- BTC spot ETF noticed an outflow of over $200 million.

- Alternate netflow was dominated by optimistic move.

Following the approvals of spot Bitcoin [BTC] ETFs within the US, Bitcoin has skilled sustained excessive volumes of flows. As the worth of BTC appeared poised to reclaim its all-time excessive, the move of ETFs peaked for the month.

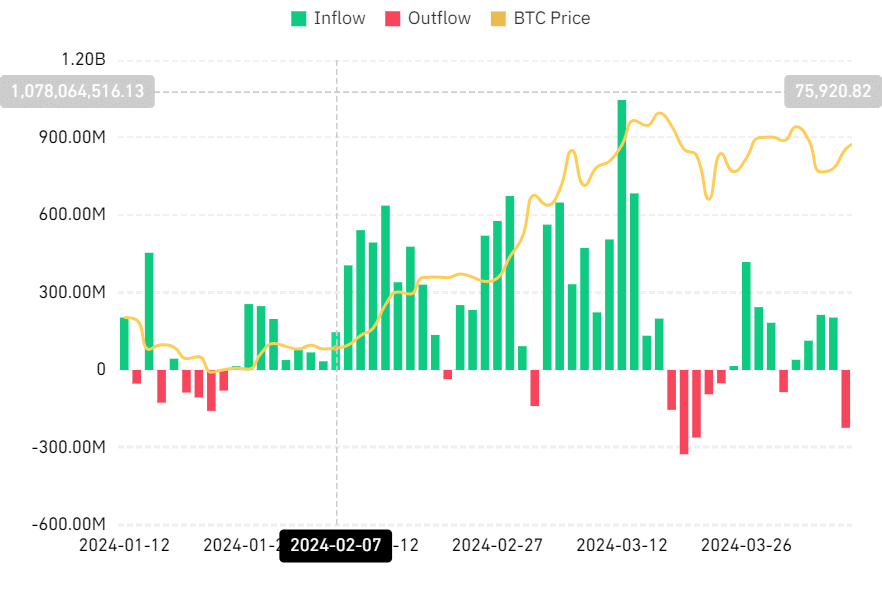

Outflow dominates Bitcoin spot ETF quantity

Evaluation of the Bitcoin spot ETF Netflow on Coinglass revealed that it noticed its highest move since twenty seventh March on eighth April. Nonetheless, this move marked a deviation from the pattern noticed in latest days.

In line with the chart, eighth April noticed a big outflow, the primary of its variety since twentieth March. The info confirmed an outflow of over $223 million value of BTC on eighth April.

Apparently, the final time such a quantity of outflow occurred, Bitcoin was experiencing a worth decline. Opposite to earlier situations, this outflow occurred whereas Bitcoin rose, surpassing $71,000.

