Bitcoin’s [BTC] dominance has not too long ago proven indicators of decline, with its market share slipping beneath key thresholds.

Because of this, capital is more and more flowing into altcoins, sparking debate amongst buyers and analysts.

Is that this an indication that Bitcoin is dropping its grip in the marketplace, or is it merely a short lived dip in an in any other case dominant pattern?

The autumn of Bitcoin’s dominance

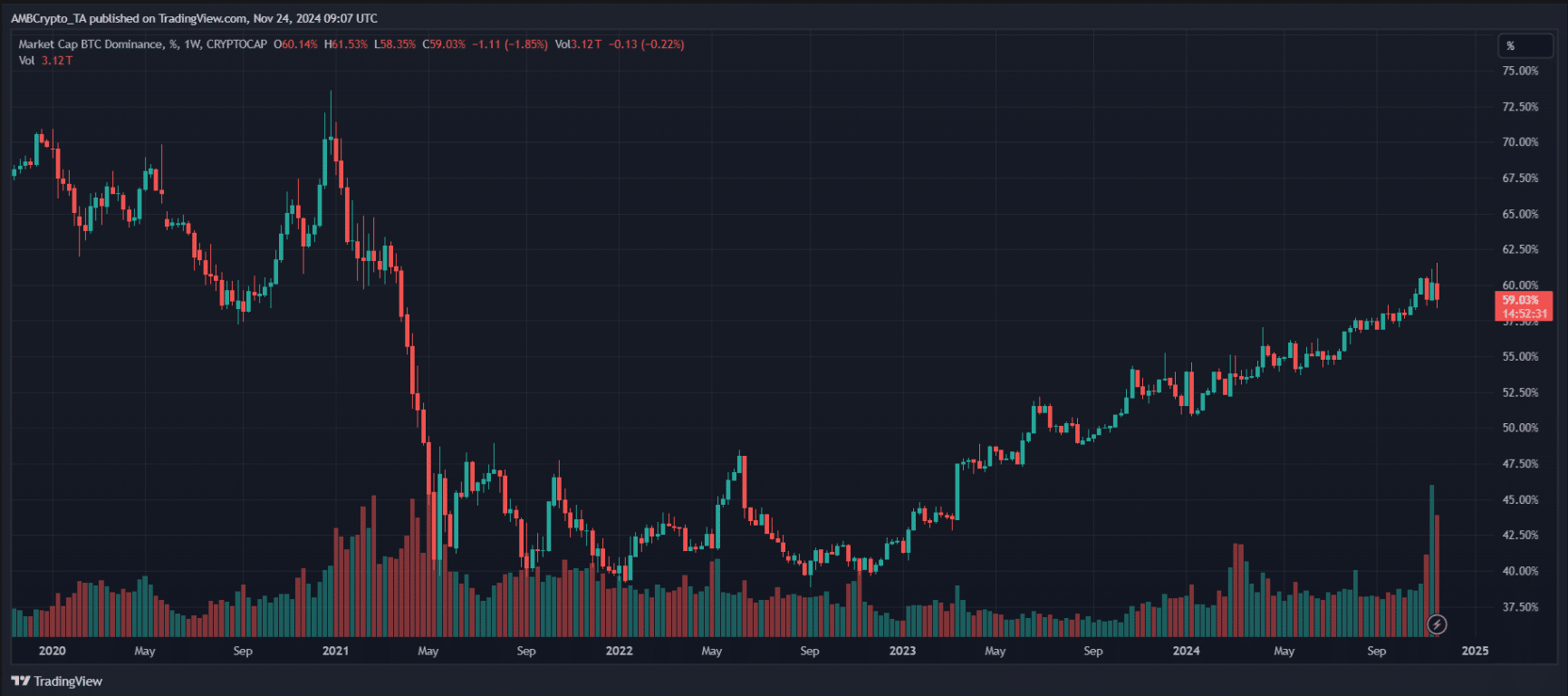

As depicted within the hooked up 1-day chart, Bitcoin’s dominance has slipped beneath a big threshold of fifty%, reflecting a zoomed-out projection of its weakening maintain on the crypto market.

