- Bitcoin breezed previous the October vary highs,

- A minor value dip earlier than the uptrend resumes is the perfect end result for bulls.

Bitcoin [BTC] has a comfortably bullish outlook, going by social media posts.

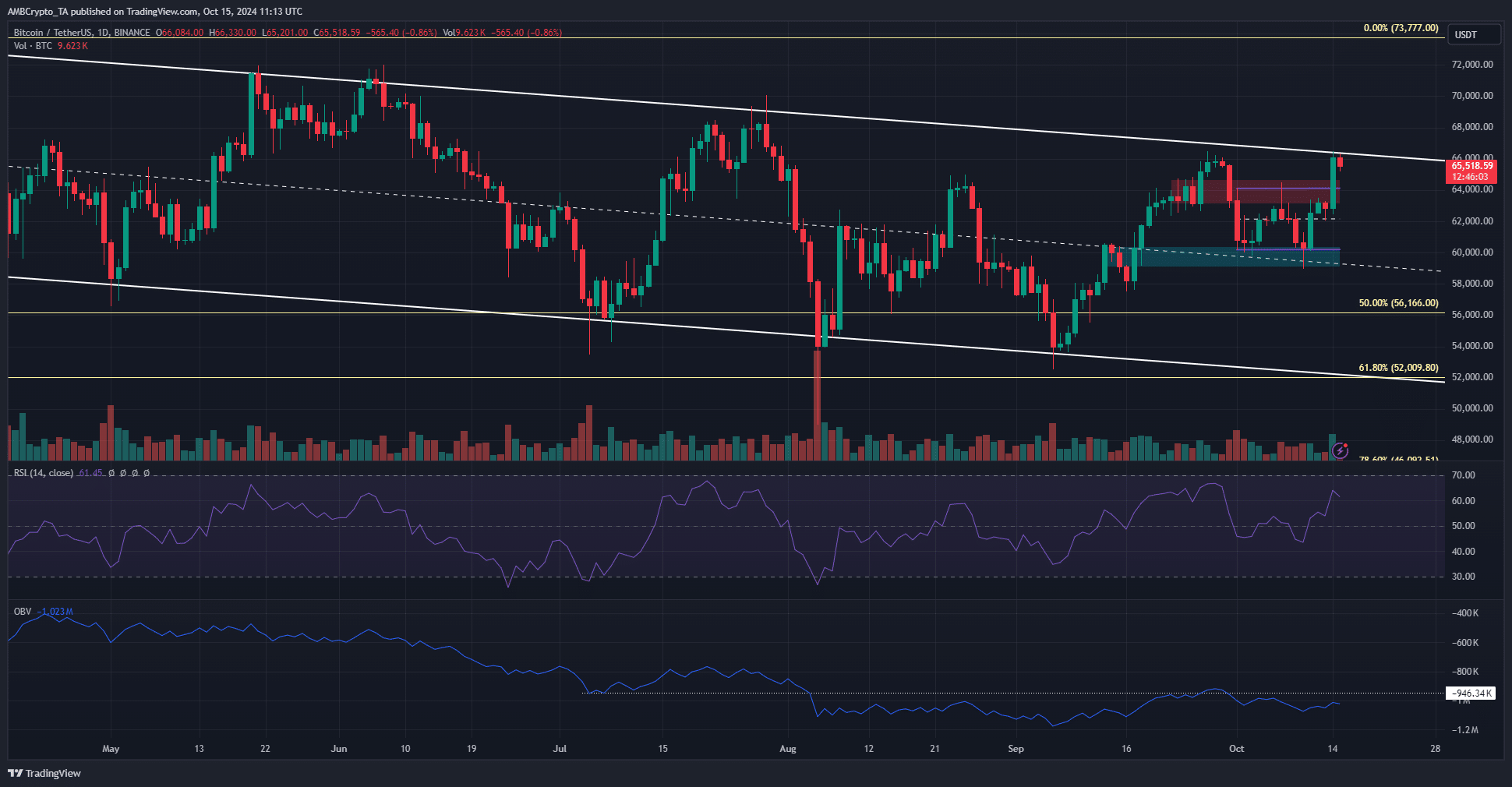

The speedy surge past the $64k resistance stage that opposed the bulls in October was breached on the 14th of October, and the channel highs had been retested.

The record-breaking Bitcoin spot ETF inflows seemingly aided this 5.1% value transfer. Nonetheless, the ETF share is barely a fraction of the full buying and selling quantity. Ought to buyers brace for a breakout or one other rejection?

Channel highs vs. vary breakout

BTC has traded inside a short-term vary in October that prolonged from $60.2k to $64.1k. The day by day buying and selling session on Monday beat the resistance with ease, however confronted opposition on the $66.5k mark.

