- CryptoQuant knowledge reveals that Bitcoin and Ethereum trade stability has been on a decline.

- Technical evaluation signifies vital worth actions for each cryptocurrencies if key resistance ranges are damaged.

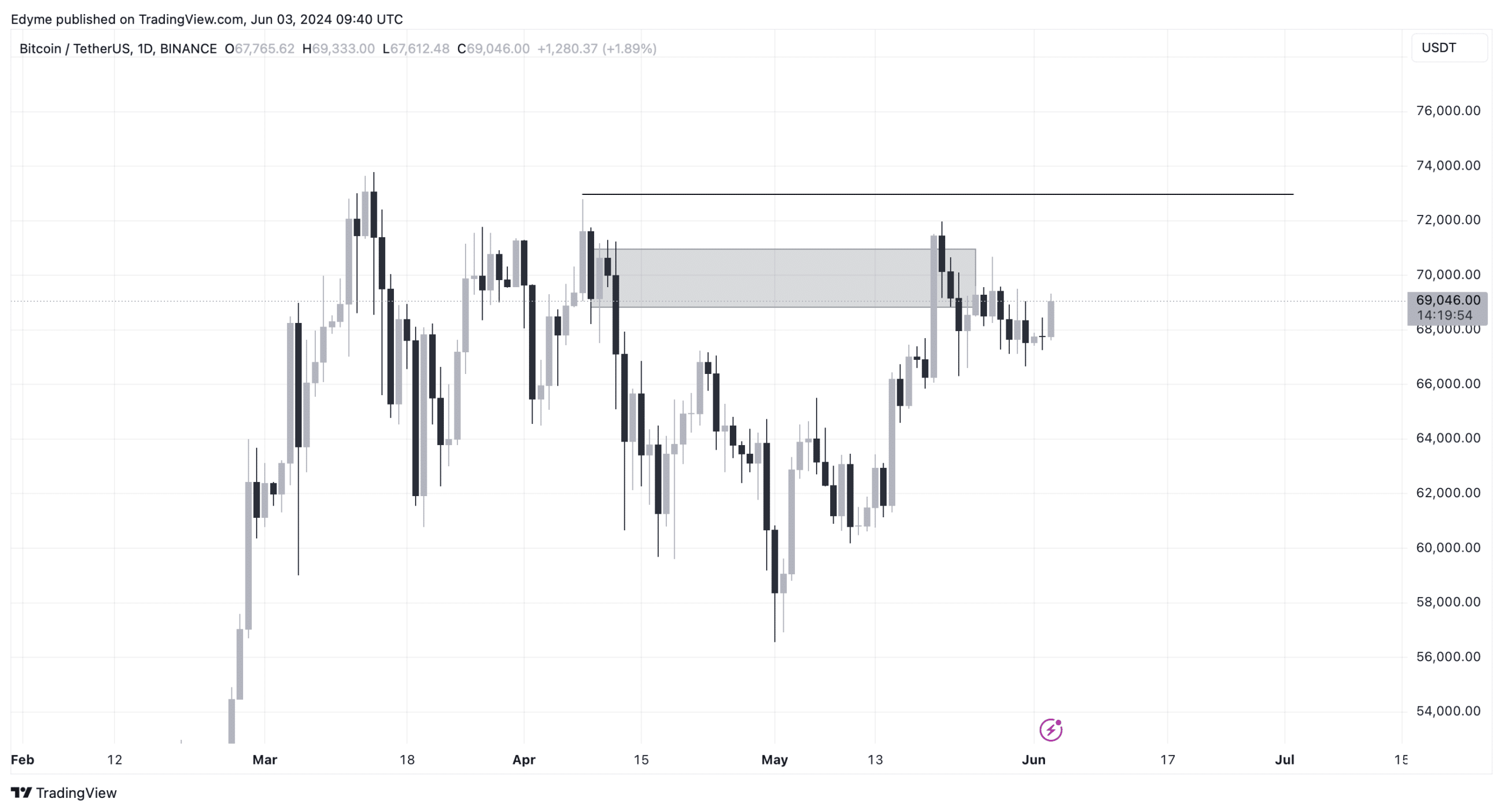

Bitcoin [BTC] was buying and selling simply shy of $70,000 at press time, reflecting a average upswing of two% within the final 24 hours, although it stays under its March peak of over $73,000.