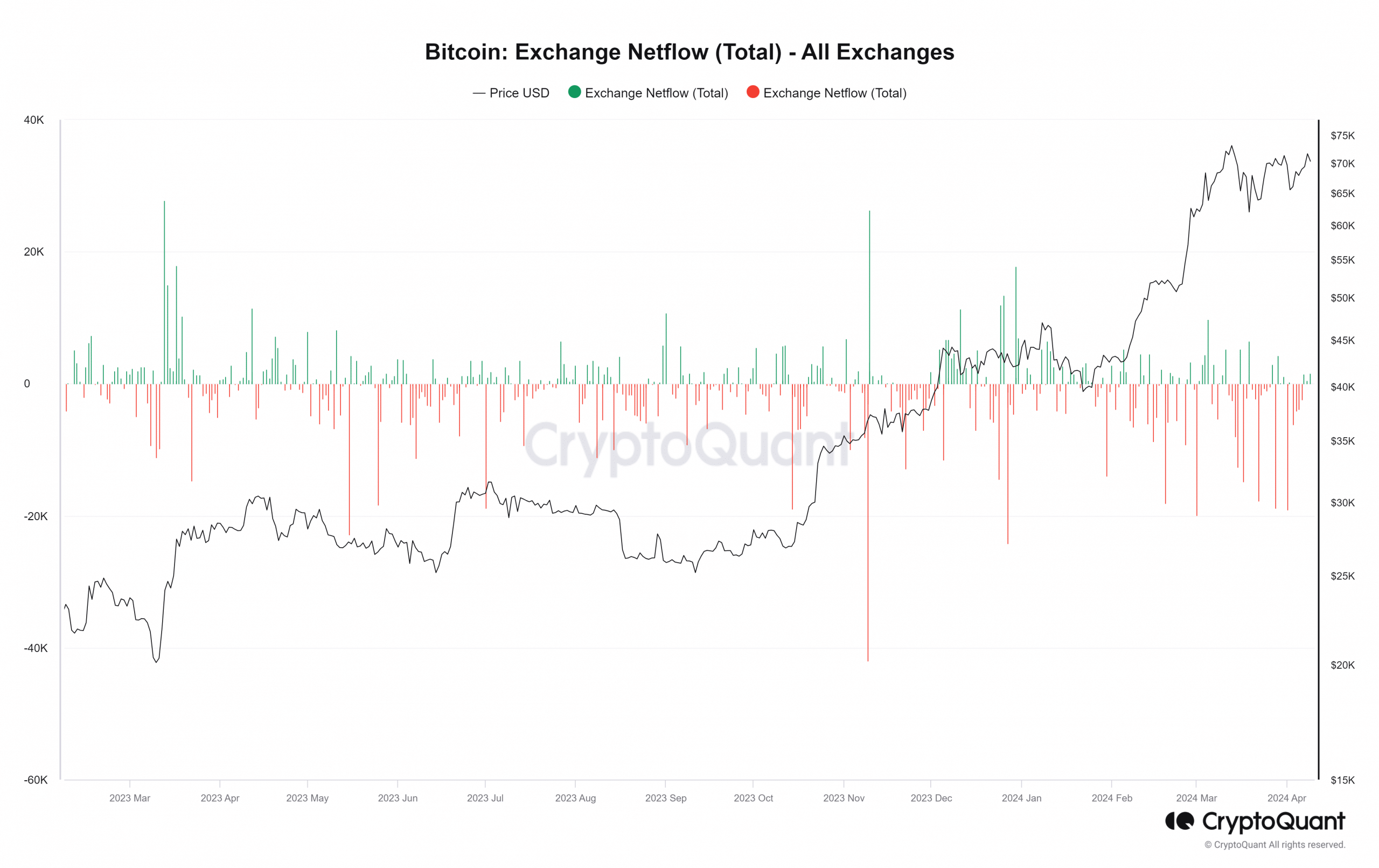

Bitcoin sees extra alternate influx

Whereas the Bitcoin spot ETF skilled a big outflow amidst the worth rise, the overall BTC netflow exhibited the other pattern on eighth April. Evaluation of the netflow indicated a dominance of inflows, suggesting that extra merchants had been depositing their holdings into exchanges.

Nonetheless, it’s noteworthy that regardless of the dominance of inflows, the amount was not significantly important. The full influx recorded was roughly 555 BTC. In the intervening time, the influx has elevated to over 1,300 BTC.

Though the Bitcoin spot ETF and Alternate Netflow metrics seemingly moved in reverse instructions, their underlying responses are comparable.

A surge in spot ETF outflow signifies that shareholders are promoting, probably motivated by varied elements, together with profit-taking. Equally, the prevalence of inflows in alternate netflow means that holders additionally promote to safe income.

In each eventualities, the driving pressure is the rise in BTC worth, a standard issue influencing these actions.

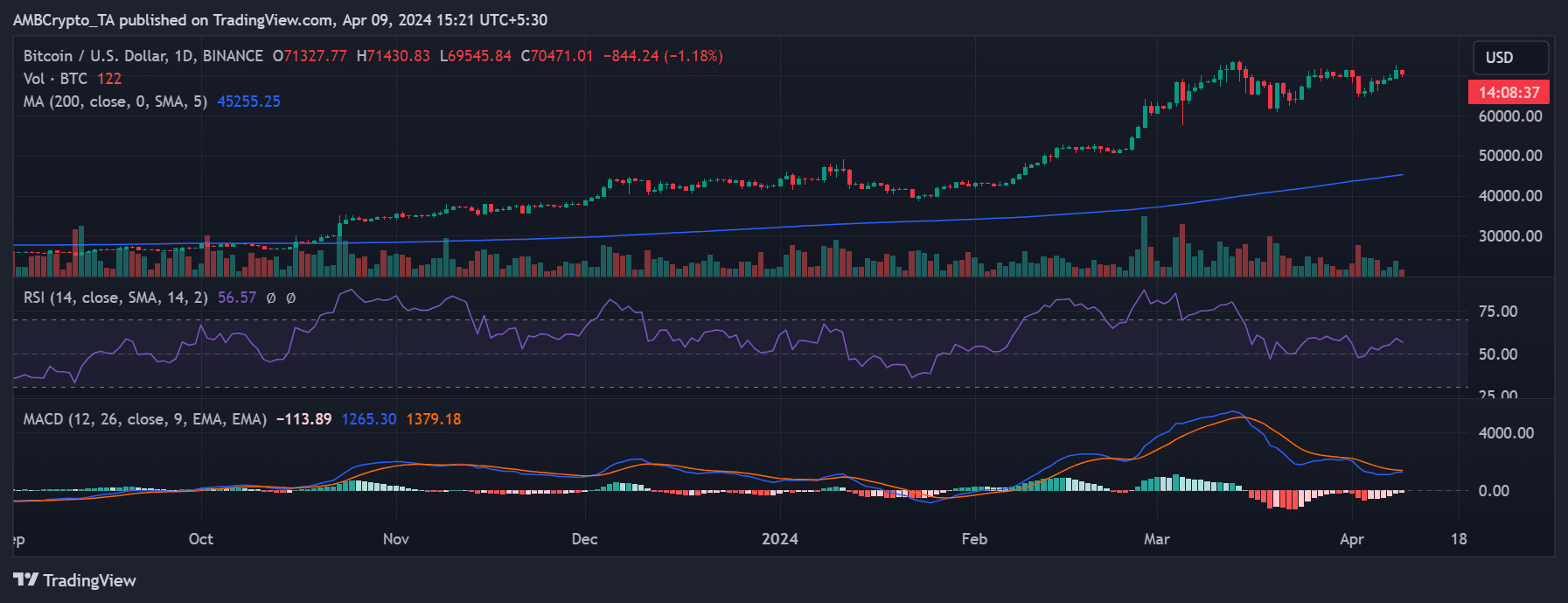

BTC worth rise takes a breather

On eighth April, the worth of Bitcoin surged by roughly 1.73%, reaching round $71,313. Whereas this wasn’t Bitcoin’s peak, evaluation indicated it marked the third-highest worth in its historical past.

Learn Bitcoin (BTC) Worth Prediction 2024-25

Nonetheless, by the point of this writing, the worth had skilled a decline. BTC was buying and selling at round $70,400, reflecting a lower of over 1%.

Though this decline represented a setback from yesterday’s rally, BTC remained inside a bullish pattern regardless.