This coincided with the descending channel’s highs, in addition to with the native highs from the twenty seventh of September. A session shut above $66.5k can be an indication of agency bullish conviction.

The OBV was unable to clear the native highs, and was a noticeable distance decrease, whereas the value was on the identical resistance at $66.5k.

This was an indication that purchasing quantity in latest weeks was not as excessive because the periods the place BTC famous losses.

Potential brief squeeze imminent

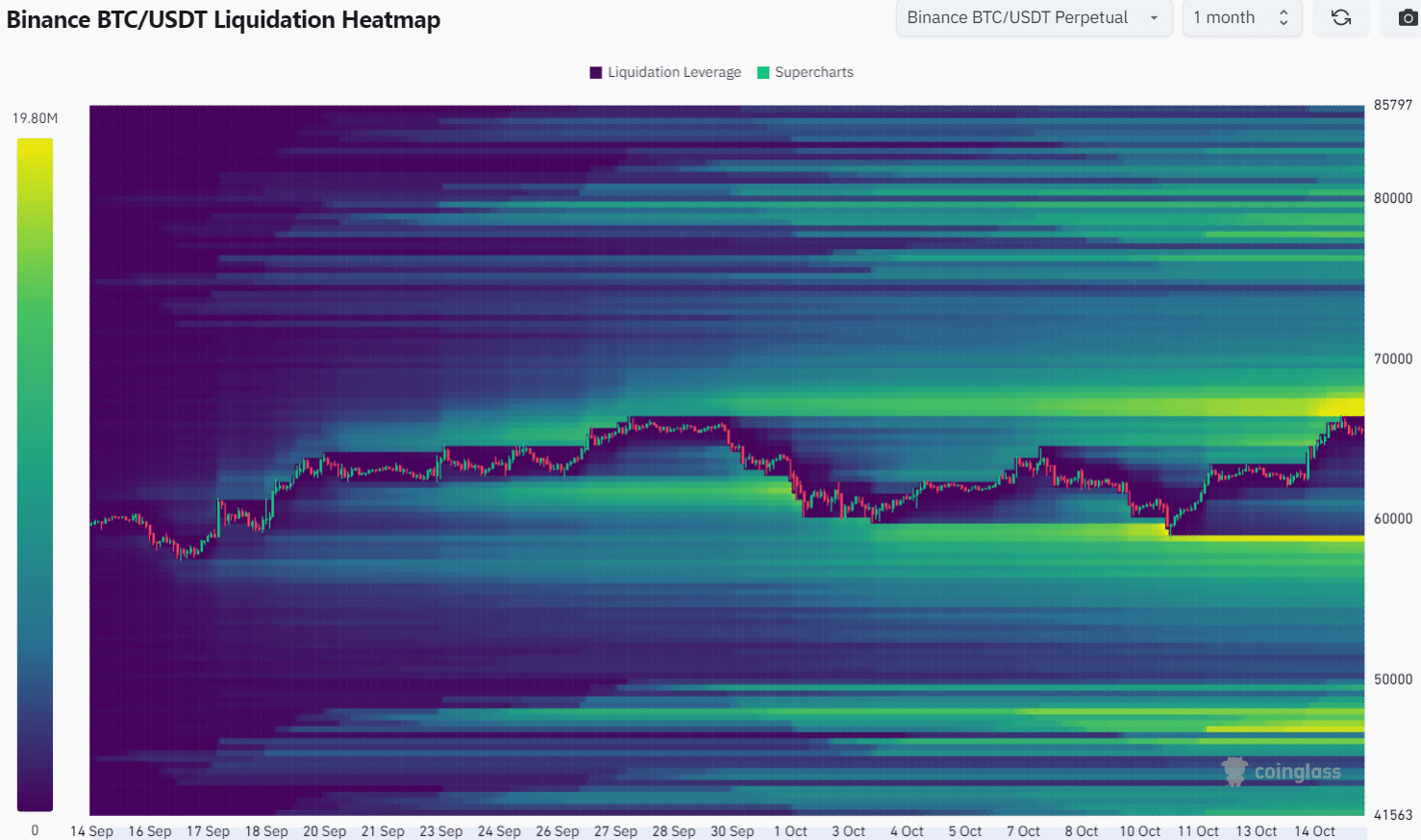

Supply: Coinglass

The 1-month lookback interval confirmed a focus of liquidation ranges at $66.6k to $67.4k. The proximity of this liquidity pool might entice costs greater earlier than a reversal towards $60k.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

It’s unclear whether or not Bitcoin is prepared for the bull run anticipated in This fall 2024, or whether or not extra consolidation is forward. Based mostly on the liquidation heatmap and the OBV, a rejection appeared seemingly.

A bullish response might observe on the former vary highs at $64k and will current a shopping for alternative, however swing merchants ought to be ready for a deeper dip and handle their danger accordingly.

Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion