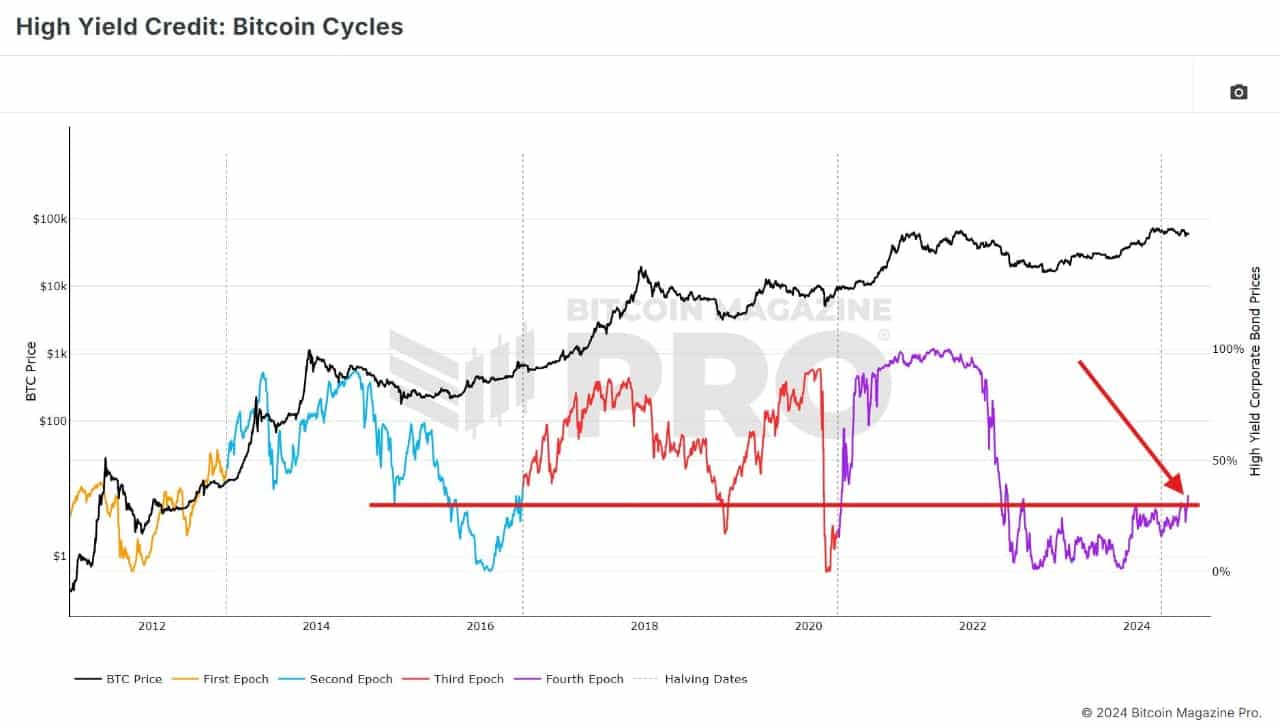

- Excessive-yield credit score charges flip bullish after breakout.

- Bitcoin value motion sitting on essential help.

Bitcoin [BTC] has develop into a focus in discussions, notably after yesterday’s, the twenty eighth of August, downturn.

Analyzing high-yield credit score charges reveals a bullish breakout from the lows, signaling elevated investor optimism towards the worldwide financial system.

This shift in sentiment is contributing to a rising risk-on urge for food for threat property, together with Bitcoin. This development is anticipated to positively affect Bitcoin value, probably driving it greater.

The actions in high-yield credit score charges might play a big position in shaping market dynamics, making it important to observe how these developments impression Bitcoin and different property.

As BTC at present sits on essential 4-hour help, the query arises: Will this renewed risk-on urge for food assist Bitcoin recuperate its current losses?

Important help holding

Specializing in Bitcoin value motion, the BTC/USDT pair is at present consolidating inside the $59K – $60K vary on the 4-hour timeframe.

9 consecutive 4-hour candles have failed to interrupt under this vital help stage, resulting in hypothesis that BTC could have gathered the required liquidity round this vary. Nonetheless, the weekly candle nonetheless presents a regarding outlook.

Given the rising risk-on urge for food and the potential for upcoming price cuts, carefully monitoring Bitcoin efficiency in September can be very important because it might set the path for BTC within the coming months.

Bitcoin RSI approaches extraordinarily oversold ranges

Furthermore, BTC’s Relative Power Index (RSI) is nearing extraordinarily oversold ranges. Whereas a direct rebound could not happen, traditionally, such RSI ranges have typically preceded vital value reversals.