This decline prompt rising investor curiosity in altcoins, with capital flowing into Ethereum [ETH], Solana [SOL], and rising tokens — doubtlessly difficult Bitcoin’s supremacy.

Traditionally, Bitcoin’s dominance has oscillated with market cycles.

In the course of the early crypto period, it commanded over 90% of the market, however the 2017 bull run marked a shift as altcoins surged, lowering its dominance to beneath 40%.

Whereas Bitcoin regained some floor in subsequent cycles, hitting round 70% in 2021, its market share has since confronted regular erosion.

This cycle-driven ebb and stream highlights how evolving narratives, technological improvements, and investor preferences form the market, leaving Bitcoin to compete with an more and more numerous ecosystem of digital belongings.

Altcoin season: Cash main the cost

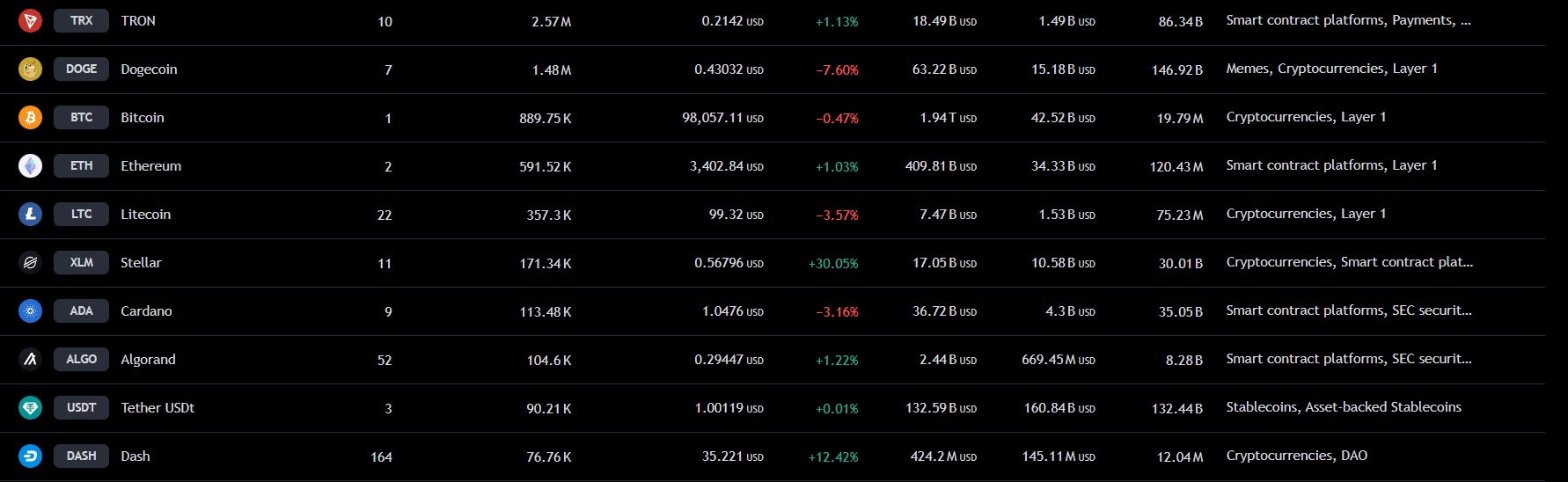

The transition of capital into altcoins signifies a possible altcoin season, as proven by the rating of cash based mostly on lively addresses.

Cash like Ethereum, Stellar [XLM], and TRON [TRX] are experiencing notable traction, benefiting from elevated community exercise.