This continued development from the asset is a part of a broader narrative that underscores the complexities of crypto market actions.

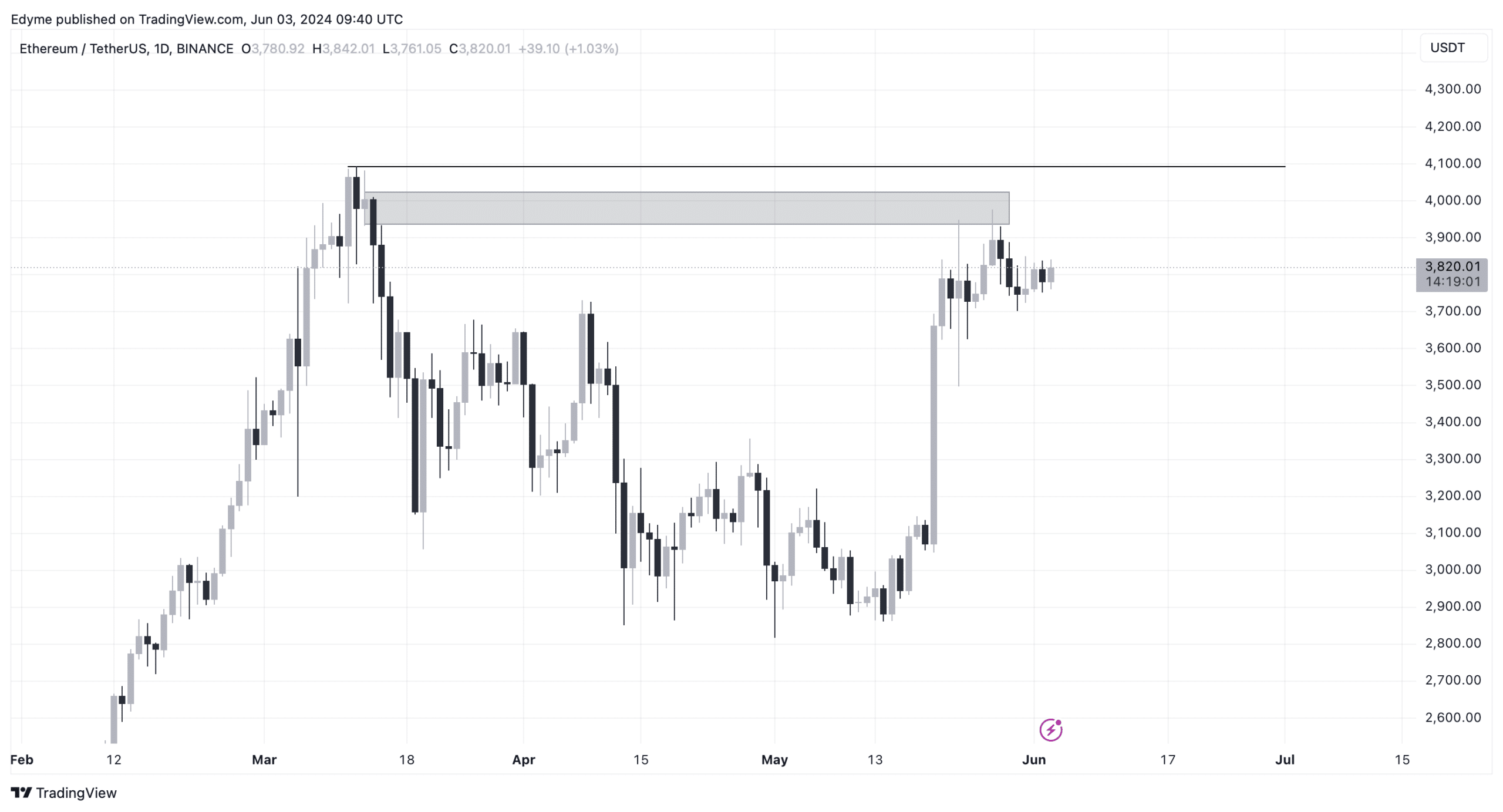

Conversely, Ethereum [ETH] has proven exceptional stability, sustaining a place above $3,800. This steadiness comes regardless of a slight 2.5% drop over the past day, stabilizing with a minimal 0.7% improve in the present day.

