outcomes, whales’ historic affect in the marketplace suggests their shopping for exercise may very well be a bullish indicator for Bitcoin.

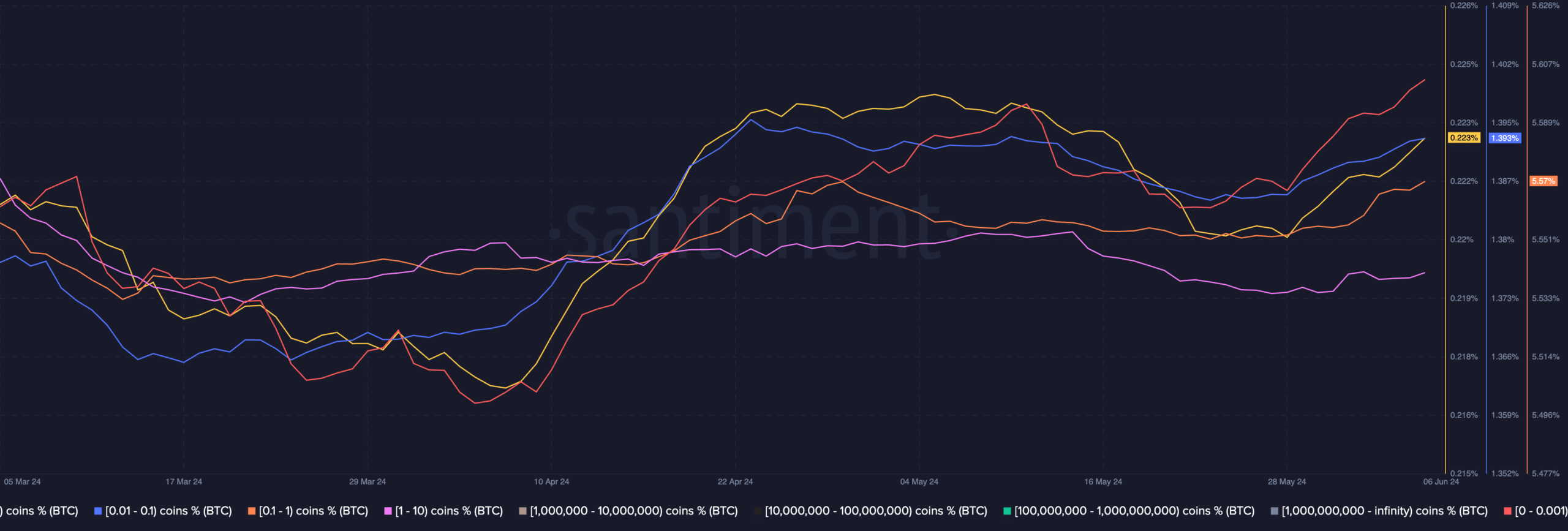

Retail traders additionally confirmed curiosity in BTC. AMBCrypto’s evaluation of Santiment’s knowledge revealed that the cohort of addresses starting from 0.1 to 10 had confirmed curiosity in BTC.

Curiosity in BTC ETFs was additionally rising

Regardless of a surge in curiosity for Bitcoin ETFs, with a report 19-day streak of inflows into US-based spot Bitcoin ETFs, there wasn’t a budge in BTC’s costs.

Whereas holdings in spot Bitcoin ETFs globally have reached a major stage, with round 1.3 million Bitcoin or 5.2% of circulating provide as of sixth June, and a big portion concentrated in US-listed ETFs, the value hasn’t reacted as dramatically as some would possibly count on.

Knowledge from Farside confirmed inflows on June sixth alone reached $217.7 million. Complete inflows since launch have surpassed $15.5 billion, however some merchants imagine this quantity remains to be inadequate to considerably transfer the value needle till different markets open up.

Open Curiosity surges

Other than that, the Open Curiosity(OI) in BTC additionally grew.

Traditionally, excessive OI was marked by extreme leverage and hypothesis usually precedes a worth correction. Nevertheless, this didn’t appear to be the case on the time of writing.

Whereas funding charges which mirror the willingness of lengthy and quick positions to pay one another remained barely optimistic, they have been considerably decrease in comparison with the highs seen in March.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

This indicated that bullish lengthy positions have been dominant and bulls have been prepared to pay bears to keep up their quick positions. Nevertheless, the market was not as heated in comparison with March.

At press time, BTC was buying and selling at $71,138.10 and within the final 24 hours, it had grown by 1.09%.