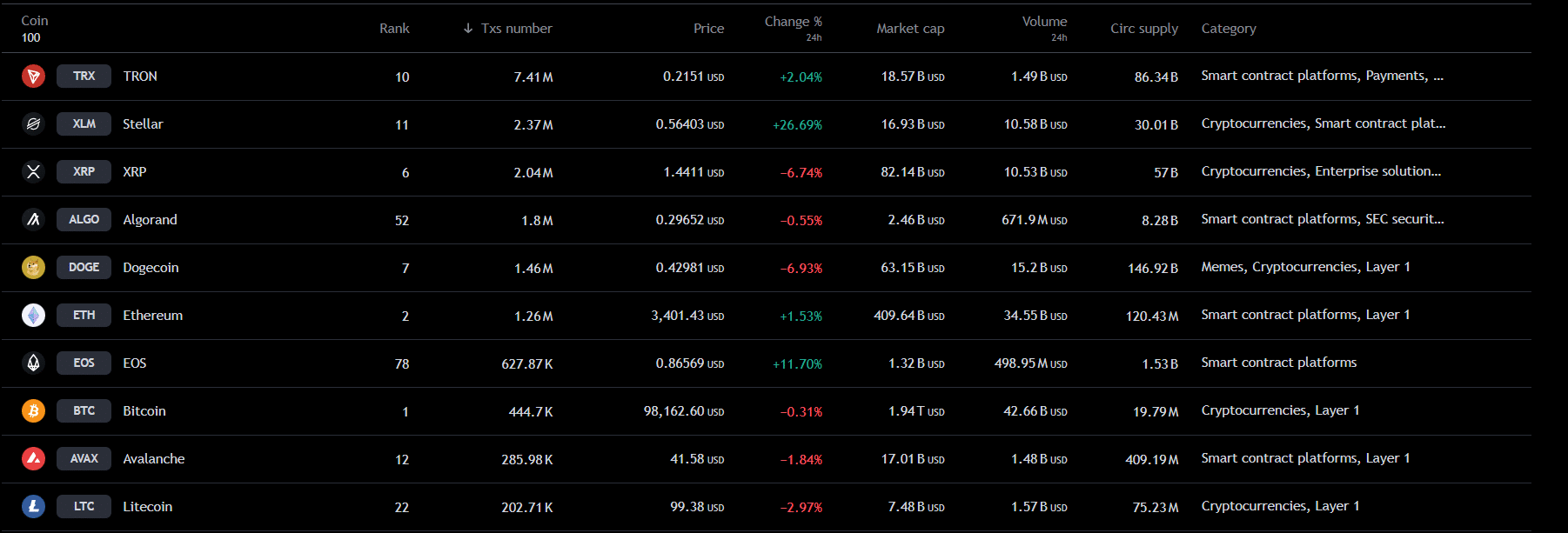

The transaction rankings additional emphasize TRON’s dominance, with 7.41 million transactions showcasing its rising position in funds and DeFi.

Stellar adopted intently with 2.37 million, highlighting its energy in cross-border remittances, whereas Ethereum maintains relevance with 1.26 million, with a deal with high-value actions like DeFi and NFTs.