The steadiness in Ethereum’s worth factors to a sustained curiosity within the asset amid fluctuating market circumstances.

Bitcoin & Ethereum market shifts

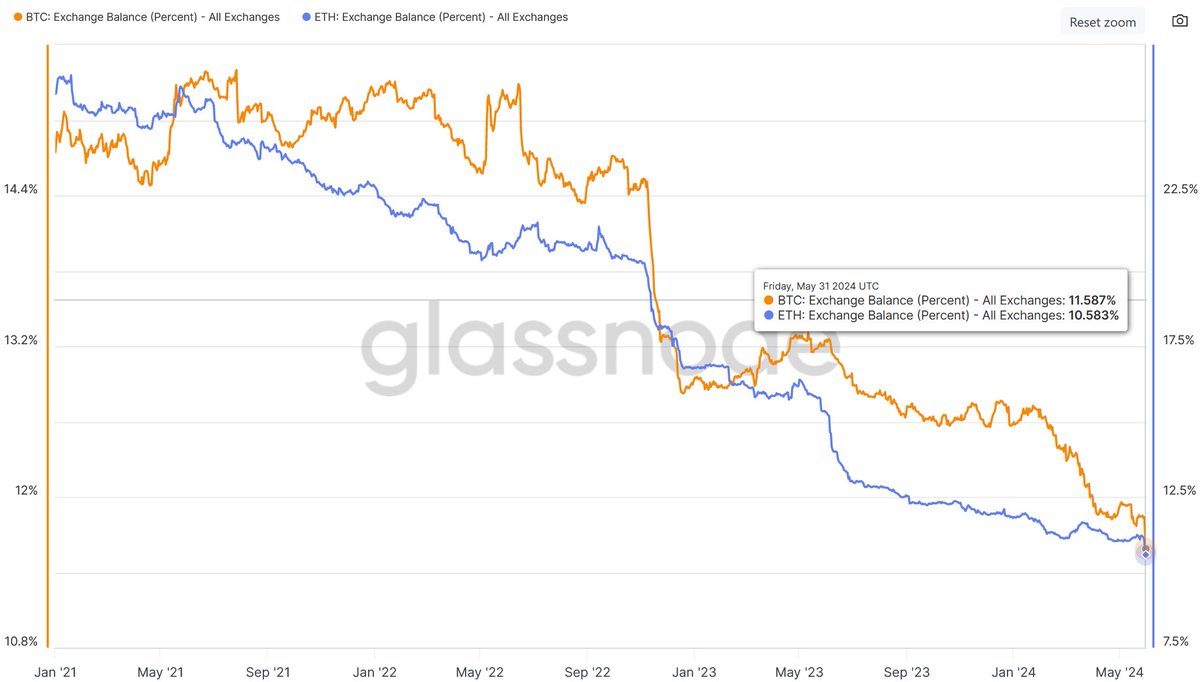

Latest evaluation by BTC-ECHO’s Leon Waidmann revealed that each Bitcoin and Ethereum have witnessed their lowest trade stability ranges in years.

Particularly, Bitcoin’s presence on exchanges has diminished to 11.6% whereas Ethereum’s has dipped to 10.6%.

This pattern suggests a big motion of those belongings away from exchanges and doubtlessly signifies a technique amongst buyers to carry onto their cash for longer durations.