With the indicator approaching the flip zone, the growing risk-on urge for food might assist BTC reverse its current losses and probably purpose for the $70K value stage.

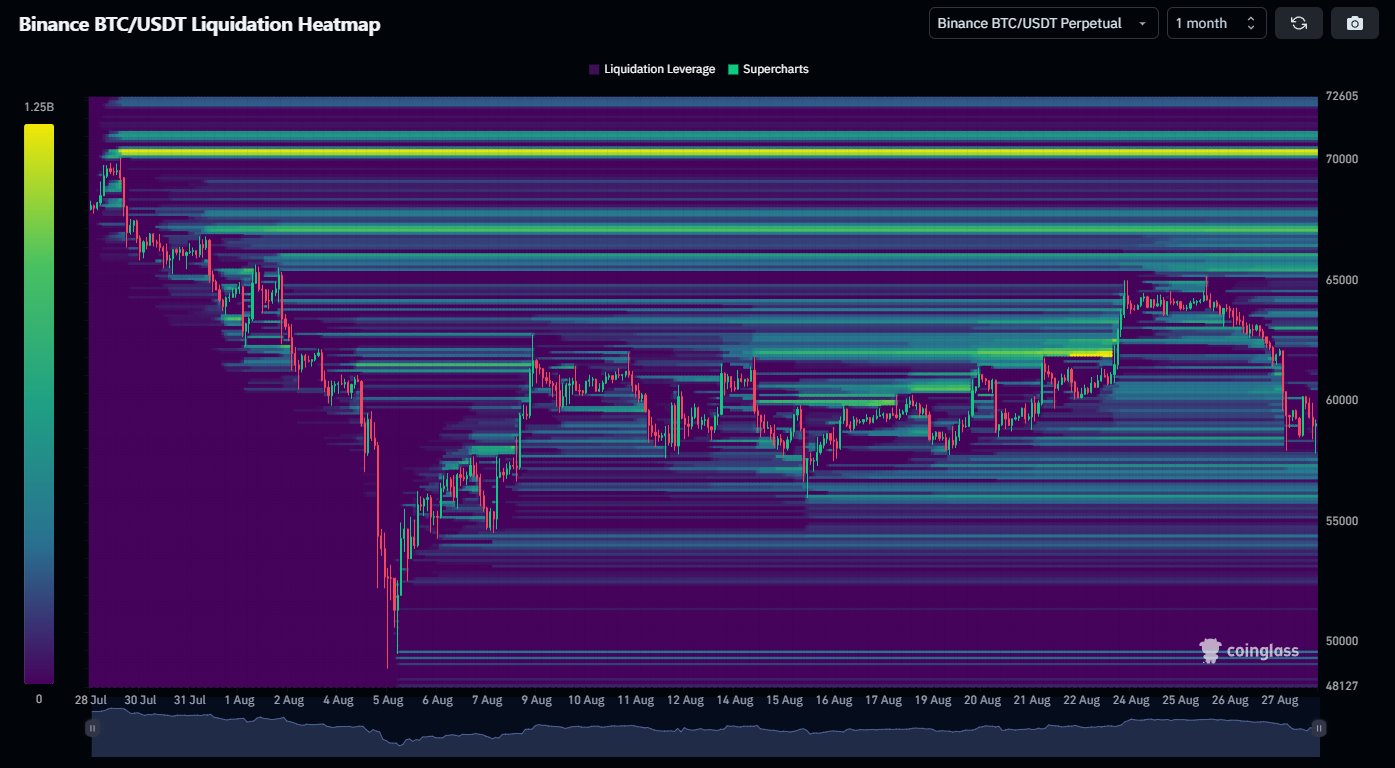

Liquidity evaluation

Liquidity evaluation additionally reveals that Bitcoin just lately absorbed substantial liquidity under the $60K mark, with costs briefly dipping under $58K.

Nonetheless, a big liquidity zone awaits above $70K. If BTC fails to interrupt under its present help stage, there’s a robust expectation that the worth will revisit this greater zone.

Though it’s too early to fixate on this goal, if Bitcoin value begins buying and selling inside just a few p.c of this stage, it turns into extra possible that the liquidity can be taken out.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

For now, BTC stays close to the decrease finish of this vary, so vigilance is important. Bitcoins value motion, influenced by the rising risk-on urge for food, might see a restoration from current losses, particularly if vital help ranges maintain.

The potential for BTC to maneuver greater is obvious, however it requires cautious statement of key indicators and market dynamics.