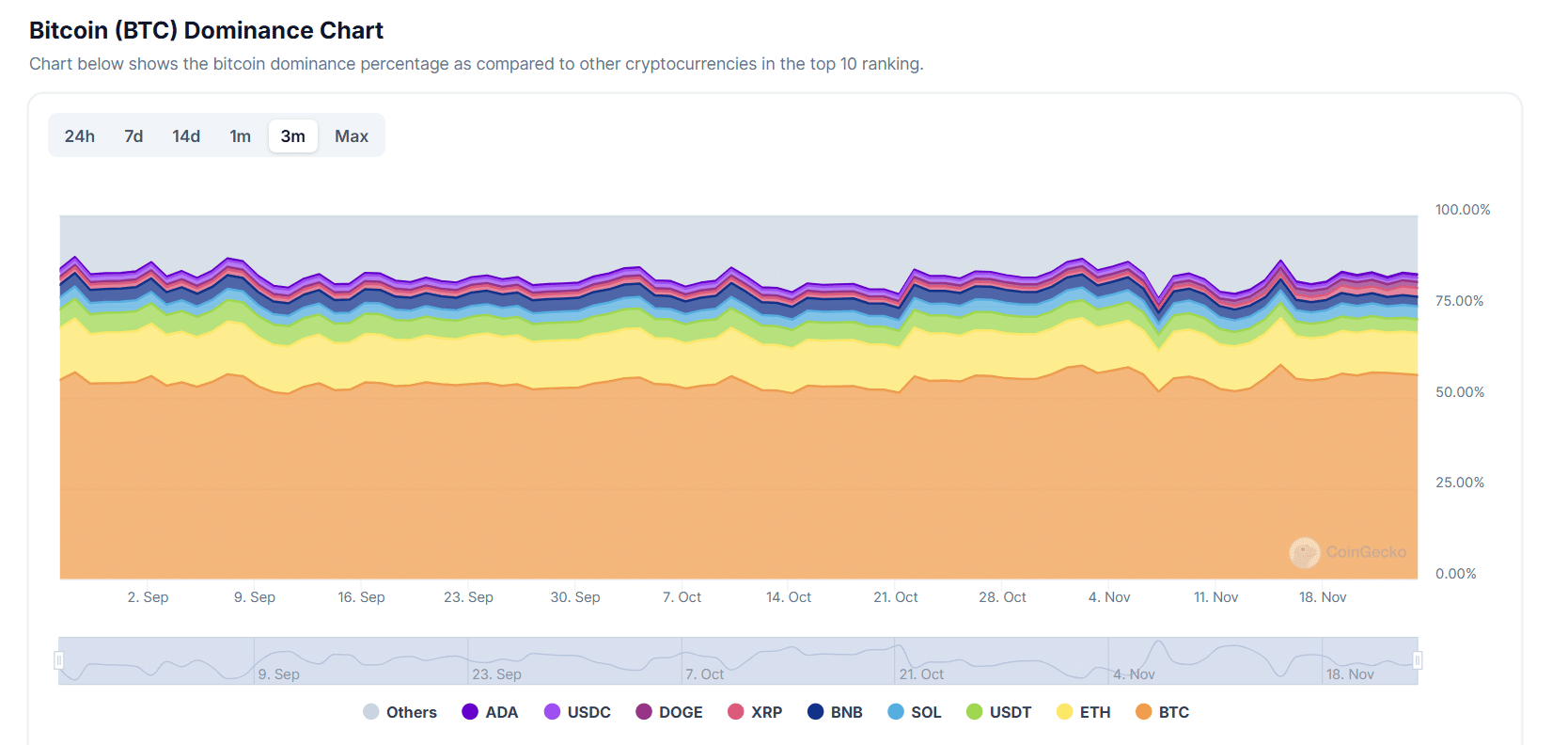

Insights from the Bitcoin dominance chart additional strengthened this pattern. Bitcoin’s market share decline has allowed altcoins like Ethereum, Solana, and TRON to carve out important house.

Ethereum now instructions over 20% of market share in some sectors, whereas rising gamers like Avalanche [AVAX] are seeing regular inflows.

This dynamic indicators a redistribution of capital as buyers search worth past Bitcoin.

Is altcoin season lastly upon us?

The shift from Bitcoin dominance to altcoins is pushed by a mixture of elements.

Regulatory pressures have additionally pushed buyers towards altcoins with compliant frameworks, reminiscent of Stellar, whereas macroeconomic uncertainty encourages diversification.

Technological developments, like Ethereum’s upgrades, additional improve altcoin competitiveness.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Though cyclical, Bitcoin’s market share decline displays a maturing ecosystem, with altcoins gaining structural significance and signaling a possible long-term shift somewhat than a fleeting “altcoin season.”

This diversification highlights evolving investor priorities in a quickly altering market.