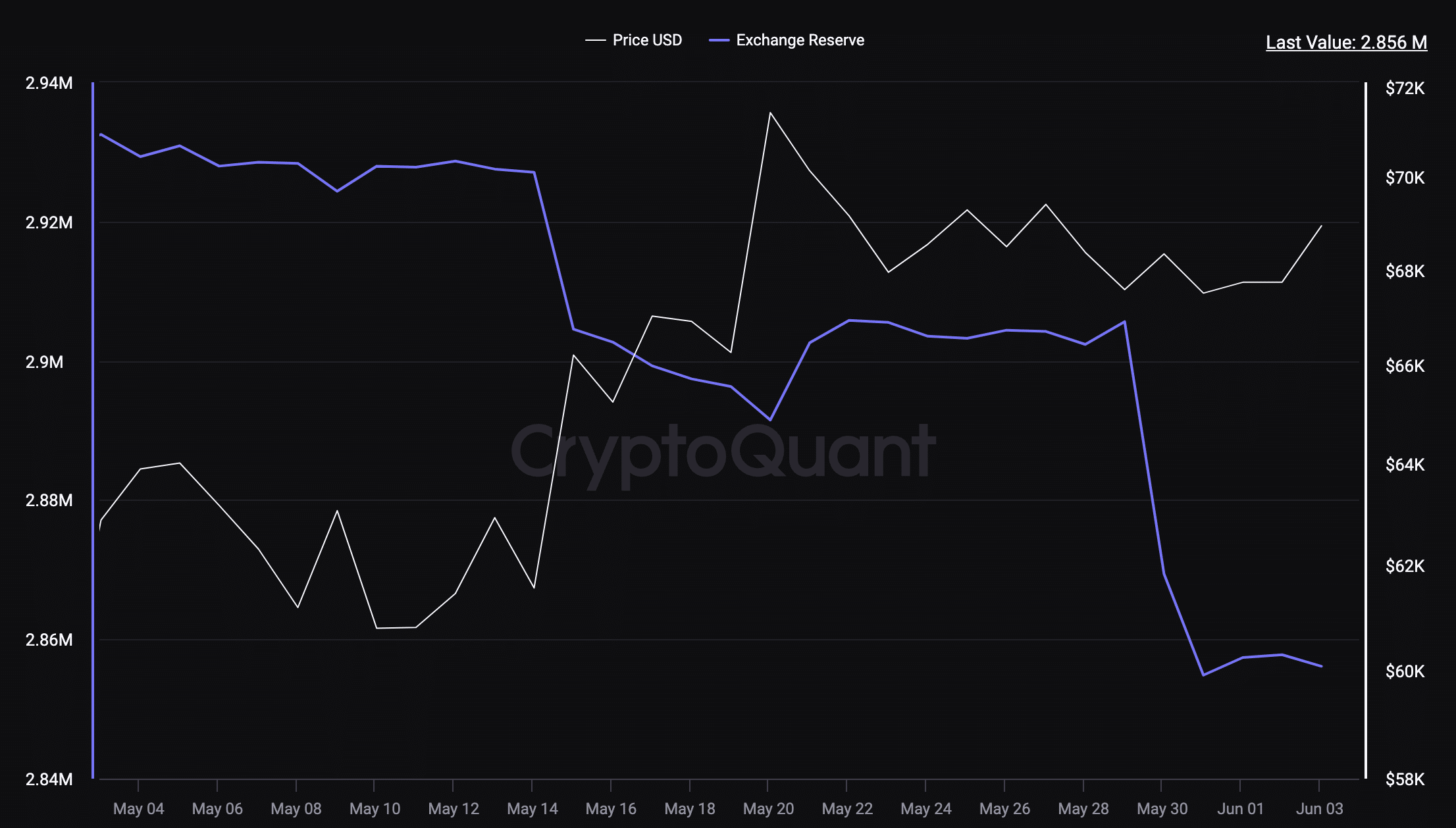

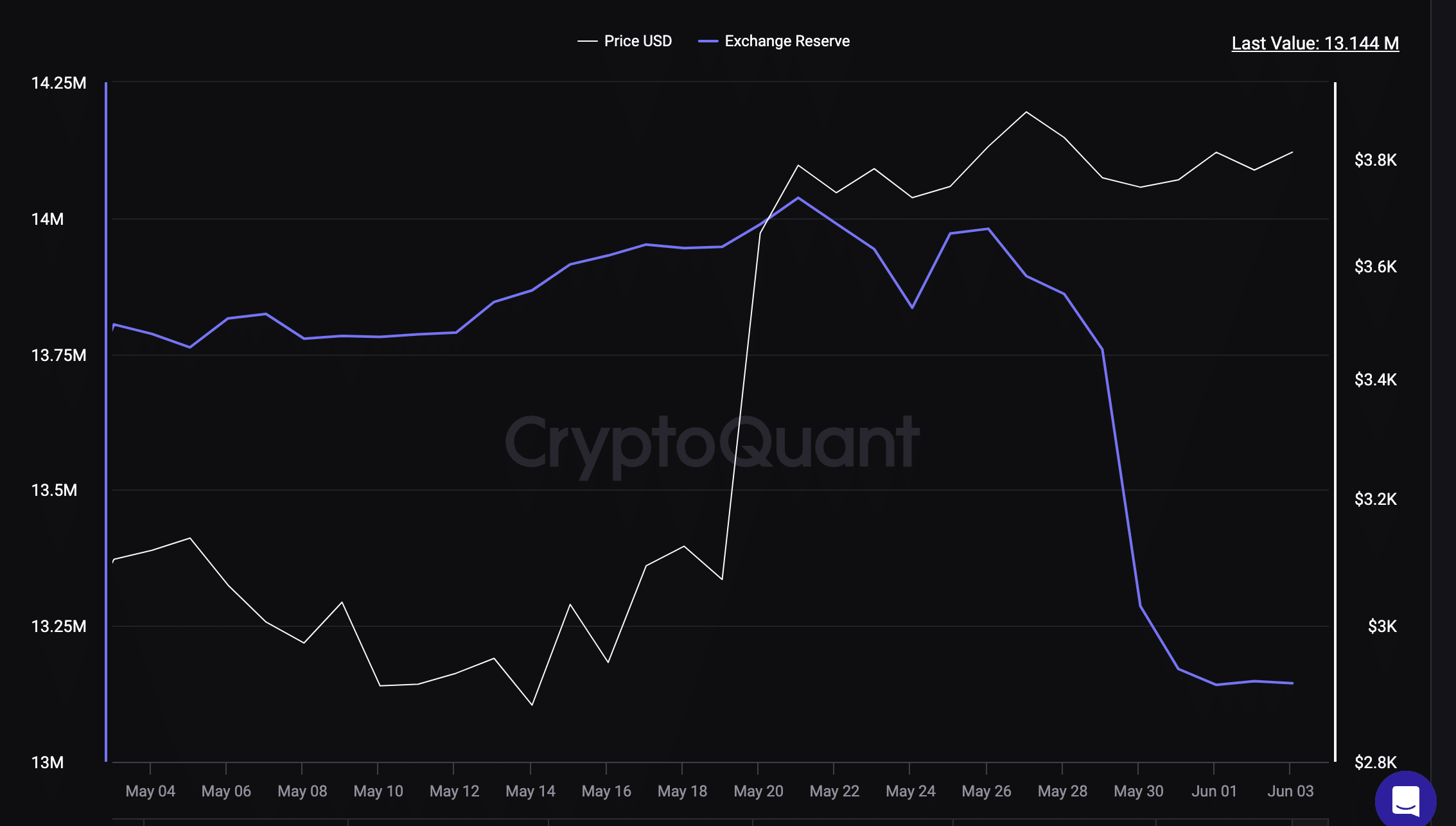

AMBCrypto’s examination of CryptoQuant knowledge additional revealed a considerable outflow of those cryptocurrencies from exchanges.

Over $5 million value of Bitcoin and greater than $1 billion in Ethereum have withdrawn from exchanges since early Might.

This motion is noteworthy because it follows the approval of spot Ethereum ETFs within the US, hinting at a attainable provide squeeze on the horizon.

The discount in trade reserves implies that fewer cash are actually obtainable for rapid buying and selling, pointing to a possible worth improve as a consequence of shortage.

Waidmann anticipates this may result in a provide squeeze, urging buyers to organize for vital market actions, noting:

“Whales continue to accumulate. Supply squeeze incoming. Get ready for the next big move.”

Market dynamics and technical evaluation

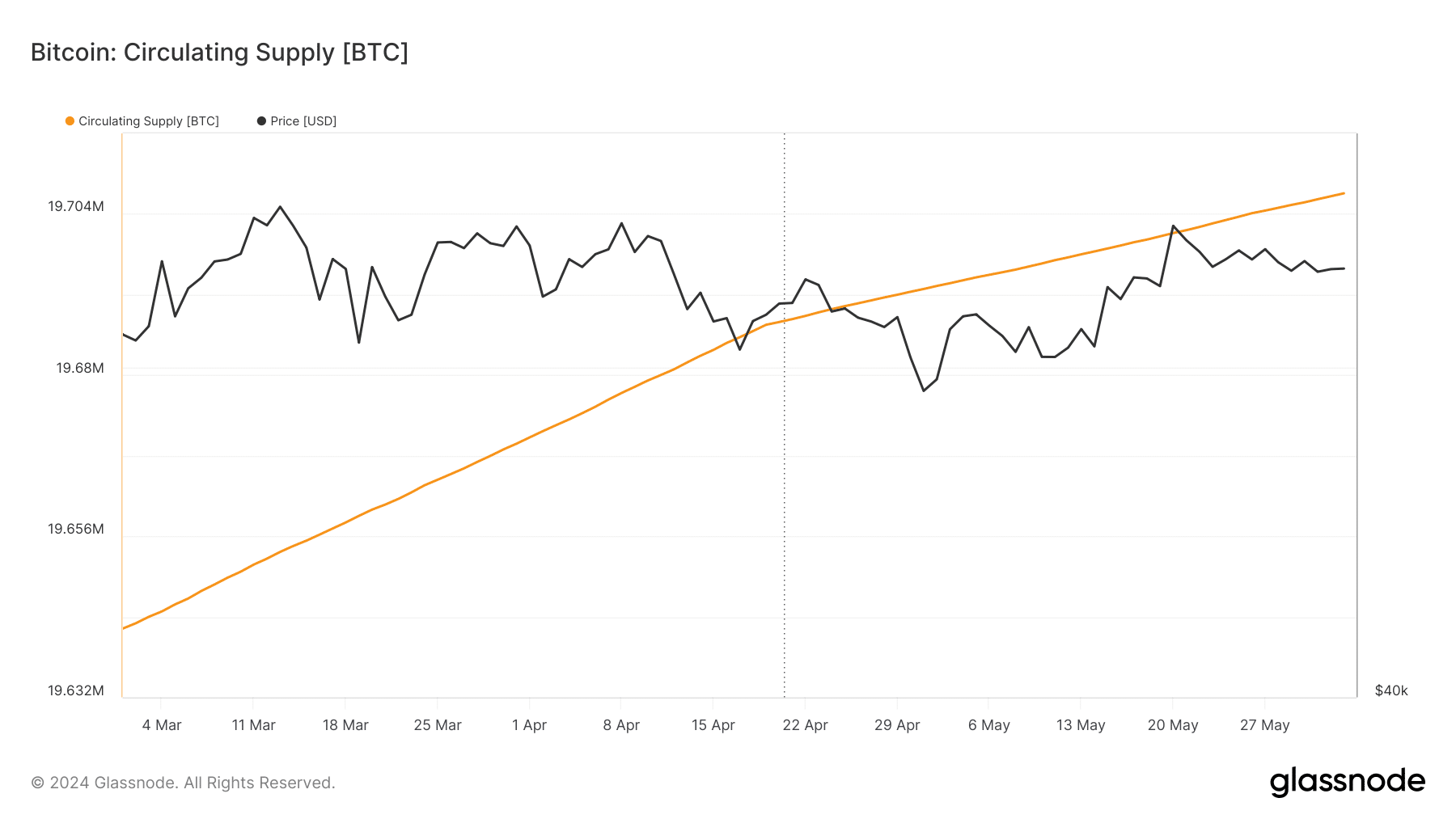

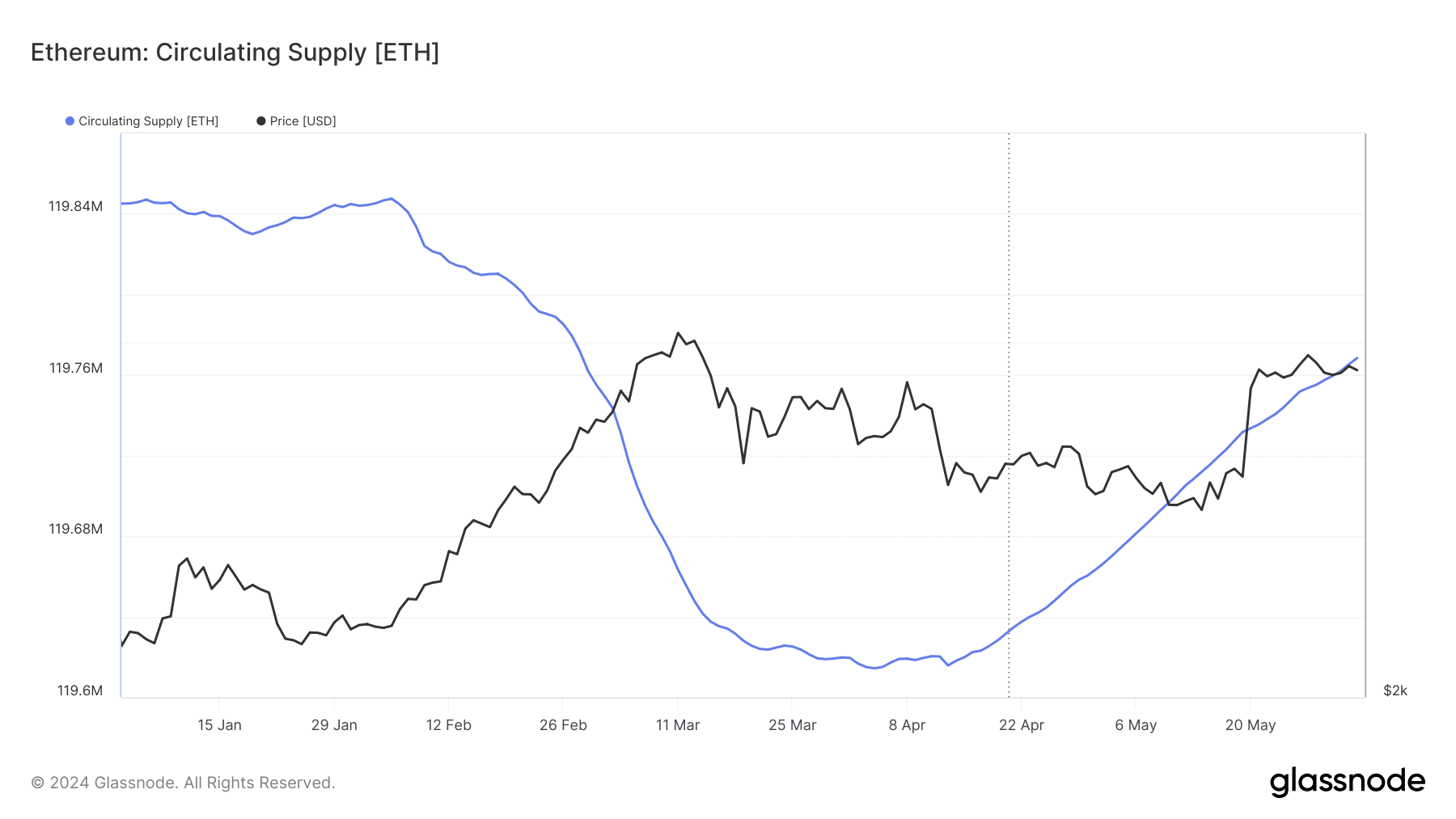

Nevertheless, Glassnode knowledge presents a contrasting view, displaying a rise within the circulating provide for each cryptocurrencies, suggesting that regardless of diminished trade availability, the general market provide stays excessive.

This situation units the stage for potential worth corrections if demand fails to maintain tempo with the rising provide. Nevertheless, the present market indicators counsel demand is maintaining, as there was no notable worth dip regardless of the rising provide.

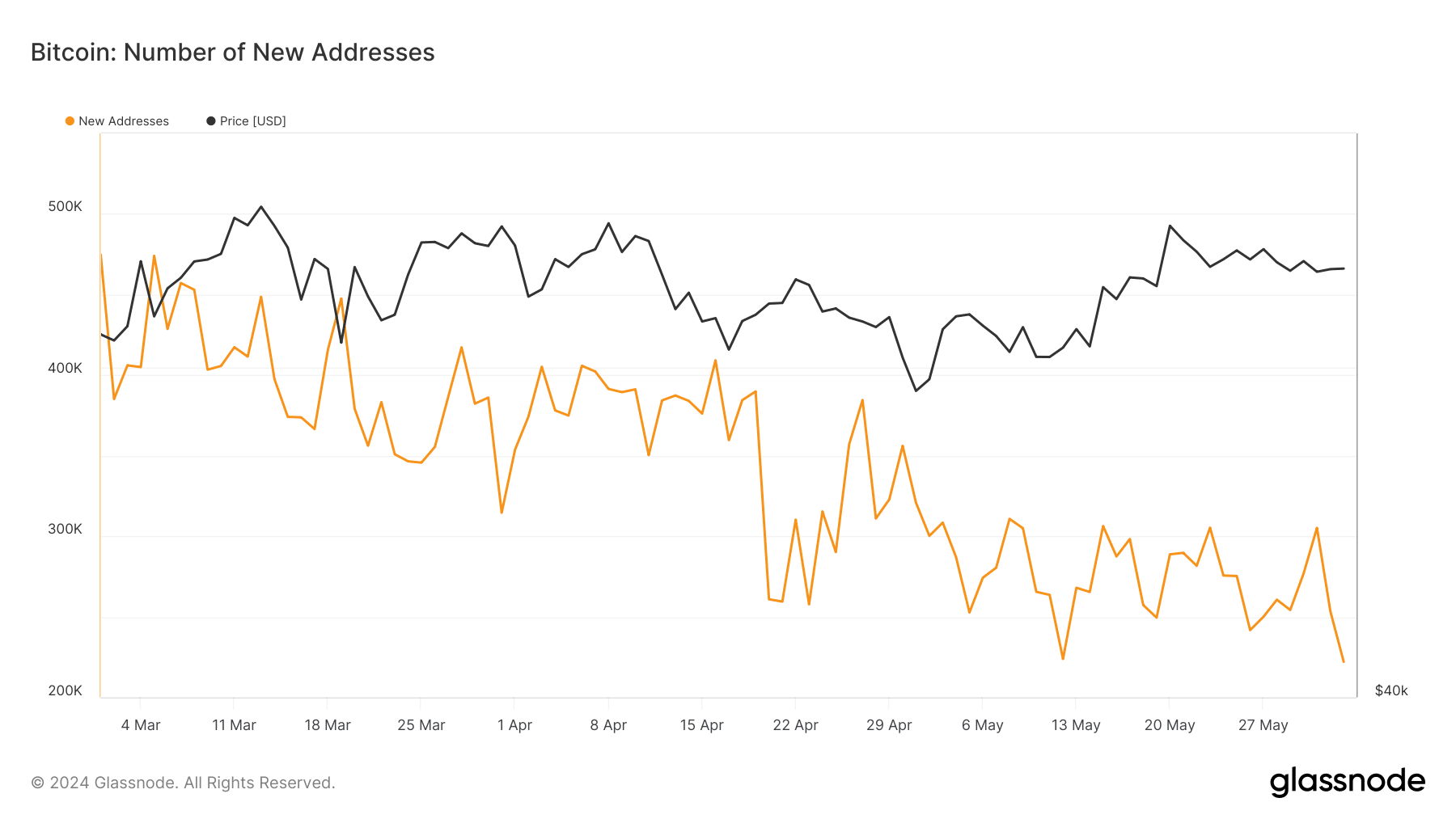

In the meantime, there’s a decline in new addresses for each Bitcoin and Ethereum which might point out a cooling curiosity amongst new buyers, doubtlessly impacting future demand.

In the meantime, technical evaluation of each Bitcoin and Ethereum’s charts reveals a doubtlessly intriguing efficiency on the horizon.

Specializing in Bitcoin’s each day chart, it illustrates a sample the place the cryptocurrency has been breaking by way of decrease assist ranges, lately reversing to faucet into a serious provide zone.

This motion sometimes indicators a continuation of the downtrend. Nevertheless, if Bitcoin surpasses the $72,000 mark, breaking the earlier decrease excessive and negating the bearish setup, this might counsel a reversal to an upward pattern.

AMBCrypto, citing an analyst from XBTManager on CryptoQuant, reported that Bitcoin is poised for a notable ascent. The analyst suggests,

“Bitcoin is gathering strength for the next rise. When it gathers enough strength, a sharp rise seems to be imminent. It seems likely that rises akin to those seen in Q3-Q4 will continue.”

Is your portfolio inexperienced? Test the Bitcoin Revenue Calculator

An identical sample emerges on Ethereum’s each day chart. Ethereum has lately entered a serious provide zone, suggesting an impending sell-off.

Nonetheless, if Ethereum breaks above the $4,000 threshold, surpassing the latest decrease excessive and overturning the present promote sign, this might pave the way in which for an upward motion.